Our new Investment is Echo IQ (ASX:EIQ)

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,470,000 EIQ Shares and the Company’s staff own 140,000 EIQ shares at the time of publishing this article. The Company has been engaged by EIQ to share our commentary on the progress of our Investment in EIQ over time.

Today we are announcing our newest Investment.

It’s an ASX healthcare technology stock just a few weeks from a major share price catalyst.

Our June tech Investment has been up as high as 306%, and is currently up 119%.

One of our best ever tech Investments has been up as high as 608%, and is currently up 475%.

After months of due diligence, we have now found another ASX tech stock that fits our investment criteria, and we have decided to Invest.

Here’s why.

It’s been long talked about - but it’s now happening.

Artificial Intelligence (AI) solving some of healthcare's biggest challenges.

This company helps detect serious, potentially fatal problems in the most important muscle in the human body - the heart.

Diseases of the heart are the leading cause of death worldwide.

Even though treatments are improving, accurate diagnosis remains complex.

Our latest Investment can deliver vastly more accurate diagnoses than current standard clinical practise.

This company has just raised $7.1M at 15c per share, which gives it a significant amount of runway to commercialise its products.

There’s an imminent catalyst ahead as well - US FDA approval for it's aortic stenosis product is expected any week now.

And after that, we’re hoping for rapid sales growth in the US - the largest healthcare market in the world.

Introducing our new Investment, Echo IQ (ASX:EIQ).

EIQ is an AI-driven med-tech company with a proprietary algorithm for detecting adverse heart conditions.

EIQ has exclusive access to the largest heart image database in the world.

This data has been collected over 24 years. Given the importance of exclusive data in training AI algorithms, this dataset has significant value.

The technology EIQ has built has been trained on this database using over a million images of the heart.

We think it could take any potential competitor years to catch up.

Heart conditions are diagnosed by specialised doctors called cardiologists that read a scan of a person’s heart.

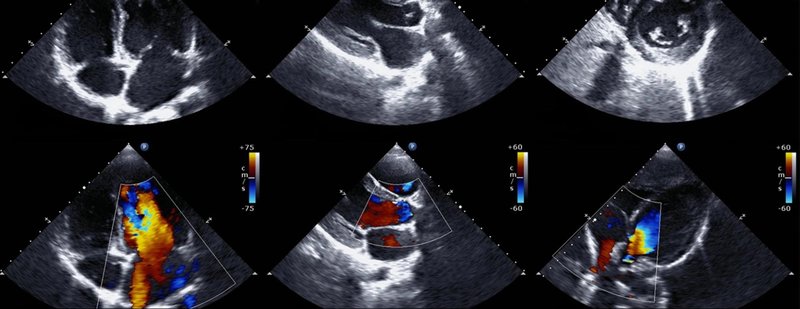

These scans are called echos:

To the untrained eye, an echo just looks like blobs of colours... but to a cardiologist, the echo is the most important tool to identify heart issues.

Cardiologists are incredible professionals that help people stay alive, but even with years of training and the ability to read echos - sometimes adverse heart conditions are not always identified.

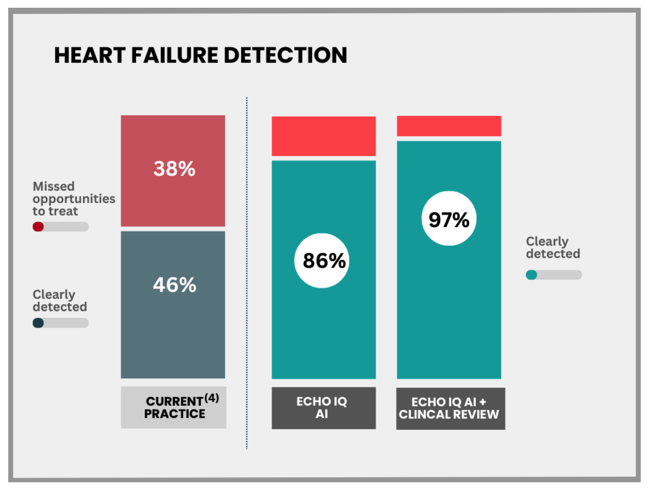

Standard clinical practice detects just 46% of heart failure cases - less than half.

EIQ has demonstrated in clinical studies that its AI technology can better identify heart issues much better than humans - EIQ’s tech detects heart failure in 86% of cases.

But where the magic really happens is when the cardiologists work together with EIQ’s technology.

EIQ’s latest data shows that nearly 97% of heart failure is detected when the AI works with the cardologist.

Humans and AI working together to make everyone's lives better.

A great thing for EIQ, patients, cardiologists, and the entire health care system.

Heart failure is the leading cause of re-hospitalisation in the US, accounting for 17% of all US healthcare expenditure and is a US$60BN market annually.

Again, EIQ’s proprietary AI algorithm was trained on the largest dataset of “echoes” in the world here in Australia.

It’s called the National Echo Database of Australia (NEDA).

NEDA was co-founded by Professor Geoff Strange and Professor David Playford.

Two highly credentialed individuals in the cardiology industry.

Professor Strange is EIQ’s Chief Research & Strategy Officer.

So far, EIQ’s algorithm can detect two heart conditions:

- Aortic Stenosis - A condition where the valve that controls blood flow from the heart to the body becomes too narrow, making it harder for the heart to pump blood.

- Heart Failure - A condition where the heart can't pump blood as well as it should, causing tiredness, shortness of breath, and fluid buildup in the body.

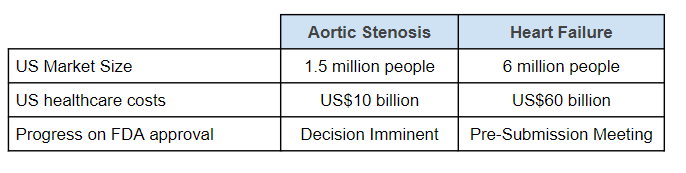

US healthcare costs are US$10BN per annum for aortic stenosis.

The number rises to US$60BN per annum for heart failure.

Here is a quick snapshot on EIQ for each of these conditions and where each condition sits along the regulatory approval pathway:

Right now EIQ is a pre-revenue company.

The next stage for EIQ is to start commercialising its business.

EIQ’s two pronged approach involves:

- Licencing its technology to strategic partners

- Reimbursements from the US healthcare system (Medicare, Medicaid) for insured patients.

Before EIQ can start getting reimbursements however, it needs approval from the FDA.

The FDA approval provides independent validation of the technology as well as unlocking the potential for reimbursement from private and public health insurers.

For the first condition, aortic stenosis, EIQ has published clinical data and applied for FDA approval.

We expect an FDA decision to be made before the end of the quarter, providing an imminent share price catalyst for EIQ.

For the second condition, heart failure, EIQ has published data and is in early discussions with the FDA, but it will likely need to do a second study before applying for FDA approval.

We expect this process to take roughly 12 months before final FDA approval for heart failure - given heart failure is a bigger market than aortic stenosis - this could be an even bigger share price catalyst, in the medium term.

EIQ is also looking to commercialise its technology through licensing deals with organisations that sell products to treat adverse heart conditions.

(Think of heart valve replacement manufacturers, drug treatments, etc...)

There are strongly aligned incentives for organisations that treat heart conditions and those that diagnose heart conditions.

The more heart conditions are diagnosed, the more sales are made.

There is a strong alignment for the patients as well.

For aortic stenosis, there is a 50% mortality rate within 2 years if left untreated.

And for heart failure, it is the leading cause of hospitalisation for people 65 years and older.

These are potentially fatal conditions and EIQ is looking to help identify them sooner and better than has been done before.

Again, key to these licensing deals will be FDA approval, as it provides regulatory validation for the technology and allows EIQ to market its product in the US.

Once FDA approval is granted, and a reimbursement strategy is in place, we anticipate that revenues for the company could grow significantly.

Of course, there are no guarantees here. EIQ is a pre revenue small cap company right now - and EIQ will need to execute on its sales strategy over the coming years (see more in our Risks section below).

But, if EIQ can grow fast and large enough, we think it could make the perfect takeover target for a big pharma company OR a medical devices manufacturer.

This brings us to our Big Bet...

Our EIQ ‘Big Bet’:

“EIQ re-rates to a >$1BN market cap on successful commercialisation of its heart disease detection technology and/or an acquisition at a multiple of our Initial Entry price.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EIQ Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Here are the 8 key reasons we Invested in EIQ...

1. The data shows that the AI algorithm works.

EIQ has published three studies since it acquired the technology in 2021.

For the first target condition aortic stenosis, the technology has been shown to accurately identify 100% of severe aortic stenosis patients.

For the second condition, heart failure, the technology has been shown to accurately identify 97% of patients in conjunction with a cardiologist (compared to 46% as the current standard of care).

These are incredibly strong results and underpin the technology's potential.

2. Imminent share price catalyst in potential aortic stenosis FDA approval.

We expect the FDA is set to make a decision on EIQ’s first target condition, aortic stenosis by the end of September based on our interpretation of typical review timelines.

FDA approval opens the door for EIQ to commercialise its tech.

FDA approvals for algorithms related to health have dramatically increased over the last few years. EIQ’s FDA approval shapes as a key near term catalyst for the stock.

3. Multi-billion dollar market target for “heart failure” diagnostics assistant.

Over 64 million people suffer from heart failure each year across the world.

And in the US, heart failure costs the US healthcare system roughly $60BN because many of these patients wind up back in hospital within 30 days.

The reimbursement cost for heart failure is US$284 per patient, and at 25% market penetration, EIQ could earn up to ~US$100M in ARR.

There is still a long way to go, given EIQ has not started generating revenue yet - but we like the size of the prize.

4. Second catalyst for FDA approval on heart failure could be within 12 months.

EIQ recently published very promising data on its AI detection algorithm targeting heart failure.

This data will be used, along with potentially another study, to secure FDA approvals within the next 12 months.

5. Exclusive commercial access to the world's biggest heart data repository

EIQ has exclusive access to a database of over 1 million echocardiographic records from NEDA (National Echo Database of Australia).

NEDA is the largest echo database in the world and data stretches back to January 2000 and has a replacement cost north of US$300M.

This data is not easily replicable or acquired.

EIQ Chief Research & Strategy Officer, Professor Geoff Strange, is the creator, Director and Chief Investigator of the National Echo Database.

This means EIQ has the right personnel to work with this exclusive data.

Also, considering it took NEDA 24 years to reach this point, we think this gives EIQ a significant moat and competitive advantage over any new market entrants.

6. Clear pathways to commercialisation in the USA - the biggest healthcare market in the world.

There are two ways that EIQ can make money, one is reimbursement, one is licensing.

Each pathway opens up new avenues to monetisation and can work hand in hand.

Reimbursement involves the acquisition of specific codes which allow hospitals and echo labs (physical location health providers) to claim for reimbursement from US insurance companies.

Licensing on the other hand targets echo machine makers (like Phillips and GE) or Big Pharma (which would be interested in a wave of new patients that EIQ’s tech picks up).

7. SaaS revenue model, potential to rapidly grow revenue and/or secure large licensing deals.

EIQ is a cloud based platform that will likely operate on a Software as a Service (SaaS) model when initially commercialised.

SaaS tech companies with demonstrated recurring revenue growth over time attract large valuation multiples.

EIQ’s tech platform is already built, meaning software development costs should be low, leading to higher margins on sales.

An ongoing “soft launch” has the product in the hands of an end user via a strategic partnership with a leading US medical Enterprise Cardiovascular Information Systems (CVIS) provider, Scimage, which has over 2000 sites in the US.

We expect this to provide an early opportunity for revenue growth under US reimbursement codes if EIQ secures FDA approval.

8. Cost savings, 3 seconds until results, removing bias

Health practitioners are under immense stress, and the current method of Trans-Thoracic EchoCardiogram (ultrasound on your chest, or “echo”) takes time.

These echos may be performed and interpreted in suboptimal conditions.

EIQ’s tech strips that out of the equation, delivering results in 3 seconds and also removing unconscious bias in the interpretation of results (for certain conditions, women are more frequently misdiagnosed than men).

Our EIQ Investment Memo

Below is our EIQ Investment Memo, which lays out the following:

- What EIQ does

- The macro theme for EIQ

- Our EIQ Big Bet

- What we want to see EIQ achieve

- Why we are Invested in EIQ

- The key risks to our Investment Thesis

- Our Investment Plan

The purpose of our Memo is to set and then track milestones for EIQ, which we can then look back at to see how well the company performed relative to our expectations.

Investment Memo: Echo IQ (ASX:EIQ)

Memo Opened: 6 September 2024

Shares Held: 3,470,000

What does EIQ do?

Echo IQ (ASX:EIQ) is a technology company that uses AI to provide early warning and enhanced detection of heart disease.

What is the macro theme behind EIQ?

Heart diseases are the leading cause of death worldwide.

Diagnosis is performed by humans who have to interpret 3D models of the heart, which leads to inaccuracy and delayed or missed diagnosis costs lives.

With 30% of all deaths around the world attributed to cardiovascular disease, we think EIQ solves for a pressing problem as AI increasingly enters the health economy.

Why did we Invest in EIQ?

- The data shows that the AI algorithm works.

- Imminent share price catalyst in potential aortic stenosis FDA approval.

- Multi-billion dollar market target for “heart failure” diagnostics assistant.

- Second catalyst for FDA approval on heart failure could be within 12 months.

- Exclusive commercial access to the world's biggest heart data repository.

- Clear pathways to commercialisation in the USA - the biggest healthcare market in the world.

- SaaS revenue model, potential to rapidly grow revenue and/or secure large licensing deals.

- Cost savings, 3 seconds until results, removing bias

What do we expect EIQ to deliver?

Objective #1: Secure FDA approval for aortic stenosis product

FDA approval for aortic stenosis will allow EIQ to commercialise its technology for this product. We want to see this happen by the end of September 2024.

Milestones

🔄 FDA Approval for aortic stenosis

Objective #2: Commercialise aortic stenosis product

We want to see EIQ make sales and grow its revenue for this product.

🔲 Reimbursement approvals

🔲 First sales from aortic stenosis product

🔲 Deal with healthcare provider (Hospital)

🔲 Licensing deal (medical device manufacturer/imaging company)

Objective #3: Secure FDA approval for heart failure product

FDA approval will allow EIQ to commercialise its technology for heart disease.

Milestones

✅ Publish results of clinical study (A)

🔲 FDA Pre-Submission meeting

🔲 Clinical study (B) starts

🔲 Clinical study (B) interim results

🔲 Clinical study (B) final results

🔲 FDA 510(k) application

🔲 FDA 510(k) decision

Objective #4: Commercialise heart failure product

We want to see EIQ make sales and grow its revenue for this product. This is a much bigger market than aortic stenosis.

Milestones

🔲 Secure reimbursements

🔲 First sales from heart failure product

🔲 Deal with healthcare provider (Hospital)

🔲 Licensing deal (medical device manufacturer/imaging company)

What could go wrong?

Regulatory Risk

EIQ has applied for FDA clearance under the 510(k) pathway for aortic stenosis and will apply for FDA clearance for heart failure.

There is no guarantee that the FDA will provide clearance, and the application may be rejected.

Also, EIQ’s strategy is reliant on securing reimbursement for its product.

If EIQ is not able to secure a reimbursement deal then its commercialisation strategy may need to pivot.

Sales/Commercialisation risk

EIQ is reliant on its partners, both under the licensing and reimbursement strategy, to use EIQ’s product.

If EIQ’s product is not used (because it doesn’t add value back to the provider), then it won’t be able to generate revenue.

There is no guarantee that EIQ’s product will be used by its partners and, therefore, no guarantee of revenue.

Funding and dilution risk

EIQ is a small cap company and is essentially pre-revenue. This means that EIQ may need to raise funds in the future via capital raises that may incur dilution to shareholders.

Competition Risk

There may be other companies developing AI products in the medtech space. It is possible for competing products to enter the market.

Key personnel risk

EIQ is reliant on a number of key professionals via its scientific advisory board and board more generally. If these personnel leave it could hurt the company’s prospects.

Market risk

There is always the possibility that broader market sentiment gets worse and shares as a whole trade lower, taking EIQ’s share price with it. Alternatively, there could be further sector specific pain ahead where junior explorers suffer a lot more than the broader market.

What is our Investment Plan?

We plan to hold a position in EIQ for the next 3-5 years (and beyond) as it progresses its plan to gain significant market penetration in the large US market.

We eventually may look to take some profits by selling up to ~20% of our holding (in line with our holding policy and escrow conditions) if the share price materially rerates on the company successfully delivering on the key objectives listed above.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.