Metminco signs term sheet to acquire DSO nickel-bauxite play

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

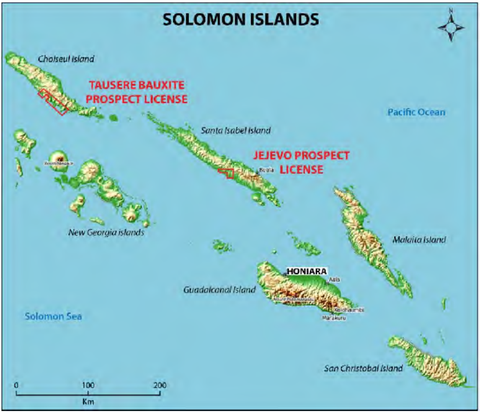

Metminco Limited (ASX:MNC) has announced it has entered into a binding term sheet to acquire 100% of the issued capital of Sunshine Metals Ltd which holds 80% of the Jejevo Nickel Project on Santa Isabel Island in the Solomon Islands, as well as an 80% interest in an early stage bauxite prospect — the Tausere Project — located on the southern coastline of Choiseul Island, situated at the northwest extent of the Solomon Islands.

The Jejevo Nickel Project is based on a nickel laterite deposit which was previously held by Inco and Sumitomo and the subject of considerable drilling and studies. The Project combines attractive nickel grades, with close proximity (~11 km) to a site believed suitable for barge exports and is potentially suitable for a low capital direct shipping operation (DSO) development.

MNC proposes to acquire all existing share capital in Sunshine Minerals and complete an accompanying capital raising to advance MNC’s existing Quinchia Gold Project in Colombia and the Jejevo Project.

Given the company’s existing Quinchia Gold Project in Colombia, the Sunshine Minerals acquisition would result in MNC having dual advanced exploration projects in gold and nickel, while being well positioned to benefit from any upswing in metal pricing.

The acquisition will provide MNC with a project it can rapidly advance and provides exposure to nickel prices in a period when demand growth is expected to be driven by, in particular, the growing market for batteries to support increasing electric vehicle production.

Executive Chairperson Kevin Wilson commented: “The acquisition of the Jejevo Nickel Project, gives Metminco exposure to nickel at a time when rising battery manufacture is expected to accelerate demand for the metal.

“We will commence advancing Jejevo as soon as the acquisition completes. Together with our Quinchia Gold Project we now have two advanced exploration projects that we believe offer near term development potential.”

The below map shows Sunshine Minerals’ two Solomon Islands projects:

The company will conduct due diligence at Sunshine Minerals’ projects, while it also aims to complete a capital raising up to $3 million.

Of course MNC still has a lot of work to do here, so investors should seek professional financial advice if considering this stock for their portfolio.

The Jejevo Project

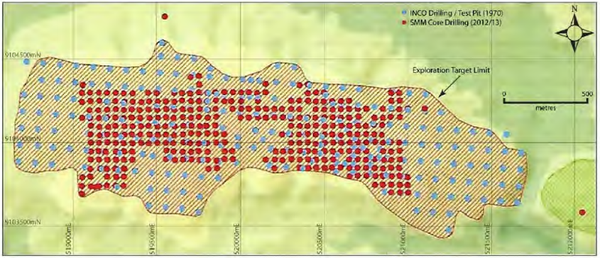

The Jejevo Project, located on the south coast of Santa Isabel Island, is a nickel project with an advanced Exploration Target for which the majority of drilling was completed by Sumitomo back in 2013.

Strategic acquisition of a potential direct shipping (DSO) nickel laterite project, the Jejevo Nickel Project, with near-term development potential in close proximity to numerous international markets.

The project provides the opportunity to rapidly add value on previous historical data which includes 472 diamond drill holes.

Previous exploration led to an Exploration Target being generated of between 10Mt and 15Mt, at between 1.1% and 1.3% nickel within limonite, transition and saprolite zones.

Given the growing demand for quality bauxite proximal to China, Tausere could have potential for future development into a large-scale bauxite project.

MNC’s near term plan is to progress Jejevo and its existing gold assets towards production.

Acquisition details

The consideration for the acquisition is as follows:

(a) $1,500,000 less a $50,000 deposit and agreed debts in Sunshine which will be satisfied through the issue of up to 250,000,000 fully paid ordinary shares in the capital of MNC at a deemed issue price of $0.006 each;

(b) 250,000,000 MNC Shares upon announcement to the ASX by MNC of an initial JORC compliant resource estimate at Jejevo Nickel Project of at least 125,000 tonnes of contained nickel metal at a cut-off grade of not less than 0.7% nickel, which must be based upon exploration information delivered to MNC by Sunshine and exploration work undertaken by MNC in the amount of not greater than $500,000; and

(c) 500,000,000 MNC Shares upon the receipt of a mining license over the Jejevo Nickel Project located in the Santa Isabel Province, Solomon Islands.

MNC has agreed to pay Sunshine Minerals a non-refundable deposit of $50,000. The Deposit funds are to be used to pay part of the landowner access fees for the Jejevo Project.

Capital raising

To fund its new nickel-bauxite ambitions via the proposed acquisition of Sunshine Minerals, MNC is seeking to raise $3 million, with Patersons Securities Limited as lead manager to the placement. MNC intends that the Placement funds will be settled on Tuesday 25 September 2018.

The funds raised will be used to advance the Quinchia Gold Project in Colombia and Jejevo Nickel Project in Solomon Islands, evaluate the Tausere Bauxite Project in Solomon Islands and for general working capital

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.