Sacgasco embarks on potential company making drilling campaign

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

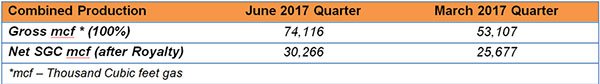

Sacgasco Limited (ASX: SGC) released its quarterly result for the three months to June 30, 2017 on Monday. It was an active three months for the company from a corporate and operational perspective, and promising newsflow provided positive momentum. However, the next quarter could see some game changing developments.

As a backdrop, SGC is an Australian-based energy company focused on natural gas exploration in the Sacramento Basin, onshore California. The company has an extensive portfolio of gas prospects at both exploration and appraisal stages, including multi-Tcf opportunities.

SGC is targeting gas supply to the high demand local Californian gas market and the burgeoning LNG market in North America. Management is of the view that the size of the prospects in California have the potential to supply both the domestic Californian gas market and export LNG markets.

During the June quarter, and into July, SGC achieved a number of corporate and operational milestones, further strengthening its diversity and resilience, effectively consolidating its position as one of the leading Natural Gas operators in California’s world-class Sacramento Basin.

Share price fails to capture the value of producing assets and near-term production upside

However, even though the company’s share price has increased substantially since June, it doesn’t appear to factor in the significant potential upside from drilling which has just commenced at its 50% owned Dempsey prospect.

Of course, it should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

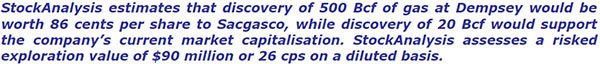

As Peter Strachan from StockAnalysis highlights below, Dempsey could be a company maker worth up to 86 cents per share for SGC.

Given this backdrop and the fact that the company is already generating cash flow from production as indicated below, it is difficult to understand the disconnect between the company’s recent trading range of circa 9 cents and Strachan’s target price of 25 cents.

It is worth noting that this is a risked valuation which only attributes a value of 14.8 cents per share to the Dempsey Field, which under his assessment based on upcoming exploration results could draw a valuation of more than $500 million with $262 million attributable to SGC.

However, broker projections and price targets are only estimates and may not be met.

New pipeline connections to drive natural gas production in fiscal 2018

In May, SGC advised that it had begun permitting pipeline connections to facilitate an increase in natural gas production by up to 1.5 million cubic feet of gas per day (mmcfgpd). This additional production would be the result of bringing back online some of the recently acquired shut-in gas wells. At current gas prices of around US$3.50 per mcf the gross cash flow from production from SGC operated wells would be over AUD$4 million per year.

The company has also identified additional workover opportunities and pipeline connections in its portfolio that provide opportunities for further increases in production in the near future. Production facilities also provide access points for future exploration success from Sacgasco’s appraisal and exploration activities.

Interest in farm-out agreements an endorsement of confidence in Dempsey

A key development during the quarter was the signing of an additional farm-out agreement with London Stock Exchange listed Empyrean Energy plc (“EME” or “Empyrean”) for the 1+ TCF natural gas Dempsey Prospect and other Sacramento Basin assets, onshore California.

Commenting on these developments, SGC Managing Director Gary Jeffery said, “A key focus for the Board over recent times has been to de-risk our activities, as evidenced by the strategic farm-out agreements executed during the quarter with both Empyrean and Pancontinental (Bombora)”.

After Farm‐in Working Interests in the Dempsey Gas Project:

Sacgasco Limited (ASX: SGC) (Operator) 50%

Empyrean Energy PLC (LON:EME) 30%

Pancontinental Oil and Gas NL (ASX: PCL) 10%

Xstate Resources Limited (ASX: XST) 10%

Jeffery also highlighted the fact that the company’s ability to execute these agreements has provided the business with the required funding to undertake a number of initiatives as well as completing the drilling of Dempsey in the September quarter, saying. “Sacgasco is now in the enviable position of holding major working interests, and operatorship, over two drill-ready, multi-Tcf natural gas prospects located in one of the largest natural gas markets in North America”.

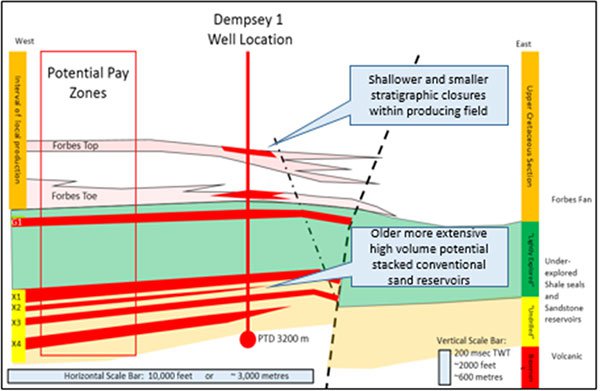

Importantly, the Empyrean farm-out provided Sacgasco with the necessary funding commitments to drill the Dempsey Prospect immediately. A number of key advancements were made in recent weeks in preparation for the August commencement of a 3200 metre combined appraisal and exploration well, the details of which are illustrated below.

Sacgasco interprets over 7 target gas reservoir levels. Individual, unrisked Deterministic Prospective Resources for the primary targets range from 116 Bcf to 352 Bcf of recoverable gas. Should all the stacked reservoirs be full of gas, the cumulative unrisked recoverable Prospective Resources within the prospect could exceed 1 Tcf.

Note: “The estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially movable hydrocarbons.”

The primary targets are interpreted in a series of Cretaceous sandstone reservoirs that exhibit structurally consistent amplitude anomalies similar to those that are observed on seismic elsewhere in the basin where conventional sandstone reservoirs have trapped natural gas in mapped structural closures such as the Tulainyo/James and Alvares wells.

California Natural Gas Market Dynamics

Commenting on the gas pricing environment in California, Jeffery said, “The continuing solid performance of California gas prices (between US$3 and US$3.50 per mcf during the reporting quarter), in one of the lower operating cost environments in the world, in conjunction with improving capital markets for oil and gas investments, underpins a positive outlook for Sacgasco as it embarks on the drilling of the Dempsey well with its potential for significantly increased sales of clean, natural gas in California, a “Top 6 World Economy”.

California consumes enormous quantities of gas, equivalent to around 2.25 times the entire output of Australia’s NW Shelf LNG plants – but produces less than 10% of this consumed gas. The rest is imported from elsewhere in the US and Canada. Hence the premium market for natural gas compared with most of the US.

Access to extensive gas pipelines and production equipment enhances the commercial potential of the SGC Sacramento Basin natural gas play.

The following picture of preparations being undertaken for drilling the Dempsey 1-15 show how close the Dempsey well bore is to an existing Sacgasco JV owned meter station connecting to the massive California Natural Gas market.

The proximity of the connection to California’s gas pipeline system will facilitate early cashflow from any success at Dempsey. It also means that the commerciality threshold at Dempsey is very low.

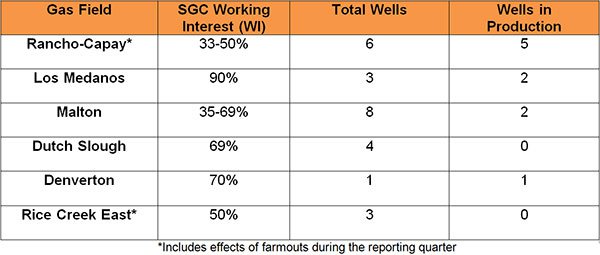

The table below outlines Sacgasco’s current gas fields and associated well Interests:

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.