Reporting from on site in Brazil…

Published 15-JUN-2024 15:52 P.M.

|

14 minute read

“Sell in May” didn't happen this year...

It was more like “small cap stocks are finally going up again” May.

Then June rolled around...

Since June started two weeks ago things have slowed down a little bit.

Some of the wind has come out of small cap sails.

But even by “June tax loss selling” standards, it’s still looking pretty good...

June tax loss selling usually stops somewhere in the second half of June (next week) as bargain hunters come in to pick away at the lower share prices created by the tax loss sellers.

In 2023, we predicted that after June 2023 tax loss selling finished the small cap market would roar back...

We were wrong.

Or maybe we were just a year early with our prediction...

Again, we are betting that the second half of 2024 will be a very good time for small cap stocks.

The eventual return to “risk on” in the small cap space that always eventually rolls around (that we were hoping to see in 2023) but seems to have taken longer than usual this time around.

These are the “normal to good” conditions we have been preparing for over the last 2 years of “soft to terrible” conditions.

In anticipation of this improved sentiment, we are looking even harder at potential new Investments.

The most recent Investment we have made a few days ago is a biotech company called Inoviq (ASX:IIQ) - read why we just Invested in IIQ here.

Reporting from on site in Brazil...

Today we’ve got an update from one of our team members who is currently in Salinas, Minas Gerais, Brazil.

He’s checking in on three of our Brazilian lithium Investments...

- Lightning Minerals (ASX:L1M)

- Solis Minerals (ASX:SLM)

- And one of our best ever Investments - the Chris Gale helmed Latin Resources (ASX:LRS).

LRS currently has a $560M market cap and is rapidly developing Brazil’s largest lithium resource, aiming to be in production by 2026.

L1M is asub $5M market cap early stage explorer in close proximity to LRS and lithium producer Sigma Lithium.

SLM is a sub $10M market cap early stage explorer in Brazil lithium assets and also has copper assets in Peru.

Brazil Lithium Summit in Minas Gerais

Lithium producers, developers, explorers, and buyers all descended onto Belo Horizonte last week for the Brazil Lithium Summit organised by IV-VR.

After previously living in Brazil for a number of years in other cities, it was great to finally spend some time in Belo Horizonte.

Belo Horizonte is the capital of the state of Minas Gerais in Brazil.

There’s over 300 mines in the state, with Vale, Rio Tinto and BHP all established here.

As I touched down in the city I couldn't help but recognise the red dirt, strikingly similar to that of the Pilbara in WA.

Minas Gerais and Western Australia are both powerhouses of iron ore production.

Western Australia is now a powerhouse of lithium production - and Brazil is only just getting started when it comes to lithium.

Minas Gerais is fortunate enough to have the right geology to host many lithium deposits, and is able to produce high grade lithium at relatively low costs.

But there’s only two lithium mines there... so far.

It’s just a matter of time before more Tier 1 lithium discoveries are made here and moved into development.

Here in Minas Gerais, it was obvious that all levels of government are determined to put Brazil’s “Lithium Valley” on the map and transform the country into one of the world’s biggest lithium producers.

In particular the government of the state of Minas Gerais is extremely welcoming of foreign investment in its emerging lithium industry, and they were very present at the conference:

Having a pro-business government keen to accelerate progress speeds up development of mines, and attracts more capital to the state.

Here’s some of the key attendees ringing in the TSX-V bell on Friday morning:

(Source)

Brazil is only just getting started - expect more lithium discoveries

There were a number of speakers at the conference saying that “Brazil is like WA 10 years ago when it comes to lithium”.

Until 2016, Australia as a country was producing modest amounts of lithium - it's hard to believe that was only 8 years ago.

Between 2016 and today, some of the world's biggest lithium deposits were discovered, developed and went into production in WA - with billions of dollars in value created.

A good example of one company that capitalised on it all was Pilbara Minerals.

Pre-2016 Pilbara Minerals was a tiny micro cap explorer with a market cap <$15M.

Now Pilbara Minerals is one of the biggest producers of spodumene concentrate in Australia - and the company is capped at ~$10BN.

WA is also home to the world’s highest grade lithium mine - Greenbushes.

Interestingly, earlier this year Greenbushes lithium expert Peter Oliver joined the board of LRS - bringing all his expertise and experience to LRS’ Brazilian lithium asset.

The lithium mines that came online during the boom years have made Australia the number one producer on the planet.

Brazil for lithium is like WA 10 years ago

Brazil shares similar geology to Australia and more specifically WA.

At the same time, the established Brazilian iron ore industry means it's a favourable jurisdiction for doing business.

(Brazil is the world's second largest iron ore producer - second only to Australia)....

But when it comes to lithium, Brazil is only just getting started - like WA was around 10 years ago.

To get an idea of where the lithium industry is in Brazil and how fast it is transforming - three years ago it was illegal in Brazil to export lithium.

Sigma Lithium and Companhia Brasileira de Lítio are the only lithium producers at present.

Brazil wants to climb from 7th in the world to 3rd in the world in lithium production.

And that is definitely possible - it's got the right geology, it's got multiple projects in development - with our very own LRS pushing towards production, plus a number of other companies moving fast including Atlas Lithium and Lithium Ionic.

Over time, Brazil could have 10-15 lithium producers, analogous to Australia.

To really climb up the producer rankings and catch up to Australia, Brazil will need NEW discoveries from other companies...

That’s where we think the opportunity is for our early stage, high risk for high reward Investments:

We should point out of course that early stage exploration is extremely difficult, and there is no guarantee that these companies will be successful in making a discovery.

But if they DO manage to make a rare discovery, then we expect to be rewarded with a substantial share price re-rate.

A word on lithium pricing - and profitable mining

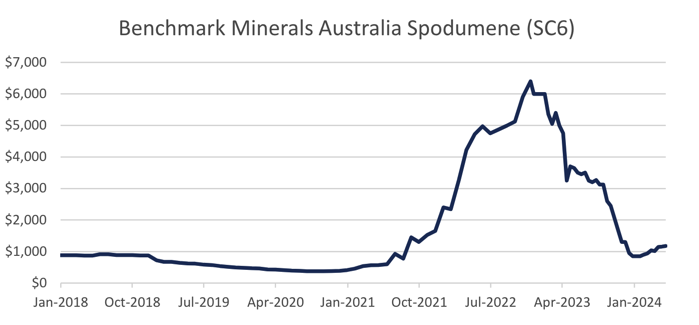

Here’s a reminder of the wild ride the lithium prices went on between 2021 and today, with the price climbing to over $6,000/tonne.

LRS presented a slide during the conference of a consensus view from analysts on a long term lithium spodumene price of ~$1,500/tonne.

As pointed out earlier - Brazil lithium discoveries tend to be high grade and low cost - which means they are economic even in more subdued forecasts like the consensus analyst forecast.

Sigma is producing lithium for $480/tonne.

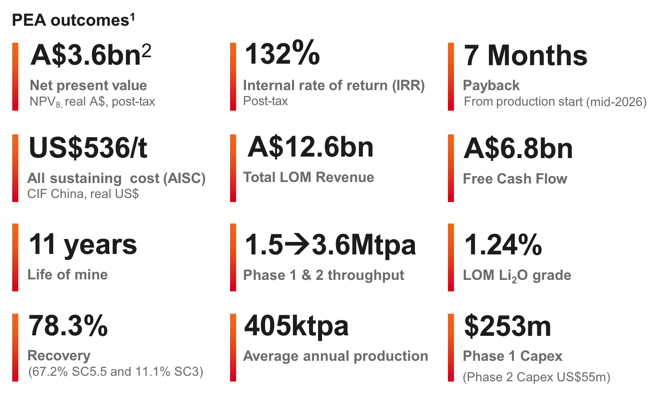

LRS is anticipating an all-in sustaining cost of US$536/tonne.

Both are still extremely profitable in the current lower price environment.

The relatively low costs of operating in Brazil was something Canaccord Genuity analyst Reg Spencer mentioned in an interview a few months back.

We listened to the whole thing, and it was interesting to hear LRS singled out as one of Reg’s top picks for the next cycle...

(Source)

LRS DFS has been released - with a Phase 1 CAPEX of $250M, for a $3.6BN NPV - some of the most impressive project economic numbers we have seen.

LRS - from discovery hole in 2022 - to largest lithium resource in Brazil in 2024 - and production forecast for 2026

LRS was a major sponsor of the Brazil Lithium Summit and hosted the “VIP icebreaker drinks” on the first night.

You can watch LRS MD Chris Gale’s quick welcome video here - it's a great 2 minute elevator pitch of where LRS finds itself today.

(Source)

LRS has been one of our best ever Investments.

We have been holding a position since November 2020 - way before the company made its lithium discovery.

Our Initial Entry Price for LRS was 1.8c.

Then in 2022 LRS hit its discovery hole and its share price rallied as high as ~23x our Initial Entry Price.

LRS now has the largest lithium deposit in Brazil.

And one of the largest undeveloped lithium deposits on a global scale.

A resource so vast, you can get lost in its enormity while using VR goggles (like I did).

LRS has been building its team too

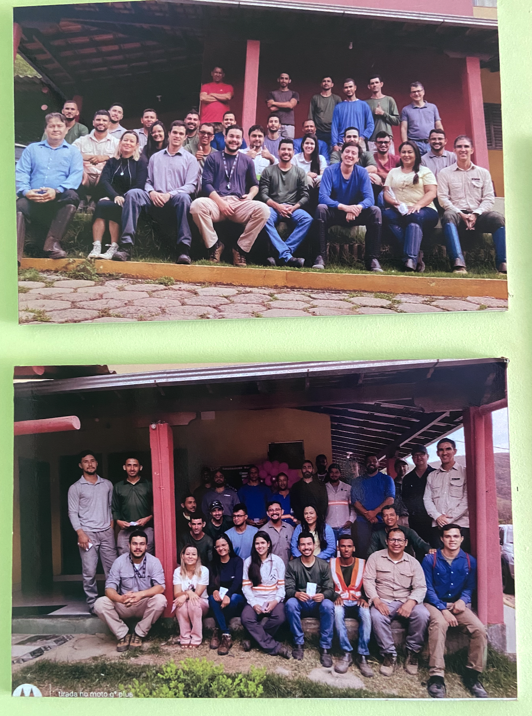

As LRS transitions from exploration into development, it's been adding expertise to the team too.

LRS has recently brought onboard:

- Peter Oliver as a non-exec director - Peter was the former CEO/MD of Talison lithium and corporate advisor to Chinese major Tianqi Lithium. He was also the GM at the highest grade lithium project in the world (Greenbushes).

- Aaron Maurer as COO - Aaron was previously the Executive General Manager for Mineral Resources.

And plenty more team members have joined with LRS total headcount in Salinas around 300 - here’s some of them:

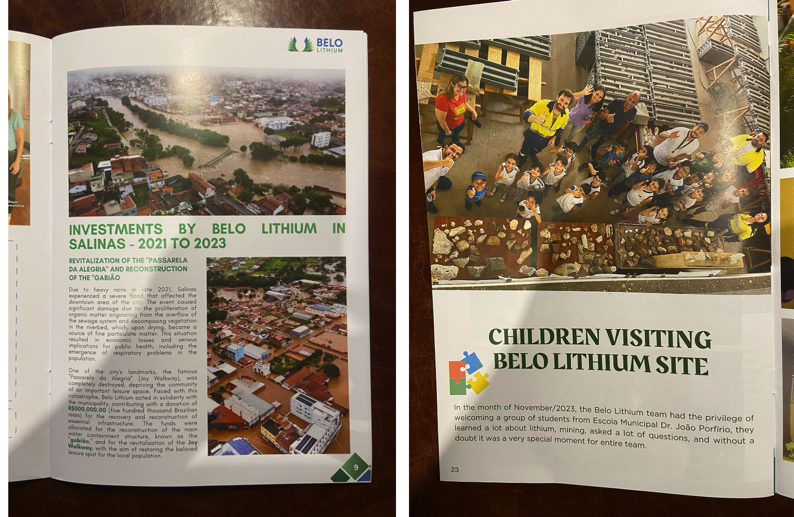

LRS also has a local social “licence to operate”

One of the most important aspects to get right in mining is to make sure the local communities back your project and are onside.

LRS employs around 300 people and is delivering on its promise of ESG friendly lithium.

This starts by engaging with the local community...

(which LRS is doing)

ESG friendly lithium is at the top of the agenda for western lithium buyers, and LRS has positioned itself to attract these kinds of customers.

The next LRS?

Naturally, like most investors, when you have success in a specific investment theme (lithium in Brazil) you want to try and repeat it...

And we currently have two horses in the race to be our next LRS:

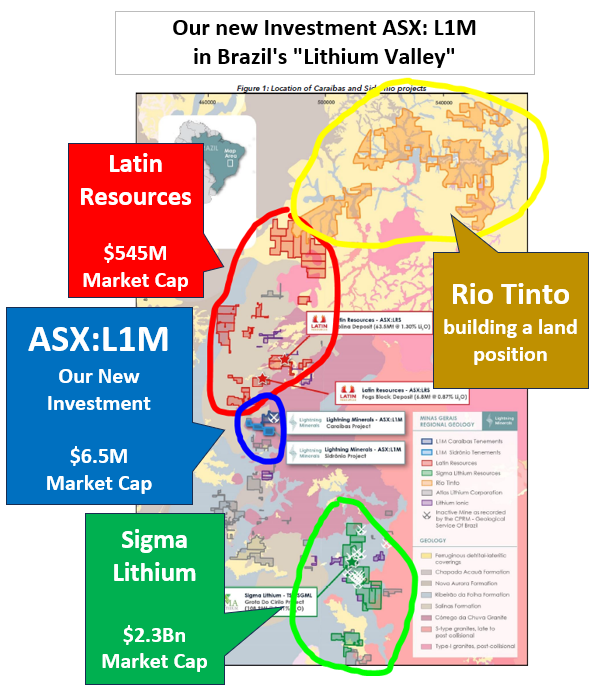

Lightning Minerals - ASX:L1M

If Brazil is like Australia 10 years ago, in many ways L1M is like LRS was 2+ years ago.

A pre-discovery ASX explorer, valued like one - with a market cap of less than $5M.

L1M currently has circa $2.5M in the bank, which is enough runway to meaningfully progress exploration in Brazil.

I spent some time in recent days with L1M MD Alex Biggs, who like me has also spent a lot of time on the ground in Brazil, so knows the culture and place well.

~$4M capped L1M has ground prospective for lithium just 20km from ~$560M capped LRS’ Tier 1 deposit and 60km from the ~$2.1BN capped Sigma Lithium.

L1M’s early stage lithium projects sit in the same Salinas Formation as LRS.

Multiple pegmatites have already been identified, with peak lithium rock chip grades assaying up to 0.53% lithium oxides (lepidolite).

L1M MD Alex Biggs and Exploration Manager Jarrod Woodland spent a number of days on site last week checking things out, here’s some of the photos:

With the capital raise and transaction complete, we are expecting the newsflow to increase with L1M over the coming months...

What to watch out for:

It’s early days for L1M, with a fair bit of work to get through ahead of planning a drill campaign.

After this week’s site visit, the next steps for L1M will be to run a number of sampling (stream sediment, soil) and mapping exercises, along with the collection of higher resolution aeromagnetic geophysical data to target “prospect scale” structures.

So far, so good though, and we will be tracking L1M’s progress closely.

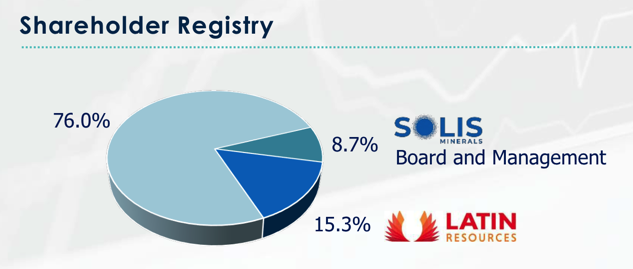

Solis Minerals ASX:SLM - copper in Peru

SLM is a spin out from LRS, with LRS maintaining ownership of 15.3% of the company.

SLM is a sub $10M capped explorer, aiming to make a new discovery which would see the company re-rate its share price.

In 2023, SLM saw its share price move from ~13c to $1.20 in anticipation of drilling at its Jaguar lithium project.

Whilst it still has lithium ground in Brazil in the state of Bahia, more recently SLM has turned its focus to its Peruvian copper assets, with the aim to firm up some drill targets.

SLM was in attendance and presenting during the conference, and helping ring in the TSX-V bell on Friday morning.

After not seeing enough at the Brazil lithium assets it held an option over, SLM has focussed its efforts on its copper assets in Peru.

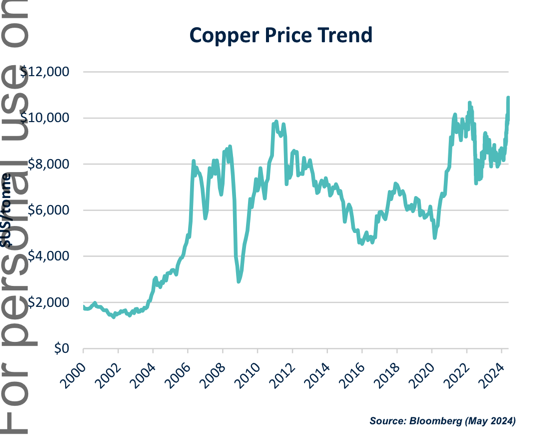

With the copper price starting to move up - up 35% in 2024 alone - it's actually a very good time to prove up some copper targets to go after.

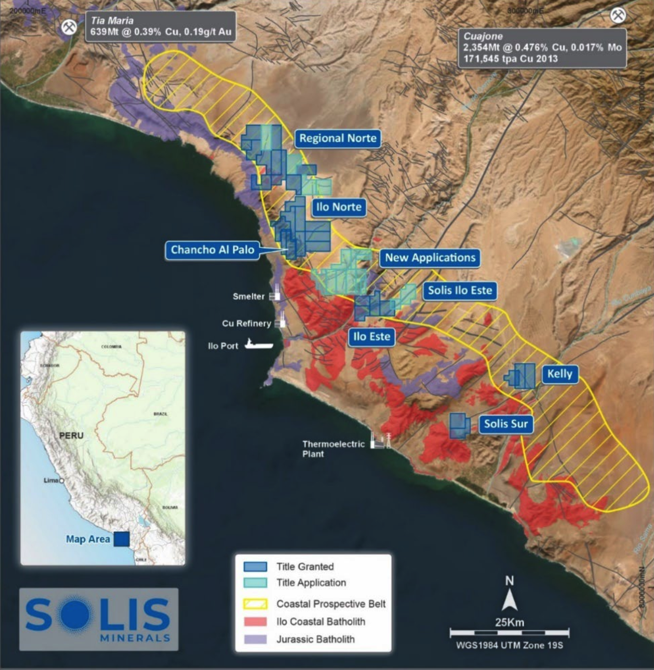

And Peru is a top contributor to copper production, accounting for 10% of the world’s copper output, so it's a good place to look for copper.

SLM has 43,500 ha of ground primarily along the coastal porphyry belt:

What’s next:

SLM is busy working on progressing its Peruvian copper assets, and we will be keeping an eye out for which one it moves to ‘drill ready’ stage. A pending drill campaign can be quite exciting - as we saw when SLM drilled for lithium in 2023. With still not many shares on issue, we have seen SLM run before...

Signing off from Belo Horizonte

After a great couple of days in Belo Horizonte, I’ll be spending the rest of this weekend in Salinas - the home of Sigma Lithium, LRS and L1M.

Look out for a site visit report from there next week...

What we wrote about this week

NEW INVESTMENT - Inoviq Ltd (ASX:IIQ)

This week we announced Inoviq as one of our new investments for 2024, a biotech company developing groundbreaking exosome technology for diagnosing and treating cancer and Alzheimer's.

Their promising products include a breast cancer test outperforming current methods, potential breast cancer therapies, and exosome isolation tools.

Read: Our New Investment is Inoviq (ASX: IIQ)

Global Uranium and Enrichment Ltd (ASX:GUE)

GUE reported an advancement in its uranium enrichment technology, which is crucial for nuclear power.

The U.S. ban on Russian uranium imports, which has already raised prices, boosts GUE's market potential. With key projects in the U.S. and ongoing Colorado drilling, GUE is well-positioned for growth.

Read: GUE: Uranium enrichment technology achieves 3x “separation factor” in enrichment process

Sun Silver Ltd (ASX:SS1)

SS1, our Next Investors 2024 Small Cap Pick, will begin drilling its Nevada silver project in a few weeks, with results expected over the following months.

The focus is to expand its 292Moz silver resource and upgrade its classification. The initial drilling will focus on the high-grade northern section.

SS1 is also developing silver paste for the U.S. solar market, seeking government grants for funding.

Read: Big two months coming up - SS1 starts drilling in next few weeks...

Quick Takes

GAL completes deal with MinRes + drilling update

TYX hits more lithium in Angola

MTH hits high grade gold and silver from diamond saw

SS1 rock chip assays coming, anomalous readings to north

GUE gets key permit, drilling next

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc:

- The Future Money: https://future-money.co/

Macro News - What we are reading

Copper:

Chinese Trader’s $20 Million Pile of Russian Copper Goes Missing (Bloomberg)

- Wuchan Zhongda Group Co. faces $20 million loss from missing Russian copper shipment diverted to Turkey.

- Chinese traders scrutinise contracts amid fraud fears in global metals trade.

- Incident highlights ongoing challenges in commodities markets, affecting market stability.

Energy:

Saudi Arabia ends petrodollar agreement: What it means for the USD, Bitcoin, and gold (Kitco News)

- U.S. and Saudi Arabia allow historic petrodollar agreement to lapse, signalling a significant shift in global economic dynamics.

- Potential implications include reduced USD dominance in global oil trade and heightened geopolitical tensions amid emerging energy transitions.

Uranium:

Uranium Price Surge Helps Deadly Metal Dominate Commodity Market (Bloomberg)

- Patterson Lake, Saskatchewan, emerges as a key uranium mining hub with significant global potential.

- Rising uranium prices driven by increased global demand for nuclear energy amid geopolitical tensions and climate concerns.

- NexGen Energy's Rook 1 project attracts substantial investment, showcasing confidence in Canada's pivotal role in uranium supply.

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.