JBY: New Portfolio Addition

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 1,979,167 JBY shares at the time of publishing this article. The Company has been engaged by JBY to share our commentary on the progress of our Investment in JBY over time. 1,791,667 shares are subject to shareholder approval

Today we are announcing the newest addition to our Portfolio.

James Bay Minerals (ASX: JBY), a gold developer in Nevada, USA.

We think gold and silver are going to be one of the big stories of 2025.

With the gold price at near all time highs, gold producers are trading at record high share prices.

We think the next batch of gold companies to run will be the ones that are pre-production and closest to being developed with large existing resources.

JBY is acquiring a project in Nevada, USA, with a 1.18Moz gold and 7.6Moz silver resource in the coming days.

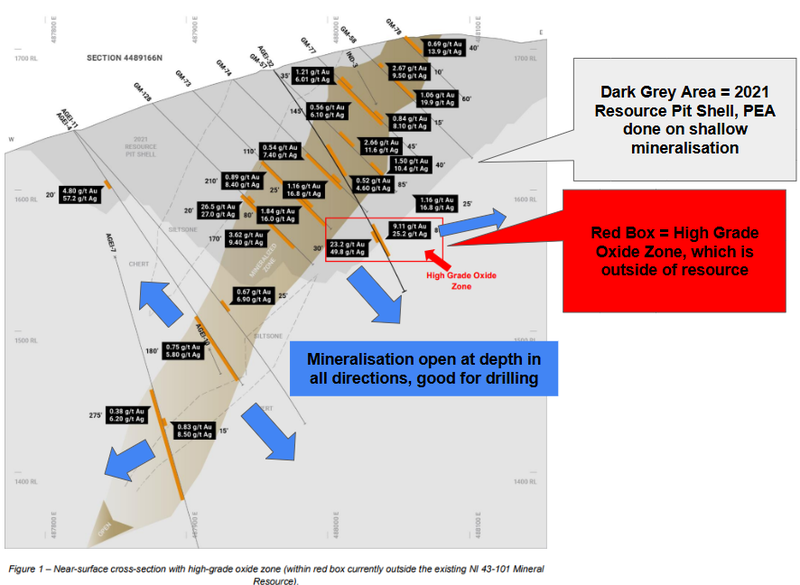

The resource includes a high grade component of 796,200oz gold at 6.53g/t - open at depth and in all directions.

So there is plenty of exploration upside...

AND

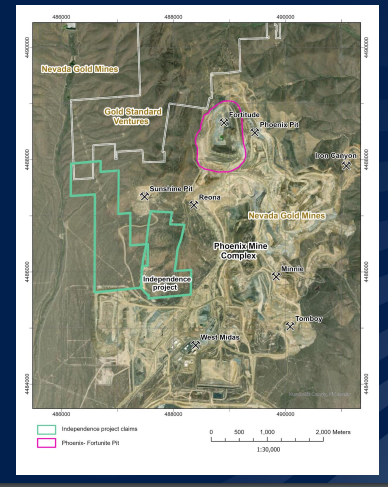

It sits right next door to a large producing mine (and project infrastructure) currently being operated in a JV by $49BN Barrick and $76BN Newmont.

As the gold price keeps hitting new all time highs, we think the markets are shaping up for gold stocks like JBY to outperform.

Already, some of our best performers this year have been our new additions in precious metals.

Mithril Silver and Gold (ASX: MTH): was the best-performing stock on the ASX in September up ~362%. The stock is currently up 325% from our Initial Entry price of 10c, and was as high as 715%.

Sun Silver (ASX: SS1) touched as high as ~582% up from our Initial Entry Price and is now the biggest position in our Portfolio.

We think SS1 is only just getting started and it will be the biggest silver story of 2025 (the silver price even started a proper bull run yet).

The same team that put together and manages SS1 is behind JBY.

Board, management, corporate advisor and top 20 shareholders are very similar across JBY and SS1.

And we are backing them to deliver with gold for JBY.

This team has a knack for finding quality, advanced stage projects.

Both SS1 and JBY already have a large resource.

Both are drilling to extend it.

Both assets are in tier 1 mining jurisdiction Nevada, USA.

Introducing our newest Investment - James Bay Minerals (ASX: JBY).

Reasons that we like JBY

1. JBY has a 1.18Moz gold and 7.6Moz silver resource with exploration upside.

JBY already has a foreign resource estimate of 1.18Moz gold, 7.6Moz silver. Inside this sits a 796Koz high-grade component (3.8Mt at 6.53g/t gold). The current resource is open at depth and in all directions with scope to upgrade that resource number. Right now, we think it is cheaper and lower risk to Invest in “already discovered” ounces in the ground - provided there is enough exploration upside at the project as well.

2. JBY has the same team and backers as our 2024 Small Cap Pick of the Year SS1.

Board, management, corporate advisor and top 20 shareholders are very similar across JBY and SS1 (our 2024 Small Cap Pick of the Year that IPOd at 20c and hit over $1.18 within nine months). We have observed them to be very hard workers and good holders so far - We are backing the same group to deliver a win with JBY. They also have a knack for securing quality, advanced projects on good deal terms, and maintaining good tight cap structures with no options overhang.

3. We like the gold macro thematic for 2025 and beyond.

Gold is currently trading at all time highs and we think it will continue running. We are yet to see a wave of new production being brought online during this cycle, our expectations is that a lot more projects will get into production and start producing gold while spot prices are high. We are hoping JBY’s project is one that gets into production during this gold bull market window OR they build a resource big enough to be taken out by a bigger player in the region.

4. Nevada a top 3 Fraser Institute mining jurisdiction every year for the past 10 years.

Nevada was ranked as the best mining jurisdiction in the world in 2022 by the Fraser Institute. Nevada has also consistently ranked in the top 3 every year for the past 10 years.

5. We have success in Nevada in silver with SS1, JBY’s project is similar, but for gold.

Nevada is home to some of the biggest gold and silver mines in the world, including Barrick's “Goldstrike” project which was the asset that put the company on the map. The gold and silver deposits in Nevada are known for being easy to mine and process at a low cost. We have had success in Nevada with SS1, we are hoping that JBY can replicate this success.

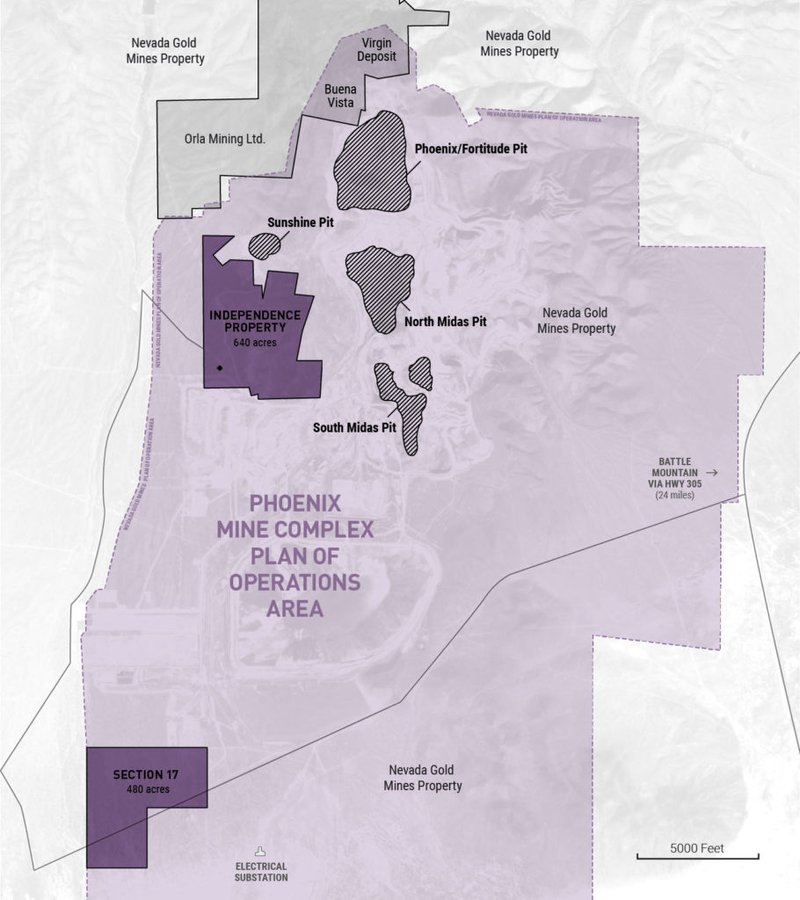

6. JBY is right next door to a mine operated by Barrick and Newmont.

JBY’s project sits right in the middle of Barrick and Newmont’s Phoenix Joint Venture. Barrick and Newmont have sunk billions of dollars into mine infrastructure and are currently producing gold from the project. Barrick and Nemont have both committed to growing production at the Phoenix operation and there is always a chance that they look at a bolt on acquisition with a project like JBY .

7. JBY is surrounded by low cost heap leach mines with same geology

JBY’s project is surrounded by some of the lowest cost gold mining operations in the world. Barrick and Nemont’s Nevada Gold Mines JV has pits operating with AISC (all in sustaining cost) to produce at below ~US$1,000 per ounce. $19BN Kinross’ Bald Mountain asset operated with a cost of sales of ~US$1,241 per ounce in 2023. Great margins at the current spot price of ~US$2,700 per ounce.

8. Previous owners spent >US$25M on this project and have completed a Preliminary Economic Assessment (PEA)

JBY’s project has had over US$25M in capital spent to get the project to where it is today. The project also has a 2022 PEA which showed 32,050 ounces of gold per year for 6 years at an all-in sustaining cost of US$1,078 per ounce. By our calcs that is US$86M in revenues per year assuming a US$2,700 ounce gold price. That PEA only covered a small portion of JBY’s existing foreign resource, excluding the high grade skarn which contains a resource of 796Koz ounces of gold.

Note this rough calculation doesn’t take into account capex or opex etc and assumes a gold price that could move down (or up).

9. Clean, tight cap structure, ~89M shares post transaction, no options overhang

We like JBY’s capital structure because there are no option overhangs and only 89m shares on issue. We have seen a similar style clean structure for SS1 which has so far worked out well. A lot of the top 20 shareholders are the same across both companies and they appear to be stable long term holders so far. A clean structure with no options overhang allows for the company’s share price to rise off the back of strong positive news.

10. Well-known retail stock with potential to re-rate.

JBY appears to have a large retail following and the potential for share price re-rates on good news. The company promotes well, it was a hot IPO back in September of 2023, when James Bay lithium stocks were popular amongst investors and right before the lithium sentiment crash. As a result, we think that if the company can deliver material news on their gold project, there will be enough eyeballs on the stock for the share price to re-rate.

Our full JBY Investment Memo is at the end of this note, including objectives we want to see JBY achieve, risks we have identified and accepted and our Investment plan.

Our JBY Big Bet:

“JBY re-rates to a +$300M market cap by expanding its large US gold resource and moving into development studies and/or attracting a takeover bid at multiples of our Initial Entry Price”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our JBY Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Gold and Silver to run in 2025

We think gold and silver are going to be one of the big stories of 2025.

We won't cover our views again today on why gold and silver are going to run instead , you can read our recent commentary on why here:

- Why is there such growing interest in gold and silver? - read it here

- Will gold and silver be the driving force behind the next small cap bull market? - read it here

- What mining Investment experts think about gold and silver: Rick Rule, Eric Sprott, Pierre Lassonde - read it here

JBY’s gold project

JBY’s project is in one of the lowest cost gold mining jurisdictions in the world - Nevada, USA.

The project sits inside what’s known as the “Nevada Gold Mines” JV between Barrick and Newmont:

The project currently has a foreign resource estimate containing 1.18M oz of gold and 7.6M oz of silver.

JBY says they will be converting this foreign resource estimate into a JORC compliant resource.

This means the resource will align with:

- Australian reporting standards

- Have a competent person sign off on it (such as a geologist) and

- Use terminology and criteria that fit with the Australian legal and regulatory frameworks.

Over the years US$25M has been spent on exploration by the previous owners getting the project to where it is today....

But the resource is still open in all directions.

We are backing JBY to take the asset and grow that resource by changing the exploration and development approach on the asset, and while gold prices are at near all time highs.

(like they did with SS1)

With the last round of drilling, previous owners of the asset were focused on defining the lower grade, shallow mineralisation which could be put into production in the near term.

After running a drill program in 2020-2021, the project had a 2022 Preliminary Economic Assessment (PEA) completed on that low grade portion of the resource which showed:

A low cost heap leach operation producing 32,050 ounces of gold per year for 6 years at an all-in sustaining cost of US$1,078 per ounce.

By our rough calcs that is US$86M in revenues per year at today’s US$2,700 ounce gold price.

Note this calculation doesn’t take into account capex or opex etc and assumes a gold price that could move down (or up).

This PEA was calculated on just the shallow mineralisation.

It excluded the 796,200 ounces in the deeper higher grade portion of the project's existing resource.

So there is clearly a way to realise short-term value from the asset if JBY ever wants deliver the plan in the 2021 PEA...

(we actually like this option, as we are fans of near term gold production while we expect even high gold prices over the next few years)

Being so close to existing infrastructure that is likely something that is always on the table.

JBY is changing the approach and will be going back and drilling out the deeper higher grade skarn.

As much as we like near term production stories, we are backing the JBY team to add size/scale to the project, before it considers any short term monetisation opportunities.

A large part of the reason we Invested in this project is because of the mix in short-term monetisation pathway AND the blue sky exploration upside.

We think that is an attractive combination for a gold small cap where gold prices are trading at all time highs.

Gold and Silver stocks are being rewarded for progress right now

This year has been a strong year for precious metals with gold increasing 36% and Silver increasing 29%.

We think this is the start of a longer term rise in precious metals prices because of sticky inflation, general global uncertainty and the US debt situation.

So for this year, our precious metals stocks have performed relatively well too. Here are some of the highlights from our precious metals stocks in the last 12 months:

- Sun Silver (ASX: SS1): Touched an all time high of ~$1.18, up 582% from our Initial Entry Price of 17.3c. We are expecting big things from SS1 in 2025, especially if the silver price rips.

- Mithril Silver and Gold (ASX: MTH): Was the best performing stock on the ASX in September - up ~362%. The stock is currently up 325% from our Initial Entry price of 10c, and was as high as 715%.

- Titan Minerals (ASX: TTM): recently hit new 52 week highs of ~63.5c.

- BPM Minerals (ASX: BPM): Was up ~200% off the back of a new gold discovery at its project in WA - more drilling starting very soon.

- Kaiser Reef (ASK: KAU): touched ~23c, up from our Initial Entry Price of 15c.

Past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

One of the strongest performers so far has been SS1 whose success came off the back of drilling results and a resource upgrade at its giant silver project in Nevada, USA.

We think there is still plenty more to come for SS1 (we participated in the last SS1 capital raise at 60c)

We think the same will happen for gold stocks - JBY is a similar story to SS1 but for gold.

JBY is backed by the same team from SS1

Just like SS1, we think that JBY has plenty of exploration upside, and that resource could grow pretty quickly once the drill rigs start spinning.

Into rising gold and silver prices next year.

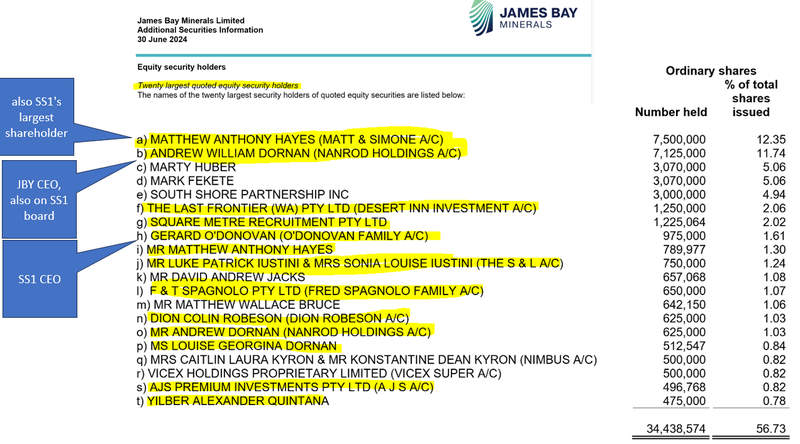

The board, management, corporate advisor and top 20 shareholders are very similar across JBY and SS1.

(SS1 is our 2024 Small Cap Pick of the Year that IPOd at 20c and hit over $1.18 within nine months).

We have observed them to be very hard workers.

We are backing the same group to deliver a win with JBY.

They also have a knack for securing quality, advanced projects on good deal terms, and maintaining good tight cap structures with no options overhang.

Specifically in Nevada, USA.

A quality project, clean cap structure and solid shareholder base is half the battle in allowing a share price to appreciate if a company delivers good news.

A summary of key people across both JBY and SS1:

- Matt Hayes - Wagtail Capital, corporate advisor (responsible for acquiring assets and raising money) - largest shareholder of both SS1 and JBY

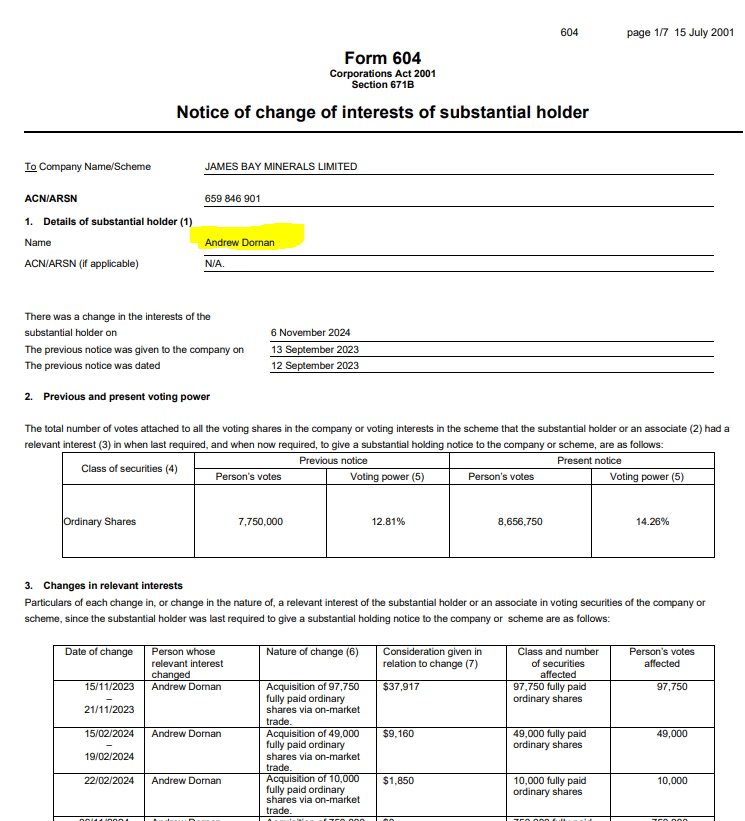

- Andrew Dornan - Executive Director of JBY, the second largest holder of JBY and second largest holder of SS1 (has been buying JBY on market last 2 weeks)

- Gerard O’Donovan- Exec director of SS1 and on the board of JBY, top 10 shareholder in both companies

- Dean Ercegovic - Board member on both JBY and SS1

The top 20 shareholder lists of SS1 and JBY have a lot of overlap of the same shareholders.

Here JBY top 20 shareholders, yellow highlights show which holders are also in the top 20 of SS1:

(Source JBY annual report 2024 top 20 holders compared against SS1 top 20 holders as at 13 May 2024)

We also noticed the JBY Managing Director and second largest (now largest?) shareholder Andy Dornan buying JBY on market last two weeks, now holding 14.26% of the company:

We are following the Wagtail Capital team (who successfully floated SS1) into JBY.

We think SS1 has had such a good start due to good project selection, tight cap structure and good management.

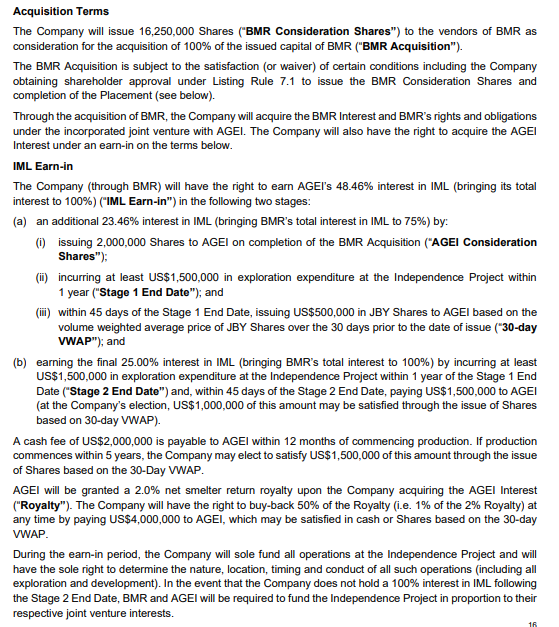

JBY project acquisition terms

We like that the acquisition is being done in JBY shares for the initial 51.54% and the remaining 48.46% is acquired via an earn-in agreement.

That means JBY takes its ownership to 100% by spending cash on exploration and advancing the asset toward production.

We also like that a lot of payment milestones are payable in JBY shares at a 30 day VWAP, because we believe the JBY capital structure and shareholder base sets the company up to rerate on positive news in the future.

(Hopefully by then the company is worth a lot more and the payments are a nominal amount relative to the company’s market cap).

You can read the full acquisition announcement which details a lot about the project and the acquisition terms here.

The deal terms are here:

(Source)

We already Investors in the company that owns 51.54% of the gold project and is being acquired by JBY

(these are the shares in our disclosure that are still subject to shareholder approval)

We have now also increased our Investment directly in JBY.

Our Average Entry Price across the project vend and the Investment in JBY is ~28c per share.

The acquisition of their Nevada gold project is scheduled to complete immediately following the company’s shareholder meeting this coming Friday.

Investment Memo: James Bay Minerals (ASX: JBY)

Memo Opened: 25 November 2024

Shares Held: 1,979,167

What does JBY do?

James Bay Minerals (ASX: JBY) is a gold explorer developing its project in Nevada, USA.

JBY also owns lithium exploration assets in Quebec, Canada.

What is the macro theme behind JBY?

Gold price is trading near all time highs and looks like it wants to go higher against a backdrop of high inflation and global uncertainty.

Nevada is home to some of the world’s biggest, lowest cost operating gold mines with gold majors like Barrick and Newmont active in the region.

JBY also has lithium projects in Canada which gives us a chance to pick up lithium exposure during the lithium winter. We think these projects can come good when sentiment improves.

Our JBY Big Bet:

“JBY re-rates to a +$300M market cap by expanding its large US gold resource and moving into development studies and/or attracting a takeover bid at multiples of our Initial Entry Price”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our JBY Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Why did we Invest in JBY?

- JBY has a 1.18Moz gold and 7.6Moz silver resource with exploration upside.

- JBY has the same team and backers as our 2024 Small Cap Pick of the Year SS1.

- We like the gold macro thematic for 2025 and beyond.

- Nevada a top 3 Fraser Institute mining jurisdiction every year for the past 10 years.

- We have success in Nevada in silver with SS1, JBY’s project is similar, but for gold.

- JBY is right next door to a mine operated by Barrick and Newmont.

- JBY is surrounded by low cost heap leach mines with same geology

- Previous owners spent >US$25M on this project and have completed a Preliminary Economic Assessment (PEA)

- Clean, tight cap structure, ~89M shares post transaction, no options overhang

- Well-known retail stock with potential to re-rate.

What do we expect the JBY to deliver?

Objective #1: Complete acquisition of gold project in Nevada, USA

We want to see JBY complete the acquisition of its gold project. The AGM is set for 29th November after which we hope to see the transaction close.

Milestones

🔄 JBY completes acquisition of gold project

Objective #2: Convert foreign resource estimate into a JORC resource

We want to see JBY convert its existing foreign resource estimate into a JORC resource.

Milestones

✅ JORC conversion commenced

🔲 JORC resource estimate completed

Objective #3: Upgrade existing resource estimate

We want to see JBY run an extensional drill program to expand its existing resource beyond the 1.18m ounce gold & 7.6m ounce silver resource.

Milestones

🔲 Drilling commenced

🔲 Drilling results

🔲 Resource upgrade

Objective #4: Identify lithium drilling targets on Canadian projects

We want to see JBY identify and rank high-priority lithium drill targets. We want to see JBY have these targets ready when lithium prices increase, and the market is rewarding drilling success again.

Milestones

🔄 Geochemical work

🔄 Geophysical work

🔲 Drill targets identified

What could go wrong?

Exploration risk

There is no guarantee that JBY can increase its existing resource estimate through exploration drilling. There is always a chance that drill programs fail to find any economic mineralisation that may not add to the project’s overall resource estimate.

Resource risk

At the moment, JBY’s project has a “foreign resource estimate”. This means it is built on a different set of assumptions & guidelines relative to the JORC code that we are more accustomed to seeing on the ASX. There is no guarantee that JBY can convert all of its foreign resources into a JORC resource. If this risk were to materialise it may have a negative impact on the company's share price.

Funding risk/dilution risk

JBY is a small cap that is not generating any revenues at the moment. As a result, the company is reliant on access to financing from the market. If there is any negative news (macro or fundamental) then JBY may be forced to raise capital at lower share prices. Capital raises at lower valuations could dilute the ownership of existing shareholders and cap the upside potential of the company’s share price.

Commodity price risk

The performance of commodity stocks are often closely linked to the value of the underlying commodities they are seeking to extract. Should gold prices fall there could be a negative impact on JBY’s share price.

Market risk

There is always the possibility that broader market sentiment gets worse and shares as a whole trade lower. In this scenario we would expect JBY’s share price to re-rate lower. Given JBY is pre-revenue and considered a lot riskier than revenue generating companies, JBY’s share price could be impacted the most in a “risk-off” market.

Development/delay risk

Should any or all of the above risks materialise, JBY could wind up stuck in “development purgatory” where newsflow dries up and the project remains stagnant for a prolonged period of time, hurting the share price.

What is our Investment Plan?

We are Invested in JBY to see it expand its resource and progress its project into development.

Our plan is to hold the majority of our position in JBY for 3 to 5 years which we hope is enough time to see JBY to move towards development (see “our long term bet” above).

After 12 months we will apply our standard de-risking strategy.

We may look to sell up to 20% of our holding if the company delivers on one or more of our Investment Memo objectives and/or the share price materially re-rates.

Any sell downs will be in accordance with our trading and hold policy disclosure.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.