Roto-Gro improves access to European markets through dual listing

Published 09-JUL-2018 11:54 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

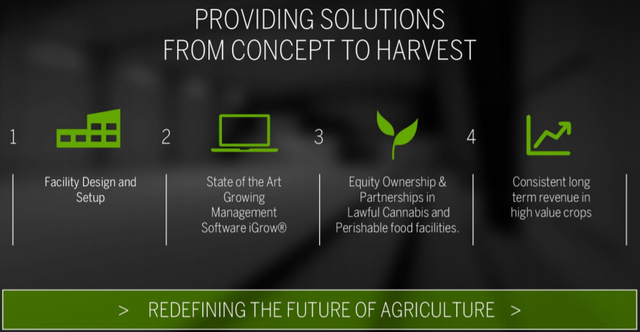

Roto-Gro International Limited (ASX:RGI) has completed its dual listing on the Frankfurt Stock Exchange, and the company has appointed Deutsche Gesellschaft für Wertpapieranalyse GmbH ("DGWA") as its European Corporate Advisor.

The engagement of DGWA provides Roto-Gro with investor relations and corporate advisory services, positioning the company in the German-speaking media environment and broadening investment from European retail and institutional investors.

Managing Director of Roto-Gro, Michael Carli said, “The engagement of DGWA and the dual listing on the Frankfurt Stock Exchange are key milestones in our aspirations of building a European investor base and operational footprint.

“Boasting a population in excess of 750 million, the opportunities to capitalise on the changes to cannabis legislation and partnering with existing perishable food growers such as Agrarius are very exciting.”

Potential to capitalise on worldwide licences

The company holds worldwide exclusive licenses for lawful medicinal and recreational cannabis markets.

Roto-Gro also holds worldwide non-exclusive licences for all other purposes including pharmaceuticals, nutraceuticals and perishable foods.

Although this remains a speculative stock and investors should seek professional financial advice if considering it for their portfolio.

Fits with expansion strategy in northern hemisphere

Fostering an understanding of its business in northern hemisphere markets is important for the company as it will improve its chances of raising capital in that region.

Of further significance is the fact that Roto-Gro has recently entered North America having recently acquired a revenue and earnings accretive business in Global Fertigation Solutions Inc (GFS).

Management has expressed its desire to expand further organically or through acquisition in other markets where it can find demand for its agricultural technology services.

These are particularly sought after by cannabis growers and GFS has a patent-pending specialized business line for water treatment and nutrient management in the viticulture, perishable foods and lawful cannabis space.

Müller has background in assisting other ASX companies

With several European countries at the forefront of the lawful medicinal and recreational cannabis markets, representation and access to capital markets in that region will be beneficial.

It is also worth noting that the chief executive of DGWA, Mr. Stefan Müller, has a strong track record in assisting dual listed ASX companies in Europe.

Mr. Müller holds the position of Non-Executive Director at Cape Lambert Resources (ASX:CFE) and European Lithium Ltd (ASX:EUR) both dual-listed on the Australian Securities Exchange and Bӧrse Frankfurt.

The engagement of DGWA has seen the European shareholder base of both EUR and CFE increase to 70 per cent and 30 per cent respectively.

Müller is also on the board of Agrarius AG, a publicly-listed German agricultural company which grows perishable foods in central Europe, providing high quality food products directly to wholesalers.

Agrarius could emerge as partner

In discussing the potential development opportunities he said, "We are very excited to be working with Roto-Gro as the company looks to advance its cutting-edge agricultural technology and investments in high value crop facilities.

“The European investor community is very conversant with the agricultural, engineering and technology space which places Roto-Gro in a unique position to capitalise on the strength of European investment in these sectors.

“Additionally, there is keen interest from Agrarius to partner in technology and urban farming opportunities in Europe.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.