Metro Mining generates 2019 EBITDA of $44 million

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

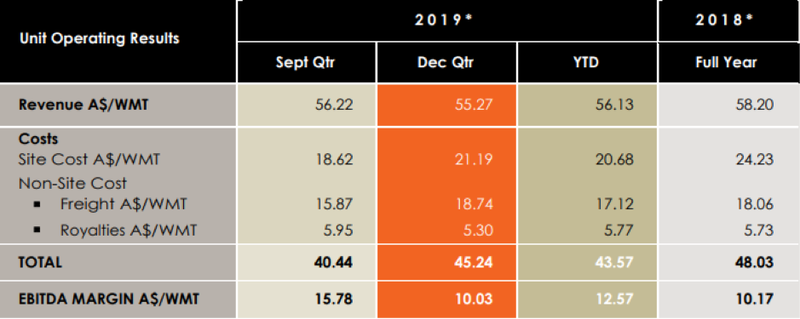

Metro Mining Ltd (ASX:MMI) continues to surprise on the upside, advising today that it had generated EBITDA of $12.6 million from sales of $69.3 million in the December quarter.

While the bauxite producer had already informed the market that it had achieved annual production of 3.5 million wet metric tonnes in 2019, representing the top end of management’s guidance, it wasn’t until today that Metro released quarterly earnings.

This should be well received by the market, as it brings full-year EBITDA to $44 million.

Ahead of these figures being released, Morgans’ analyst Chris Brown was the most bullish in terms of the brokers covering the stock, forecasting EBITDA of $39 million.

Consequently, this represents a substantial ‘beat’ and may have brokers upwardly revising valuations, share price targets and possibly their 2020 earnings estimates.

Brown currently has a valuation and price target of 35 cents on the stock, implying upside, albeit speculative, of more than 100% to Wednesday morning’s opening price of 16.5 cents.

With the mine expansion expected to result in production increasing to 4 million tonnes in 2020 and 6 million tonnes in 2021, Metro offers some of the best metrics in the mining sector for investors targeting emerging high growth companies.

The group’s market capitalisation of around $220 million suggests there is substantial share price upside based on enterprise value to EBITDA metrics.

These figures will look even better when the company hits full production in 2021.

Prior to today’s release, Brown was forecasting EBITDA of $82.6 million, implying an extremely conservative forward enterprise value to EBITDA ratio of less than three.

Offtake agreements account for large proportion of sales

All production during the December quarter 2019 was sold and shipped to Chinese customers and deliveries were within contractual specifications.

Approximately 2.3 Million WMT of the 2019 production was sold under the long-term off-take agreement to Xinfa, underlining the income predictability that this arrangement offers.

Under this contract, prices received were linked to an RMB (Renminbi - official currency of the People’s Republic of China) denominated alumina price index.

Pricing of the rest of 2019 product sales was linked to the prevailing spot market price.

Average price received for the December quarter was in line with the June and September quarters.

Stage II expansion on track and on budget

Work proceeded on the detailed engineering and design work related to the Stage 2 expansion.

Rocktree Consulting (EPCM Consultants for the Floating Terminal) are tendering for the long lead time items and the project costs remain in line with DFS estimates.

At the end of the quarter, tenders had been received for all major work packages.

Based on current industry dynamics, Metro should continue to see substantial demand for its product, and indeed be able to find buyers for its extra 2 million tonnes come 2021.

China’s November bauxite imports were up 11.4% to 7.2 million WMT (month-on-month).

Year to date imports were 10 million tonnes higher than the same period last year and total 2019 imports were on track to exceed 100 million tonnes for the first time.

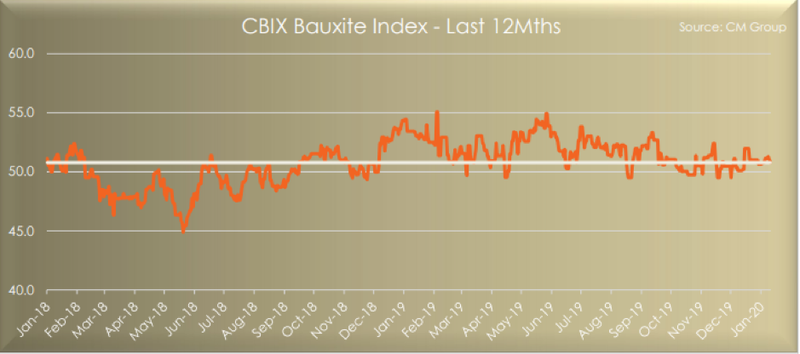

As indicated below, imported bauxite prices CFR China, as measured by the CBIX bauxite index, remained at recent levels of US$50.80/DMT (dry metric tonne).

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.