Our plan for 2024

Published 05-JAN-2024 09:21 A.M.

|

5 minute read

Christmas Eve to January 5th...

That glorious time of the year where it’s possible to actually forget what day of the week it is.

(and send our weekend newsletter on a Friday)

It was nice to have a bit of time away from the markets.

Following the small cap markets can get hectic.

A lot happens and happens quickly.

It’s always good to take some time away to clear the head.

(and let the brain heal)

Time off also gives us a chance to really think about the year ahead.

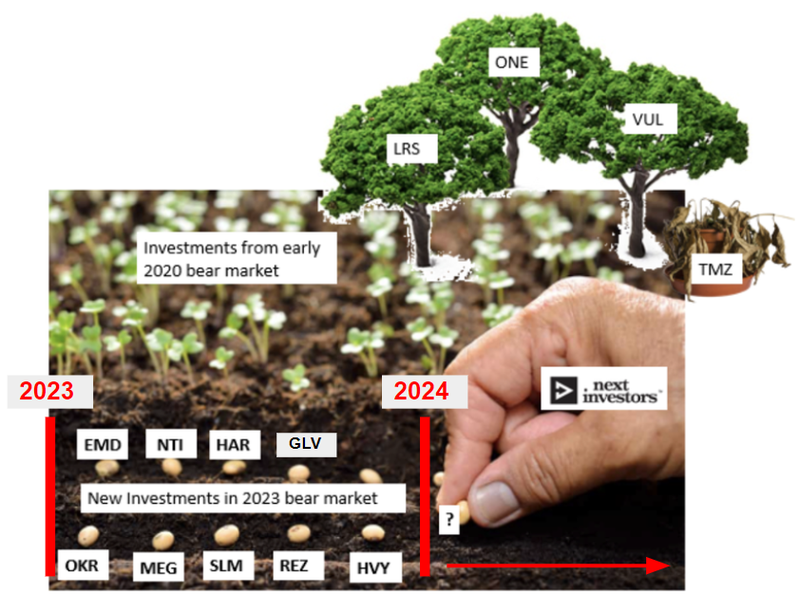

2023 was about making new Investments and adding to our existing positions while small cap share prices were bombed out.

We think 2024 will be the year where stock picking becomes more important than ever.

In bull markets it’s not that difficult to pick a company where the share price will quickly rise.

Everyone becomes a “genius” investor in a bull market.

In bear markets, it isn’t that difficult to pick companies with low valuations... every share price is smashed.

The challenge is finding the beaten down companies that have the highest potential for a bounceback when the market eventually turns.

Here is the criteria we look for when Investing:

- Low valuations

- Strong macro themes

- Great projects

- Great management teams

Our view is that if we can pick the rare few companies that tick all of these boxes, then we set our Portfolio up to re-rate the strongest when the market turns, and share prices are going up again.

More often than not, companies with a combination of these factors become the “market darlings” when sentiment is overwhelmingly positive.

It also acts as a way of mitigating risk, the companies that lack any/all of these criteria tend to perform the worst.

All things considered - we are hoping 2024 will see positive sentiment start to return to the small cap markets.

We hope to see our 2023 cohort of new investments re-rate upwards.

We also hope to be rewarded for the “averaging down” we did on our existing positions.

(we participated in almost every cap raise done by our Portfolio companies)

The first week of January is too early to tell what the year will look like for small caps.

So far, a couple of nice green days on our Portfolio and watchlist have been encouraging.

But we have also seen a couple of red days too.

The small cap market still seems unsure of which direction it wants to go in...

Next week will reveal more.

What’s our plan for 2024:

For the first part of 2024 the plan is going to stay the same as it was in the negative sentiment market conditions during 2023.

We are going to keep looking for undervalued stocks where we like the project and management team, in a strong macro theme.

We will look to add about 10 new investments in 2024.

New Investments in 2024:

As always, we are looking to add a couple of exploration stocks (our specialty), mostly in battery materials.

We are on the hunt for an oil & gas explorer going for a huge prize.

We are looking more closely at gold and uranium, both of which are having a run.

Biotechs have been delivering us some great returns in tough market conditions - so we are on the lookout for a couple of biotechs too.

We want to add one technology stock.

We also want to add some later stage mining companies (studies stage) that we think are heavily undervalued and set up for a rerate when the market eventually turns.

And finally, we will look for one fairly “left field” company trying something big - something that is a “swing for the fence”.

Things to watch out for in the coming weeks

Every new year starts off the same...

Most investors don't make it back to their desks until after Australia Day (26 January), and companies continue working on major catalysts that didn't get delivered before the end of the previous year.

Here are some companies across our portfolio that we are expecting material news in the next couple of months.

- Dimerix (ASX: DXB) - Interim results from its Phase 3 clinical trial on FSGS (March 2024)

- Neurotech International (ASX: NTI) - NTI has TWO catalysts coming up., results from a Phase II/III trial for Autism Spectrum Disorder and a Phase I/II Rett Syndrome clinical trial (positive Rett Syndrome results laid the foundation for Neuren Pharmaceuticals now +2,000% re-rate).

- 88 Energy (ASX: 88E) - Flow test of its Hickory-1 oil & gas discovery in the North Slope of Alaska in the US.

- Noble Helium (ASX: NHE) - final independent lab analysis on samples from its two wells.

- TechGen Metals (ASX: TG1) - Rock chip/soil sampling results from its lithium project in WA ahead of the company’s first drill program.

- Haranga Resources (ASX: HAR) - Assay results from its uranium project in Senegal.

- Grand Gulf Energy (ASX: GGE) - Sidetrack well at its Jesse-1A well. GGE will be looking to isolate and then stimulate its helium discovery - the goal being a commercially viable helium flow test.

- Tyranna Resources (ASX: TYX) - Assay results from its Angolan lithium project. TYX has hit plenty of visual spodumene in its drill cores so the assay results should be interesting.

- Solis Minerals (ASX: SLM) - Assay results from its Brazilian lithium project.

- Lanthanein Resources (ASX: LNR) - Drilling to start in February/March at its Lady Grey lithium project, next door to SQM/Wesfarmers giant Early Grey lithium mine.

- Galileo Mining (ASX: GAL) - Assay results from its nickel/palladium project in WA.

- Kuniko (ASX: KNI) - Maiden JORC resource from its nickel project in Norway.

- Arovella Therapeutics (ASX: ALA) - We’re looking for a finalised Phase 1 clinical trial plan from ALA, which could drop this quarter or the next. We’re also looking for data on animal studies from the ALA + Imugene partnership for solid tumours.

Quick Takes 🗣️

ALA completes key manufacturing milestone

KNI’s new Swedish lithium projects

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.