Navarre…Hot on The Trail for Victoria’s Next Major Gold Deposit

Published 09-JUL-2020 11:38 A.M.

|

14 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Results from Navarre Minerals' (ASX:NML) ongoing diamond drilling program at its Resolution Lode prospect on the western side of Victoria’s premier 80 million ounce gold province may be shaping up to be the next “Magdala”.

The four million ounce Magdala Gold Mine in Stawell — privately-owned by one of Navarre’s major shareholders and just located 20km north of Navarre's project — is the model Navarre is using to hone its exploration programs.

NML can’t hide its excitement that Resolution is shaping up to be similar in character to Magdala, displaying some highly encouraging geometry and a style of gold mineralisation — right as attention focuses in on the booming Victorian gold sector.

Navarre is delivering consistently strong grades of high-grade gold mineralisation from within the Stawell Gold Corridor, an extension of a corridor of rocks that host the 5Moz Stawell and 1Moz Ararat goldfields.

The company yesterday reported further significant high-grade gold assays from its ongoing expansion diamond drilling program at Resolution Lode with the aim of delivering a maiden Mineral Resource in early 2021.

The 9,000 metre diamond drilling program, that’s now 45% complete, is testing the continuity and extent of previously intersected shallow gold mineralisation.

According to managing director Geoff McDermott, the company has “cracked the code” at Resolution Lode by working out which way the gold mineralisation extends, essentially laying out the fairway for further expansion.

That expansion is anticipated to be rapid with the company reversing a decision earlier this year to slow operations amid the coronavirus pandemic. In a sharp change of direction, Navarre is now transitioning drilling towards 24 hour per day, 7 day per week operation to increase diamond drilling productivity.

Also reflecting the company’s enthusiasm is its recent appointment of former Kirkland Lake Gold Ltd. (ASX:KLA | TSX:KL | NYSE:KL) Vice President, Australian Operations, Mr Ian Holland, who was also the general manager of the Fosterville Gold Mine.

Ian was at the centre of the recent revival of the historic Victorian goldfields, developing the Fosterville Gold Mine into one of the world’s highest grade, most profitable gold mines.

Under Ian’s guidance the mine transitioned from approximately 100,000ozs of gold production in 2010 to a world-class 619,400ozs in 2019, following discovery of the high-grade Eagle and Swan orebodies.

Fosterville, located 25 kilometres from Bendigo, has ore reserves of 2.7Moz at 31 g/t gold and anticipated production of up to 610,000oz per year over the coming years, so Holland’s value to Navarre cannot be overstated.

Navarre’s Tandarra Project, a joint venture with Catalyst Metals (ASX:CYL), is another highly promising project located under shallow cover, just 60kms from the Fosterville Gold Mine. Victoria’s Geological Survey (GSV) has estimated the undiscovered gold endowment under cover to the north of Fosterville to be approximately 32Moz.

Navarre, with Catalyst, has an early mover advantage at Tandarra and just confirmed further high grade gold mineralisation at the project’s Macnaughtan prospect, the third significant mineralised gold zone at Tandarra alongside Tomorrow and Lawry.

Along with the well-recognised potential at Resolution Lode, Tandarra is a “really exciting greenfields opportunity” not far from Fosterville and a major factor in attracting Ian Holland to Navarre.

In addition to the Stawell Corridor and Tandarra gold projects, Navarre recently acquired the Jubilee Gold Project — a complementary and strategic high-grade gold exploration licence, located 25km south-west of Ballarat.

The acquisition of this highly prospective gold tenement, within close trucking distance of an operating 12 million ounce goldfield, is a significant step forward for the future of the company.

Navarre’s impressive management team has a assembled an equally impressive portfolio of gold projects with outstanding potential. Now with drilling transitioning to 24/7 operations at Resolution we expect there to be plenty of potential catalysts in the near term with 5,000m of diamond core drilling remaining to be completed over winter.

Market Capitalisation: $69.35 million

Share Price: $0.14

Cash at Bank: $6.7 million (at 31 March 2020)

Interest in the Victorian goldfields is soaring

As is the case with many small cap ASX gold stocks right now, interest is soaring in Victoria’s gold projects.

Yet Navarre Minerals (ASX:NML) isn’t simply jumping on the bandwagon to ride the market higher.

The company was an early mover in the historic region’s gold revival, which includes the now Kirkland Lake Gold-owned Fosterville Gold Mine — Australia’s largest gold producer and the world’s highest grade, most profitable gold mine.

Navarre has been steadily expanding and developing its portfolio of Victorian gold projects for years.

And now it’s go-time for the $70 capped ASX exploration company as the company expedites exploration activities at Resolution Lode — its Magdala gold mine lookalike — and continues to expand and develop its Victorian gold portfolio.

Leveraged to a rising gold price

As mentioned in my last update on Navarre — “Drilling Underway for Navarre Amid New Victorian Gold Rush” — Hartley’s notes that Navarre’s geologists have been piecing together the case for a potential repeat of the 4Moz Magdala gold system since 2014.

Incidentally, it 2014 was also the year that the Next Small Cap first brought Navarre to readers’ attention.

As you can see below, in that time the stock has established a definite long term uptrend.

As one may suspect, NML’s performance is correlated to that of the gold price in Australian dollars (below).

What’s interesting here is that NML, while trending in a similar pattern to gold, its returns (as seen it the chart above) are many multiples of that of the spot gold price.

However, it’s not just the gold price that’s attractive here and it’s not just ASX investors recognising the upside potential of Victorian goldminers.

As reported by ABC News, the state's resources regulator received more than 80 new mineral licence applications in the 2019 financial year to May, while February marked a five-year application high.

The spike in applications has been driven not only by the strengthening AUD gold price, but also an increased production rate and improvement in the quality of the minerals produced at the Fosterville Gold Mine. Also helping is improved investor confidence in Victoria's resources thanks to the state government’s work to promote investment in mining.

Navarre’s project portfolio

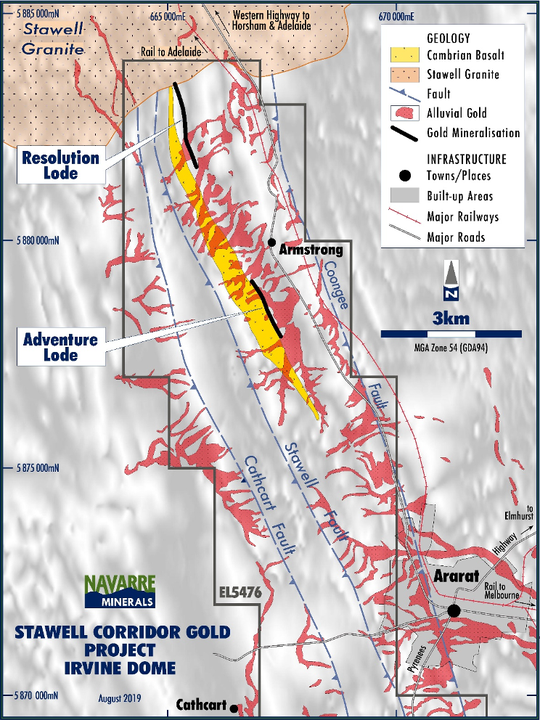

Navarre’s Stawell Corridor Gold Project incorporates the Irvine (Resolution and Adventure lodes) and Langi Logan gold projects and five other prospective basalt dome targets.

The company’s second-most advanced project, the Tandarra Gold Project, is a joint venture (JV) with Catalyst Metals (ASX:CYL). The project is in the Bendigo Gold Corridor and located close to the Fosterville Gold Mine.

The company also recently acquired a 100% interest in the Jubilee Gold Project, a complementary and strategic high-grade gold exploration licence to the south of the company’s existing projects.

The company’s primary focus is the Resolution Lode at the Stawell Corridor Project’s Irvine basalt dome — its most advanced prospect.

Stawell Gold Corridor Project

Navarre is searching for large gold deposits in the Stawell Gold Corridor — an extension of a corridor of rocks that host the 1Moz Ararat goldfield and the 5Moz Stawell goldfields which includes the 4Moz Magdala gold deposit at Stawell.

Navarre has identified seven basalt dome structures within the multi-million ounce gold zone — a 60km long tenement package to date at Stawell.

While the Irvine basalt dome is Navarre’s most advanced prospect, previous drilling has confirmed extensive shallow gold footprints at the Resolution and Adventure lodes with a combined strike length of 2.9 kilometres along the eastern contact of the Irvine basalt dome.

High-grade gold assays extend Resolution Lode

It’s looking more and more like NML has its very own Magdala with each announcement.

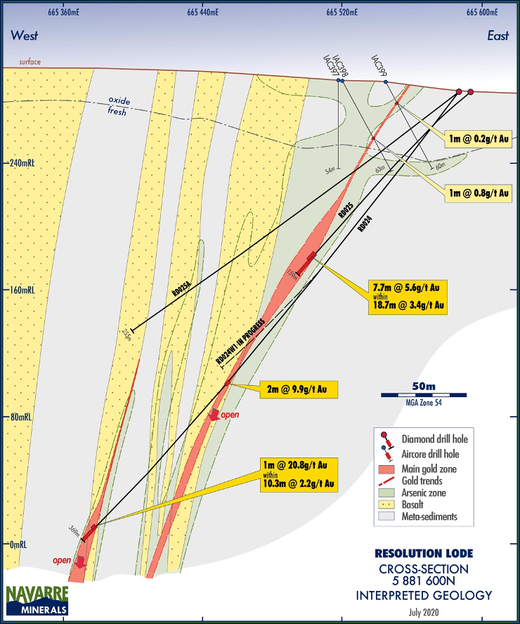

Yesterday, Navarre released further significant gold assay results from an ongoing 9000m diamond drilling program at its Resolution Lode prospect, 20km south of Stawell’s 4Moz Magdala Gold Mine.

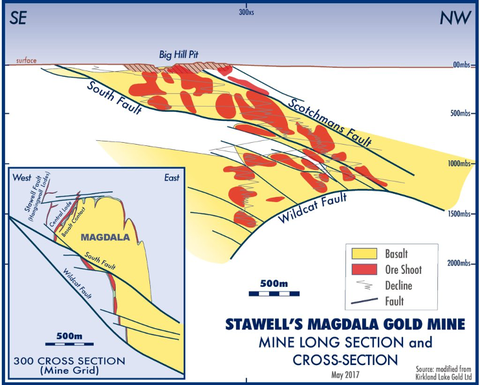

Navarre’s exploration model for the Stawell Gold Corridor is based on the Magdala deposit where primary gold mineralisation occurs proximal to the margins of large basalt dome structure:

Encouragingly, the style and geometry of gold mineralisation at Resolution Lode is similar to the Magdala gold deposit, on-strike 20km further north, where gold has been mined from surface to 1.6km depth.

Navarre’s 9000m diamond drilling program, which is now approximately 45% complete, is to scope the depth potential of the 1.6km long Resolution Lode discovery with the aim of delivering a maiden Mineral Resource in early 2021.

The drilling is targeting a potential Mineral Resource by scoping the down-plunge extents of shallow gold mineralisation.

Prior drilling had already confirmed that the mineralised quartz–sulphide structures occur in geometries similar to the gold shoot patterns of the on-strike 4Moz Magdala Gold Mine.

The new intersections (not true widths) include:

A second zone of gold mineralisation was also identified approximately 50m west of main gold zone.

The gold mineralisation was confirmed from surface to beyond 300m depth and remains open down-plunge.

Drilling results returned to date continue to demonstrate continuity, predictability and robustness of the mineralised system at Resolution Lode. Interpretation of the diamond results also indicate:

- Gold mineralisation occurs in two higher-grade shoots;

- The gold shoots plunge gently to the south;

- Gold tenor is relatively uniform, averaging between 4 and 6 g/t below the base of oxidation;

- The width of gold mineralisation generally ranges between 1.5m and 5m;

- A second significant sub-parallel zone of gold mineralisation has been identified approximately 50m west of the main gold zone.

The news was covered by Finfeed:

Diamond drilling continues at Stawell Corridor Gold Project

A further 5,000m of diamond core drilling remains to be completed with results expected to be reported in batches of between 4 and 6 drill holes following receipt of assays and interpretation of geology.

The company is now transitioning transition drilling to 24/7 operations to increase diamond core productivity and, for the first time, drilling operations will continue through winter.

This follows a decision by management in April — in light of the COVID-19 pandemic — to scale back its exploration efforts, a move which negatively impacted the company’s share price at the time and now makes yesterday’s announcement particularly newsworthy and relevant to investors.

While the Stawell Gold Corridor Project, and its Resolution Lode in particular, are the immediate focus of Navarre’s attention, it is not the only prospective Victorian gold project in its portfolio.

Kirkland Gold’s Ian Holland Joins NML Board

Navarre recently appointed Mr Ian Holland as an Independent Non-Executive Director of the company.

A highly regarded mining executive with a strong track record of value creation, Ian joins the board after 13 years at the Fosterville Gold Mine — the highest-grade, low cost gold mine in the world and Australia’s largest gold producer.

As Vice President, Australian Operations at Kirkland Lake Gold Ltd. (ASX:KLA, TSX:KL, NYSE:KL) — Fosterville’s current owner — Ian was responsible for all Australian activities, including overseeing the Fosterville mine.

Under his guidance the mine transitioned from approximately 100,000ozs of gold production in 2010 to a world-class 619,400ozs in 2019, following the discovery of the high-grade Eagle and Swan orebodies.

I spoke with Ian to see what exactly it was that attracted him to Navarre.

Highlighting the quality of both the asset portfolio and the team, led by managing director Geoff McDermott, he recognised an opportunity at Navarre to the next gold opportunities and apply his experience of operating in Victoria.

In particular, Ian identified Tandarra and Resolution Lode as locations to find opportunities, develop them, and permit them.

At Resolution Lode he highlighted its likeness to Magdala, “it sits adjacent to a basalt contact. It’s got a similar grade profile at 4-6 grams and looks like it has a geology that lends itself to underground mining. It’s looking pretty exciting — outstanding potential and that’s why I was really excited to join Navarre.”

Ian highlighted Tandarra and Resolution specifically — looking for Bendigo-style under cover, looking for Stawell-style to the south of the Stawell granite — but noted there’s other opportunities as well. In particular, the “recent acquisition of the Jubilee prospect — 25kms south of Ballarat is really interesting as well, so a really high quality portfolio and high quality team.”

Navarre Chairman, Mr Kevin Wilson, said, “The Navarre Board is delighted to have Ian join our team at this important time in Navarre’s growth. Ian’s depth of relevant industry experience will be invaluable to Navarre as we seek to advance our projects towards the development stage. Ian’s commitment to building wealth for all Navarre’s stakeholders is strongly aligned to that of the Navarre Board.”

Tandarra Gold Project

Navarre’s second of its advanced projects, the Tandarra Project, its JV with Catalyst Metals (ASX:CYL), is located in the Bendigo Gold Corridor, not far from the Fosterville Gold Mine.

Tandarra is a greenfields (virgin) gold discovery under cover in the North Bendigo Zone of Victoria (an area of about 7,600km2) that has a Geological Survey of Victoria estimated undiscovered gold endowment of approximately 32 million ounces.

Recent AC drilling at the Tandarra Gold Project has revealed high grades and continuity of gold mineralisation.

The air core (AC) drilling program comprising 42 holes of infill AC drilling on the southern extension of the Macnaughtan gold trend and 31 holes of reconnaissance AC drilling north of the Lawry Zone at Tandarra.

The high grades and continuity of gold mineralisation confirmed the potential of the southern Macnaughtan prospect to become the third significantly mineralised structure at Tandarra, in parallel with the high-grade gold intersections at the Tomorrow Zone, located 250 metres to the east and the Lawry discovery 200m further east.

Follow up AC and reverse circulation drilling is planned on both these project areas during the 2020-21 field season.

Jubilee Gold Project

NML also recently agreed to acquire 100% of the Jubilee Gold Project, a complementary and strategic high-grade gold exploration licence to the south of the company’s existing projects.

The Jubilee Gold Project includes the historical 620 metre deep Jubilee Gold Mine (mined 1887 – 1913) that produced approximately 130,000 ounces of gold at a recovered grade of around 12 g/t gold from a single east-west trending quartz reef.

Since the mine's closure in 1913, there have been no reported modern attempts at sustained exploration, and no drilling has occurred.

The property is located within a highly prospective and prolific mining district in close proximity to a significant operating gold mine and processing facility within the historical 12 million-ounce Ballarat Goldfield.

Managing director, Geoff McDermott, said:

“This outstanding exploration property has a history of delivering relatively uniform and continuous high-grade gold mineralisation from within quartz lode structures, all just 25km from a significant processing facility and mine infrastructure. The existence of transverse quartz reefs represents a rare opportunity for exploration as these structures have never been drill tested.

Navarre intend to immediately commence exploration and will look to add extra geological resources to manage the additional workload. A systematic exploration program will target extensions and repetitions of the historically mined quartz reefs which we anticipate drill testing towards the end of this year.”

A final word

Clearly, there’s plenty of activity in the works for Navarre Minerals.

There remains 5,000m of the company’s diamond drilling program at Resolution Lode, which is being rapidly progressed with the company transitioning to 24 hour per day, 7 day per week operations.

At the company’s JV project with Catalyst, Tandarra, follow up AC and reverse circulation drilling is planned for the Macnaughtan prospect and Tomorrow Zone project areas during the 2020-21 field season.

Furthermore, drilling at the newly acquired Jubilee project will kick off by the year’s end.

The renewed interest in ASX gold miners and the renewed focus of the company and it strengthened team should attract significant market attention in the months ahead.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.