MAN Produces Battery Grade 99.9% Pure Lithium Hydroxide from its US Brines

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,860,000 MAN shares at the time of publishing this article. The Company has been engaged by MAN to share our commentary on the progress of our Investment in MAN over time.

Is something big brewing in the US lithium market?

The US Inflation Reduction Act incentives will be coming into play over the next 4-6 years.

We expect buying decisions from the big carmakers to slowly shift toward US domestic supply.

Starting this year, the US Inflation Reduction Act requires that EV manufacturers source 40% of critical battery minerals domestically...

OR with free trade partners by 2024 and ~80% by 2030.

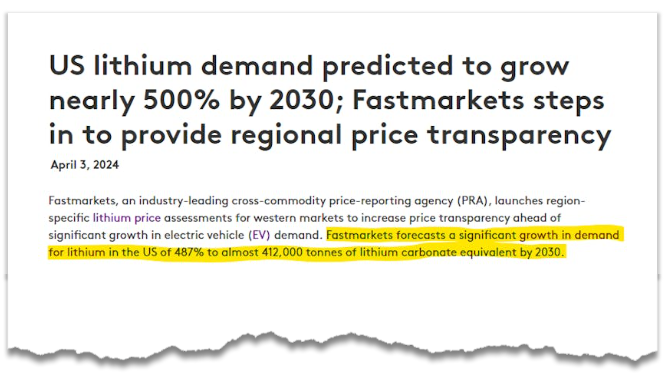

Partly due to the US IRA policies, price reporting agency, Fastmarkets, recently forecast ~500% growth in US lithium demand through to 2030.

So it's a good time to be proving up large lithium resources in the USA.

Mandrake Resources (ASX:MAN) has ~ 379 km2 of ground in the Paradox Basin, Utah, USA.

It is former oil producing land, full of old drill holes.

Turns out that MAN’s ground also contains lots of underground lithium rich brines...

... which MAN is planning to extract at a low cost by the existing old oil drill holes.

(in the resources game, we have all seen how expensive it is to drill a deep hole - MAN doesn’t need to pay for that)

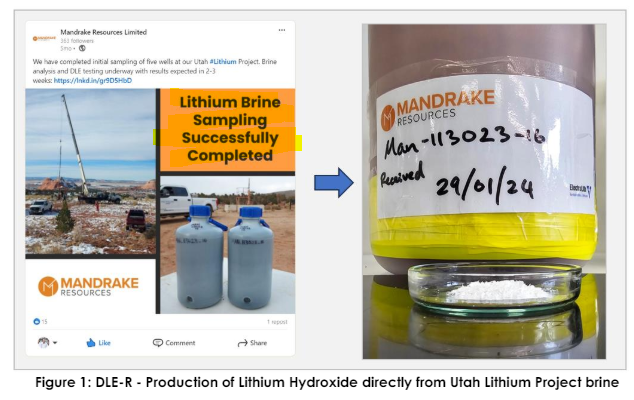

Yesterday MAN announced it successfully converted its lithium rich brines into 99.9% pure, battery grade lithium hydroxide in just one processing step.

MAN just showed the market its lithium rich brines can be processed into battery grade lithium hydroxides.

AND without all of the energy or chemicals typically required when using DLE technology...

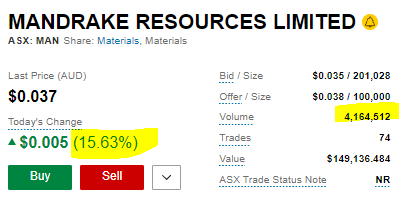

The market liked it - MAN was up 15% on relatively large volumes yesterday.

Next we want to see MAN finish analysing old well data, announce a maiden JORC resource estimate and update the market on potential DLE tech partnerships.

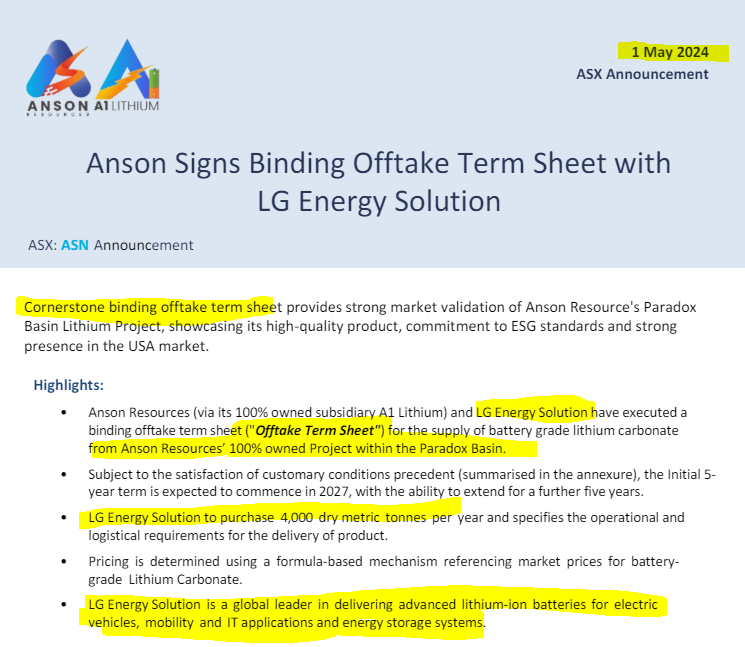

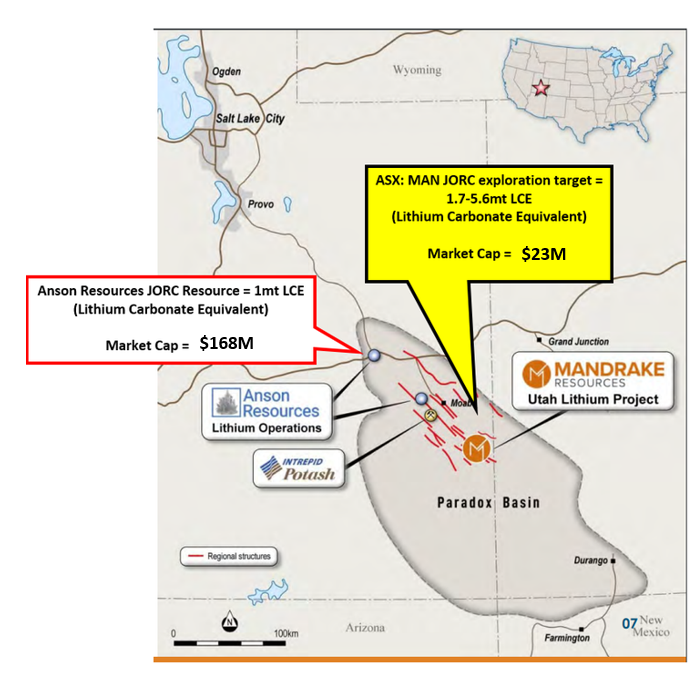

MAN’s lithium project sits in Utah, USA - in the same region as $168M Anson Resources.

MAN is currently capped at $23M, and had a healthy $15M in cash at the end of last quarter.

Anson is capped at $161M and just recently signed a binding offtake agreement with LG Energy Solutions.

LG Energy Solutions is already one of the biggest battery manufacturers in the world, and is obviously looking to secure US based lithium supply that it can feed into its ~8x battery facilities.

Here’s where all the Paradox Basin lithium developers sit on the map:

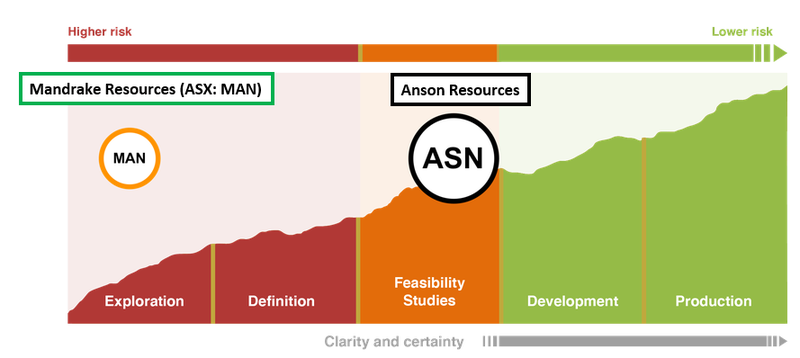

A big difference between MAN and Anson right now is that MAN is “pre-resource”.

At this point, MAN has a 1.7mt and 5.6mt of contained LCE exploration target.

It hasn't delivered a maiden JORC Mineral Resource Estimate yet - yesterday’s announcement said this work was “well advanced” - so hopefully this news is not too far away.

With a defined Mineral Resource Estimate, it will allow the market to compare MAN to other lithium companies with defined resources.

This could result in a value uplift for MAN, especially given it currently only has a circa $8M Enterprise Value...

So, MAN is currently working on defining its maiden JORC resource estimate.

Within the next few months, MAN could technically have a maiden JORC resource at least as big as Anson’s if not bigger...

For context - Anson’s project has JORC resources of ~1mt LCE which is below the bottom end of MAN’s exploration target.

A big part of the reason why we are Invested in MAN is because we see a clear pathway for the company to go from where it is now to hopefully a market cap in line with its neighbours (and we hope one day bigger).

AND we think the news yesterday was one step toward that re-rate process.

What happened yesterday?

MAN ended the day up ~15% yesterday off the back of the DLE news...

The reaction makes sense because MAN delivered what we see as a surprise to the market.

MAN showed the market that it could produce battery-grade lithium hydroxide from its brines.

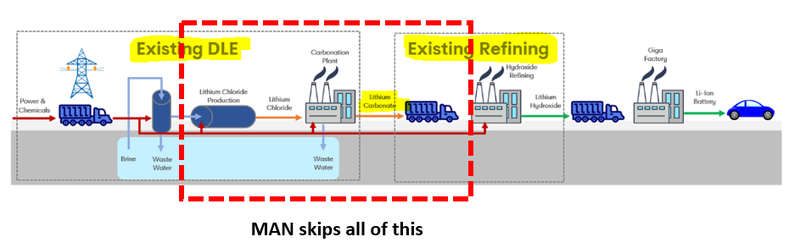

AND it showed that it was able to do it without having to turn the brines into lithium carbonates first.

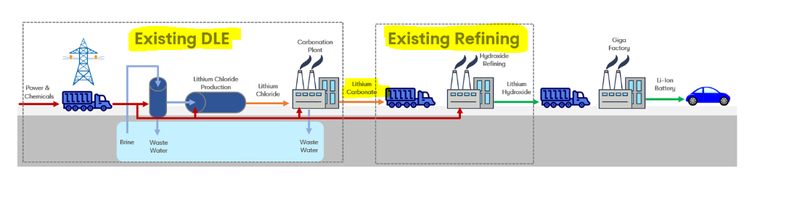

Typically, converting lithium brines into battery-grade hydroxide products involves first producing carbonates and then converting them into battery-grade hydroxides.

Skipping the carbonate step means MAN’s brines can be “sale ready” much quicker AND without the energy/chemicals required in a typical DLE process.

Below is what some of the more conventional DLE flowsheets look like:

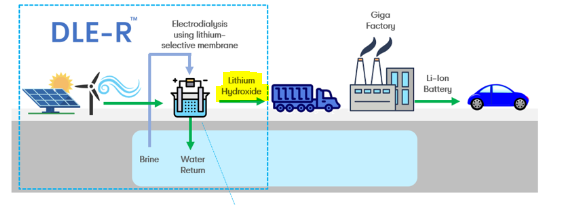

And here is how it looks when MAN’s product was paired with ElectraLith’s DLE tech:

So MAN would be skipping that intermediary step:

MAN mentioned in yesterday’s announcement that it would be pursuing a “Strategic Partnership Agreement” with Rio Tinto backed ElectraLith.

If an agreement is reached we could see ElectraLith build a pilot facility at MAN’s project.

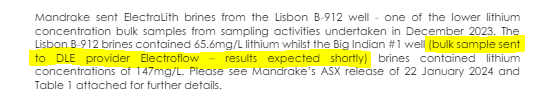

At the same time, MAN is also working with Bill Gates-backed ElectroFlow, and results from that testing are “expected shortly.”

(source)

Another reason we think yesterday’s news was big for MAN is because it de-risks the project from a technical perspective.

Unlike the lithium brine assets in South America, in the US, projects can't rely on evaporation to turn the brines into a precursor material for processing.

Instead US based brine assets need to find a suitable DLE technology for their projects.

So technically finding a suitable DLE technology & then proving it works with a project's brines can be a huge market de-risking event for a company.

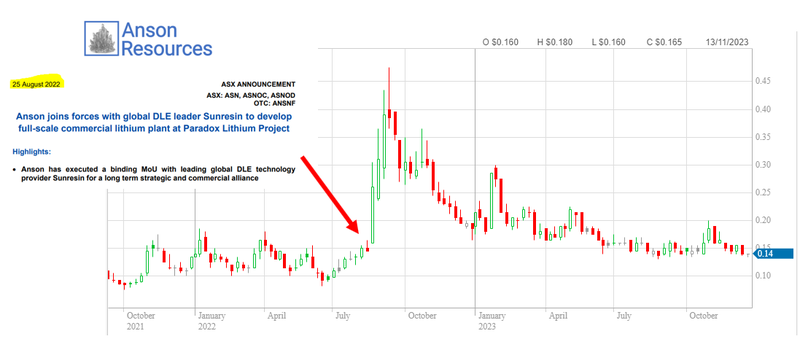

We saw this with Anson Resources. Back in June 2022, Anson announced an MOU with Sunresin for partnership on applying DLE to its project.

Off the back of that news, Anson’s share price went from ~14c to just under 50c per share.

At the end of that run, Anson’s market cap peaked at ~$490M.

Now - this was in another time for lithium companies - mid 2022 - when market sentiment was much stronger. In any case, Anson is still valued many multiples higher than MAN right now.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

After yesterday’s announcement we know that MAN has at least one potential DLE partner it can work with on its project.

In the coming months we should know who it locks in a deal with.

MAN now working with two DLE tech providers

MAN has two potential DLE technology partners it could lock in for its project:

1. ElectraLith - which is backed by Rio Tinto and is working on Rio’s Rincon project in Argentina as well as MAN’s project.

In yesterday’s announcement, MAN said it was working on getting a “Strategic Partnership Agreement” which could see a pilot facility built on MAN’s project.

2. ElectroFlow - a company backed by Bill Gates’ $2BN “Breakthrough Energy” (BE) Group. The same group that backed Lilac Solutions which is being used on some of the biggest brine projects in the world.

In yesterday’s announcement MAN confirmed the test results from ElectroFlow are “expected shortly”.

See our write up on ElectroFlow here: MAN signs DLE partnership with Bill Gates backed Electroflow

Over the next few months we want to see MAN deliver a maiden JORC resource, sign a DLE partnership and take its US lithium brine project into the feasibility stage.

All of this forms the basis for our MAN “Big Bet” which is as follows:

Our MAN “Big Bet

“MAN returns 1,000%+ by making a lithium discovery significant enough to move into development studies, or attract a takeover offer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our MAN Investment Memo.

US lithium projects to outperform?

As we noted above, we think something big could be brewing in the US lithium market, where MAN’s project is located.

With the US Inflation Reduction Act incentives slowly coming into play over the next 4-6 years we expect buying decisions from the big carmakers to slowly shift toward US domestic supply.

Starting this year, the Inflation Reduction Act (IRA) requires that EV manufacturers source 40% of critical battery minerals domestically or with free trade partners by 2024 and ~80% by 2030.

Price reporting agency, Fastmarkets, recently forecast ~500% growth in US lithium demand through to 2030:

(Source)

Meanwhile the largest Western lithium producer, the $28BN capped Albemarle’s share price looks to have consolidated over the last 6 months and is starting to push up over the last few weeks:

The chart looks similar for the Sprott Lithium Miners ETF (LITP) over the last few weeks.

There’s a theory here that big Western lithium stocks are moving up ahead of the wave of demand coming out of the US - demand which doesn’t necessarily show up in the lithium price benchmark which is a China based benchmark.

Analysts that follow the big Western lithium stocks would have access to greater data than just the China based lithium spot price benchmark, which is what smaller investors may be basing their lithium positions on.

In short - we think that the long term lithium macro thematic is much stronger for MAN than many think.

What’s next for MAN?

Testing old oil and gas wells for lithium 🔄

The first step before MAN is able to deliver a resource estimate is to re-enter a well and collect data on:

- Brine volumes

- Porosities (how well the reservoirs flow)

- Lithium concentrations (grades)

MAN is currently running through that process and recently got permits to re-enter and reconfigure two existing wells.

The results from this program will form the basis for MAN’s resource estimate.

At the moment MAN’s exploration target has concentrations ranging from 55 to 101 mg/L.

Neighbour Anson’s resource is based on an average concentration of 124 mg/L. (Source)

BUT we know that a historical well (Peterson 88-21) which was drilled in 1959 sits <1.6km outside of MAN’s acreage and showed lithium concentrations of ~340 mg/L.

That’s where we think the upside will be for MAN - if it can show grades ~340% higher than its exploration target, then we think it could surprise the market to the upside and potentially signal a much bigger JORC resource than expected.

Maiden JORC Lithium resource 🔄

We want to see MAN convert its exploration target into a maiden JORC resource.

This would give the market a reference point to appropriately value MAN relative to the other US lithium brine players.

DLE testing results/partnerships 🔄

We are still waiting on the results from the samples sent to Bill Gates backed ElectroFlow.

Once these results come back, we want to see MAN start progressing partnership discussions with its preferred technology partner.

What are the risks?

The two key risks we see for MAN in the short term are “Exploration risk” and “Processing risk”.

Exploration risk is relevant because its possible that the company finds uneconomic quantities of lithium in the wells it re-enters.

Processing risk is also a factor because, even if MAN does find a decent amount of lithium, there is no guarantee that any of that lithium can be extracted and processed at rates that make MAN’s project commercially viable.

Large scale DLE technology is constantly evolving and so there is always a chance that MAN’s tech partners are unable to scale up their technology to work with MAN’s brines.

To see all of the key risks to our MAN Investment Thesis, check out our MAN Investment Memo.

Our MAN Investment Memo

In our MAN Investment Memo, you can find:

- MAN’’s macro thematic

- Why we Invested in MAN

- Our MAN “Big Bet” - what we think the upside Investment case for MAN is

- The key objectives we want to see MAN achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.