Melbana’s Australian assets overlooked

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Towards the end of April, Melbana Energy Ltd (ASX:MAY) informed the market that it had elected to terminate the farm-in agreement for the Cuba Block 9 Production Sharing Contract.

This decision was taken in light of prospective farm-in partner Anhui Modestinner Energy Co., Ltd. (AMEC) not satisfying the conditions precedent to an agreement within the time allowed.

While management indicated it will pursue an alternative farm-out transaction with a number of other potential parties who have continued to express an interest in the world class potential of Block 9, there are other assets in play that appear to have been overlooked.

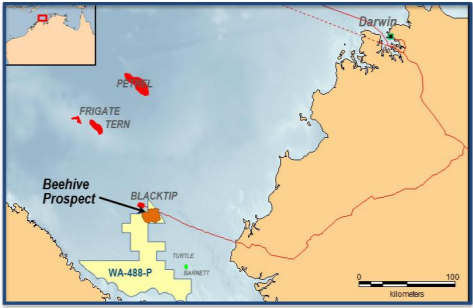

Melbana’s share price came off approximately 20% in response to the Cuba Block 9 news, seemingly an overreaction given the potential worth of the group’s Beehive Prospect offshore Western Australia.

Option period commenced at Beehive

During the March quarter Melbana, Total (NYSE:TOT) and Santos (ASX: STO) accepted the Beehive 3D Seismic Survey data set, confirming it as the contractual Final Data Set.

From a contractual perspective, the acceptance of the processed survey data as the Final Data Set has triggered the contractual commencement of a six month “option period” from April to 2019 whereby Total and Santos each have an option, exercisable together or individually, to acquire a direct 80% participating interest in the permit and drill an exploration well, which is planned to be the Beehive-1 exploration well.

If the option is exercised, Melbana will be fully carried on all costs incurred from the time the option is exercised until 90 days after the rig is released after drilling the well.

Drilling is anticipated in the second half of 2020, with Melbana estimating the cost of the Beehive-1 exploration well to be in a range between US$40 million and US$60 million.

Hartleys sees 70% share price upside

While Hartleys industrials and energy analyst, Aiden Bradley, acknowledged that the Block 9 news was disappointing, he noted the opportunities that could stem from the company’s other prospects in Cuba, as well as the positive news that has emerged regarding the Beehive Prospect, WA-488-P.

Bradley highlighted the fact that Santos had already expressed its upbeat opinion on Beehive, in saying, “STO have highlighted previously that the Beehive Prospect is a Multi-TCF gas / large light oil prospect in a new play, so depending on the outcome of the seismic evaluation, there is a reasonable chance that this well gets drilled.”

Bradley added that “as time goes by, Beehive is looking more and more like the jewel in the crown”, and he has increased his valuation of the asset from US$16.5 million to US$20 million.

A decision by Santos and/or Total to drill the prospect would see that valuation increase.

However, even based on current metrics Bradley’s numbers imply a valuation of 2.2 cents per share, representing upside of approximately 70% to its current price.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.