PRM & GLV: “No commercial hydrocarbons were detected” - so what happens now?

Published 06-JUN-2022 12:59 P.M.

|

7 minute read

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 7,000,000 GLV shares, 49,000,000 PRM shares and 11,833,332 PRM options at the time of publishing this article. The Company has been engaged by PRM and GLV to share our commentary on the progress of our Investment in PRM and GLV over time.

Well, it’s a duster.

After an ~8 week build up of excitement for the PRM & GLV Sasanof-1 drill result, this morning the companies announced that:

“no commercial hydrocarbons were detected”.

These are the words that seasoned investors in high risk oil & gas exploration don’t want to hear, but are fully expecting and prepared for.

Oil & gas exploration is one of the fastest - but riskiest - ways for investors to seek 1,000% plus gains.

On the rare occasion an exceptional drill result is delivered, it can be one of the best days an exploration speculator can get.

However - most attempts will be like today was for PRM and GLV - not much fun at all.

To maximise our chances of hitting a winner, we need to place numerous bets, the majority of which will not pay off. So despite today’s failure, we will be back again, hoping to strike on the next one.

There was no technical analysis of the drill results from the companies today, which is understandable as there has been no time to fully analyse the result yet.

In an effort to refine our knowledge going forward to help us assess risk on future Investments, we will provide an assessment of how the Investment performed against our original Investment thesis documented in our PRM & GLV Investment Memo.

Here is an initial high level overview (reminder: this is based on our personal experience and personal Investment strategy, this is not personal financial advice):

What we learned:

We generally try to stick to the Investment plan we set out in our Investment memo.

In the compressed investment time frame with PRM & GLV, we found we didn’t have the opportunity to Free Carry prior to the result.

Definition: “Free Carry” means to have sold enough shares once a share price rises to recoup the initial Investment amount, leaving a “free carried” position going forward. For more detailed definitions see our definitions of our key terms on our FAQ page.

So we held our full position into the binary drill event.

We are now sitting on a significant paper loss.

At the time, we decided we were comfortable to hold the full position into the result because the Investment made up less than 2% of our total portfolio.

Would we do it this way again?

Probably yes, if the right opportunity came along and our exposure level was less than 2% of total portfolio value.

However we won’t be making a regular habit of it, because too many failures like this in a row without executing Free Carry will quickly add up to materially dent our Portfolio.

In small cap investing, the key aim is to preserve capital in order to ‘live to fight another day’ when an investment goes wrong - which happens more often than not.

What are we doing now that a negative result has been delivered?

After a bad drill result is announced, the share price drops significantly during peak fear and uncertainty.

At the time of writing this, PRM is trading down 75% and GLV down 76%.

In the same way that we avoid buying a stock when the share price is aggressively spiking upwards, we also avoid selling a stock when the price is aggressively spiking downwards on a very bad news day.

In our experience, good and bad results nearly always cause a share price to initially overshoot upwards or downwards, before the stock finds its new near term trading range.

However this is just a general observation we have made over the years. While we expect the share prices of PRM and GLV to settle a little higher than the initial spike down, both share prices may actually still go lower over the next few weeks - we simply don’t know.

In any case, we will continue to hold our full position in PRM and GLV until the share prices settle and then reassess what to do next.

So what happens now?

In our opinion, both PRM and GLV have now effectively become “shells” that will need to find a new project that will get the market interested, and then to raise a new round of cash at around wherever the share prices settle at in the coming months.

Finding a new project to acquire can take months or even over a year, so holding a shell requires patience and faith in management to find a good project and do a good deal.

Investors need to be ready to wear “opportunity cost risk” being parked in a shell while other potential investments in the market are delivering value.

The market will need time to digest the news and place a value on what is left over in PRM and GLV - we want to see where it ends up valuing the company's remaining assets.

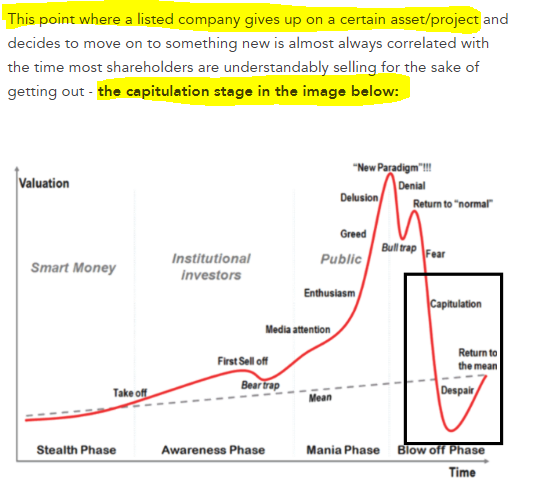

More on the Capitulation and Despair Phases

Markets are a simple game of supply and demand. If the number of sellers of a stock outweigh buyers, the share price goes down.

This can mean that when bad news is released, buyers will disappear and investors will look to sell at whatever prices they can get.

This inherently creates overreactions to these types of negative news announcements.

We touched on how markets react to these type negative announcements in a recent educational article we wrote titled "What is an ASX-listed shell?".

With some investors looking to “exit at all costs” on bad result, both companies enter the “capitulation stage” of a company’s share price life cycle.

In the article we touch on how companies like PRM and GLV move on from failed objectives and assuming the right boxes are ticked can be given a new lease of life.

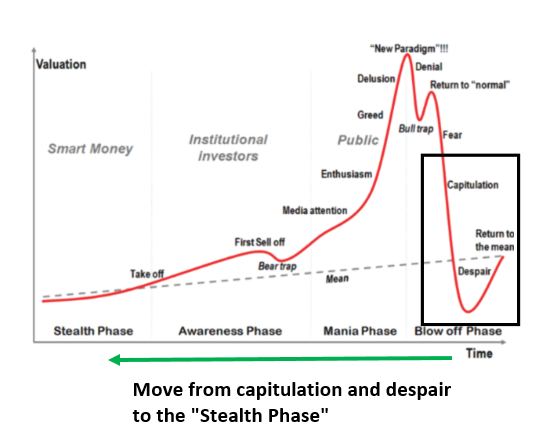

In summary, we plan to hold our position during the “capitulation” and “despair” phase and assess what to do after that.

We will spend the next few weeks assessing where the market settles, we will run through our normal due diligence process over both PRM and GLV’s remaining assets and then decide what to do next.

Because the process of finding a new project for a shell can take time, we will consider moving our shares into our investment trust where we hold our long term positions.

🎓 = To learn more about ASX listed shells and how they come about check out our educational article here.

What are the trading patterns telling us?

Today the volume of selling versus the total shares on issue in both PRM and GLV has so far been less than we expected.

At the time of writing:

- GLV is down 76% based on a total of ~414 million shares traded, this compares to 1.88 billion shares on issue.

- PRM is down 75% based on a total of ~294 million shares traded, this compares to ~2.4 billion shares on issue.

We believe the selling today is mainly investors who do not want to wait for the months (or even over a year) it may take for the companies to come up with a new plan. Every investor has their own personal investment plan and circumstances.

Selling today does have some merit to crystallise a capital loss for tax purposes (to offset capital gains) after many investors may have had a good year in other investments.

Alternatively, it’s likely that some investors who are holding or even buying today believe there could be an interesting new project announced by each company at some point in the future (much like the interest in the Sasanof Prospect was acquired prior to drilling).

The investors that are holding from pre-Sasanof drilling may have decided to sit on the large paper loss and patiently wait for this to happen - however this strategy will not suit many investors.

Depending on the trading volumes over the next few days, we are hoping for a speedy consolidation phase whereby the selling pressure is churned through relatively quickly and the share price starts to creep back up over the coming week (or it still may go down depending on how many sellers there are still lurking).

We think that the move from capitulation and despair into the “stealth phase” should happen over the next few months.

So in summary, it has been a disappointing result, we are wearing a paper loss, and for the next few weeks we will be holding and waiting to see where the near term trading bands will form in both PRM and GLV.

And of course we will be getting right back on the horse and looking for the next high risk, potential high reward Investment.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.