High Grade Graphite Results Just the First Catalyst to Come for This ASX Junior

Published 09-DEC-2019 09:50 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After falling by an average of -0.9% (CAGR) each year since 2014, the global graphite market is expected to grow exponentially in the coming years.

The growth will come on the back of rising sales of smartphones, cars and in particular, electric vehicles (EVs), along with growing demand for lithium-ion batteries, plus industrial uses such as refractories manufacturing and growth in steel and aluminium production and processing.

The electric vehicle industry is key here, in which graphite will have a major role in production. Rising commercial applications of graphene (made from graphite), and growing demand for energy storage will also drive graphite requirements.

One Australian junior graphite explorer is poised for a strong 2020 on the back of resource growth and the delineation of higher grade mineralisation.

The team behind this company has an outstanding track record with major project successes. The company discovered and evaluated the Ravensthorpe Nickel Project (developed with BHP), delivering a A$32 million return to shareholders.

It will be hoping for something similar with its latest venture – its 100% owned Springdale Graphite Project.

Springdale consists of two tenements (E74/562 and E74/612) located approximately 30 kilometres east of Hopetoun in southern Western Australia.

The project is in a safe jurisdiction, surrounded by infrastructure and holds a mineral — graphite — that is set to come back into vogue as EV production ramps up and mineral requirements for improved technologies increase.

Recent drilling at Springdale provided outstanding results, including its highest grade graphite result to date of 3.23 metres at 51.02% TGC (total graphitic carbon) from 35.3 metres, from a wider interval of 42.5 metres at 17% TGC from 20 metres.

These results set the scene for further drilling and surveying in 2020, while also advancing its metallurgical test work.

Also of note is its work in the graphene space.

The company has produced graphene using a process of electronic exfoliation from graphite mined at the Springdale Project.

Like graphite, graphene is used in a range of high value markets including 3D printing — which is expected to be worth US$47.9 billion by 2025, and wearable tech — a market anticipated to hit US$54 billion by 2023.

That’s a lot of potential upside for this $6.5 million early stage company, so let’s find out more.

Introducing...

Share price: $0.022

Market capitalisation: $6.5 million

The Comet Resources investment case:

Comet: a brief overview

When negative sentiment exists in a sector it is often the emerging players that are hit the hardest, therefore offering the best opportunities, and potentially superior capital gains when boom times return.

Comet Resources (ASX:CRL) could be one of those emerging players.

This graphite junior is currently flying under the radar, but has recently delivered outstanding exploration results from its 100% owned high-grade Springdale Graphite Project.

The project is located approximately 30 kilometres east of Hopetoun in southern Western Australia and as you can see by the graphic below, the company has clear ownership in the region that boasts exceptional infrastructure including grid power and piped gas.

Here is newly minted managing director, Matt O’Kane speaking about his vision for the company, the recent diamond drilling program and the project’s upside:

Matt points out the stable nature of the jurisdiction, its proximity to high level infrastructure and the port of Esperance and the high grade resource which is close to surface and should be amenable to open pit mining.

He also notes the small matter of the growing need for battery anode materials that a successful project could tap into.

With that in mind, let’s take a look at its history and the latest results.

Leading up to the latest drilling

Comet’s Springdale tenements lie within the deformed southern margin of the Yilgarn Craton and constitute part of the Albany-Fraser Orogen.

A first pass aircore drilling program in February 2016 confirmed the presence of graphite (Western Zone) and a detailed aeromagnetic survey the following year delineated 26 kilometres of stratigraphy deemed to be prospective for graphite mineralisation.

The upside here is that less than 20% of the identified stratigraphy has been drill tested, indicating the potential scale of the project.

A range of drilling programs have been conducted in the last couple of years targeting the Northern Zone where Comet was successful in identifying high-grade graphite mineralisation.

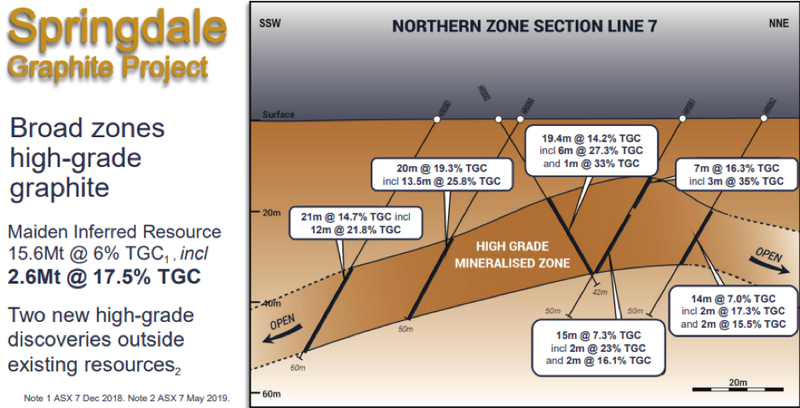

In December 2018, Comet released a maiden Inferred Resource of 15Mt @ 6.0% Total Graphitic Carbon (TGC) including a high-grade component of 2.6mt at 17.5% TGC, incorporating the Northern, Eastern and Western Zones. It is this high-grade component of the resource which is the company's focus.

The discovery of two new high-grade zones of graphite mineralisation outside the existing resource was announced in May this year. The results of the drilling program confirmed that electromagnetic (EM) surveys could be used as a targeting tool for shallow, high-grade graphite mineralisation. This has proved highly successful at Springdale and could enable the company to reduce exploration costs through more accurate drill targeting.

Results of a diamond drilling program and aerial EM survey in September and October 2019 were released in November.

Promising drill results

Final results from recent infill drilling conducted at Springdale have Comet poised to hit the ground running in the new year.

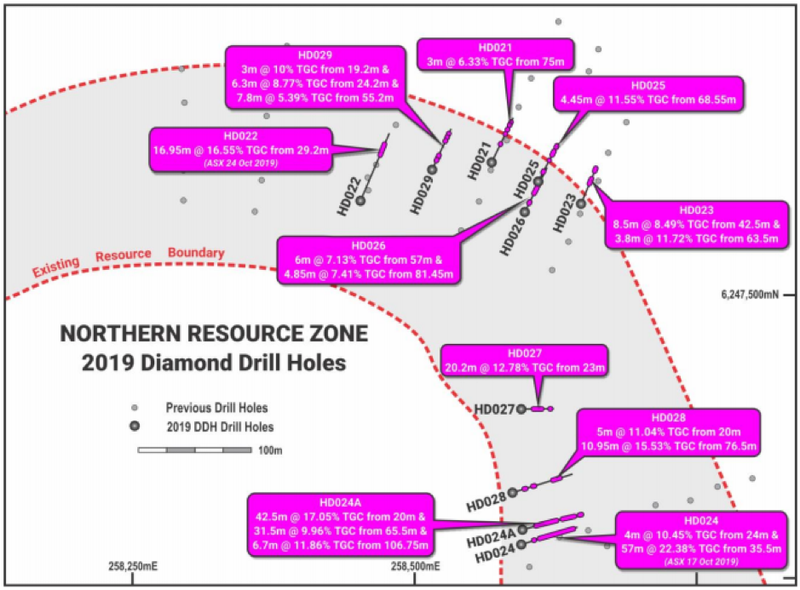

The highlight is a highest grade graphite result to date of 3.23 metres at 51.02% TGC (total graphitic carbon) from 35.3 metres from a wider interval of 42.5 metres at 17% TGC from 20 metres in hole HD024A.

This hole was drilled as a twin of HD024 (Oct 2019) and showed stronger oxidation and veining but again confirmed the continuity of the high grade graphite mineralisation on the eastern side of the north zone as indicated in the following map (right-hand corner).

Metallurgical testwork programs using the material from this drilling have been designed to be undertaken in Australia and internationally with results expected into the first quarter of 2020.

The two new high grade discoveries that will contribute to a resource upgrade in 2020.

O’Kane highlighted the significance of this recent round of results and their relevance in terms of the company’s strategy in 2020 in saying, “Once again we saw spectacular grades in the infill program.

‘’While we have already achieved many high grade intercepts in the Northern Zone at Springdale, we are particularly impressed by the width and grade of the intercepts in hole HD024A, including the highest grade intercept to date of 3.23m @ 51%.

’Now we’re very focused on the active metallurgical test work program and look forward to releasing those results as they become available.”

Metallurgical testwork and flake size

A specialist metallurgical team with significant graphite-specific experience will undertake the analytical and metallurgical testwork for Springdale in Q4 2019 and Q1 of 2020.

Comet actually has several metallurgical programs currently underway, all designed to classify and characterise the graphite while maximising recoveries.

Additional testwork programs will be conducted to assess the value-add potential for producing products to supply the electric vehicle, static battery, expansion and graphite foil markets.

As a comparison

Not far up the road, as you can see on the location map above, is Munglinup, which hosts Mineral Commodities Limited's (ASX:MRC) proposed Munglinup Graphite Project.

The $101 million capped Mineral Commodities site ranks among the world's highest grade for graphite, with a total graphitic carbon content of 15.3%.

Although, Mineral Commodities is a multi-site operation, with two other projects in Norway and South Africa, Munglinup does share some similarities with Sringdale.

Just 50 kilometres away, the Munglinup project is moving toward a DFS, with the PFS showing the size of the reserve being 3.4 million tonnes at the 15.3% graphite, which is similar in size to the high grade zone Comet has delineated of 2.6 million tonnes at 17.5%.

Whilst, Comet is at a much earlier stage, based on its results so far it is confident it too can reach DFS stage and prove up robust economics.

The similar grade, proximity and Mineral Commodities’ much larger capitalisation, makes for an interesting comparison and gives the company a bright outlook.

Is Comet undervalued?

With a possible conversion of a portion of the resource from the inferred category to indicated on the cards, we expect plenty of newsflow and potential catalysts throughout 2020.

One factor that works in favour of graphite explorers is the consistent accuracy of electromagnetic survey in terms of identifying where the mineral is located.

Graphite lights up like a Christmas tree when surveyed using electromagnetic technology. As Springdale’s resource is located near surface, Comet has a distinct advantage in terms of expanding the existing resource and possibly identifying new zones of mineralisation within the tenements that are known to have similar geological characteristics.

Bearing in mind the likelihood of resource expansion, and particularly taking into account Comet’s established resource, its market cap of approximately $6.5 million seems extremely conservative, especially when you consider how quickly Munglinup has progressed.

Market expectations

The final factor with the potential to define Comet’s growth is the graphite market.

As the world moves towards carbon neutrality, the demand for battery anode raw materials will increase exponentially. However, the graphite market, hasn’t had it all its own way of late.

Big players such as the $180 million capped Syrah Resources (ASX:SYR) saw its shares plummet from approximately $2.00 in January to recently trade as low as 35 cents.

It was burdened by high expectations and fat built into its share price.

Yet, the sector has to rebound at some stage after being pummelled in the second half of 2019 as the depreciation of the Chinese Yuan, increased graphite production out of China, cuts in Chinese electric vehicle subsidies and negative sentiment related to broader international trade tensions combined to create the perfect storm.

China is the common denominator and has a long history of being able to indirectly impact the prices of all commodities, but particularly metals where it can control the amounts used in its manufacturing industry, as well as the volume produced within its own borders.

This leaves China with a number of levers to pull in terms of dictating import terms which, in turn, has a direct impact on commodity prices.

In recent years graphite has been held hostage — next month it could be iron ore, coal or copper — it’s anyone’s guess.

Predictions by ReportsnReports suggest the graphite market is set for rapid growth.

Research and Markets say the market for special graphite is anticipated to register annual growth (CAGR) of 11.14% during from 2019 to 2024, suggesting the market will be worth US$29.05 billion by 2022.

Predictions of growth were made a year ago and they seem to be coming in line now:

The conclusion can thus be drawn that graphite will again be in high demand and this has a lot to do with rise of electric vehicle production.

Scaling electrics

Car manufacturers are reducing the carbon footprint of their battery supply chains in order to boost the green-credibility of their EVs.

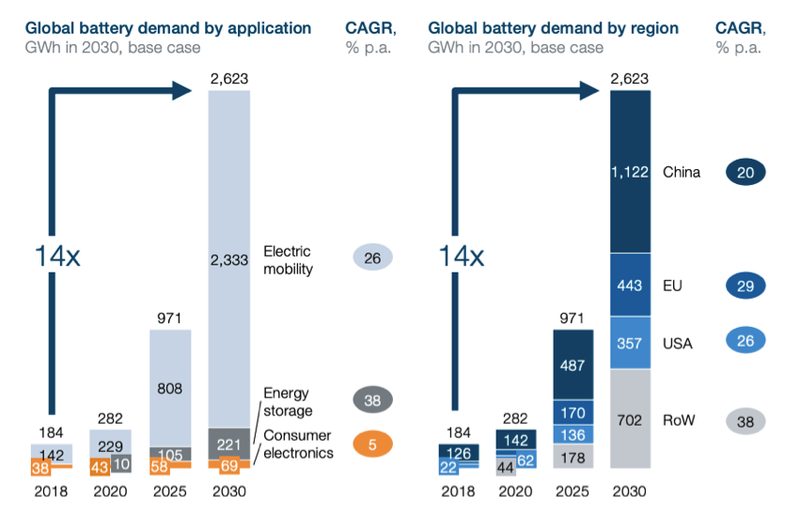

Here’s a look at the increase in demand.

According to a McKinsey report, “The main drivers of demand growth are the electrification of transportation and the deployment of batteries in electricity grids.

“By 2030, passenger cars will account for the largest share (60%) of global battery demand, followed by the commercial vehicle segment with 23%. Geographically, China is the biggest market with 43%. Consumer electronics, which account for more than 20% of the market today, will represent only a marginal share of the global battery market in 2030.”

The economic and social benefits are extraordinary.

The following Finfeed article discusses how Europe is on track to triple the number of electric vehicles on its roads by 2021 and will easily meet the EU's car CO2 emissions target by 2025 and how Tesla has now entered the European fray:

Essentially demand for EVs is rising and graphite will play a major role in its continued growth.

We should remember, however, that it is not just EVs leading the charge in battery metals requirements. Wearable technology, AI and computing and aeronautics are just a few industries that require battery metals.

These are all multi-billion dollar industries that may require graphite supply and with its high grade, Comet is looking to one day be a supplier.

Then there’s the further weapon in Comet’s arsenal — the work it is doing to convert graphite to graphene.

Comet has produced graphene using a process of electronic exfoliation from graphite mined at Springdale.

Work is ongoing, but graphene can be used for almost all of the same applications as graphite, such as in rechargeable batteries, but with a much higher level of performance.

Graphene builds on and exceeds the market reach of graphite.

Here’s a look at why graphene is such an exciting commodity:

Comet has a lot of work to do in this field, but is progressing its research.

The final word

With outstanding assay results in hand from a recent drilling campaign that could lead to a resource increase, returning favourable graphite market conditions and a desirable location, Comet Resources could be in the gun for a big 2020.

There are several catalysts to look forward to and backed by its highest grade intercept to date, if it does expand the existing resource, we could see a significant leap in value.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.