SPB is an Early Bird Hunting for the PNG Shale Worm

Published 04-OCT-2016 10:39 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Next Oil Rush presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

There is a bit of a “worm-catching early bird” story for our reader’s perusal in this edition of The Next Oil Rush ; a story about a company whose assets could potentially mature into a significantly proportioned resource.

South Pacific Resources (ASX:SPB) is a small ASX explorer looking for a ‘big kahuna’ result in one of most underexplored hydrocarbon-bearing areas in the world: Papua New Guinea.

Estimates indicate that PNG has the potential for 282 trillion cubic feet of recoverable shale gas, previously unexplored.

Before we go too far, it should be noted that for political and social reasons, this is a very high risk stock. Getting oil and gas projects up and running in countries such as PNG is no simple feat, and there may be challenges ahead.

There have been many pretenders to the PNG tap over the years, but unfortunately, the PNG government has kept access to its oil basins under wraps tighter than a US oiler’s purse strings since 2014.

That would be about this tight:

But with all things that have never happened before, there is always a first time.

SPB has played its cards patiently for the last 4-5 years, gradually working up a technical and commercial plan to tap the PNG shale as and when it was able to.

Now, the most recent news from SPB is its engagement of the very experienced Tamarind Management Sdn Bhd to provide support in developing its recently acquired license reservations in PNG.

Going back though, as part of this lengthy 4 year period, SPB wasn’t just counting its chickens — its technical team was working directly with the PNG authorities to help establish articles of best practise and raise PNG’s collective nous in terms of oil exploration.

After a long-wait, in February this year, SPB received word that PNG’s government has now opened its doors to foreign drilling...

... but the best part is that it is SPB at the front of the queue to have its applications reviewed first.

Even Aussie powerhouses such as BHP and Rio Tinto, or foreign behemoths like BP and Shell, must all fall into line behind this oil company worth a paltry A$9MN...

The upside is that SPB could grow into a huge multi-million barrel oil producer with a prime PNG asset, or, it will be swatted in mid-air by a larger predator of BP’s ilk – at a large premium to its current market value – much like what happened to InterOil which was acquired by Exxon for US$2.5B after discovering the booming Elk-Antelope prospects.

Either option would probably suit shareholders but for SPB’s Management team, the focus is set firmly on taking this PNG shale idea all the way through to commercial fruition.

Swooping into alignment with:

Since 2011 South Pacific Resources (ASX:SPB) has been toiling for a piece of the Papua New Guinea (PNG) shale pie.

We’ve been tracking this emerging hydrocarbon story since July 2016, when we published an article titled, “ ASX Junior Receives First Licences in Highly Sought After Oil and Gas Region ” as we decided to look in detail at SPB’s aspirational market strategy.

We took the plunge after seeing SPB finally arriving at a stage where its ambition, innovation and progress have reached a synchronistic and critical-massive moment.

SPB’s original strategy was to work up a strong case for shale gas exploration in PNG, while collaborating directly with local officials to help form an effective oil and gas extraction policy in PNG.

Now, it should be noted that SPB does need to improve its bank balance soon, as at last report it had just $660k in the bank account, however:

After years of hard work, could now be the time for the payoff?

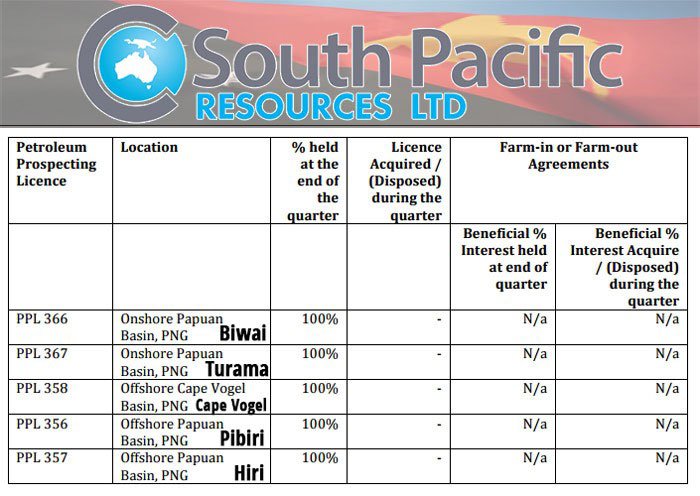

In July this year, SPB secured five licenses , covering 75,000 km 2 , to explore the highly prospective unconventional oil and gas reserve acreage in Papua New Guinea.

SPB has already undertaken a significant amount of preliminary geological and geophysical work over the past five years in order to complete the first country-wide assessment of the shale gas potential of PNG.

The results have been encouraging, indicating the presence of good quality shales, often at shallow depths, and usually close to existing and proposed infrastructure.

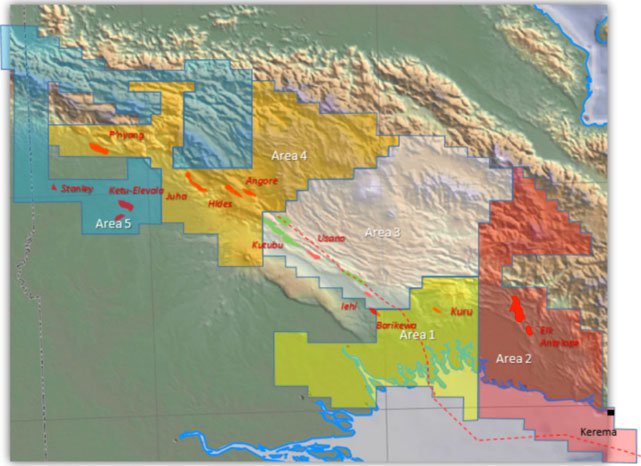

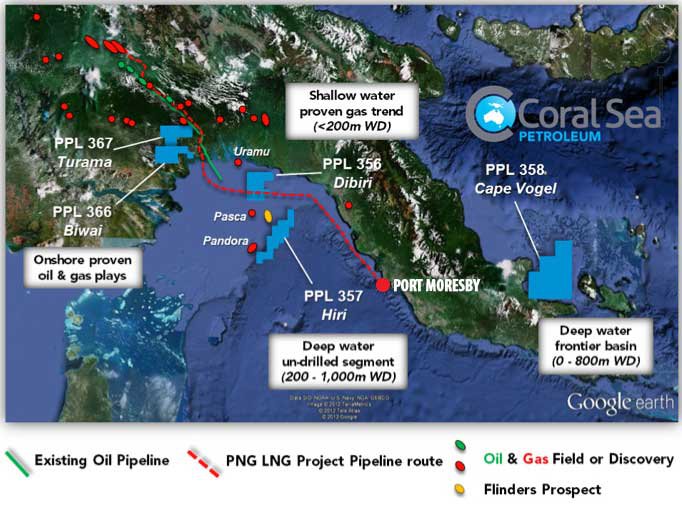

Here are SPB’s licenses in all their glory:

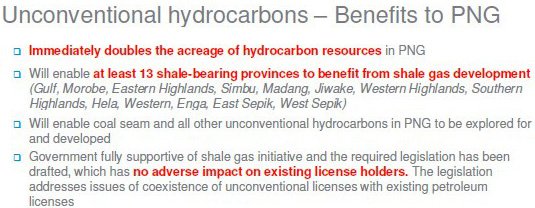

The opportunity for unconventional exploration and development of oil and gas reserves in PNG has come about due to the country’s Unconventional Hydrocarbons Act enacted on 26 February 2016, replacing the previous Oil and Gas Act of 1998.

The upside for SPB is that it has been promoted to the front of the exploration queue on the back of its faithful work in PNG over the past 5 years.

SPB now plans to conduct drilling within its permit areas to prove up any unconventional resources, potentially partner with much larger players, or follow in the footsteps of InterOil by attracting takeover offers...

Squabbling for hydrocarbons

PNG is currently the scene of an almighty scrap for territory and market positioning because of its large hydrocarbon endowment, low-cost exploration and lack of previous shale exploration.

Woodside Petroleum had their feelers out in PNG not too long ago, Oil Search and Total are currently spending billions to farm-in to premium tenements and then there’s InterOil who were reportedly courting takeover offers for its PNG assets until Exxon bought it for $3.6B.

So why all the hype?

The answer is that PNG is seen as one of the few remaining regions able to maintain oil/gas extraction competiveness whilst withstanding the impact of soft oil prices.

PNG also presents non-conventional shale gas opportunities, which could mean a huge boost for oil/gas that’s recoverable.

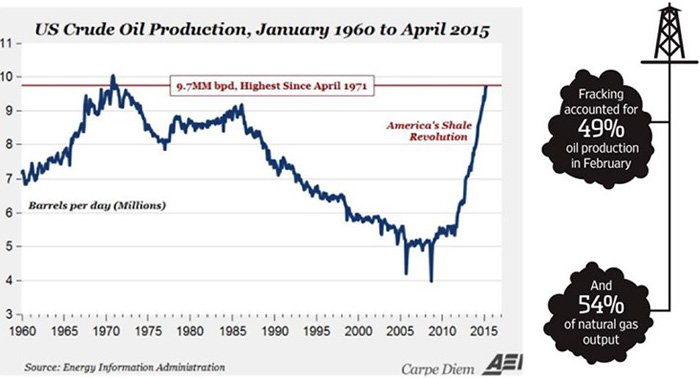

Take a look at how the ‘shale revolution’ affected the US in recent years:

For years, the US saw its production gradually seizing up, until some clever spark plugs stepped in with hydraulic fracturing to revolutionise what is thought of as possible in oil/gas exploration.

One of the more boisterous shale industry proponents was Aubrey McClendon — a mastermind oiler who was dubbed ‘ The Steven Jobs of Shale’ , and whose strategy can be found in the case of ASX-listed Empire Energy (ASX:EEG).

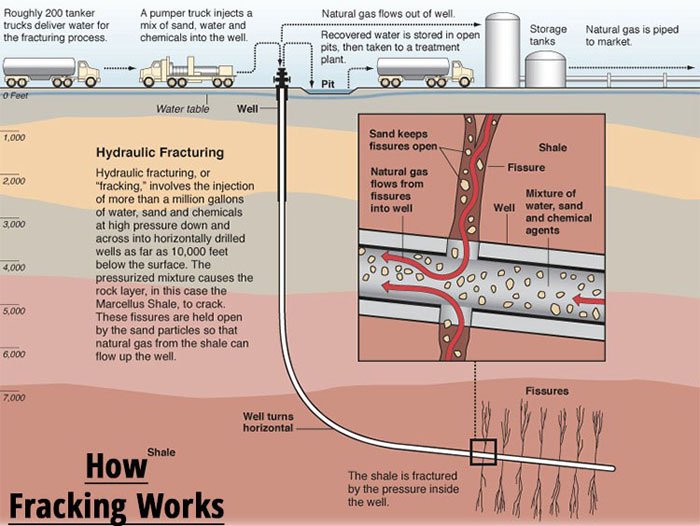

Here’s how ‘fracking’ or ‘fraccing’ actually works in practise; bear in mind this is the kind of exploration SPB is focused on:

Listen to a geologist talking about the ins and outs of fracking in PNG by clicking on the following link:

http://www.abc.net.au/news/2016-07-07/png-considers-developing-shale-gas-industry/7578430

The trick with fracking is to tweak the balance of water, sand and chemicals to an appropriate level and choose the correct exploration area, for it to successfully tap a large shale basin.

SPB is confident its 4 years of development can now be leveraged to tap such a shale basin.

Previously untapped shale regions like Papua New Guinea are only now starting to see feel the ripples of oil giants such as Exxon, Total, and Oil Search dipping their toes into the region.

The oilers that have risked exploration in PNG, already have major success from conventional oil and gas operations — but now the unconventional side looks like it could be even more substantial.

Especially when you consider that junior companies such as InterOil, who made one of the biggest oil and gas discoveries in the last decade (the booming Elk-Antelope prospects), was targeted by another oiler, Oil Search Ltd. And Total SA in a US$2.2 billion takeover bid before Exxon came along.

The region is throbbing with activity, so...

Let’s take another look at SPB’s ground in PNG

Mapped out below and marked in pink, are SPB’s five licenses — 2 onshore and 3 offshore.

As conventional oil and gas reserves are diminishing worldwide, attention is being paid to exploring for unconventional oil and gas resources — principally shale gas and coal seam gas, which are seen as resources of the future.

SPB’s unconventional exploration permits sit right over the top of existing oil and gas fields like Elk/Antelope and Juha, and include many highly prospective shales.

As we mentioned above, one of the biggest discoveries in decades in resources rich Papua New Guinea was InterOil’s Elk/Antelope gas field, which recently sparked a multi-billion dollar bidding war.

Now, of course we are not suggesting, and there is no guarantee that SPB will spark anywhere near the same sort of interest as Interoil, and investors should consider all information and do their own research before making an investment decision. Invest with caution and seek professional financial advice.

Already, PNG’s national endowment is creeping up the top 10 list, and there’s been hardly any exploration done so far.

Newly appointed technical team

In what is a significant move for SPB, the company has engaged Tamarind Management Sdn Bhd to provide support in developing SPB’s recently acquired license reservations in PNG.

Tamarind is a private oil and gas company based in Kuala Lumpur and has substantial experience in developing assets in the PNG region.

Tamarind is run by some high-profile personnel with past experience leading energy services groups such as Schlumberger.

The group was previously backed by Blackstone Energy Partners LP with a capital commitment of US$800 million to facilitate exploration of oil and gas opportunities in Southeast Asia.

The agreement between SPB and Tamarind is subject to ASX and shareholder approval and involves a minimal cash outlay, dependent on a capital raising event and with an incentivised share option scheme based on the achievement of key development and corporate milestones.

The deal stipulates Tamarind will be allotted 20 million options structured on progressive terms to align with the achievements of significant commercial and technical milestones.

These milestones are dated between 12 months and 36 months and will be determined by the group’s share price achieving share price levels up to 15 cents per share with exercise prices ranging between 8 cents and 15 cents per share.

The full details can be found here .

This arrangement clearly aligns the performance of SPB’s management and its technical team with the interests of shareholders and is a positive step in the company’s development.

Taking the inside track

As we mentioned earlier, SPB’s top-tier connections have facilitated a strong working relationship with the PNG authorities, and this has paved SPB’s road to finding market traction.

PNG’s Minister Micah has reserved SPB’s granted licenses for five years ensuring SPB will avoid competition for at least 5 years.

All this sums up to a great working environment for first mover SPB. Ground work across PNG indicates colossal shale deposits in the region, and current analysis has concluded that the unconventional oil and gas reserves may be significantly greater in magnitude than the country’s known conventional oil and gas reserves.

It is no wonder that PNG’s authorities have decided to pursue exploration albeit at a measured pace — which may even be more of a boon for SPB given its ability to beat larger names to the post despite its smaller size.

Making waves in the South Pacific

The US shale revolution is going global with fracking in tow.

Given the lack of any slowdown in the rate of unconventional oil exploration and shale targeting; fracking strategies, depending on specific project economics, appear to remain one of the most lucrative methods of conducting oil exploration nowadays.

As the old saying goes, every problem is an opportunity in disguise...

SPB identified a huge opportunity in PNG on the back of a significant pricing problem in the oil market — it is simply too easy to extract oil these days. So the answer to this problem becomes quantity.

SPB could potentially identify a multi-billion barrel resource, which further exploration will hopefully prove up and commercialise.

What could be described as one of the most audacious attempts in oil market history is being progressed by SPB in the PNG — to be one of the first companies to take a stake in possibly the world’s next Gorgon, and with a head start to boot.

It’s not a question of whether there are hydrocarbon deposits in PNG — the question is how much, and how complicated will it be to extract?

Considering the region and type of geology — the development costs are a fraction of any other large shale deposit, anywhere in the world.

At the same time, SPB is a high risk stock, given its projects are located in PNG. Investors should consider with caution, and take into account personal circumstances and risk profile before choosing to make an investment.

With the price of oil now clawing its way back to respectability, several companies are taking this as a sign to re-enter oil and gas regions with high-impact potential upside.

Yet, big oil strikes are an investor’s favourite prey and SPB could be a tasty morsel that’s tendering up to turn into a commercial feast.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.