GTI Resources receives assay results from Niagara

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTI Resources Ltd (ASX: GTR) has received assay results from the recently completed first pass shallow reverse circulation (RC) drilling program at the company’s Niagara Gold Project, six kilometres south-west of Kookynie in the central goldfields of Western Australia.

The RC drilling program intersected elevated gold values and anomalism of up nearly 1 g/t gold.

Results from the RC drilling will assist in refining the overall exploration model and facilitate the interpretation of several anomalous gold structures.

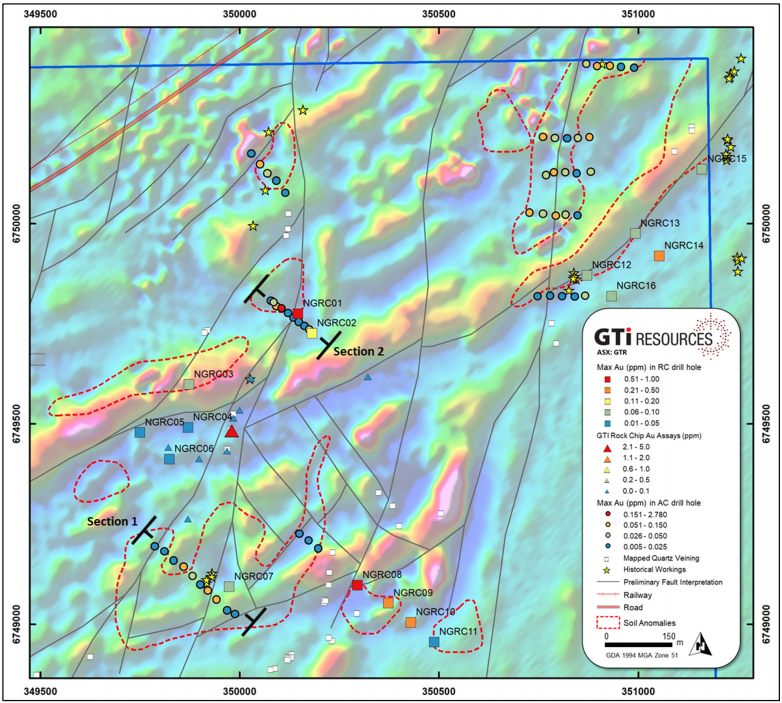

This RC drill campaign targeted significant gold anomalies identified by previous soil sampling programs and confirmed by September’s aircore (AC) drilling within exploration licence E40/342 at Niagara as shown below.

In addition, the drilling has helped to interpret the structural geology and identify a new target below a rock chip sample assaying 2.4 g/t gold.

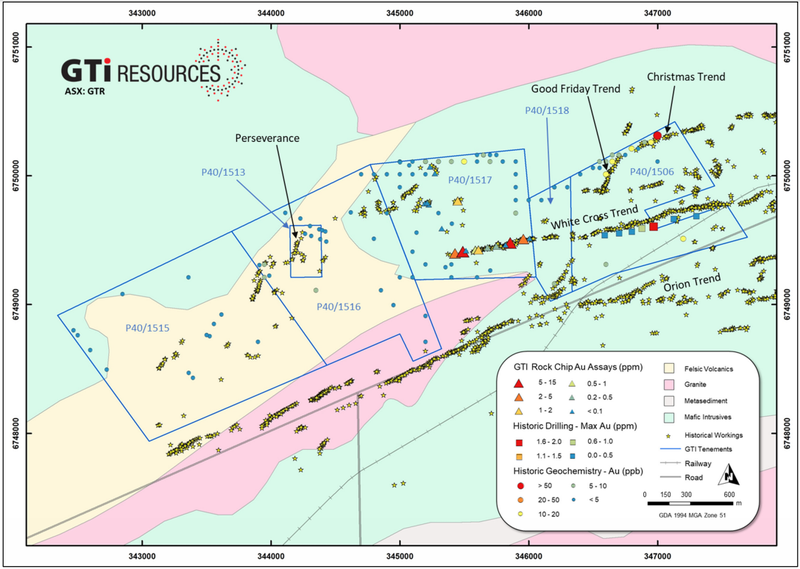

GTI awarded four new licences in Niagara District

In another promising development, GTI advised that it has been granted four new prospecting licences, P40/1515, P40/1516, P40/1517 and P40/1506, in addition to the recently acquired P40/1513 and P40/1518.

This land package now creates a significantly enlarged consolidated holding over extensive historic mine workings of the Niagara gold mining district as shown below.

The tenements incorporate the historic White Cross and Perseverance mining areas and smaller historic working trends including the Christmas and Good Friday trends.

The Orion Trend extends east north-east to the south of the tenement holdings and hosts the historic Orion/Sapphire Mine.

In highlighting the potential benefits of exploring this area more extensively, executive director Bruce Lane said, “The newly consolidated land package at Niagara, immediately to the west of our current exploration licence, offers exciting potential to properly test this historically heavily worked area using modern exploration techniques”

Nearly 2400 metres of drilling at E40/342

A total of 2,376 metres (16 holes to average depth 148.5 metres) of RC drilling was carried out over the eastern part of E40/342 and analysed for gold.

The drilling program confirmed anomalous gold with downhole assay results up to 0.98 g/t gold (NGRC08 95‐96 m), and 0.54 g/t gold intersected in NGRC01 (86‐87m) below the previous result of 2.8 g/t gold (NGAC004 19‐20m).

Drilling intersections with elevated gold assays were generally associated with logged intervals of quartz veining and the presence of pyrite in rock chips, spatially associated with significant NNE trending magnetic structures.

Correlation of downhole assay results with magnetic trends and surface features such as anomalous auger results and/or the location of historic workings has provided information that will assist in the interpretation of the primary structural trends.

The interpreted east‐dipping, NNE‐trending structures are consistent with similar structures regionally that host high profile deposits such as Cosmopolitan, Altona and Champion.

Rock chip sampling of quartz veining along the NNE trend between drilling sections 1 and 2, yielded assay results with up to 2.4 g/t gold, and these more recent results further confirm the gold anomalisms related to this trend and provide encouraging targets for follow‐up exploration.

Modern exploration methods could pay dividends at new licences

A first‐pass compilation of historic records indicate there has been little modern systematic exploration coverage of the western Niagara Project area covered by the newly granted Prospecting Licences.

Compilation of data will continue to extract additional information from older exploration and mining records in the licence areas in the lead up to planning targeted exploration activity.

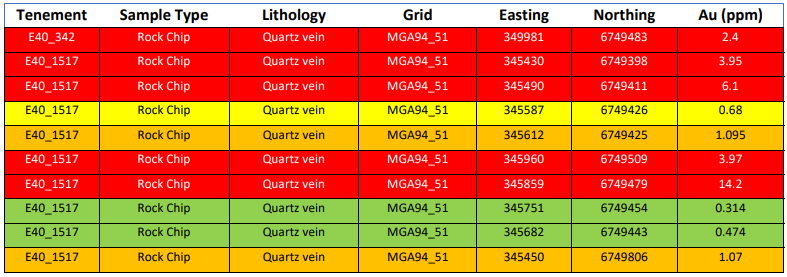

As shown below, initial rock chip sampling by CSA Global on P40/1517 associated with cuttings from historic workings along the western White Cross Trend yielded good assay results with quartz vein assays returned at 14.2 g/t, 6.1 g/t, 3.97 g/t and 3.95 g/t gold.

The data compilation suggests mineralisation associated with these workings has not been sufficiently tested at depth and therefore represent a strong target for follow‐up exploration.

Records show that modern drilling programmes are notably limited in the areas covered by the newly granted Prospecting Licences.

Only one drilling programme from Laconia Resources Limited between 4 August 2010 and 3 August 2011 is recorded within the tenement package.

The drilling sparsely tested depth extensions of historical workings on the White Cross Trend with results of up to 1.95 g/t gold.

The remaining drilling programmes in the area of interest are otherwise immediately outside the tenement boundaries and further work is required to determine the potential for drilled structures to extend into the current GTI landholdings.

The results from CSA Global Rock Chip sampling along the White Cross Trend highlights this structural trend as an exploration target for consideration, together with follow up mapping, sampling, and potential drill testing of targets within the Prospecting Licences.

Samples from E40/342 undergoing multi-element analysis

A subset of samples from the gold assays from RC drilling on E40/342 will be considered for additional multi‐element analyses.

Such multi‐element analyses will refine the geochemical fingerprint of the mineral system and assist in vectoring towards mineralisation.

Compilation of historical data over the newly consolidated Prospecting Licences will continue with an emphasis on extracting value from older exploration activities.

This information will be taken together with the current understanding gleaned from results to date, and mineralisation occurrences more regionally, to target further exploration efforts.

Planning is also underway for field programs to undertake surface mapping and additional rock chip sampling.

Further geophysical work is also being evaluated over the western-most portion of the newly consolidated land package.

Results from these activities will assist in targeting future RC drilling programs, which could test the potential for gold mineralisation at depth beneath historical workings, and additional targets as determined by ongoing work.

GTI is also preparing a fieldwork program at its uranium prospects in Utah when spring commences in March/April, and management will provide a separate update on these activities.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.