NTI’s clinical trial meets primary endpoints for neurological disease

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,400,000 NTI shares at the time of publishing this article. The Company has been engaged by NTI to share our commentary on the progress of our Investment in NTI over time.

The clinical trial results are in... and they are “profound”.

Our most recent biotech Investment, Neurotech International (ASX:NTI), has just released successful phase I/II trial results for treating a rare childhood neurological disorder called PANDAS/PANS.

NTI’s treatment “showed clinically significant and meaningful improvements in clinical function, with excellent safety and tolerability over 12 weeks of daily oral treatment.”

These trial results are the first ever broad-spectrum cannabinoid therapy to show a strong benefit in this population.

Our quick take on the results:

- These results were excellent - there is enough data here to continue a trial in a bigger patient cohort to take this to phase 3

- The treatment showed improvement across the board for patients including severity of illness, improvement in behaviour, reduction in depression and anxiety

- Statistical significance reached for both primary endpoints

- No major safety issues

- The results were good enough where all parents decided to continue the treatment for their children after the trial (a strong endorsement from the families)

We stress in this last point that EVERY patient in the trial is continuing with the treatment after the trial - this is an extremely positive sign.

Based on this success, NTI is now planning further trials.

NTI Managing Director Dr Tom Duthy will be hosting a webinar to talk through the results today at midday AEST - register to attend here.

It’s been a big week for small cap biotechs.

NTI’s results come a day after our other biotech Investment Dimerix surged ~150% on a “pre-trial results” commercial deal and Noxopharm (we are not investors) rose ~100% on gaining orphan drug designation.

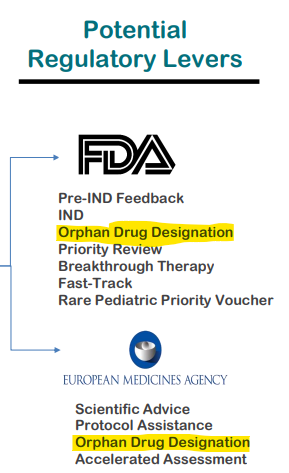

Commercial deals and orphan drug designation are both on the roadmap for NTI.

PANDAS/PANS is the SECOND neurological disorder where NTI’s treatment has shown strong benefits.

The first being Autism.

NTI is working through its clinical trial pipeline on the basis that its pharmaceutical product “NTI164” has benefits when it is used to treat disorders tied to neuroinflammation.

Neuroinflammation reduction has possible general applications to other childhood disorders, and today’s results are positive for NTI’s other upcoming trials for treating Autism and Rett Syndrome.

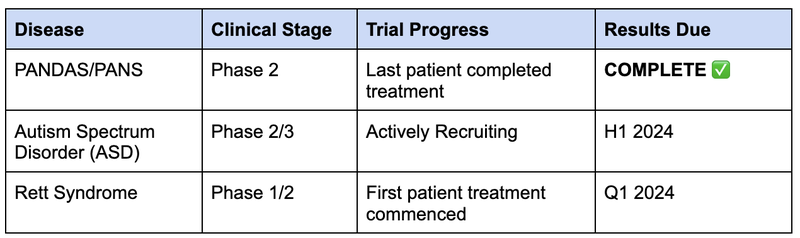

Today’s trial results for PANDAS/PANS are just ONE of three catalysts we expect to see from NTI in the next 6 months:

While Autism is a broader market, PANDAS/PANS and Rett Syndrome are classed as “orphan diseases” meaning they are relatively rare.

To encourage the development of treatments of rare diseases, governments provide generous incentives to companies with orphan drug designation:

- Fast Tracked Approvals: This means that the company will not always need to undertake the entirety of a Phase III clinical trial in order to get the product to market.

- Market Exclusivity: Once the US FDA grants orphan drug designation to a drug, it also gets seven years of market exclusivity.

- Orphan drug pricing: Orphan drugs are priced at a point that encourages drug developers to make treatments.

The average price for an orphan drug is US$32,000 per year per patient.

This amount is not paid by mums and dads, but rather governments and insurance agencies subsidising the treatment.

Securing “orphan drug designation” is a big deal for small cap biotechs.

This week, Noxopharm went up 100% on announcing orphan drug designation for its treatment of pancreatic cancer.

NTI has said it is looking to file for “orphan” drug designation for treating PANDAS/PANS and Rett Syndrome.

What we want to see in the medium term from NTI is successful orphan drug designation for PANDAS/PANS and Rett Syndrome.

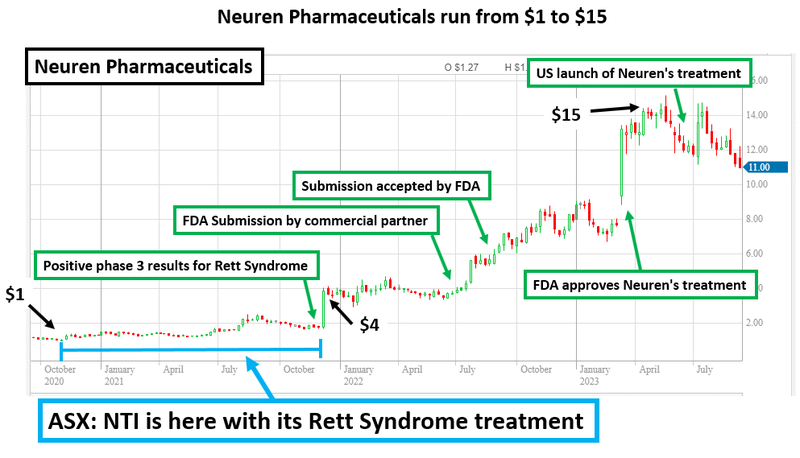

NTI basically copying the playbook of Neuren Pharmaceuticals that delivered 1,300% rise over 3 years through successful phase III trial and commercialisation of a treatment for orphan disease Rett Syndrome (yes, the same disorder NTI is currently running a trial on).

NTI is currently capped at $59M - we Invested because we think NTI can follow a similar pathway to success as $1.4BN Neuren.

(Assuming of course that NTI can continue to deliver success on more of its trials over the next 6-12 months - this is what will start the share price re-rate).

After listing the main reasons we Invested in NTI, we will provide a quick reminder of what PANDAS/PANS disorder is , an explainer on today's trial results and what is next for NTI.

REMINDER: Why did we Invest in NTI?

- NTI has significant material newsflow in the next 6-12 months across 3 trials - Clinical trial results are massive share price catalysts for biotechs. NTI has three different trials completing over the next 12 months. One of them is expected in the next couple of weeks. (🚨Successful PANDAS/PANS trial results released today).

- NTI is targeting “orphan” diseases - treatments that are highly valuable - NTI is currently targeting PANDAS/PANS and Rett Syndrome, which are potentially eligible for orphan drug designation. The average price for an orphan drug is US$32,000 per year per patient and government approvals to market are fast tracked.

- NTI is following the same strategy as the $1.4BN capped Neuren - Neuren Pharmaceuticals’ share price re-rated by more than 1,300% (~$100M market cap to $1.4BN market cap). Neuren developed a successful treatment for Rett Syndrome and is working on other orphan diseases. NTI is unashamedly trying to replicate Neuren’s path to success. We like this approach.

- Strong safety profile, is NTI’s treatment better than $1.4BN Neuren? - If NTI’s upcoming Rett Syndrome trial shows its treatment is SAFER than $1.4BN Neuren’s “claim to fame” Rett Syndrome treatment, we think NTI can take a big chunk of the market (and hopefully get to a similar $1.4BN market cap).

- Promising efficacy data at treating Autism, large addressable market - If NTI’s treatment is proven safe and effective for Autism Spectrum Disorder (ASD), we think it could become an important part of the overall care for ASD sufferers, which is 1 in 100 children.

- NTI Management track record - NTI’s Executive Director is Dr Tom Duthy, who is also Chairman of Arovella Therapeutics, another one of our Portfolio Companies, which grew from a low of 2 cents to a high of 10.5 cents between January and April 2023. We like to follow management that has delivered for us in the past.

- Successful fund, Merchant Group has a substantial position in NTI - Merchant Group became a substantial shareholder of NTI with a 5.01% stake when NTI was trading at ~9 cents. We have followed Merchant Group’s investments closely and think the fund has a keen eye for high potential biotechs given its past history of success.

Our Big Bet for NTI

“NTI re-rates to a +$500M market cap by successfully advancing one or more of its clinical trial programs through to regulatory approval, partnership/licensing and/or is acquired by a large pharmaceutical company”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our NTI Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Neurotech International

ASX:NTI

Today’s Trial Results: What is PANDAS/PANS - a neurological disorder in children

PANDAS/PANS is a nasty rare disease that affects children and currently has no specifically approved treatment.

Symptoms include, sudden onset of OCD, tics, anxiety, emotional lability and some motor abnormalities.

Basically, the child becomes a nervous wreck following an infection - which no parent wants to see.

And NTI’s treatment reached both of its primary endpoints - a reduction in severity of illness and improvement in overall symptoms of anxiety and depression.

Basically, the data from the trial showed, with a level of statistical significance, that NTI’s treatment is effective at reducing the symptoms of PANDAS/PANS.

This primary endpoint was measured across a range of metrics that are considered the “gold standard” of neuropsychiatric disorders.

This data stems from a 47-item parent-report questionnaire that is independent and measured throughout the trial.

Early signs are that the treatment is both safe and effective, and impressively so.

Although this patient cohort was small (15 children), NTI will likely have enough data here to take this trial through to a Phase 3.

This is significant as we think it builds on a growing body of evidence that NTI’s treatment works across a range of disorders tied to neuroinflammation.

Neuroinflammatory means what it sounds like - inflammation of the brain and spinal cord.

NTI has already shown to the market good results from a Phase I/II trial on Autism Spectrum Disorder (ASD).

The patients in that trial also had the trial term extended, just like today’s PANDAS/PANS trial.

PANDAS (Paediatric Autoimmune Neuropsychiatric Disorders Associated with Streptococcal Infections) and PANS (Paediatric Acute-onset Neuropsychiatric Syndrome) are conditions that affect children, resulting in sudden changes in behaviour and mood. PANDAS is specifically linked to strep infections, however PANS can be caused by various infections.

- Causes: PANDAS is thought to be triggered by strep infections in children. Whereas, PANS can be set off by various infections, toxins, and other triggers. Both disorders are autoimmune in nature, where the child’s own cells mistakenly attack healthy brain cells.

- Symptoms: Sudden onset of OCD, tics, anxiety, emotional lability and some motor abnormalities. Symptoms may worsen acutely.

- Prevalence: Research suggests that PANDAS impacts 1 in every 200 children, however prevalence of PANS is less clear.

- Treatments: There is no simple treatment for PANDAS/PANS. Treatment usually involves antibiotics, anti-inflammatories and immunotherapy.

What do Today’s NTI trial results mean?

There was “significant efficacy” (the treatment worked) AND no major adverse events on the safety front - and these were the key takeaways for us from today’s announcement:

“NTI164 has shown statistically significant efficacy in improving the symptoms associated with PANDAS/PANS after 12 weeks of daily therapy, with [...]”

And this is important:

“the trial met the key primary endpoints of anxiety and depression (RCADS-P) with a 30% improvement overall and severity of illness displaying an 18% improvement. Other efficacy measures also showed improvements over 12 weeks of treatment.”

So two primary endpoints, anxiety and depression and severity of illness - BOTH with statistically significant improvements.

Statistical significance basically measures whether the results could be repeated in another trial and being able to say with a high level of confidence that the results are attributable to NTI’s treatment.

Meeting the primary endpoints was a big win for us as NTI Investors today - but there’s something else at play here as well...

In a sign of how profound the improvement was for patients on NTI’s treatment - all patients will remain on the treatment for an additional year.

Put simply, if parents are comfortable seeing their children stay on the treatment for a year - the improvement in their child’s symptoms must be good enough for them to be fine with an extension.

If it wasn’t working or there was no noticeable improvement from the parent’s end, it stands to reason that after the trial, things would just stop.

So we see this extension as a glowing endorsement of the safety and efficacy of the trial and the basis for an accelerated pathway to market.

NTI Managing Director Dr Tom Duthy will be hosting a webinar to talk through the results today at midday AEST - register to attend here.

This news comes a day after our other biotech Investment, Dimerix tacked on ~150% in the space of a single day on a long awaited $230M commercialisation deal.

It shows that even in a rough bear market - big results can generate re-rates.

We think today’s NTI results could provide a pathway to a similar scale of commercial deal.

Dimerix has orphan drug designation - a set of regulatory incentives for rare diseases that can make commercialisation of treatments particularly lucrative.

The good news?

NTI is also going after orphan drug designation for its treatment after today’s PANDAS/PANS results:

(Source)

This is the same pathway to commercialisation that helped a company called Neuren Pharmaceuticals rise ~1,300% over three years (it now has a $1.4BN market cap).

Neuren Pharmaceuticals and the orphan drug playbook

Neuren is the biggest biotech success story on the ASX in the past three years.

The company has grown over ~1,300% since it developed and commercialised its treatment for Rett Syndrome (a rare and nasty disease).

Neuren now has a market cap of $1.4BN and has offered the market a pathway to drug development success through the treatment of orphan diseases.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

An orphan disease is a rare disease with less than 200,000 patients in the US.

Neuren’s strategy was to target a number of these rare diseases that have a small number of patients - in particular Rett Syndrome.

To encourage the development of treatments of rare diseases, governments provide generous incentives to companies.

- Fast Tracked Approvals: This means that the company will not always need to undertake the entirety of a Phase III clinical trial in order to get the product to market.

- Market Exclusivity: Once the US FDA grants orphan drug designation to a drug, it also gets seven years of market exclusivity.

- Orphan drug pricing: Orphan drugs are priced at a point that encourages drug developers to make treatments.

The average price for an orphan drug is US$32,000 per year per patient.

This amount is not paid by mums and dads, but rather governments and insurance agencies subsidising the treatment.

Drug development companies will generally negotiate with payers (in this case governments and insurance agencies) to set a price for the orphan drug.

Currently capped at just $59M, NTI is following the Neuren path, developing its own pipeline of rare disease treatments including PANDAS/PANS and Rett Syndrome.

NTI will seek orphan drug status for PANDAS/PANSs - meaning it is eligible for all of the incentives and approvals of rare diseases.

🎓To learn more about orphan drugs read: Orphan Drugs Explained

We think that the suite of products that NTI is developing, to reduce neuroinflammation, will put it in good stead to commercialise at least one of its treatments.

Reducing neuroinflammation? What do these results mean for the rest of NTI’s trials?

NTI is working through its clinical trial pipeline on the basis that its pharmaceutical product “NTI164” has benefits when it is used to treat disorders tied to neuroinflammation.

Neuroinflammatory means what it sounds like - inflammation of the brain and spinal cord.

NTI already had one positive trial result on a neuroinflammation linked disorder - the data from the company’s Phase I/II trial on Autism Spectrum Disorder (ASD).

And it now has a second set of positive clinical trial data for a disorder tied to neuroinflammation - today’s Phase I/II PANDAS/PANS study.

While we aren’t scientists, it appears that there is now a growing body of evidence pointing to the fact that NTI164 has an anti-neuroinflammatory effect.

Meaning, and we must caveat this by saying clinical trial results can vary, the initial signs here could be good for the other trials that NTI has in its pipeline.

We’re thinking especially about NTI’s Rett Syndrome trial which is another childhood neurological condition linked to neuroinflammation.

It’s early days, and a lot can still happen - but we’re pleased with today’s results as we think it enhances NTI’s chances of delivering positive results in the Rett Syndrome trial after these two positive results on neuroinflammation linked disorders.

What’s next for NTI?

Catalyst #1: ✅Phase I/II PANDAS/PAN clinical trial - today’s results are strongly positive, a trial for a rare child neuropsychiatric disorder showed both safety and efficacy in a small group. Opens the door to a larger trial and potentially, commercialisation.

Catalyst #2: 🔄Phase I/II Rett Syndrome clinical trial (results in Q1 CY2024) - a trial on another child neuropsychiatric disorder called Rett Syndrome - $1.4BN capped Neuren re-rated ~1300% on commercialisation of its treatment for this disorder. We think NTI could be safer than Neuren’s treatment and if it works better or similar, hopefully, re-rate accordingly.

Catalyst #3:🔄 Phase II/III trial for Autism Spectrum Disorder (patient recruitment complete in H2 CY2023, we think results could be reported H1, 2024) - NTI already has positive results from a Phase I/II trial for its treatment for Autism - this trial will ideally build on these results, with the trial already being extended so that the original trial participants can stay on the treatment.

So we now have two trials where NTI’s treatment has been shown to work safely and perhaps the biggest trial in NTI’s clinical portfolio is just around the corner.

The next trial we are expecting results for is NTI’s is the results from the Phase I/II Rett Syndrome clinical trial (results in Q1 next year).

Risks

Clinical trial risk

It is important to be aware that clinical trials can be unsuccessful.

In particular, there are some standard risks that are associated with biotechs that are undertaking clinical research:

- Patient recruitment is delayed or fails

- Ethics approval is delayed or fails

- Clinical trial cost blowouts

- The drug/treatment is not considered safe for human consumption (usually established in Phase I)

- The drug or treatment is ineffective at treating the particular disease (usually determined by clinical trial results in Phase II and Phase III)

- The design of the trial is such that the regulatory body does not approve the drug/treatment

There is a chance that one or more of NTI’s clinical trials fail to meet their primary or secondary endpoints, meaning the treatments fail to satisfy the criteria of the studies. Any clinical trial results, if negative, could hurt the NTI share price.

Funding risk

Pre revenue biotech companies regularly need to raise capital to fund their growth ambitions. Capital raises can cause dilution to existing shareholders.

NTI will likely need to raise capital at some stage in the future, potentially at a discount to market prices to secure funds. This will be contingent on clinical trial results and broader market sentiment (see next risk).

Market risk

Broader market sentiment for small pre-revenue biotechs could get worse and the sector as a whole trades lower, taking NTI’s share price with it. Alternatively, the entire market could sell down as well.

Our NTI Investment Memo

In our NTI Investment Memo you’ll find:

- Key objectives for NTI

- Why we Invested in NTI

- What are the key risks to our Investment thesis

- Our Investment plan

Key resources for this article:

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.