Mako ready to strike as drilling commences at Tchaga

Published 29-OCT-2019 10:29 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

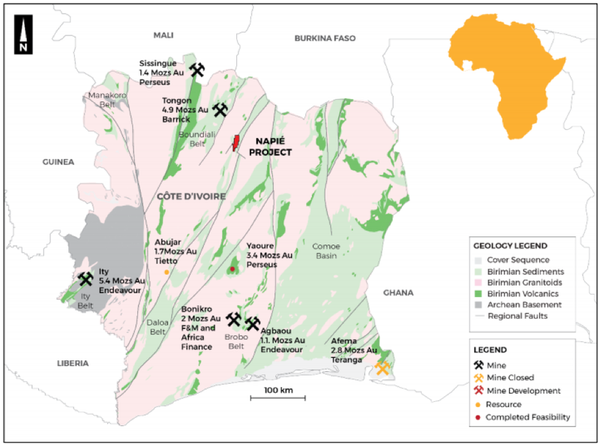

With the wet season now behind it, African gold mining group Mako Gold Ltd (ASX:MKG) is poised to start its much anticipated exploration campaign, building on the high grade drilling results achieved over the last 12 months, and of course the all-important discovery at the Niou Project.

Regards the latter, Mako Gold’s wholly owned Burkina Faso subsidiary, Mako Gold SARL, signed on 31 July 2016 an option agreement with a Burkinabe private company for 100% ownership of the Niou Permit.

Management informed the market today that the company had recommenced drilling at the Tchaga Prospect on the Napié Project in Côte d’lvoire, its key focus in the coming months.

Mako will be following up on previous high-grade intercepts including 28 metres at 4.9 g/t gold.

Upcoming work will include infill drilling on previous sections and along the one kilometre mineralised strike length that was extended following the last round of drilling.

As well as offering the prospect of further positive drill results which could add to the strike length, the exploration program will add confidence in management’s geological modelling.

On this note, Mako’s managing director Peter Ledwidge said, “We are excited to be drilling again on the Tchaga Prospect.

The results of this drill program should help unlock another piece of the puzzle of our geological modelling of gold mineralisation and bring Mako closer to a resource on the Tchaga Prospect.”

Drill for equity agreement preserves cash

Importantly, Mako recently negotiated a highly beneficial agreement with Geodrill which will maximise drilling metres and preserve cash during the upcoming campaign.

This is an important development as Geodrill has partnered with Mako’s management team in the past, having drilled on previous discoveries together in Burkina Faso where the Orbis Gold Project progressed to become a major producing mine.

Geodrill’s decision is significant in that the group has a strong working knowledge of the characteristics of promising early stage orebodies in Africa.

Further, the group’s decision to drill for equity is a show of faith in Ledwidge and his team who have successfully worked with Geodrill in the past.

Discussing this agreement, Ledwidge said, “We are extremely pleased to have secured a drill-for-equity agreement with such a high-calibre drilling company.

‘’We have a long-standing relationship with Geodrill and have always been impressed with the quality of their work.

‘’It will be a great endorsement for Mako to add Geodrill to our share register, since they have worked in West Africa for so many years and understand junior exploration companies better than most.

‘’We look forward to continuing and strengthening our relationship with Geodrill, which should be beneficial to all Mako shareholders.”

What to expect at Tchaga

Mako will focus on the more advanced Tchaga Prospect in its endeavour to better understand the gold mineralisation and to help move towards outlining a JORC compliant gold resource.

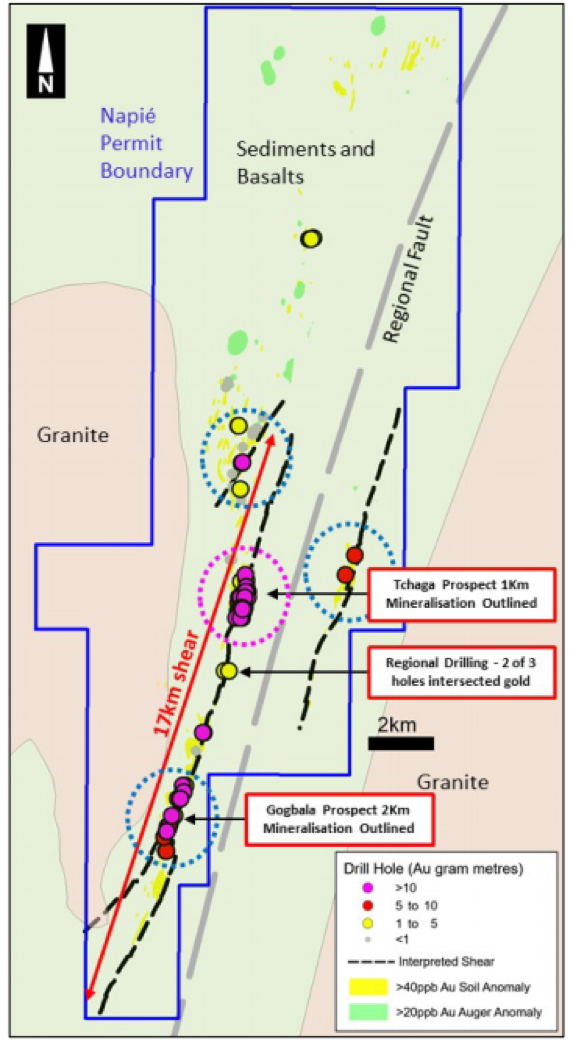

The program consists of approximately 2000 metres of reverse circulation (RC) drilling on the Tchaga Prospect shown below in the dashed pink circle.

The Tchaga Prospect is associated with a +40ppb gold soil anomaly and is located along the long shear zone of more than 17 kilometres thought to be a major control for gold mineralisation.

Ledwidge said that the long shear zones and coincident 23 kilometres of gold soil anomalies present excellent regional targets for future drill testing.

Three other specific targets, shown in the above map as dashed blue circles host significant gold intercepts from previous RC drilling and these will be tested in follow-up drill programs.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.