Green-Hydrogen Ammonia is coming

There is currently a global energy crisis.

Gas fired energy prices are soaring, increasing the cost of producing pretty much everything and driving up inflation.

The current push to “green energy” from solar, wind, hydro-electricity, and nuclear is being looked to as the solution for global energy security.

The problem is that building clean energy infrastructure takes billions of dollars in capex and at least 5 to 10 years to build.

But the energy crisis is happening right now.

We are seeing many companies trying to move into the Green Hydrogen space...

... but every Green Hydrogen project requires an expensive, nearby clean energy supply... and these need to be built from scratch.

This is why we think Minbos Resources (ASX:MNB) gaining access to Angola’s EXISTING, available, excess hydro-electric power, at close to the CHEAPEST RATES IN THE WORLD is one of the most significant developments in MNB’s history.

Using this ready made clean energy supply, MNB can now fast track its Green Hydrogen-Ammonia Project.

MNB is skipping years of development pain, and billions of dollars in capex funding.

Since the initial announcement 15 days ago, the market seems to have been asleep on its significance.

But it appears from today’s announcement that some bigger players HAVE noticed and made some quick moves:

To us, the interest coming from multiple parties is a significant proof point (pending MNB actually securing any deals of course) that MNB is onto something big with this project.

It is early days, but we think this fast-tracked Green Hydrogen-Ammonia Project is going to make the next six months very interesting for MNB, and will be a great source of potential share price catalysts while we wait for MNB’s original fertiliser (phosphate) project to be constructed and deliver first production.

Here is a quick, high level breakdown of the key important points from today’s news (we will then follow on with a deeper dive with more detail):

Instant, cheap, local, clean, green energy - sounds too good to be true? Here’s how it happened:

MNB has strong, existing in-country relationships in Angola, built over the last decade while it was bringing its local fertiliser (phosphate) project for food security from exploration to construction (this is the reason we invested in MNB).

Angola has always had the perfect environment for hydro electricity, and actually built an oversupply of hydroelectric dams BEFORE clean energy was cool.

With an abundance of rivers and waterfalls, the International Hydropower Association views Angola's hydropower potential as among "the highest in Africa."

A number of dams began construction in the 70s and 80s, but after the Angolan Civil War ended in 2002, hydroelectricity became a key pillar of the country's economic development.

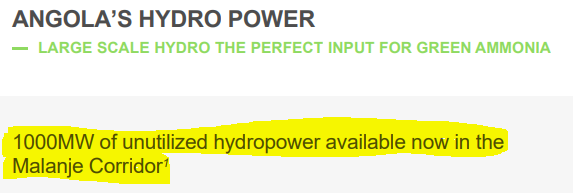

With all this hydroelectric power, Angola now has more than 1,000MW of excess carbon free hydro-electric generation capacity — residents plugged into the grid are paying nothing, and even received credits, from the national energy provider.

(To give you an idea, 1000MW would usually cost about $3BN to build).

MNB was able to quickly swoop on this opportunity to secure some of the excess, ready-to-go clean energy supply, given its track record in Angola and hard earned trust with the Angolan government.

So what are MNB going to do with rare and coveted cheap, clean energy supply?

We Invested in MNB because of its fertiliser (phosphate) project which is currently being constructed and will be in first production soon - amazing timing in a global food crisis.

For its latest project, MNB COULD use its new cheap, clean energy supply to quickly build a green hydrogen plant (with no delays or costs of a clean energy infrastructure build).

Because MNB doesn't have to build the clean energy infrastructure, any project they choose should come online very quickly and be selling product into market in the medium term.

But the green hydrogen market is only just starting to develop, which is why we really like MNB’s decision to focus on Green Hydrogen-AMMONIA.

Green Ammonia is made from green hydrogen, and it is easier to store and transport. Ammonia already has an extensive established market for fertilisers and explosives for mining.

Ammonia prices are surging because expensive natural gas is the key feedstock to produce (blue/grey) Ammonia.

We also like that the secondary market for MNB’s future green Ammonia is going to be in the fertiliser space, where they are already operating.

What happens next?

Today MNB gave us a forward plan (that has been agreed with the Angolan government) to progress the Green-Hydrogen Ammonia Project.

In order to track the progress, we have added project milestones to our MNB investment memo (where you can also read about the other objectives, risks and our investment plan):

We will be closely tracking the progress for the rest of the year. This new project has massive potential and will also keep things interesting while we wait for MNB’s phosphate project to be constructed.

With this newly announced clean energy supply and forward development milestones, MNB’s Green Hydrogen-Ammonia Project has suddenly become very real, and has already generated interest...

How will they do it?

While the market seemed to be asleep to this latest development, the industry definitely noticed. From the announcement:

Basically what this means is that MNB is in discussions with potential partners on all the key aspects to get their green hydrogen Ammonia project to life.”

Technical Partner - we have the technology experience to help build your green hydrogen ammonia plant

Investment Partner - we have the money to invest to help build your green hydrogen ammonia plant

Offtake Partner - we want to buy the ammonia the plant produces

We think if MNB secures one or more of these partners in the near term it will significantly de-risk the project (and hopefully re-rate the share price), and the unsolicited enquiries from these parties after the last MNB announcement just 15 days ago is very encouraging.

That was the quick high level overview of what has happened - now we will provide a deeper dive with more supporting info and these latest developments on our Investment in MNB.

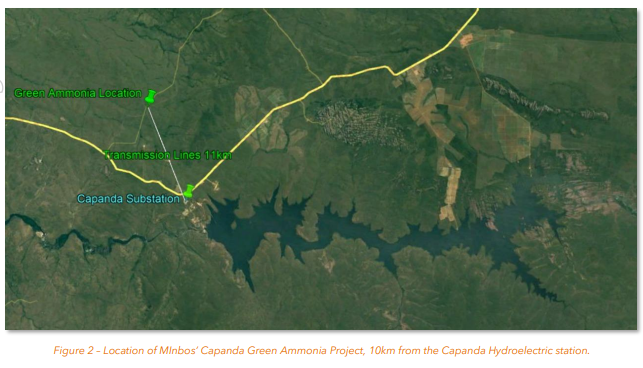

Our long term investment, Minbos Resources (ASX:MNB) has two projects in Angola — the Cabinda Phosphate Fertiliser Project, and the Capanda Green Hydrogen-Ammonia Project.

Since we first invested back in August 2020, MNB’s work to provide fertilisers to tackle food security in Africa has been the central reason for holding the stock.

In an announcement this morning, and as we pointed out above, MNB revealed that it had received “significant enquiries” from potential technical, offtake, and investment partners for its Green Hydrogen-Ammonia Project.

MNB’s Green Hydrogen-Ammonia Project looks like it's going to give us plenty of share price catalysts over the next 6-12 months while the phosphate project is moving toward construction.

The reason behind all the interest in partnering with MNB is the low cost of its energy supply, since the biggest input cost of Hydrogen-Ammonia Plants is the energy.

You may have noticed that ‘hydrogen’ and ‘ammonia’ are often used interchangeably here. That’s because hydrogen is created through the process to power the plant through the electrolysis process, and after separation, the end result is creating ammonia. At this stage MNB isn’t planning to create hydrogen as a stand alone product as it makes more sense to make ammonia-based products — fertilisers and explosives.

What separates MNB from other ammonia projects globally is the company’s access to the cheapest, greenest power globally and with no large CAPEX costs attached.

Its Angola location provides access to some of the cheapest energy prices globally (at 1.7c/kWh, as compared to the 15.7c/kWh industrial price in Australia) thanks to the country’s extensive hydro-electric capacity. And having operated in the country for years, MNB has an excellent relationship with the Angolan government (it has been allocated land from the government’s Agricultural department for its ammonia project, while its hydro-electric power came from the energy department).

Those relationships have now seen MNB secure 200MW of power at just US$0.011 (1.1c) per kilowatt hour over 25 years — that’s ~90% cheaper than the US$0.157 that industry is paying for power in Australia.

MNB today confirmed its long term supply agreement with Angola’s power authority for 200MW of zero carbon hydroelectric energy, meaning it has the biggest cost of a Hydrogen-Ammonia plant sorted.

With this cheap supply, MNB’s Green Hydrogen-Ammonia Project is in the top percentile of commercially viable projects worldwide, even if gas prices were to fall back to long term prices.

It also puts MNB ahead of most (if not all) of its ASX-listed peers, giving MNB a significant time, infrastructure spend, and power pricing advantage.

Making it even more attractive is that most of the other hydrogen-ammonia plants globally are formerly blue, or gas powered, and MNB is green (100% powered by renewables). So not only is it cheaper, but it has a zero carbon green ammonia product.

MNB also confirmed today it had banked another $2.4M in cash from the sale of a non-core Madagascan project, which adds to its cash on hand at the end of last quarter of $3.33M.

MNB is currently capped at less than $70M, and now with access to some of the cleanest and cheapest energy in the world, we think its got significant upside in the years to come.

MNB’s Zero Carbon Green Hydrogen-Ammonia project

There are four key advantages that MNB’s hydrogen-ammonia project has over all of the facilities already built globally.

These distinct advantages make MNB’s project truly unique and more importantly will mean that in a climate conscious world MNB can produce Ammonia products that are not only more competitive from a cost perspective but are “Zero Carbon” sourced.

The four advantages are as follows:

- MNB has secured a CHEAP, carbon free power source in Angola - home to some of the cheapest electricity in the world.

- Carbon-free power sources are expensive to build - MNB are tapping into already EXISTING carbon free electricity generation infrastructure.

- Ready market for its ammonia products

- Optionality to produce both explosives and nitrogen based higher value add fertilisers.

First, the Zero Carbon hydro-electrical power source.

Today, MNB announced that it has received an updated resolution from RNT-EP, Angola’s power authority, regarding a long term supply agreement of 200MW of zero carbon hydroelectric energy for MNB’s Green Hydrogen-Ammonia Project.

The agreement provides MNB with long term power and price security with MNB to receive zero-carbon hydropower over the 25 year term at some of the cheapest prices in the world.

The updated resolution confirmed the key commercial parameters of the deal, including:

- Initial 100MW at $US0.004 (0.4c) kilowatt hour for 5 years, then 0.8c kilowatt hour for 20 years.

- Subsequent 100MW at $US0.015 (1.5c) kilowatt hour for 25 years.

This translates to a weighted average cost of power of US$0.011 (1.1c) per kilowatt hour over 25 years.

For some context this is ~90% lower than prices available to industry in Australia, which pays around US$0.157 (15.7c) per kilowatt hour and it is 55% cheaper than natural gas prices in the US (based on a US$7.18 per MMBTU (million British thermal units) gas price).

The one that really jumps out to us is the comparison to natural gas prices in Europe, where natural gas recently hit US$8.80 per MMMBTU, while in Europe the natural gas touched US$36.60 per MMBTU, ~500% higher than the reference price MNB used in this today’s announcement.

Second, is the fact that Angola is home to >1,000MW of excess carbon free hydro-electric generation capacity.

The most expensive input cost when developing any “zero carbon” project is by nature making sure that the key inputs that go into producing said good comes from carbon free sources.

For a green hydrogen-ammonia project, the most important input cost is energy.

This is where MNB’s project again benefits from its geographical location - located in Angola where there is >1,000MW of carbon free spare hydroelectric power capacity that is currently untapped.

Today’s announcement sees MNB secure the first 200MW of power supply, but more importantly the country has a vast carbon free power supply source that underwrites MNB’s green hydrogen-ammonia plant.

To really understand how much of a benefit this is it's important to understand just how expensive it can be to build out renewable energy infrastructure. For reference, the development of a 113MW wind farm in NSW cost ~$240M in 2017 translating to ~$2.2M per MWH.

This was in 2017 though so accounting for all of the recent inflation, this would likely cost upwards of $3M.

If MNB had to develop the ~1,000MW of renewable energy generation capacity, then automatically any feasibility study into a new green hydrogen-ammonia plant would include $3 billion + in upfront infrastructure CAPEX.

MNB is in the unique position where all of this infrastructure is already in place, and it can tap all of this carbon free power without any of the upfront capital costs.

Third, MNB’s location in Angola is central to mining companies that are in desperate need of mining explosives, plus there’s the much discussed African agricultural industry in need of fertilisers.

Most of MNB ammonia production will be for explosives for some of the biggest mines in the world that are just over the border in the DRC, as well as in South Africa and other surrounding countries.

Explosives for mining are a massive import cost for these big mining companies — they’re typically around the third biggest OPEX cost for a mining company and these mining companies in the DRC can be spending tens of millions of dollars on explosives. Consider that when mining copper, for example, a lot of dirt must be moved to get a small amount of copper, this requires a lot of explosives.

Currently, there is no local production of explosives, so as the only African-based producer of mining explosives, MNB will be able to take its ammonium nitrate — the explosives byproduct — and send it over the border.

This is home to some of the biggest mining corporations in the world, and they can all be accessed through road and rail networks from Angola right into the DRC. Many of those mining operators actually export their product out of Angola, giving the rail networks.

As you can see below, there is a rail network from the Capanda substation, which is just 11km from the Green Ammonia project.

And finally, MNB has the optionality to produce both explosive and high value nitrogen based fertilisers.

Ammonia-based explosives are fundamental to mining operations all across the world and this makes up one of the biggest input costs in mines globally.

With Africa being seriously resource rich we expect mining activity across the continent to grow exponentially which will in turn drive more demand for locally produced ammonia products.

The second advantage for MNB comes from its ability to produce higher value add nitrogen fertilisers. That’s because ammonia is the key ingredient in producing “nitrogen fertiliser” — a mix of phosphate and nitrogen.

MNB will have its operating phosphate project which it can supplement with ammonia produced from its zero carbon hydrogen-ammonia plant.

Nitrogen-based fertiliser is important in the agricultural industry, specifically because of the impacts on crop yields. Consider that without nitrogen fertilisers, US corn producers’ crop yields would decline by an estimated ~40%.

This is particularly important in Africa where low fertiliser consumption, and ultimately lower crop yields, ultimately comes down to a lack of access to cheap domestic supplies.

Basically, MNB will be able to produce cost effective, zero carbon hydrogen-ammonia that it can then use to build out a standalone business in the ammonia nitrate explosives industry and supplement its existing fertiliser business with higher value add nitrogen fertiliser products.

A two pronged approach that ASX listed ammonia producer Incitec Pivot (capped at $7 billion) announced this week: Incitec Pivot bucks demerger trend – UBS, Macquarie tapped.

Just look at Incitec Pivot’s latest results. It announced a record 1H22 performance (explosives/fertiliser product mix) with NPAT of A$384m for 1H22, an increase of A$348m compared to A$36m in 1H21. From its H1 report on the Ammonia Price:

“ A significant upswing in ammonia prices, which began in 2H21 and continued through 1H22, driven by high European gas prices impacting supply, favourably impacted earnings. Gas input costs increased during the period as a result of higher local demand and increased gas exports.

MNB receiving unsolicited enquiries for technical, offtake, and investment partners

As we highlighted above, an interesting takeaway from today’s announcement is that MNB has already started to receive “a number of unsolicited enquiries” from parties interested in partnering in the project.

MNB has confirmed that the interest is mostly around “potential technical, offtake and investment partners with a variety of opportunities”, which is no surprise considering all of the unique competitive advantages that we have touched on in today’s note.

The interested parties are well aware of where MNB is trying to take this project and think that the project is compelling enough to want to get in at the very early stage. We consider the fact that MNB is “focused on progressing the opportunity with suitable technology partners” so early in the development of this project to be an extremely positive sign.

MNB specifically cited the following reasons for interest in the project:

- Recognition that surging natural gas prices are squeezing industrial sectors and the attractiveness of the concessional pricing of the Zero-Carbon Hydropower franking the Green Hydrogen-Ammonia project opportunity. Basically, market participants in the hydrogen-ammonia space have noticed the CHEAP power source and the potential to develop a cost competitive carbon free ammonia manufacturing plant.

- Interest in the long-term supply of Ammonia Nitrate for industrial uses (mainly drill and blast mining activities) in the Africa region. Here, market participants are clearly looking at the growth trajectory of the African mining space and can see that domestic production of ammonia based explosives could become a lucrative market.

- Heightened interest in the Green Hydrogen-Ammonia investment thematic and its ability to improve sustainable agricultural and food security. There is clear recognition from interested parties of the need to produce nitrogen based fertilisers with the ammonia that’s produced via a carbon free source.

The company remains focussed on progressing the opportunity and has commenced meeting with suitable technology partners.

As good as that is, attracting a big name technology partner is actually not the main story here.

Rather, it’s an outcome of MNB having ready access to the world’s cheapest energy supply in combination with ready markets that are desperate for ammonia (let alone the even more in-demand Green Ammonia).

What’s next for MNB?

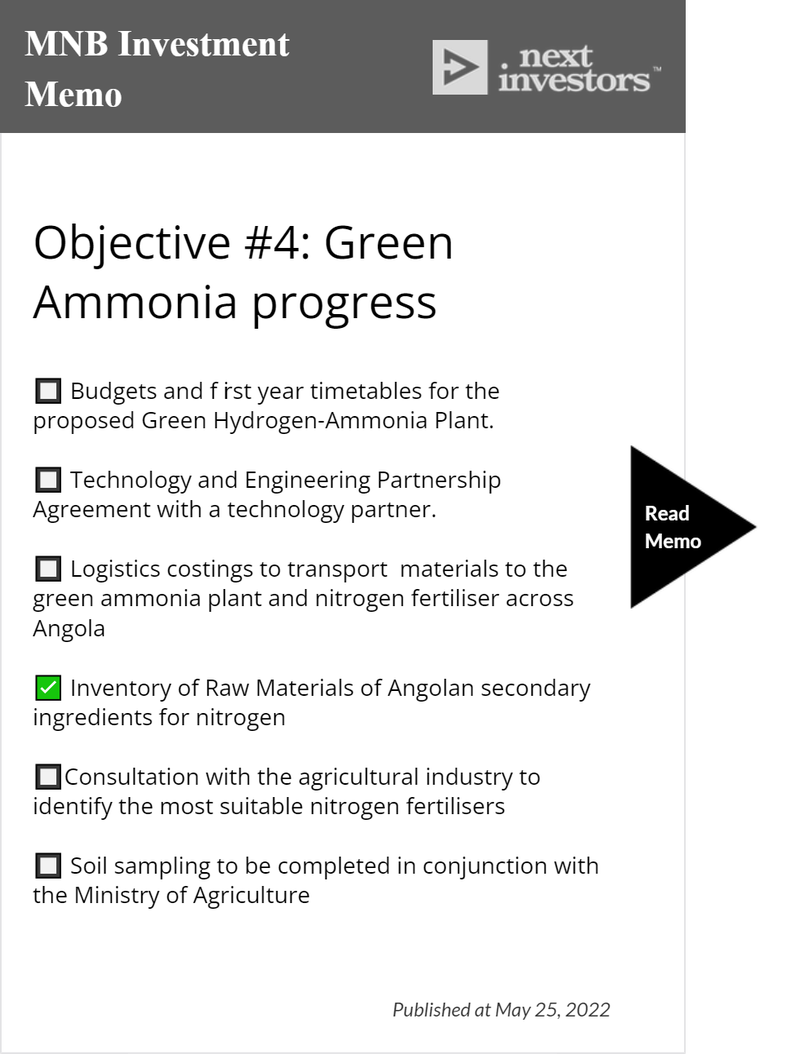

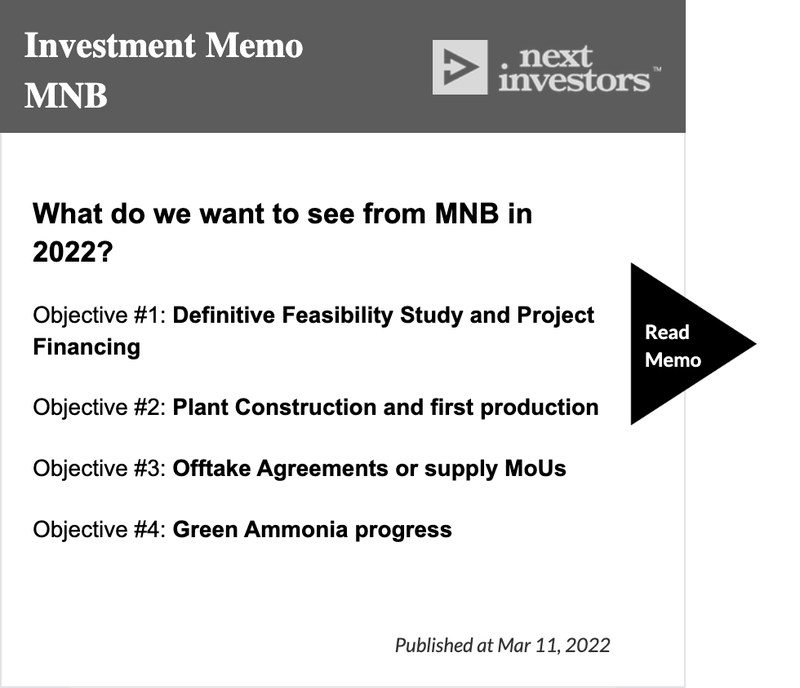

In our MNB Investment Memo in March we identified progress on MNB’s Green Ammonia strategy as the #4 Objective that we wanted to see the company achieve in 2022.

At the time, we said we wanted to see MNB “make progress with the sourcing of renewable energy power and to sign technology partnerships for the development of the plant”.

Given today’s announcement, in combination with unexpected developments in commodity markets this year and the fact that the original phosphate mine is in the less exciting "construct phase", we have followed MNB’s lead and have elevated ‘progress on its Green Ammonia Project’, with this exciting development project a main objective.

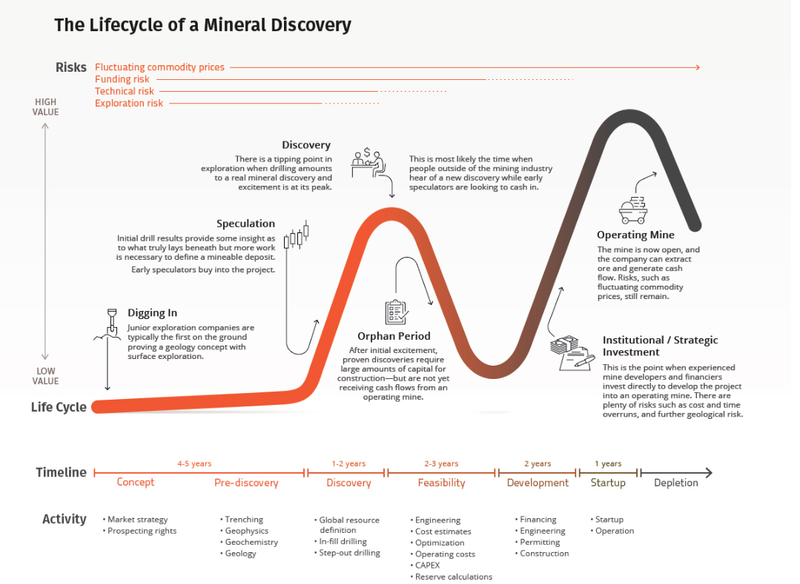

As you can see on the chart below, the feasibility and development phases are the quiet execution phases ahead of development - this is where MNB’s Cabinda phosphate project is at currently.

MNB’s is continuing to proceed towards Definitive Feasibility Study (DFS) completion at its Cabinda Phosphate Project.

The proposed quality (grade and impurities) of the phosphate from the project has seen MNB receive initial enquiries from potential Chinese partners and established battery producers in regards to its use in producing Lithium Iron Phosphate batteries (LiFePO4 or LFP).

These batteries offer multiple benefits compared to lead-acid batteries and other lithium batteries. They have a longer life span, require no maintenance, are extremely safe, lightweight, and have improved discharge and charge efficiency, to name a few.

Having now divested its Madagascan Rare Earths Project, MNB can apply the A$2.4M proceeds to complete the DFS for Cabinda, along with funding studies for the Capanda Green Hydrogen-Ammonia Project.

Interestingly, the company today announced a set of milestones that really lays out what we can expect over the coming year.

Most importantly, these milestones were set up as part of the negotiations with the government so MNB are basically making a promise to the Angolan government that they will make good on these.

The key milestones and studies outlined by MNB in relation to the Green Hydrogen-Ammonia project are:

- Budget and first years’ timetable for a market assessment study, for the proposed Green Hydrogen-Ammonia Plant.

- Technology and Engineering Partnership Agreement to be executed with a preferred technology partner.

- Transport Logistics Study to analyse the cost of transporting the materials for the Green Ammonia plant and the cost of transporting nitrogen fertilisers to the agricultural regions of Angola.

- Inventory of Raw Materials of Angolan secondary ingredients for nitrogen fertilisers, including Sulphur, Limestone, Dolomite, Phosphate, Potassium.

- Agricultural Stakeholder Consultation with nutrient users, importers, distributors and agronomists to identify the most suitable nitrogen fertilisers, climate, soil fertility, available raw materials and agricultural production forecast.

- Soil Sampling to be carried out in conjunction with the Ministry of Agriculture and covering approximately 10 million hectares of agricultural land.

MNB ticking off our objectives

All this is not to say that MNB’s Phosphate Project is no longer a focus.

Completion of the DFS for the Phosphate Project was the #1 Objective that we wanted to see MNB achieve this year and today’s announcement confirmed that funds from the Madagascar divestment would provide support on that front.

Further, the company has reported on some positive signs in regards to securing offtake agreements or supply MoUs for the phosphate project — the #3 Objective that we listed for the year.

Since we invested in MNB in August 2020, we’ve extensively covered the need for fertiliser and hence phosphate across Africa’s agricultural sector.

Since MNB announced two weeks ago that it had secured 200MW of Zero-Carbon hydro-electrical power (at some of the cheapest electricity prices possible globally) and has advanced the proposed Green Hydrogen-Ammonia Project, the company has been inundated with opportunities, requests, and potential partners in regards to its Green Hydrogen-Ammonia Project.

MNB 2022 Investment Memo

Our “Investment Memo” is a short, high-level summary of why we continue to hold a position in MNB and what we expect the company to deliver in 2022.

We’ll be using these Investment Memos as a way to assess the company’s progress over 2022 and also examine how our investment thesis plays out throughout the year.

In our MNB Investment Memo you’ll find:

- Key objectives for MNB in 2022

- Why do we continue to hold MNB

- The key risks our investment thesis

- Our investment plan.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.