How Did FOD Perform Last Quarter?

The Food Revolution Group (ASX: FOD) released its June 2021 quarterly results yesterday, and we spent some time this week with new CEO Steven Cail to unpack the results and what it all means for FOD investors.

FOD is a food and beverage manufacturing company specialising in innovative health-focused products.

The biggest takeaway from recent months is that FOD’s new Juice Labs product is delivering impressive market penetration - we are struggling to find it on the shelves of our local supermarkets - so there is clearly high demand for the product.

We invested in FOD at 3.5c back in March because we believed in FOD’s turnaround strategy.

We think the turnaround has well and truly begun, but the financial performance appears to be lagging behind the product growth and traction.

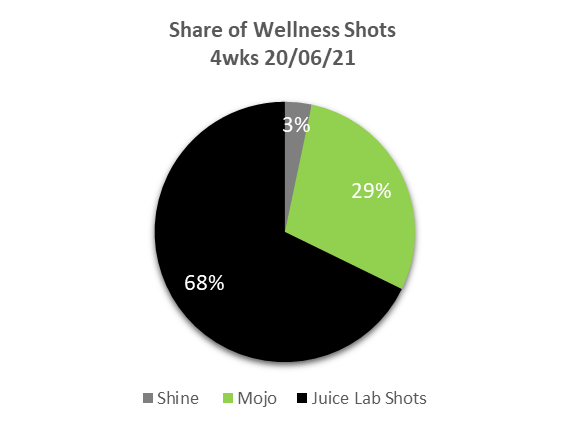

FOD’s flagship product is premium orange juice - you might have seen their ‘Original Black Label’ (OBL) juice brand in supermarkets - and as you can see below, FOD’s Juice Labs wellness shots are gaining strong traction in the market.

Our conversation with CEO Steven Cail covered the quarterly results, which in his eyes were generally in line with company expectations.

From our perspective, we were impressed with how quickly he has settled into the role, establishing a culture of under-promising over-delivering, as he continues to build upon foundations set by former CEO Tony Rowlinson.

Our strategy is to hold FOD over the long term (5 to 7 years) to see the full turnaround play out.

We expect a return on our capital through either dividends (not for a while though) or an acquisition of FOD by a larger health or food brand.

Juice Labs Dominates the Wellness Shot Market

FOD’s Immunity Wellness Shot took out the gold medal in the Juice Wellness Shot sprint, beating out FOD’s two other brands Focus and Digest, as well as competitor wellness shots from Mojo and Shine.

We were keeping a close eye on the quarterly to see if FOD would make any noise about the growth of their Juice Labs range in the wellness shot market.

Wellness shots are small, concentrated juices made from all natural ingredients with beneficial nutrients and antioxidants. They are a quick and efficient way for consumers to increase their nutrient uptake and provide important vitamins for a blanched diet.

We were extremely pleased to see Juice Labs’ market penetration strategy materialising as it accounted for 68% market share in the wellness shot segment . This signalled a significant customer uptake in their new product and a leading indicator for FOD’s turnaround.

We made a few trips ourselves to Woolies and Coles over the last few months and saw first hand the empty boxes and shelves:

This is a huge vote of confidence by consumers in the Juice Labs brand as the products were flying off the shelves .

We understand that FOD is working closely with major supermarket retailers to address product shortages caused by excess demand - a very good problem to have.

Altogether, this quarter reflected a successful launch of the Juice Labs brand and a big tick for growth.

We will be watching closely for the expansion of the Juice Labs product range as well as any trickle down revenues that will improve FOD’s overall financial performance.

✅ Juice Labs Market Penetration (Product Growth 1)

FOD’s Financials

Operating cash flow landed in the red again this quarter ($1.4m loss compared to $715k loss previous quarter), impacted by one-off costs associated with staff changes as well as capital expended on fruit inputs. Generally, we expect a weaker cash position in the winter months, Q4 and Q1 as capital is expended upfront for fruit inputs in anticipation for summer. We are hoping that FOD will reach cash-flow positive in FY22, and grow their EBITDA through further product developments.

Sales revenues were steady this quarter, so we can’t give FOD a big green tick for revenue growth, however this quarter’s financial performance will provide a good baseline for investors, as management continues to execute on its strategy.

📅 🟧 Revenue growth for the quarter

Highlights for this quarter:

- Juice Labs market dominance: Launch of Juice Lab wellness shots into Coles and Woolworths, have far exceeded expectations. Juice Lab shots now have 68% market share of the Wellness Shot market.

- Original Black Label (OBL) Growth: OBL brand continues to outperform the market for growth in Coles and Woolworths

- NAB Refinancing: debt facility refinanced with tier-1 lender National Australia Bank (NAB), replacing the legacy Greensill facility

- Steady sales: $9m revenue and $8m cash receipts for the quarter, vs $10m and $7.2m respectively for the previous quarter. Typically revenues are down a little during the cooler months, and are boosted when the sun is out.

- Back in black still to come: We are anticipating weaker EBITDA for the upcoming quarter, but that FOD transitions into cashflow positive in this financial year.

What we are looking out for next quarter:

- New Product Launch: We would like to see a new product launched over the next quarter to improve FOD’s revenues.

- Continued growth of Juice Labs: The Juice Labs brand was off to a great start and we anticipate further growth as FOD addresses product shortages due to high consumer demand.

- Revenues Steady: We are anticipating steady revenues for the June-Sept quarter in anticipation of accelerated growth in the lead up to Christmas.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.