Nusantara unveils promising gold exploration results

Published 19-DEC-2018 11:48 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

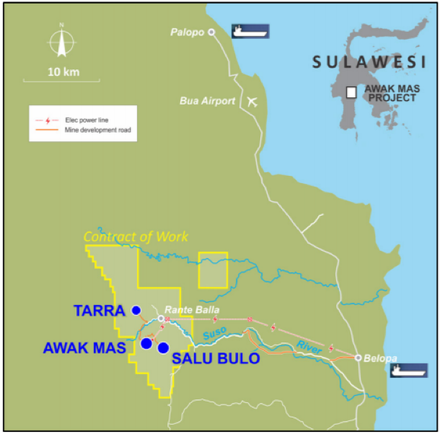

Asia‐Pacific gold development company, Nusantara Resources (ASX:NUS), has released promising trench samples from near mine exploration at its Awak Mas Gold Project, located in South Sulawesi, Indonesia.

Awak Mas is one of just a few undeveloped gold projects within the Asia-Pacific region, and has a 1.1 million ounce Ore Reserve and a 2 million ounce Mineral Resource.

Most recent results have included wide zones of 28 metres at 1.2 grams per tonne gold and 37 metres at 2.3 grams per tonne gold, as well as a narrower high-grade width of 11 metres at 2.6 grams per tonne gold.

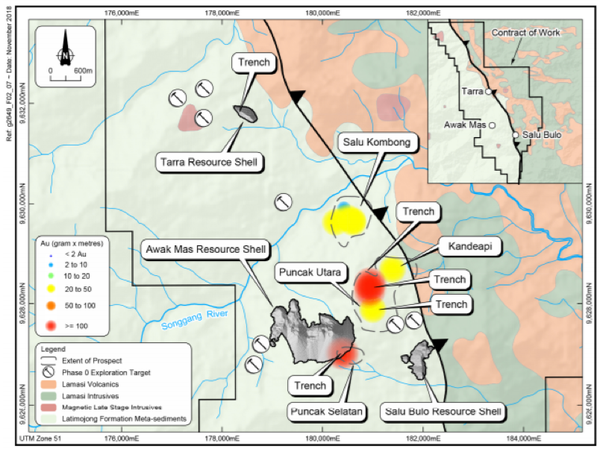

These results come from the Puncak Selatan, Puncak Utara and Tarra prospects, which form part of the broader Awak Mas project, highlighting the mineralisation potential of these areas, with drilling to kick off in early 2019.

Exploration results could provide share price momentum early next year, building on some particularly strong buying activity that has occurred as 2018 comes to a close.

Exploration results support geological modelling

These results extend interpreted mineralisation in immediate proximity to the Awak Mas pit crest.

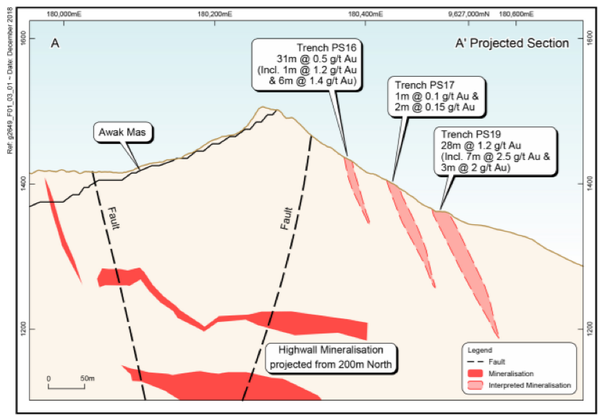

The following graphic shows the interpretation of recent Puncak Selatan sample result locations on a projected cross section through the proposed Awak Mas pit demonstrating the spatial relationship to the pit crest.

A wide zone of surface mineralisation is now defined with a strike extent of between 150 metres and 200 metres, located to the south of the previously reported Awak Mas highwall extension mineralisation, with the potential to alter the economic pit shell.

As indicated below, the trend of mineralisation fits the structural repetition model within Awak Mas to the Salu Bulo corridor.

With over 1000 metres of near mine trenching completed, the geological model in these areas adjacent to the proposed Awak Mas pit is now well-substantiated and further enhanced by mapping of new exposures and recently discovered mineralisation.

Exploration to add value

Underlining the significance of these latest exploration results, Nusantara’s managing director and chief executive, Mike Spreadborough said: “These new exploration results continue to demonstrate the potential of the Awak Mas Gold Project to grow organically and provide potential high-grade satellite operations to augment production from the existing deposits.

“The proximity of the Puncak Selatan mineralisation to the Awak Mas deposit has the potential to alter the planned pit and significantly increase the value of the project.

“Our work continues to define the geological setting of the Contract of Work area and together with geophysics analysis, increases the possibility of further substantial discoveries that will further enhance the project.”

As we'll explore shortly, the benefits of having access to extensive historical exploration data cannot be understated, as this should assist in minimising the costs of expanding the resource and extending the mine life at Awak Mas.

The current exploration focus is to follow up on historical exploration of numerous prospects adjacent to the established deposit and within a two kilometre radius of the planned processing plant, with the aim of enhancing and extending the proposed eleven-year mining operation.

Corporate activity sparks interest

Nusantara’s shares have performed strongly in recent weeks after the company secured a strategic Indonesian cornerstone investor.

On completion of a $10.25 million capital raising, PT Indika Energy Tbk (IDX:INDY), through its subsidiary PT Indika Minerals Investindo, will obtain a 19.9% interest in Nusantara, and high-profile existing shareholder, AustralianSuper, will increase its shareholding to 14.0%.

The raising was completed at a price of 23 cents per share, implying a premium of nearly 50% relative to the company’s closing share price prior to the capital raising.

This could be considered an endorsement of the definitive feasibility study (DFS) NUS completed in October, which coincided with an 11% increase in ore reserves and the identification of significant near mine mineralisation.

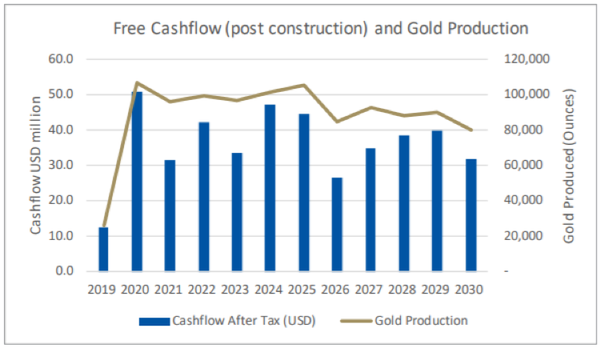

Encouraging, the DFS supports an initial 11-year project producing approximately 100,000 ounces per annum at relatively low all in sustaining costs of US$758 per ounce, implying a margin of nearly US$500 per ounce based on the current gold price US$1249 per ounce.

Management sees the potential for an improvement in project economics in the near term as further infill drilling is completed and extensions to current deposits are drill tested.

Government support and historical exploration de-risk project

Discovered in 1988, Awak Mas has over 135 kilometres of drilling completed in over 1,100 holes.

PT Masmindo Dwi Area (Masmindo), a wholly-owned subsidiary, is the holder of a 7th Generation Contract of Work and has sole rights to explore for and exploit any mineral deposits within the project area until 2050, with options for extension.

The project is supported by extensive infrastructure, with access to low cost grid power, port facilities 45 kilometres from the project, and multiple daily flights from the city of Makassar.

The island of Sulawesi has a long history of mining and provides ready access to experienced contractors, services and work force for the construction and operation of the mine.

Given Nusantara has a comprehensive understanding of the deposit from historical mining records and its own exploration, as well as a a harmonious relationship with the Indonesian government and ready access to infrastructure required through the development and production stages, some of the risks often associated with investing in projects in this region have for the best part been nullified.

Impact of exploration success

The DFS identified the potential for an uplift in grade for the Awak Mas and Salu Bulo deposits, as further drilling is undertaken to lift the reserve category to Measured status in the initial mining areas.

Any grade uplift will have a material impact on project economics.

Furthermore, known extensions to the Awak Mas and Salu Bulo deposits and inclusion of the Tarra deposit into the mine plan have the potential to extend the mine life.

Scenario financial analysis of these near-term opportunities shows a 7% grade uplift (based on detailed analysis of the mineral resource model using conditional simulation) and an additional three years of mine life (from known mineralisation extensions at Awak Mas and Salu Bulo and inclusion of the Tarra deposit into the mine plan) could significantly enhance project economics. This, in turn, could result in a Project NPV5 (net present value at a 5% discount rate) in the vicinity of US$250 million, and an IRR of approximately 25%.

Given this implies an Australian dollar value of about $350 million, Nusantara’s market capitalisation of approximately $30 million doesn’t appear to reflect the assessed value of the Awak Mas project.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.