MNB Taps US$20B Rare Earths Market in Madagascar, on Heels of EV Revolution

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Next Mining Boom advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

As we rapidly move into a greener, more sustainable future, rare earth elements (REE) will play a vital role.

While not as commonly featured in clean tech discussion as high-publicity powerhouse commodities like lithium and cobalt, REEs are essential to much of the technology that figures in our everyday lives.

They’re in the hard disc drive in your laptop and in the headphones you wear. They are also essential in wind energy generation, robotics and other clean energy applications.

However, the most in-demand application for rare earths is in the magnets used for electric motors — which is where they enter the electric vehicle (EV) supply chain.

The past 50 years have seen the rare earth industry swell thirty-fold, driven by tech innovation and the growing demand for rare earth magnets. By 2020, global demand is expected to sit at 200,000 tonnes of rare earth oxide (REO).

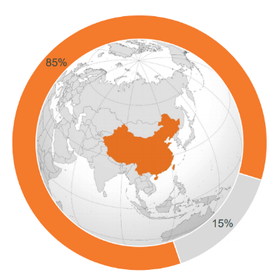

Currently, almost 90% of the world’s rare earth production occurs in China. However, China has recently cracked down on illegal rare earth mining and is expected to limit annual rare earths production, beginning in 2020.

China’s dominant supply position presents considerable risk to the rest of the world, and in turn creates incentive for the rest of the world to develop alternative supplies.

One ASX junior that’s shrewdly set its sights on this in-demand commodity — and could stand to disrupt these kinds of uneven supply/demand dynamics from outside China — is Minbos Resources (ASX:MNB).

This ASX small cap has quickly cottoned on to the role REEs play in EV transportation and the generation and storage of clean energy, and is hoping to emerge as a major global supplier.

MNB is on the hunt for rare earths in amply mineralised yet largely underexplored central Madagascar with its high-grade Ambato Project, which shows potential to be a world-class deposit.

It is, however, early stages for MNB here, so investors should seek professional financial advice if considering this stock for their portfolio.

MNB gained a 90% stake in this project when it entered into an option with Tana Minerals Ltd to acquire 90% of MRE Mining, whose sole asset is a wholly owned subsidiary in Madagascar which holds two exploration permits over 440 square kilometres.

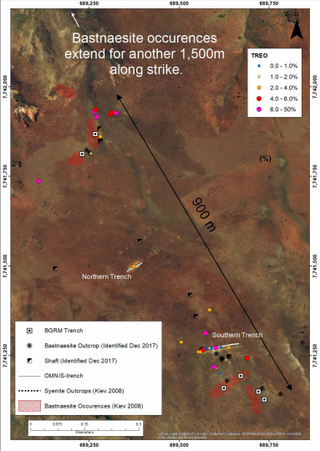

Ambato hosts multiple occurrences outcropping at surface — all undrilled. Especially intriguing is the Ankazohambo prospect, which has outcropping rare earth mineralisation over a 2.4 metre strike length.

In 2010, Tana collected 28 rock chip samples at Ankazohambo that returned high TREO (total rare earth oxides) grades of between 0.14% and 40.8% with a median grade of 3.95%.

Surface sampling has returned high-grade REE contained predominantly in bastnaesite. Bastnaesite is typically low in uranium and thorium and is one of only three REE minerals to have been commercially ‘beneficiated’ — that is, processing of the mineral to improve its properties and, in turn, its economic value.

Encouragingly, recent mineralogy tests show a high degree of liberation of the coarse grained mineralisation, suggesting that easy beneficiation into a high grade concentrate will be possible. This simple mineralogy is a major plus for MNB, potentially translated into reduced costs and timeframes.

Site inspections are currently underway for a diamond drill program at the Ankazohambo prospect. Metallurgical testwork campaigns are also being prepared to fast-track core samples into process flowsheet design for beneficiation to REE concentrate.

Considering that the global rare earths market is projected to hit US$20 billion by 2024, according to Global Market Insights, this is a strategic play indeed.

Also strategic is MNB’s prime, accessible location. The Ambato Project sits 200 kilometres south of the capital city of Antananarivo — 50 kilometres from the Route Nationale highway. The national rail network joins the nearby regional city of Antsirabe to the port of Tomasina on the east coast — something that bodes nicely for MNB, should it manage to find something substantial and rack up a commercial supply.

With that in mind — and given this project’s potential to become a high-grade, world-class rare earth deposit — this strategic $17 million-capped ASX junior could be in exactly the right place, at the right time.

Catching up on all the latest from:

Minbos Resources (ASX:MNB) is focused on advancing its flagship Ambato rare earths project in central Madagascar. This project is currently its central focus, and what we’ll primarily be looking at in this article.

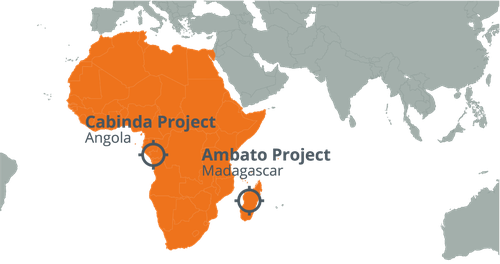

It’s worth noting, however, that MNB also has a high-grade phosphate project in a different part of Africa — the Cacata Project, which sits in the Cabinda Province of the Republic of Angola. MNB is continuing to work with the government to capture value from its Cacata Project for all stakeholders, and considering MNB’s underlying focus on clean tech commodities, this project also provides a nice side order of diversification for its portfolio.

Here is the full scope of MNB’s projects, mapped out:

For now, though, let’s get straight to the crux of the matter: MNB’s rare earths play in Madagascar...

Ambato: a snapshot

A quick word on the specifics of MNB’s stake in this project...

Earlier this year, the company entered into an exclusive option with Tana Minerals to acquire 90% of the shares in MRE Mining (Mauritius) Limited. MRE’s sole asset is a wholly owned subsidiary which holds two exploration permits in central Madagascar covering 440 square kilometres.

As part of its due diligence, MNB plans to soon meet with the mining department in Madagascar to get a better understanding of the exploration permits. It also plans to conduct exploration activities, including an upcoming drilling program. You can read the full details of the option in the announcement released back in March.

For those of you unfamiliar with this part of the woods, Madagascar is an island nation located off the east coast of southern Africa. The east side of the southern tip of the island is sedimentary and hosts Rio Tinto’s (ASX:RIO) QMM mineral sands mine and Base Resources’ (ASX:BSE) Toliara project. The eastern two thirds of the island is underlain by Precambrian, Archean and Proterozoic rocks and hosts Sherritt’s Ambartovy mine, which stands to emerge as the largest laterite nickel project in the world...

Despite its prospectivity and established regulatory framework, Madagascar remains largely underexplored, meaning that in a lot of ways, MNB is tapping new ground here...

Located in central Madagascar, MNB’s Ambato Project is 200 kilometres south of Antananarivo and just 50 kilometres from the Route Nationale highway, while the national rail network joins the city of Antsirabe to the east coast’s port of Tomasina.

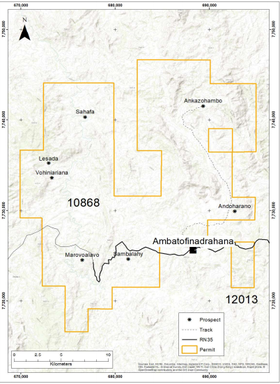

The map below shows MNB’s prospects at Ambato, including exploration permits:

MNB’s licenses host multiple REE occurrences outcropping at surface. All of these prospects are undrilled.

The Ankazohambo prospect in particular looks especially promising — it has been sampled intermittently over 2.4 kilometres of strike, returning rock chip samples up to 41% TREO and mineralised widths of up to 50 metres in trenches. Here, there’s large tonnage potential from surface.

90% of the REE in surface samples is contained in the mineral bastnasite with low levels of the radioactive elements uranium and thorium. The majority of the gangue mineral is silica. Mineralogical examination conducted by mining consultancy group ANSTO identified three quarters of the bastnasite grains are highly or fully liberated (80-100%), which is consistent with the coarse grains visually observed in the samples.

Coarse bastnasite grains look something like this:

For those of you who aren’t geologists, the key takeaway here is that the kind of simple, easily beneficiated mineralogy MNB has on its hands will likely translate into convenient extraction, reduced costs and high recovery to a saleable concentrate.

And with MNB preparing to carry out a maiden drill program on the licenses in the not so distant future, there’s plenty to look forward to here.

With this highly promising holding in mind, let’s take a closer look at the flourishing market MNB is tapping, which stands to benefit substantially from the EV boom...

Why rare earths? Of clean cities, magnet metals, and a fleet of electric cars

Rare earths are a group of 17 metals that are highly prized for their use in devices such as smartphones, batteries, displays and wind turbines. The rare earth metals and oxides are of particular interest due to unique magnetic, chemical and luminescent properties.

High performance of rare earth magnets at very high temperatures, coupled with high corrosion resistance will significantly help the market to grow at a higher rate over the forecast period.

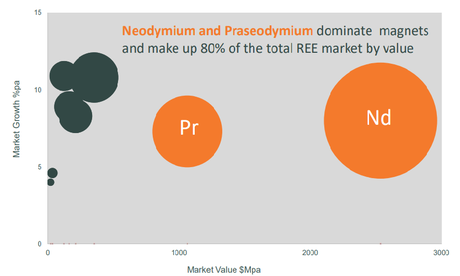

While many a strategic investor has long kept an eye on battery metals such as the lithium, cobalt and graphite used in EV batteries, attention is also steadily turning to rare earth magnet metals such as dysprosium, praseodymium and neodymium used in electric car motors.

High performance of rare earth magnets at very high temperatures, coupled with high corrosion resistance significantly drive the growth of this overall market.

It’s worth noting here that rare earths aren’t actually so rare. And while REEs are always found together, it’s uncommon to find them in commercially feasible quantities.

When you break down rare earth uses, metal alloys are used in the fast growing hydrogen storage sector.

Permanent magnets, on the other hand, are used in electric motors and wind turbines, offering size, weight and efficiency advantages over conventional induction motors. In fact, Tesla recently announced it is shifting to rare earth permanent magnet motors...

This InvestorIntel article breaks down some of these market dynamics, including the role China plays in this industry (which we’ll look at in a moment):

Studies by Curtin-IMCOA suggest that demand from the clean and green energy sectors will be the main driver for rare earths demand and growth over the next decade.

In particular, demand for the aforementioned neodymium, praseodymium and dysprosium for the REPMs (rare earth permanent magnets) used in hybrid vehicles, EVs and wind turbines, is forecast to double between 2015 and 2025.

Demand for electric vehicles — which contain up to two kilograms of REPM in the drive motor and another two kilos in the other motors — is forecast to grow by 20-50% per year.

The latest forecast from Bloomberg New Energy Finance estimates electric cars will account for 2% of the market by 2020, rising to 8% by 2025 and 20% by 2030. And by 2040, 55% of all new car sales and 33% of the global fleet will be electric.

Of course markets do fluctuate and anything can happen between now and 2040, so investors should, as always, take a cautious approach to any investment decision made with regard to this stock.

China will lead the transition into EVs, with sales accounting for almost 50% of the global EV market in 2025 and 39% in 2030. Which brings us to the next piece of the rare earths puzzle...

The China story

As we’ve mentioned, China has a distinctive monopoly over the rare earths supply chain, controlling almost 90% of the world’s rare earth production.

Around half of this is production is from two main producers: Northern Group and Chinalco. The rest of the world’s production is dominated by Lynas Corporation (more than 70%) from its Mount Weld mine.

China recently cracked down on illegal rare earth mining (a move that caused neodymium prices to skyrocket by more than 30% in just one month) and is expected to put an annual limit on its rare earths production beginning in 2020.

On top of this, China's intention to ban internal combustion engines is a huge driver of demand for rare earths that would soak up an increasing proportion of its domestic production.

Remembering that China is the source of nearly 80% of US imports, the US Department of the Interior recently included rare earths in its list of 35 strategic mineral commodities deemed critical for the country’s national and economic security.

With these kinds of tensions building, rare earths could very well sit at the sharp end of a trade war. And as EVs become more and more pervasive, and with rare earths supplies tightening in China, producers outside of China will be in very heavy demand indeed.

Which brings us back to MNB: a small-cap rare earth explorer just starting out, looking for these in-demand commodities on highly prospective ground... that’s far away from China. If MNB manages to find something sizeable at Ambato, this ASX junior could very well stand to shake up the unstable rare earths scene.

Although success is not guaranteed and investors should seek professional financial advice for further information if considering this stock for their portfolio.

A very brief peer comparison

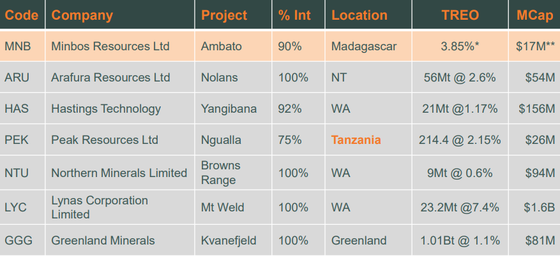

Here’s how MNB is tracking compared to its ASX rare earth peers in terms of location, TREO grades and market cap:

As you can see, while MNB is just starting out and is valued by the market at a tiny $17 million, it has plenty of space for future growth...and some of the highest TREO grades amongst its peers.

This company has a long way to go, but it seems to have all the vital ingredients for exploration success as it ramps up its game at Ambato.

A rare opportunity

MNB seems to have its hands full in Madagascar, with site inspections currently underway for a diamond drill program at the Ankazohambo REE prospect. Metallurgical testwork plans are also being prepared to fast-track core samples into flowsheet design for beneficiation to REE concentrate.

On top of that, the company is also working with the Angolan government to maximise value at its Cabinda Phosphate Project — currently a secondary priority for MNB, but an intriguing point of diversification that again targets a new age tech commodity.

MNB is also in a sound cash position, with $4 million at its disposal, which will help ease its exploration journey as it moves to capture its share of the US$20 billion global rare earths market.

In short, while these are early days for this ASX small-cap, MNB has meticulously selected forward-focused commodities with a bright future, and has every chance of finding them in mineral-rich Madagascar. This is one strategic explorer we’ll be sure to track closely in the months to come.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.