LNR Drilling for Rare Earths now

Published 03-MAY-2023 11:31 A.M.

|

9 minute read

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 22,323,582 LNR shares and 9,250,000 LNR options at the time of publishing this article. The Company has been engaged by LNR to share our commentary on the progress of our Investment in LNR over time.

It’s happening right now.

Over 10,000m of drilling across two types of rare earths targets.

Our WA rare earths exploration Investment Lanthanein Resources (ASX: LNR) just kicked off its major drill program for 2023.

We are expecting a significant amount of newsflow coming out of the Gascoyne in north west WA as LNR updates the market on drilling progress, on the ground results, and assay results over the coming months.

LNR had $5.2M in the bank at March 31st, so looks well funded over this coming newsflow period.

LNR’s share price has come off significantly in recent months - down from a peak of 6.8c to now trade at 1.8c - but now is right when the real action begins.

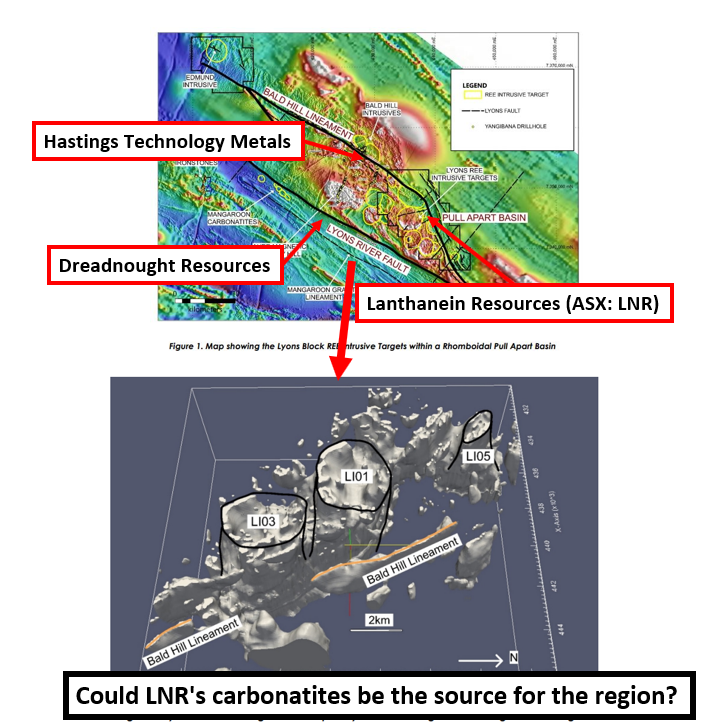

LNR’s drilling is targeting the same type of rocks that host both Hastings and Dreadnought’s rare earths discoveries - Ironstones and carbonatites.

After months of exploration work and a drill campaign last year that hit rare earths, LNR is now honing in on a much larger discovery of its own, to put it on par with its bigger neighbours.

LNR is currently capped at $20M, and with that $5.2M cash in the bank has an enterprise value of ~ $15M.

$258M capped Hastings sits ~2km away from LNR’s project and $200M Dreadnought is ~32km away.

Hastings just signed a deal to build its $210M beneficiation plant, another strong signal this region will become a rare earths production hub in the future.

But the source of the rare earths mineralisation in the region still hasn't been found yet –

Is this it?

LNR is going to have a crack at finding the source, by putting a few deep diamond drill holes into that deep target in the coming weeks.

LNR also has multiple shallow ironstone targets to test, backed up by high grade rock chip samples, EM targets and the drilling done last year.

Here’s a look at LNR’s drill rig on site now, drilling the first holes:

More context on LNR’s current drilling:

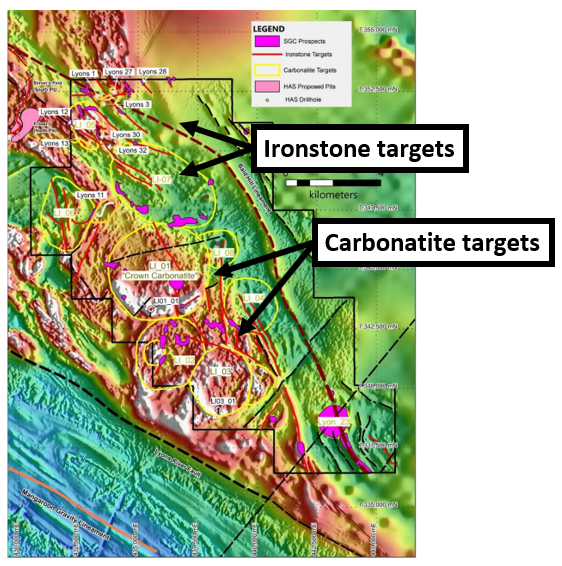

- Shallow ironstones targets - these are the same type of rocks that host Hastings resources & Dreadnought’s discoveries to the east.

- Deeper carbonatite targets - Carbonatites are the same type of rocks that host $5.9BN Lynas Rare Earths giant Mt Weld deposit in WA - one of the highest grade rare earths deposits in the world.

Shallow Ironstone targets

Here, LNR will be doing step-out and infill drilling that follows up last year's drilling.

LNR has already identified over 1km strike of rare earths mineralisation less than 5km away from Hastings’ deposit.

Ultimately the aim of the current round of drilling will be to confirm and extend the mineralisation LNR has found to date - hopefully leading to a maiden resource estimate in the future.

Deeper carbonatite targets - never been drilled before

LNR’s carbonatite targets are a little more blue sky - primarily because they have never been drilled before.

A discovery here could be a major catalyst for the company.

This is because carbonatite discoveries can be big and high grade - like Lynas’ Mt Weld.

If LNR is successful it would be a game changer for the company, as it could be the source rock for its neighbours rare earths projects.

The WA government is also interested in seeing LNR’s deeper carbonatite targets drilled - awarding LNR a $200k government grant to fund parts of the drill program.

This is high risk (they might not find anything), high reward exploration (if they do it could significantly re-rate the company), which is a style we like to see.

What we want to see from the drill program

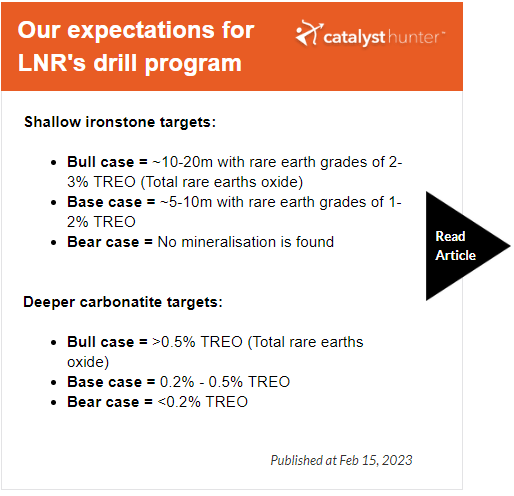

1) Shallow ironstone targets:

The goal of drilling these targets is to extend previously identified mineralisation.

So our expectations are a combination of intercept thickness and grades.

Bull case = ~10-20m with rare earth grades of 2-3% TREO (Total rare earths oxide)

Base case = ~5-10m with rare earth grades of 1-2% TREO

Bear case = No mineralisation is found

2) Deeper carbonatite targets:

The goal of drilling these targets is to confirm if the carbonatite structures contain rare earths mineralisation.

As a result our expectations are primarily focused on grades as follows:

Bull case = >0.5% TREO (Total rare earths oxide)

Base case = 0.2% - 0.5% TREO

Bear case = <0.2% TREO

Rare Earths - “the OG critical minerals”

In many ways, rare earths are the original (OG) critical minerals - ever since 2010/2011 when China cut rare earth export quotas.

This effectively put major ex-China producer, ASX-listed Lynas Rare Earths, on the map - and on investors radars:

The events of those years saw the Lynas share price rally from a low of ~75 cents to a high of ~$26 dollars in the space of roughly two years - a ~3,200% rise.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

That China export cut also got Western countries thinking about the geopolitical risks to their supply chains - well before the “critical minerals” and on-shoring/localisation thematics came into vogue in recent years.

As for more recent events in the rare earths market, once again, a lot hinges on what China does - something we highlighted in our rare earths outlook for 2023.

The rare earths market is finely poised at the moment, with a combination of new supply and weak demand combining to drive down prices for the two main rare earths Neodymium (Nd) and Praseodymium (Pr).

These two rare earths account for around 80% of global rare earths revenue.

They form a key part of the energy transition as they are required for the production of wind turbines and electric vehicles. So even despite temporary market fluctuations - if you can get your hands on high grade Nd and Pr, you are going well.

Currently, China may be in the process of upping its export quotas by 20%-25% - which could add further weakness to the market.

And yet, there is also the possibility that an export ban is enforced towards the end of 2023 - which would ratchet up friction between China and the West as part of broader geopolitical manoeuvrings.

So in the medium term, our view is that there could be upside for Western domestic sources of rare earths, in addition to the long-term demand driver that is the energy transition.

If Western countries are serious about weaning themselves off Chinese rare earth supply - they will need the resources that Australian rare earths companies can provide - and in the long-term we are betting on LNR contributing to that supply chain shift.

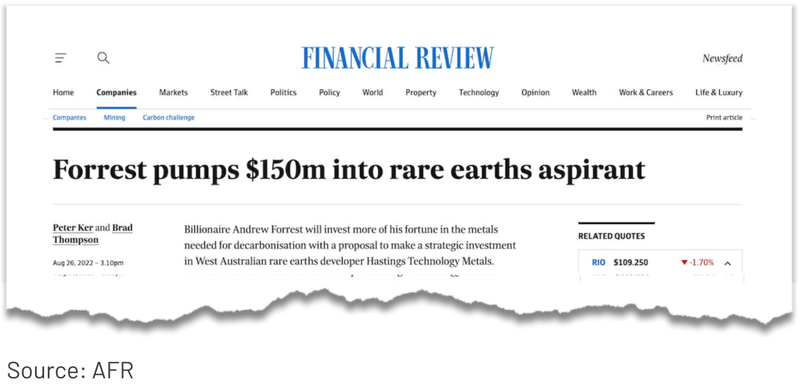

Part of this supply chain could also include companies like Hastings Technology Metals and Dreadnought Resources - LNR’s two neighbours in the Gascoyne Region.

Recognising the need for a local supply of rare earths, in August last year, Andrew “Twiggy” Forrest put $150M to work in Hastings:

LNR’s prospects are closely linked to its more advanced neighbours in the Gascoyne Region and this forms the basis of our LNR Big Bet:

Our Big Bet

“LNR discovers and proves a rare earths deposit significant enough to become an acquisition target for one of its bigger neighbours Dreadnought or Hastings - or LNR becomes part of a consolidation play for all three companies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LNR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Check out our LNR “Progress Tracker” where we track LNR’s project from acquisition through to (hopefully) a major discovery.

What’s next for LNR:

Drilling in the Gascoyne region of WA 🔄

LNR is now drilling its Gascoyne rare earths projects.

With the two drill programs targeting different styles of rare earths mineralisation, we set up our expectations differently for each of the programs.

Assay results from South Australian rare earths project 🔄

LNR just recently finished its first ever drill program at its South Australian rare earths projects.

In an announcement yesterday LNR confirmed rare earths grades up to 2,711ppm (Neodymium and Praseodymium) AND showed that all 72 holes have intersections with grades >1,000ppm.

At this stage the results are based on XRF analysis which is a first pass hand held assay tool - ultimately we need to see the final assay results to see how the drill program went, however those grades are strong.

For context on the results, LNR is looking to make a discovery similar to ASX listed Australian Rare Earths which is capped at $32M and has a 81.4Mt resource with grades of ~785ppm (Total Rare Earths Oxide).

We also noticed that Australian Rare Earths share price recently rallied by ~400%:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Given this is a project that sits outside of our LNR Investment Memo, any good news from it will be additional and unexpected upside for us.

The key risks for LNR

For all of the junior explorers in our portfolio the biggest risk we consider is “exploration risk”.

This is early stage exploration, with a lot of unknowns.

There is always a risk that drilling intersects nothing of significance and the company’s drill targets that looked compelling pre-drill, are actually not worth pursuing any further.

There is also a “commodity pricing risk” for LNR - while the two rare earths that LNR are seeking may have significant further demand projected, a number of market factors could impact the underlying commodity prices.

This includes but is not limited to, an increase in Chinese production or a “flooded market” scenario, new resources coming online, cooling investor interest or a lack of government support for new projects.

This was something that we flagged in our 2023 Outlook for Rare Earths:

This impacts investor sentiment for the junior explorers looking for these minerals, and beyond that it could impact the economic viability of LNR’s projects.

We listed “exploration risk” and “commodity pricing risk” in our LNR Investment Memo - to see the rest of our Investment Memo click here or by click on the image below:

Our LNR Investment Memo:

Below is our Investment Memo for LNR where you can find a short, high level summary of our reasons for investing.

In our LNR Investment Memo you’ll find:

- Key objectives for LNR

- Why we continue to hold LNR

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.