Is a Pending Medical Cannabis Deal about to Light up this ASX Stock?

Published 16-JUN-2017 12:15 P.M.

|

13 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is no doubt one of the flavours of the last few months has been medical cannabis stocks on the ASX.

With markets opening all across the globe due to a rapidly changing regulatory environment, even the mere mention of “medical cannabis” in an ASX announcement can get a stock moving.

We have been alerted to a $6M capped ASX Listed Investment Company that takes high conviction bets on emerging companies seeking capital and active management advice. The company is involved in several sectors including waste management and digital media and is expected to close on a medical cannabis deal in North America any day now.

This company is, in fact, in advanced stage negotiations with a number of substantial high quality medical cannabis investment opportunities.

Confirmation of a deal may be enough for this stock’s valuation to quickly escalate. In fact, it has already set up a subsidiary company to facilitate its entry into the medicinal cannabis market.

However, it should be noted that there are no future performance guarantees and any rise in valuation is speculative so any investment decision should be made with caution and professional financial advice should be sought.

The evidence for the move is compelling. This article by Forbes tells a story by itself:

Last year the University of Sydney estimated that legalising cannabis would create a $100 million domestic market and looking further afield, the global medicinal marijuana market is expected to reach a value of US$55.8 billion by 2025 .

To kickstart its entry, the company has created a subsidiary to evaluate and invest in targeted segments of the medicinal cannabis sector including veterinary science and animal treatment and will pursue global licensing and distribution opportunities with an initial focus on North America – the world’s largest medicinal cannabis market.

Should it bring the medicinal cannabis company into its fold, we think now could be the time to back this pony as it hopefully stampedes into the lush commercial savannah of medicinal cannabis commercialisation.

Introducing:

Chapmans Ltd (ASX: CHP) is not the typical stock readers are accustomed to seeing here at The Next Small Cap . In fact, after scratching our collective temples, we couldn’t find any previous instances of us delving into a Listed Investment company (LIC).

Interestingly LICs make up the majority of the listed managed funds on the ASX. Investments in these funds most commonly provide exposure to a basket of underlying shares, and in some cases some specialist funds that provide exposure to other asset classes.

So how does CHP make money and would investors take an interest in this business?

Following a management restructure, leading to a portfolio restructure, the new look CHP has set aggressive investment return hurdles to put shareholder wealth enhancement as a priority. CHP has invested in a number of businesses and is actively involved with and puts cash in companies or ventures that are likely to reap near-term rewards, in monetary or strategic terms.

Under one roof, CHP already contains four different brands, or separate businesses with entirely delineated operations.

This means CHP is a stock-picker in its own right — just like our readers.

However what really sets CHP apart is that with every investment they make they have a clear and pre-determined exit strategy that’s typically based on key events including.

- A period of significant accelerated growth

• Business expansion or transition events

• Maturity and liquidity events

• The need to access immediate and significant levels of capital for bankable projects or non-conforming higher risk opportunities.

Through these events opportunities arise to invest in strong and well-managed businesses at a low entry price.

Here’s the investment philosophy in a nutshell:

As you can see, this is a tightly defined investment philosophy, based on actively managing low entry point, scalable companies with clear differentiators to their peers; companies that have the potential to increase in valuation by multiples by the time of divestment.

Running the numbers

It’s worth having a look at the numbers here to gain an understanding of CHP’s recent financial performance before investigating the opportunities within.

As you can see, CHP recorded almost $1 million in profit last year, with a handy earnings per share (EPS) of $0.111. Not bad for an ASX-listed stock that’s worth a paltry $6 million and priced at $0.02 per share.

Now let’s have a look at its current portfolio not including the potential addition of the medicinal cannabis company:

CHP takes stakes in various companies from far afield sectors and industries, for one reason and one reason alone: value creation.

No sector is deemed out of bounds, and no company is excluded from consideration — the most important aspect for CHP’s captains is delivering their ship into the port of expectant investors.

The strategy is not necessarily to make a bundle of cash in the first 6 months, and neither is it necessarily to hang on for 6 years.

CHP’s management take different views based on market information, and the current idea being tossed around CHP’s trading desk is...

...medicinal cannabis.

Medicinal cannabis is an industry currently in the media spotlight, following moves across the globe to decriminalise.

Many of the concerns people had surrounding cannabis use are now being allayed, with the move towards creating medicinal marijuana products now in full swing.

So let’s take a look at just how lucrative medicinal cannabis could turn out to be for CHP

The size of the medicinal cannabis market is yet to be fully estimated, but it’s turning into a bit of a corker already.

Despite being a burgeoning market, liberated by the removal of strict government regulation across the globe, medicinal cannabis is already worth US$2.7 billion per year, estimated to top $14 billion a year by 2020 before reaching $US500 billion a year globally once fully mature according to data from ArcView.

Expectations of such parabolic rates of growth is not fanciful. Medicinal cannabis has been a loaded spring for years, and its liberation in North America demonstrates just how commercially viable this market niche can be.

Take a look at the North American Marijuana Index (NAMI), which measures a basket of cannabis-related stocks based in the US.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

That’s an excellent rate of growth which CHP hopes to capitalise on.

Australian investors can expect to see similar moves in Australia, as and when the industry matures into a commercial entity. This burgeoning process is currently underway after legislative changes which means CHP can realistically expect to have the entire English-speaking world as its addressable market, at some point in the future.

It should be noted though that how much market penetration CHP achieves once it enters into the medicinal cannabis industry is still a long way from being determined, so investors should take all publicly available information into account before making an investment decision.

Going global is worth the wait

Operating on a global scale will take some time as laws and regulations do not change as quickly as company operations do.

For the time being, here is the state of play for medicinal cannabis globally:

As the amount of countries where medicinal cannabis is legal increases, so will CHP’s addressable market.

In the US, the use of medicinal cannabis is legal in 23 states, of which California is the largest. Twelve states have passed, or are about to pass CBD-only medicinal cannabis regulations. These numbers are expected to rise towards 40 states by 2020 as pending legislation is expected to be put into practice in the next few years.

For CHP, being in this space is significant. CHP could advance its broader valuation within an industry bursting with spare capacity — safe in the knowledge that it has several other business units to keep earnings stable.

There have been several ASX companies with international reach that have all seen hundreds of percent gains over the past few months as tidal waves of investors join the party.

Companies such as Creso Pharma (ASX:CPH), MMJ Phytotech (ASX:MMJ), and MGC Pharmaceuticals (ASX:MXC) have all made significant gains and you can read about them in the following articles:

- CPH Signs Exclusive Cannapharm deal: On Track for 2017 Product Release

- Strategic Cannabis Acquisition Complete: MXC Set to Break Ground in Europe, Australia the Next Step

- MMJ Set to Unlock Value in Bullish Canadian Cannabis Market

Understandably, CHP has been tight-lipped about its next move into cannabis.

But so far, we know that a new company has been set up by the name of Cannabis Investments Limited (CIL), “to facilitate its entry into the medicinal cannabis sector.”

Not only does this set the scene for a price-supportive catalyst, in the foreseeable future. There are also other snippets of interesting information which gives us confidence CHP will make its newly-written biotech chapter a success.

Namely:

We do like to keep our eyes open, and veterinary applications of medical cannabis products is emerging as a treatment choice for vets and pet owners.

As all pet owners know, costs to keep your pet healthy can be enormous — but medicinal cannabis could help change all that, according to The New York Times ...

What do the analysts think?

In CHP’s case, a report from Independent Investment Research (IIR) slaps a price target of 2.7 cents on CHP, and re-affirms our own view that CHP has the legs to keep its growth-rates chugging along.

However, it should be noted that broker projections and price targets are only estimates and may not be met.

While we have focused on CHP’s latest strategic move thus far, there are several irons in the asset portfolio. So let’s take a look at its performance and gauge whether this small-cap portfolio manager has a chance of escalating its rate of progress.

Aside from medicinal cannabis

CHP is a pick’n’mix investment management company with an assortment of existing investments — and the good news is that they’re all doing rather well.

First off, the investment into 20Four — an up-and-coming digital brand enabling fans to interact with their favourite celebrities or sporting idols.

20Four is a mobile digital media business, but as its name suggests, it is an all-encompassing portal allowing full-spectrum interactivity between fans and their idols. It’s all done seamlessly via mobile phone apps and an online portal where all users can connect and network amongst each other.

Think Facebook meets Netflix for exclusive behind the scenes sports content, but on a more personalised and directed mission, deployed specifically by a sporting team, or an individual celebrity. This technology is also easily tweaked, making it useful for other uses that require multiple users having updated information and communication abilities with other users.

The business model is simple, and when factoring in the ongoing surge of celebrity-mania spreading like wildfire across the English-speaking world — we think CHP’s 20Four venture fits in well with the times.

CHP has a circa 40% holding in 20Four — a rather large chunk that gives CHP sizeable clout in the boardroom. Furthermore, the business model is highly scalable because of its Tech roots require server space rather than real-estate.

If CHP wants to deploy 20Four in countries other than the US, Australia and the UK, it is a simple matter of bagging the required server space and making sure its features have been translated.

That’s what we love about tech plays, scalability is always there. So as long as the underlying idea is a hit, the path to scale is typically assured. CHP could potentially capitalise on the rampant growth in digital content, and get itself some free publicity on a global scale in the process.

Yet it is an early stage player in this market and investors should seek professional financial advice if considering this stock for their portfolio.

Syn Dynamics

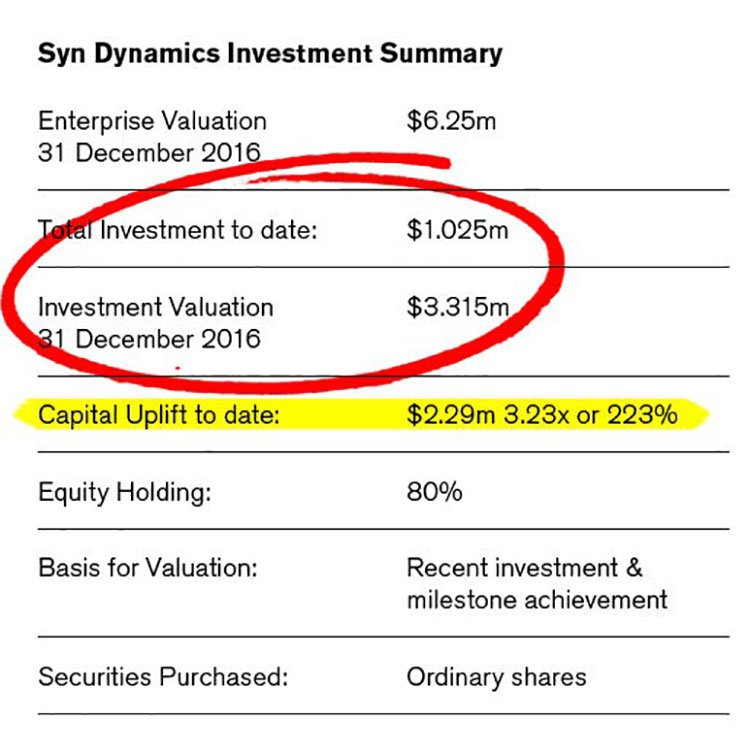

Having taken its 80% stake in Syn Dynamics in October 2016, CHP is already in the black on this investment, and hopefully, this is only the beginning.

Not too dissimilar to all its other investments, CHP’s Syn Dynamics venture, initiated late last year, has the potential to be a money-spinner in its own right.

Syn Dynamics is CHP’s entry into plasma gasification technology. As tongue-twisting as it sounds, this tech is all about improving hazardous waste remediation, and therefore, could be licensed to generate a steady income stream from existing miners, manufacturers and industrial waste disposal customers.

The technology has been developed over the past 10 years in Europe and Australia and is designed to address the performance, efficiency and scale limitations of existing waste to energy gasification technology. The ultimate objective is to optimise conversion, cost and accessibility within the global market for waste remediation and disposal.

The technology solves chronic storage and insurance costs for heavy industries that generate hazardous and toxic waste while addressing large balance sheet liabilities associated with environmental and public health risks for large waste producers such as oil refineries, petro-chemical manufacturers, mining, metals and pharmaceutical companies.

In other words, Syn Dynamics is the equivalent of cracker-jack clean-up crew, that can help pollutive business practises become more environmentally friendly. That’s exactly the kind of thing large manufacturers are seeking; in order to comply with increasingly stringent pollution controls and climate-change emissions caps.

If CHP gets this business unit motoring, it could potentially offer its services to every industrial manufacturer and heavy metals mining company in the world.

A diversified approach to small-cap investing

As all investors probably know — diversification is king, regardless of the type of investment you are most accustomed to.

In small-cap investing, diversification is a lot more difficult to find, given the lower volumes, wider spreads and less market liquidity. However, CHP’s market mantra is to take strategic stakes in well-run businesses scalable businesses. The common denominator between all of CHP’s investments, is a forward-looking future-conscious mindset that aims to capitalise on the sweeping changes being seen in energy, biotechnology, social media and electronics.

By taking key stakes in companies across potentially high-growth sectors including medicinal cannabis, digital marketing, social-media and waste-remediation, CHP is effectively sinking its fingers into several very different pies.

CHP’s strategy is dynamic enough to notice tectonic changes in market themes, but also disciplined enough to extract tangible capital growth for its investors.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.