NUS confirms robust, long-life, low cost gold project

Published 04-OCT-2018 12:37 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

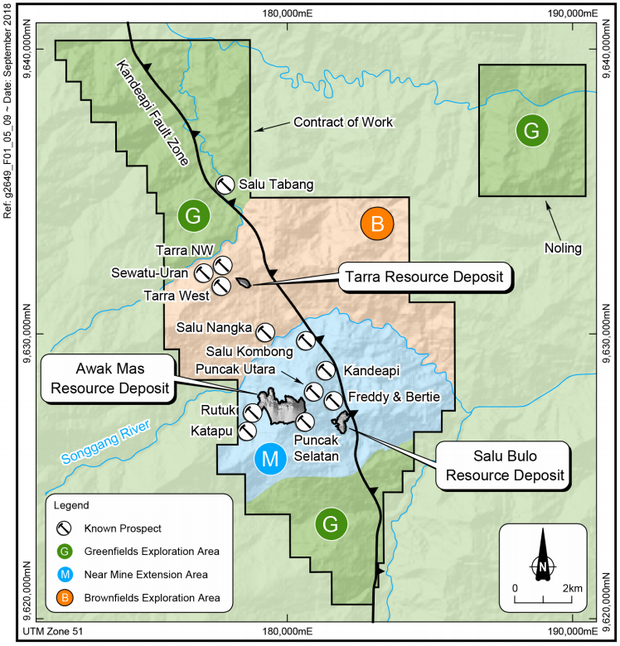

Asia‐Pacific gold development company Nusantara Resources Limited (ASX:NUS), has completed the Definitive Feasibility Study (DFS) for its 100% owned Awak Mas Gold Project located in South Sulawesi, Indonesia.

The project, which has all approvals in place for development, is one of just a few undeveloped gold projects within the Asia-Pacific region. It has an Ore Reserve of 1.1 million ounces, within a 2.0 million-ounce Mineral Resource.

The DFS supports an initial eleven-year project with the 2.5 Mtpa processing plant targeting annual gold production of around 100,000 ounces, delivering strong margins.

The mining operation will include two open pit mines with an initial 11-year life, and a low project strip ratio of 3.5.

The DFS base case determined a post-tax NPV of US$152 million, with a 20.3% IRR using a gold price of US$1250 per ounce. This included an initial capital cost of US$146 million, and an All-In Sustaining Cost (AISC) of US$758 per ounce.

NUS note the potential for improvement in project economics in the near-term as further infill drilling is completed and extensions to current deposits are drill tested.

However, it does remain a speculative stock and caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

The DFS has identified the potential for an uplift in grade for the Awak Mas and Salu Bulo deposits as further drilling is undertaken to lift the reserve category to Measured status in the initial mining areas. Any grade uplift has a material impact on project economics. In addition, known extensions to the Awak Mas and Salu Bulo deposits and inclusion of the Tarra deposit into the mine plan have the potential to extend the mine life.

Scenario financial analysis of these near-term opportunities shows a 7% grade uplift and an additional three years of mine life (from known mineralisation extensions at Awak Mas and Salu Bulo and inclusion of the Tarra deposit into the mine plan) could significantly enhance project economics, resulting in a Project NPV in the vicinity of US$250 million, and an IRR of approximately than 25%.

Managing Director and CEO, Mike Spreadborough said, “The Awak Mas Gold Project Definitive Feasibility Study has confirmed that the project is technically feasible, financially robust, with significant opportunities to increase project value through optimising the current mineral resources and through further exploration. The completion of the DFS is a significant milestone for the Company, with work now progressing on securing financing for project development and continuing exploration.”

For now, the focus is on securing a strategic partner and arranging financing for the development of the project. In the meantime, exploration continues to identify new targets and is testing known prospects which have had minimal historical assessment.

Along with the DFS, the company also provided the market with an exploration update on the Awak Mas Gold Project.

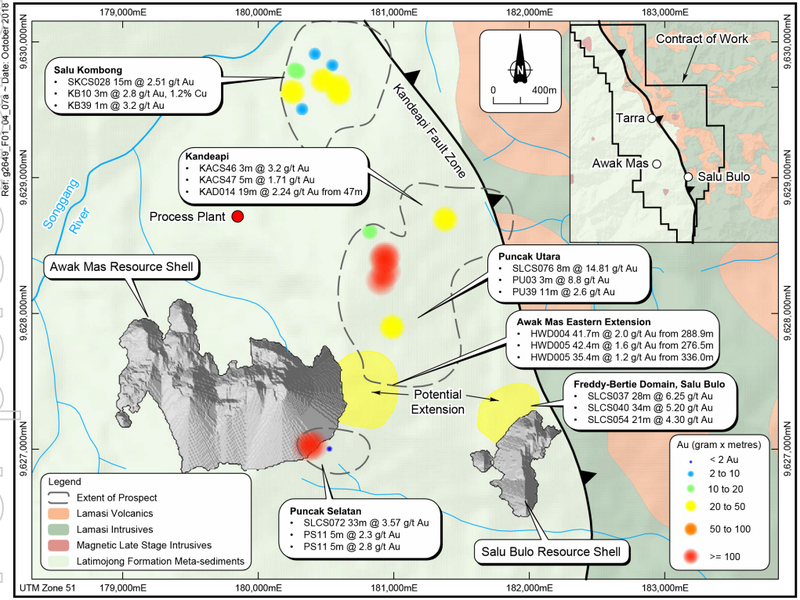

The immediate exploration focus for 2018 is exploring Near Mine prospects within a three kilometre radius of the proposed processing plant with the aim of extending the proposed eleven-year mining operation. The program also includes the re-processing of previously acquired geophysical data which is demonstrating considerable potential for further discoveries across the entire Contract of Work (CoW) area.

Significant gold and copper results from surface and trench samples adjacent to the Awak Mas and Salu Bulo deposits which enhance near mine exploration prospectivity.

Salu Kombong

- Three significant new gold and copper outcrops identified on intrusive related quartz veining covering an area of approximately 250m x 100m.

- Assay results of up to 2.8 g/t gold and 1.2% copper sampled on extensive structures.

- Nearby magnetic intrusive unit mapped, strong local geophysical signatures revealed.

Puncak Utara

- Manually excavated trenches confirm mineralisation with grades up to 11.0 g/t gold.

- Broad continuous zones of mineralisation, up to 12m at 2.39 g/t gold.

- Extensive area of gold anomalism now defined over large footprint, approximately 750m x 1500m.

Puncak Selatan

- First pass manually excavated trenches confirming surface mineralisation, up to 5.3 g/t gold.

- Broad mineralised area has strategic value given immediate proximity to the planned Awak Mas pit

- Geological model showing significant potential between Awak Mas and Salu Bulo.

Intrusive related mineralisation now confirmed at Salu Kombong, where newly reprocessed geophysics highlights multiple intrusive targets in near-mine areas and across the CoW area.

Surface exploration program has also commenced at the highly prospective Tarra Main area

The recent exploration results are extremely encouraging, which combined with extensive historic sampling, confirms the prospectivity of near mine areas and will be the focus of further mechanical trenching by excavator and subsequent drill targeting.

A number of untested or largely untested exploration prospects that have the potential to be satellite deposits have been identified within the area, both adjacent to the planned two initial open pits containing a 1.1Moz Ore Reserve and near to the proposed processing plant site.

Spreadborough said, “The completion of the DFS allows a shift in focus to CoW exploration. These promising early exploration results demonstrate the potential of the Awak Mas Gold Project to grow organically and provide potential high-grade satellite operations to augment production from the existing deposits. Our confidence in the exploration model, together with renewed focus on geophysics and the possibility of further and substantial discovery, add enormously to the future long-term viability of the project.

“Once again, we are seeing our understanding of the geology continue to rapidly evolve, which fits well with our goal of growing the project life beyond eleven years.”

In regards to the recent earthquake and following tsunami in Sulwaesi earlier this week, Nusantara management extended “our sincere condolences to everyone that has been impacted by the disaster.”

NUS also note that “our project is located on the east coast of Sulawesi so our people are safe and our site has not been impacted. However, because we haven’t been impacted, we have been assisting with the recovery and have donated food and water to those in need.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.