Improved MNB DFS Due in Q3 on Record Fertiliser Prices

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 4,895,000 MNB shares and 1,562,500 options at the time of publishing this article. The Company has been engaged by MNB to share our commentary on the progress of our investment in MNB over time.

Our African food security investment, Minbos Resources (ASX:MNB), is set to benefit from record fertiliser prices at a time when the world is desperate for new supply.

In fact, prices are so high that MNB is planning to alter its plant configuration in its Definitive Feasibility Study (DFS) so that it can maximise the economics of its low CAPEX project.

Today’s move by MNB takes place within the context of tectonic ruptures in the food supply chain.

Africa’s food security was already under threat due to the pandemic.

Then, in October 2021, China moved to ban the export of phosphate (a key fertiliser ingredient) until June 2022 (we expect that ban to continue).

Next, the war in Ukraine sent fertiliser prices flying as Russia moved to suspend fertiliser exports.

According to the The Fertiliser Institute, Russia is the world’s largest exporter of fertilisers.

The country accounts for 23% of ammonia exports, 14% of urea exports, 10% of processed phosphate exports, and 21% of potash exports.

With no end to the war in sight, and the political and economic fallout likely to continue for years, if not decades, we think fertiliser prices could remain elevated for a prolonged period.

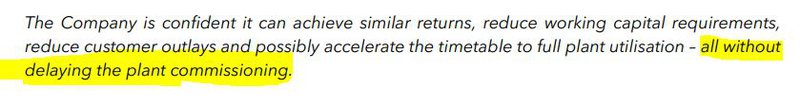

Which is why we’re of the view that MNB’s announcement today is a strong net positive - it pushes back the timetable for the DFS (our #1 Key Objective) from Q2 2022 to Q3 2022, in exchange for the ability to capture even more value from the project.

Crucially, MNB’s plant commissioning is still on track for H1 2023 - nothing has changed with regards to the production start date.

In light of this, today’s note will cover the following:

- Key pieces of information in today’s MNB announcement

- MNB’s project economics and record fertiliser prices

- What makes MNB’s project unique?

- How today’s announcement de-risks our MNB position

- Bonus: highlights from Argonaut’s recent site visit

- Our MNB Investment Memo

Ultimately, we’re invested in MNB to see it reach production - which is reflected in the “Why we continue to hold MNB in 2022” section of our Investment Memo (click the image below to access):

More on today’s announcement

Today’s announcement directly impacts Key Objective #1 on our 2022 MNB Investment Memo.

The DFS will be pushed back from previous MNB timelines to Q3, but we think it will be improved - more on that in the next section.

For now though, here are the key pieces of information as we see it:

- MNB’s plant commissioning is still on track for H1 2023 - nothing has changed with regards to the production start date

- Full utilisation of the plant may be accelerated

- The macro forces behind MNB’s product mean the DFS economics should improve

- In turn, this should make financing even easier

And here’s the key quote from MNB CEO Lindsay Reed:

MNB’s project economics and record fertiliser prices

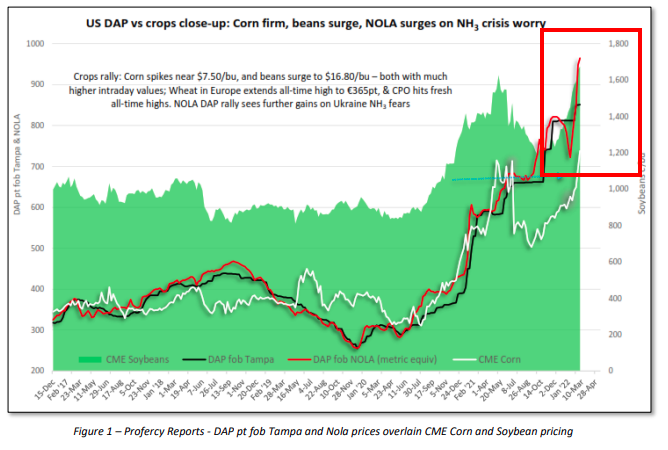

Today’s announcement by MNB comes as fertiliser prices are moving towards all time highs.

Prices for raw materials that make up processed fertilisers (ammonia, potash, phosphates, sulphur) have risen 30% since the start of the year.

MNB’s Scoping Study was completed in 2020 - the world was a different place then.

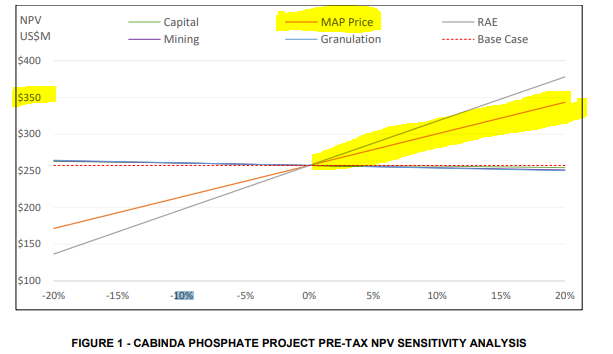

The financial metrics of the project were calculated using a using a US$357-482 per tonne phosphate price (MAP price), which gave the following project economics:

- Post-tax NPV of US$191-308M (A$260-420M).

- Low upfront CAPEX of US$22-28M (A$30-38M).

- 21 year mine life.

MNB also released a best-case scenario with phosphate prices at US$643/tonne where the after-tax NPV was US$343M.

MNB’s input price in the Scoping Study (MAP) trades at a +-5% price to DAP (Diammonium phosphate). Fertiliser prices are now trading at multiples of the figures MNB used in its Scoping Study, with prices >US$1,200/t.

The sensitivity analysis in the Scoping Study showed that for every ~10% increase in the fertiliser price, the pre-tax NPV would increase by ~US$50M.

With prices up almost 200% we think the current project economics are likely to be significantly stronger now.

Of course, we have also seen plenty of inflationary pressures in supply chains. So some of the gains are likely to be offset by cost escalations in the operating and capital costs for the project, like buying steel to build the plant.

The net positive being that MNB when it delivers its DFS in Q3 of this year we think it will be able to show vastly improved project economics.

What makes MNB’s project unique?

A lot of the recent media coverage has been fixated on the issues of food security and the potential for shortages globally. See this article from the BBC: Scottish farmers warn of rising costs and food shortages.

This has put a spotlight on fertiliser supply as the agricultural sector is primarily dependent on being able to secure cost effective fertiliser to improve crop yields (output of the raw materials that are used to produce the food we consume).

This naturally leads us to the questions of ‘why’ all of this is happening.

We think that the problems are mostly related to the following:

- The supply chain disruptions caused by the shutting out of Russia from the global economy - Russia was the world’s biggest exporter of fertilisers in 2019 and is a key supplier of urea and potash.

- The input costs to produce fertiliser and food are increasing - This is more so related to the rising energy costs. The cost of natural gas is significantly higher versus the same time in 2021 and the oil price is trading just shy of ~10 year highs.

The first issue is relatively well understood, but the second is far less obvious. Almost everything that we use in daily life requires energy during its production process. Fertiliser and subsequently the foods we consume are no different.

With energy costs increasing the natural flow on effect is that the cost of producing fertilisers and food goes up, this coupled with the major supply chain issues leads to shortages, increasing prices even further.

This is where MNB’s project’s strengths start to shine through, mainly because of its location in Angola.

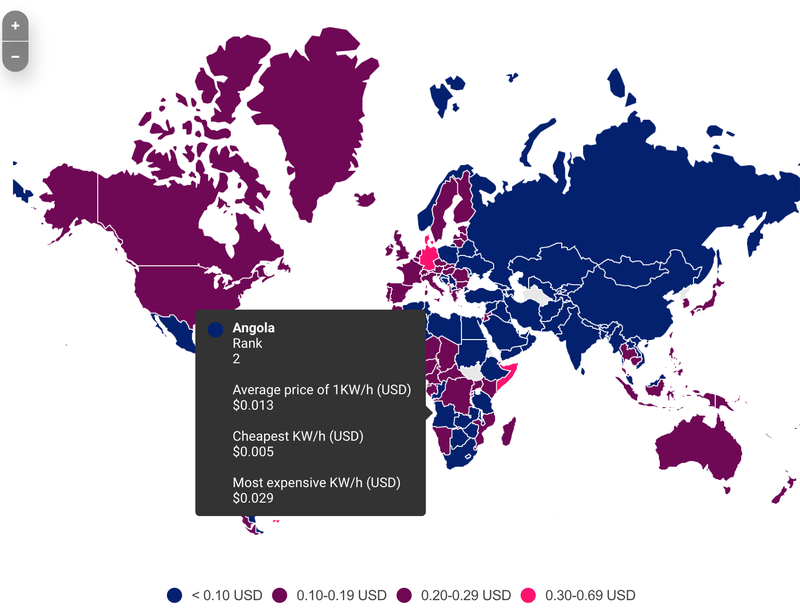

First of all Angola has an abundance of renewable energy capacity with over 1,000MW of hydropower available, this means Angola ranks second for the cheapest source of electricity on the planet.

The significance of this is that when MNB gets the project into production, it will benefit from having low input costs, and will also be producing with a low carbon footprint.

Second, MNB is located to the south of Europe, in Africa making it the ideal solution to solving the supply side issue caused by sanctions on Russia. MNB will be benefiting from both local demand increasing and the European interest for its product.

MNB will therefore not only benefit from increasing local demand in Africa but also benefit from the European Union's requirements to look for alternate supply sources as it tries to diversify away from Russia.

With competitive input costs and the project expected to be construction ready in 2023, MNB could potentially be a few years away from producing and supplying into key export markets like the EU.

How today’s announcement de-risks our MNB position

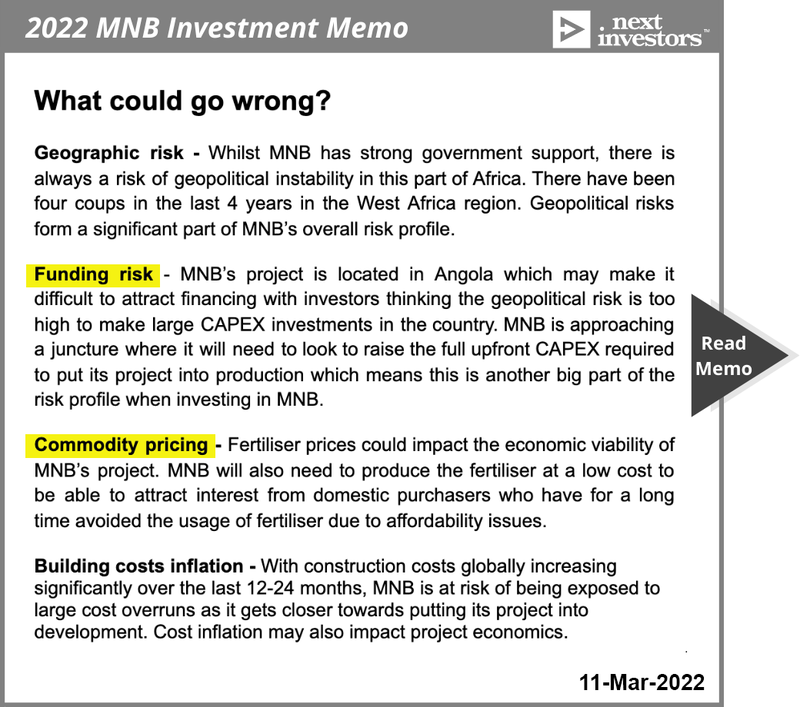

The above two risks are closely linked. As the underlying commodity (fertiliser) price rises, the economics of MNB’s project improve, in turn making funding more readily available.

We’re of the view that these two risks are being addressed in tandem, and today’s announcement further de-risks our MNB position.

Bonus: highlights from Argonaut’s recent site visit

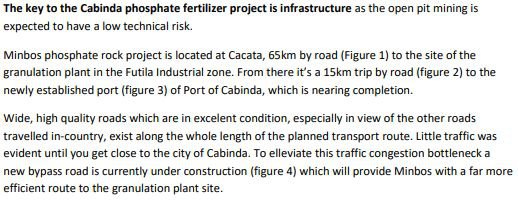

Our friends at Argonaut were kind enough to let us share the following excerpts from their recent site visit:

Source: Argonaut

Source: Argonaut

Source: Argonaut

Source: Argonaut

Source: Argonaut

After reviewing the notes from Argonauts site visit, it's pleasing to see infrastructure improvements going into the Angolan landscape that MNB will operate in.

MNB 2022 Investment Memo

Our “Investment Memo” is a short, high-level summary of why we continue to hold a position in MNB and what we expect the company to deliver in 2022.

We’ll be using these Investment Memos as a way to assess the company’s progress over 2022 and also examine how our investment thesis plays out throughout the year.

In our MNB Investment Memo you’ll find:

- Key objectives for MNB in 2022

- Why do we continue to hold MNB

- The key risks our investment thesis

- Our investment plan.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.