OncoSil on verge of CE Mark approval

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The coming 12 months is shaping up as a watershed stage in the history of Oncosil Medical Ltd(ASX:OSL) with the company having flagged finalisation of commercialisation plans for its OncoSilTM device in anticipation of CE marking early in 2020.

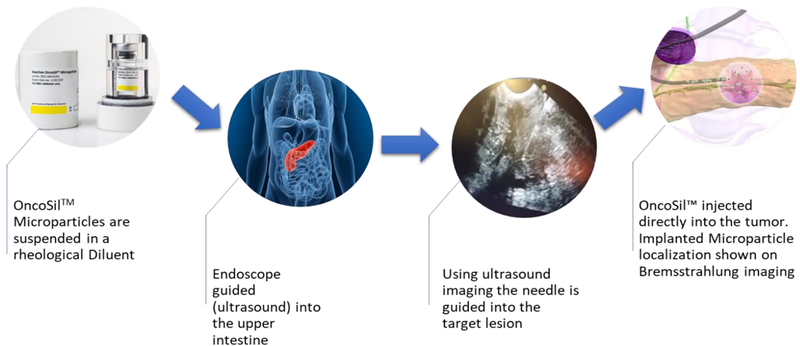

OncoSilTM is a targeted radioactive isotope (Phosphorus-32) that’s implanted directly into a patient’s pancreatic tumours via an endoscopic ultrasound. The treatment by this device delivers more concentrated and localised beta radiation compared with external beam radiation.

To date, four clinical studies have been completed with encouraging results on tolerability, safety and efficacy.

A CE Mark approval will open the way for the company to sell the device in the European Economic Area. CE Mark approval will also trigger multiple registration filings in many Asia-Pacific countries that recognise the CE Mark as part of the overall approval process.

The company is also making inroads in the US with the US FDA granting a Humanitarian Use Designation (HUD) for both intrahepatic (ICC) and distal cholangiocarcinoma (dCCA).

The HUD program creates an alternative pathway for obtaining market approval in the US. OncoSil plans to file for Humanitarian Device Exemption (HDE) in dCCA and could access US sales in the second half of 2020.

OncoSil is now conducting a clinical study of the OncoSilTM device in the US under an Investigational Device Exemption (IDE) granted by FDA aimed at supporting a PMA (pre-market approval) in locally advanced pancreatic cancer.

If successful, the company will not only be well-positioned to reap the financial benefits of its extensive and successful research and development, but it will also be one of only a few groups that can offer pancreatic cancer sufferers a positive outlook.

Indeed, only two drugs have made significant improvements in pancreatic cancer in the last 20 years, and the median overall survival during that period has only increased by two months to 8.5 months.

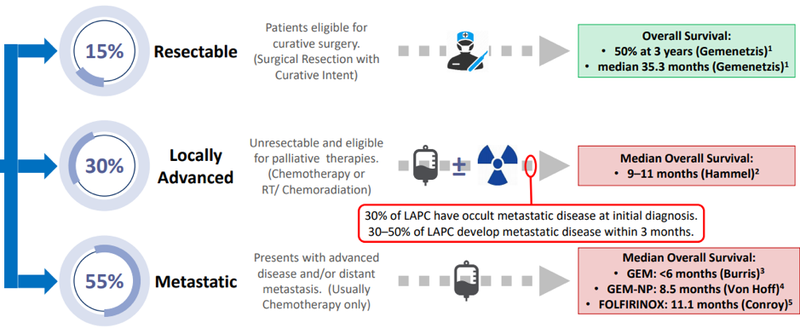

One of the key problems with pancreatic cancer is its characteristically late diagnosis which rules out surgery in about 85% of cases.

Chemotherapeutic treatments have had limited effectiveness, while also having associated toxic effects. Similarly, external beam radiation therapy has a toxic impact on a patient’s gastrointestinal tract.

The following graphic provides a good summation of where the medical profession is at in terms of successfully dealing with pancreatic cancer.

While substantial advances have been made in the surgical treatment of cancers, as indicated above, only 15% are resectable (able to be removed by surgery), a factor that can largely be attributed to late stage diagnosis.

As indicated in the graphic, more than half of the patient universe presents with the disease at an advanced stage, ruling out surgery with the only backup being limited impact chemotherapy and/or drug treatment.

‘Overweight’: Upgrade anticipating European approval

On January 30, in an update on the company, Wilsons Equity Research confirmed that it has an optimistic view of OSL.

Wilsons moved further “OVERWEIGHT” on the stock in anticipation of the imminent European approval for OncoSilTM, plus OncoSil’s pursuit of a humanitarian approval in the USA.

Wilsons lifted its 12-month target price to $0.30, a 122% premium to the current 13.5 cent share price. Plus, its signalled that catalysts over the next 3-4 years could support valuation gains up to $1.20 per share.

This valuation lift comes after Wilsons determined the probability of European approval to be 90%, up from 60% prior to receipt of the positive CE Mark Status Report. It also recognised that the clinical trial data supporting the OncoSilTM product has continued to improve in terms of patient survival.

OncoSil prepared to meet new demand

OncoSil’s development team has more than 50 years of experience with nuclear medicine products, and the processes it uses for outsourced manufacturing is certified to ISO standard.

Management has ensured that it has secured supply of ultra-pure base materials to meet upcoming manufacturing requirements.

From a logistics perspective, the company benefits from the lengthy storage periods that apply to intermediate products.

The company recently said that its current inventory is sufficient to meet clinical study commencement and early commercial needs, suggesting that it can respond quickly should the CE Mark approval be received in the near term.

The company has already shipped over 100 doses for clinical studies over an 18 month period, providing confidence in its logistical efficiencies.

Importantly, all radioactive goods shipments have been verified, and management has confirmed that a scaling up of distribution at the commercialisation stage can be handled through its established shipping arrangements.

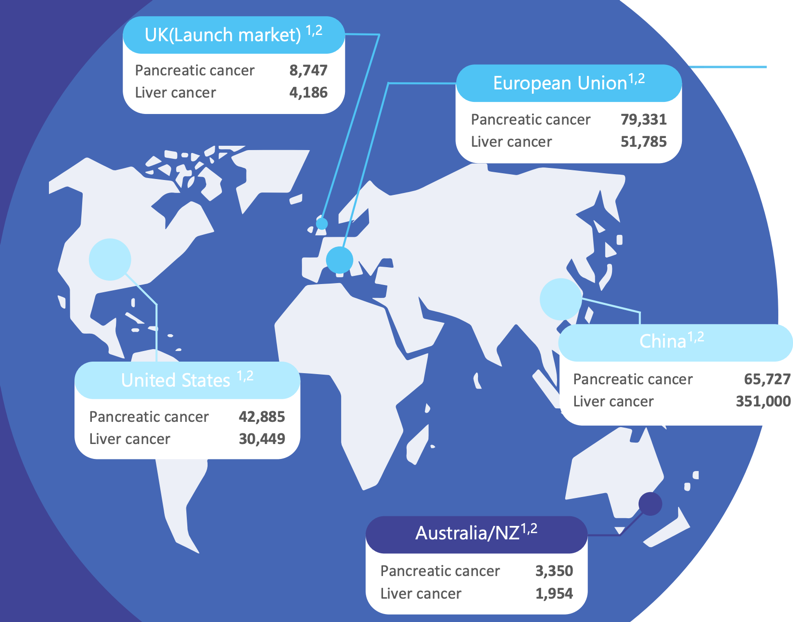

This would facilitate distribution to the European Union, the UK, the US, Australia and parts of Asia.

The annual incidence of both pancreatic and liver cancer is outlined below, which translates to a global opportunity of more than US$2 billion for pancreatic treatment and US$1.4 billion for liver cancer assuming a US$25,000 price per dose of OncoSilTM.

Institutional interest in OncoSil

The potential for OncoSil to quickly transition from device development to full commercialisation has been recognised by the market.

Merrill Lynch and its affiliates have been accumulating stock since mid-2019, but on-market purchasing of shares accelerated in October 2019, while Bank of America and related parties acquired a substantial shareholding of 5.6%, as announced in November.

Interestingly, the increased institutional support coincided with news embodied in the CE Mark update.

There has also been strong retail investor support, triggering a tripling in the group’s share price in October/November 2019.

The traditional lull in news flow during the December/January period saw a slight share price retracement, combined with the more recent market weakness see the stock trading in the vicinity of 14 cents.

This may represent a buying opportunity pending positive news regarding the CE Mark approval, which could be a significant share price catalyst.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.