GGE going after helium in the USA for US$260BN in chip facilities

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 32,510,000 GGE shares at the time of publishing this article. The Company has been engaged by GGE to share our commentary on the progress of our Investment in GGE over time.

In August, the US Government officially signed into legislation the “CHIPS for Science Act”.

CHIPS is a US$52.7BN signal of intent to re-shore and build out a domestic semiconductor manufacturing industry.

Private capital took that signal and ran with it - making ~US$260BN in commitments from companies like Intel, Samsung and Micron Technologies for US based semiconductor facilities.

All of this capital being invested in the US semiconductor manufacturing industry means that demand for the critical raw materials used to produce them will increase.

And one of those materials is helium.

Helium, as an “inert” gas, is irreplaceable in the semiconductor manufacturing process.

Increased US domestic helium demand is one of the reasons we are Invested in our 2021 Catalyst Hunter Pick of the Year Grand Gulf Energy (ASX:GGE) who is developing a helium project in the US.

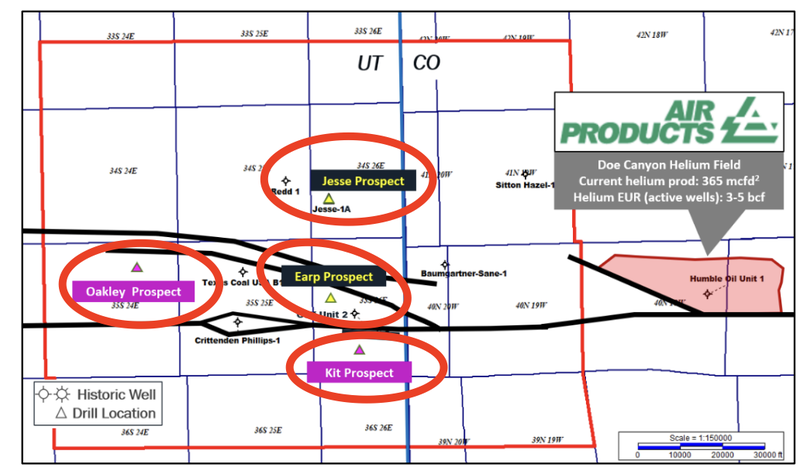

Only five months ago GGE made a new US based helium discovery in Utah, within 20 miles of two helium producing plants and adjacent pipeline infrastructure.

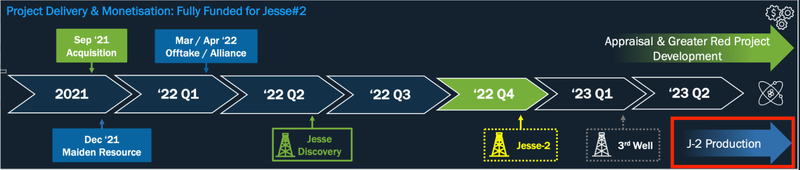

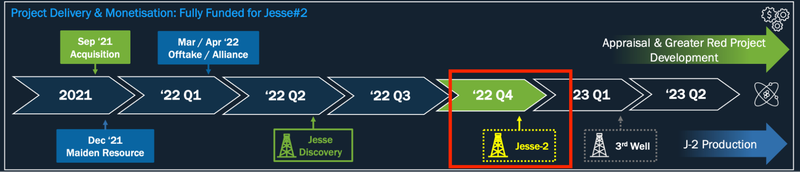

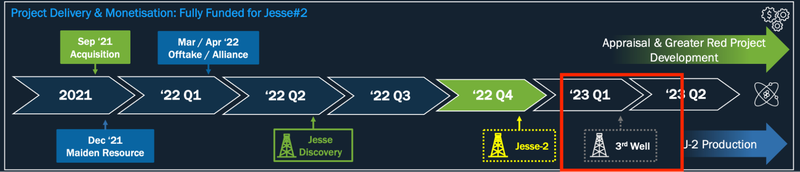

GGE is now following up that discovery with its second well - the fully funded Jesse #2 well which GGE expects to drill late Q4-2022/early Q1-2023.

The ultimate aim for the program will be to show GGE can produce a commercially viable flow rate from its discovery.

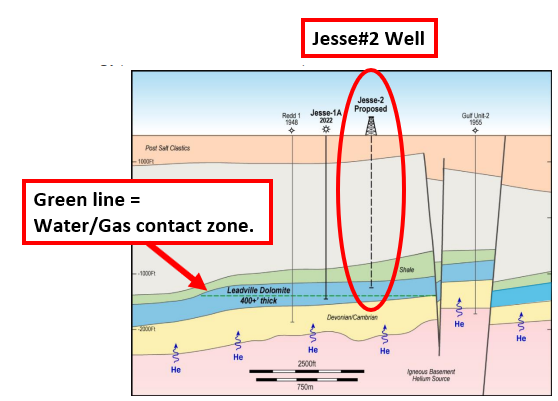

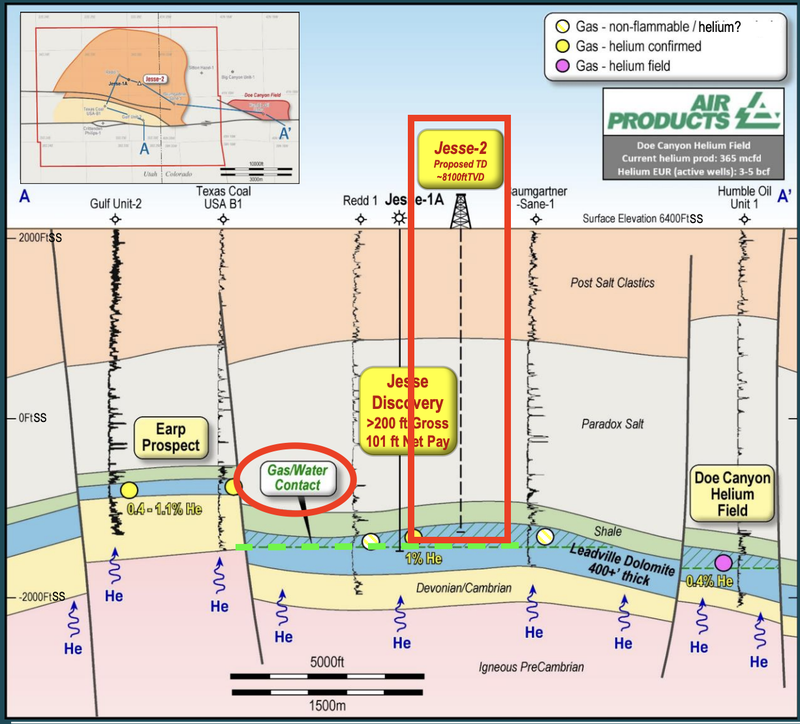

In June, GGE’s discovery well (Jesse #1A) hit ~31m of net helium pay at grades of up to 1% helium BUT it fell short of a flow rate because the drilling program went through the gas/water contact zone.

With its second well (Jesse #2), GGE will be applying all of the learnings from Jesse #1A, historic wells drilled in the area and the 2D seismic data on hand, to increase its chance of getting a flow rate.

The main point of difference for Jesse #2 is that GGE will be looking to avoid the single biggest issue that prevented a flow rate in its first well.

This issue was that the drill intersected the gas/water contact zone that prevented GGE from securing a stable, commercially viable flow rate.

GGE’s plan is to drill ~16m above the gas/water contact zone to avoid the area which is full of fluids and enable gas to flow to the surface freely.

This contact zone is highlighted by the dashed green line, and as you can see the Jesse #2 well will stop just short of this zone:

This drilling event has the sole purpose of securing a “flow rate” and fast tracking GGE’s evolution into a US helium producer.

GGE has two out of the three of the key pieces of information needed for its project to deliver commercial quantities of helium to buyers for its Jesse prospect, but is yet to prove a commercial flow rate.

For GGE to deliver a commercial helium project it needs:

- ✅ A proven helium structure: A >61m gross gas column (with ~31m of independently audited net pay)

- ✅ Commercial helium grades: Helium grades of up to 1% returned to surface (higher than our 0.4% expectation)

- 🔄 Commercially viable flow rate: GGE’s Jesse #2 well will be drilled for this

Going into this round of drilling GGE is not looking for a working helium system but rather looking to produce a commercially viable flow rate.

We are hoping GGE successfully delivers a flow rate and have set up our expectations for the drilling program as follows:

- Bullish case (exceptional result) = Raw gas flow rate at or above 10mmcf per day with helium grades >0.4%.

- Base case (good result) = Raw gas flow rate of between 5-10mmcf per day with helium grades >0.4%.

- Bearish case (poor result) = GGE fails to produce a flow test.

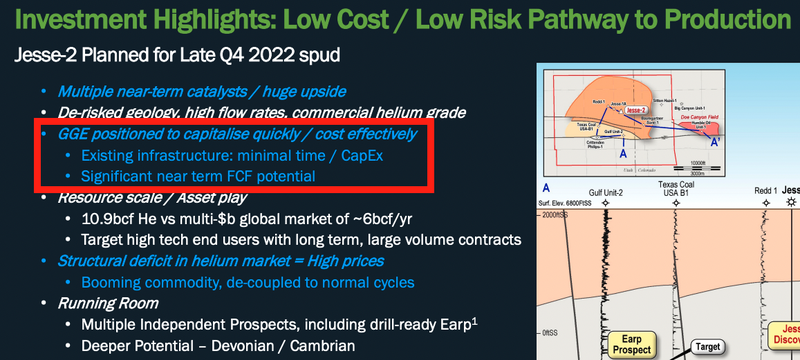

We think that IF GGE can prove a commercial flow rate it will be able to move the Jesse prospect quickly into production.

This is because GGE has an “infrastructure advantage”.

GGE’s project, located in Utah USA, is in close proximity to an idle pipeline that runs directly to Paradox Resources’ Lisbon Helium Plant, with whom GGE has an offtake agreement.

Discoveries can often be stranded as projects require a lot of capital and feasibility studies to justify building processing plants, and pipelines - even if commercial discoveries are made.

However, because of the infrastructure advantage and existing offtake agreement with Paradox Resources, GGE could be in a position where it can start selling its helium with very minimal CAPEX and in a shorter period of time.

This is all predicated on GGE securing a commercial flow rate from its Jesse prospect. Which, like all exploration drilling, is not a guarantee.

However, working in GGE’s favour are the key learnings taken from the Jesse #1A drill campaign and 2D seismic data on hand to give itself the best chance of securing a flow rate.

We also note that the nearby Doe Canyon helium field (which produces up to 50% of North American helium) is producing at ~20mmcf per day with helium grades of 0.4% from over 17 different wells.

Therefore we expect GGE to continue to try and prove commercially viable helium wells even if the Jesse #2 well is a success.

In its presentation released today, GGE has highlighted the “significant near term free cash flow potential” if it can move quickly to production.

This means that GGE may be able to offset the cost of future wells with cash generated from the Jesse prospect.

For some context, market prices for helium have increased by over 300% (to US$2,000/mcf) in the last 12 months due to a lack of supply.

Also, with bi-partisan support for the CHIPS Act, it appears that a lot of semiconductor manufacturing will come online in the US in the next two to three years.

So it's a good time to be exploring for helium and we think that the stars could align for GGE if it manages to secure a commercial flow rate.

This brings us to our “Big Bet” for GGE:

Our ‘Big Bet’

“GGE makes a commercial helium discovery, ties it into the existing local processing infrastructure, and becomes a USA helium producer - or gets taken over.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GGE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress GGE has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following GGE “Progress Tracker”:

See our GGE Progress Tracker here:

More on GGE’s Jesse #2 well.

Last week GGE confirmed the location and well design for its second well.

The ultimate aim for this round of drilling will be to get a commercially viable flow rate so that GGE can put its helium discovery at the Jesse prospect into production.

The drilling program will following up GGE’s discovery well (Jesse #1A) which fell short of a flow rate because the drilling program went through the gas/water contact zone.

With its second well, GGE has applied all of the learnings from Jesse #1A, historic wells drilled in the area and the 2D seismic data on hand, to increase its chance of getting a flow rate.

GGE’s plan is to drill ~16m above the gas/water contact zone to avoid the area which is full of fluids and enable gas to flow to the surface freely.

Below is GGE’s well design and the gas/water contact zone is marked with a green dashed line.

Why we like the Jesse #2 well strategy?

Small cap exploration stocks have a finite amount of cash and resources to make a commercial discovery, before needing to raise capital again from the market and dilute existing shareholders.

Companies will need to make decisions as to where to allocate that capital, to get the best chance at making a successful discovery.

GGE could have chosen to allocate its remaining capital (around $7M as of 30 September 2022) to drill its other prospects where it could look to make new, completely independent discoveries.

Instead, the company has decided to go back to the Jesse prospect in order to find the last piece of the puzzle - a commercial flow rate.

We like this approach because of the four following reasons:

- GGE already has a discovery - GGE has already confirmed a discovery with helium grades of up to 1% and a productive/strongly pressured reservoir at 2,465 psi.

- Improved well design - GGE with the learnings from its first well (Jesse #1A), historical well data and the 2D seismic data in the area has designed the Jesse #2 well aiming to avoid the gas/water contact zone by drilling down to a depth ~16m above it.

- Surrounded by existing infrastructure - GGE’s discovery sits less than 20 miles from two helium plants and has pipeline infrastructure running adjacent to it. This means that if GGE can successfully obtain a commercial flow rate, the company will be able to tie in the discovery and start producing helium.

- Offtake and strategic agreement in place - GGE already has an offtake agreement signed as well as a strategic agreement with Paradox resources the owner of the nearby Lisbon helium plant.

All of this means that if GGE can secure a commercial flow rate it can quickly start producing and selling its helium.

However, if a commercial flow rate is not secured, it will be back to the drawing board for GGE and the company may need to look to another one of its prospects to again make a discovery AND secure a commercial flow rate.

Despite all of the learnings that went into designing the Jesse #2 well, there is no guarantee that the company will be able to produce a flow test.

There is always a risk that the reservoir unit is not able to produce helium to the surface.

GGE has a strong cash balance:

Generally, when small cap companies are going into drilling programs, they will need to raise capital to finance the program.

GGE on the other hand is going into this drilling program with a relatively strong balance sheet after raising $11M at 4.4c per share earlier in the year. Whilst doing the raise GGE also mentioned that the funds would be used to finance TWO exploration wells.

As of 30 September 2022 GGE holds a total of $7.1M cash in the bank

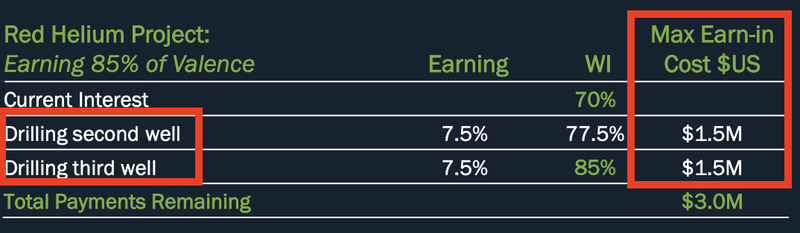

As part of its earn-in agreement for its helium project, GGE needs to fund US$1.5M of its next two wells.

At current exchange rates, GGE’s current cash balance should be enough to finance both of these wells assuming there are no cost overruns and that those estimates are correct.

Our new GGE Investment Memo:

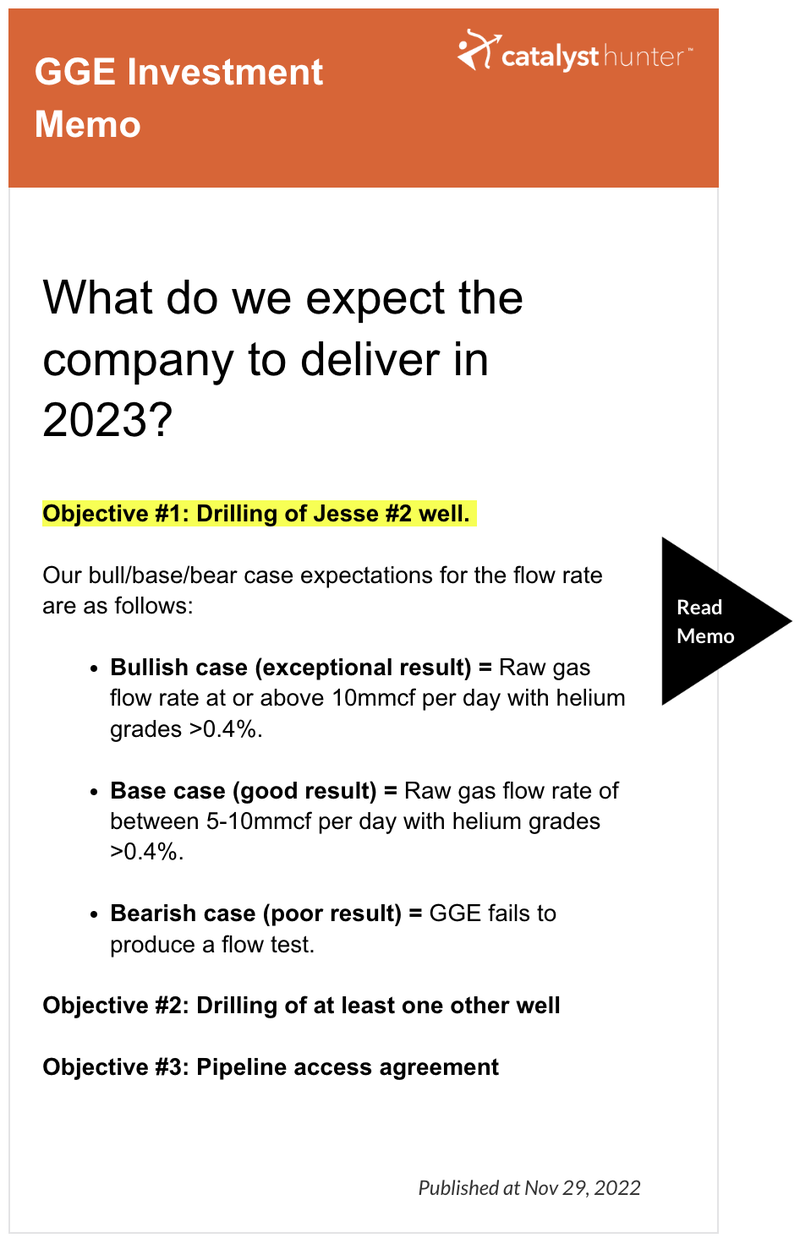

Today we are also launching our new GGE Investment Memo which is a short, high level summary of our reasons for holding GGE in our portfolio.

The ultimate purpose of the memo is to highlight the objectives, milestones and risks that the company will need to navigate over the next 12 months.

We also use the memos as a benchmark to assess the company’s performance, as well as a record of our investment plan for each company.

We only update Investment Memos when one of five “memo revision conditions” have been met. In GGE’s case the company meets the following condition:

“MEMO REVISION CONDITION 1: Times up (12 months). Our review process is completed”

🎓 To learn more about what type of company events trigger an update to our Investment Memo’s check out our educational article here.

With GGE now having confirmed the location of its next drill program we thought now would be the perfect time to close our 2022 GGE Investment Memo and launch a new Investment memo detailing what we want to see the company achieve in 2023.

As part of this process, we think that GGE has “OVERPERFORMED” on its first Investment Memo, given that it discovered a working helium system, signed an offtake agreement and we managed to nearly Free Carry our Initial Investment in the lead up to the drill campaign.

To see our grades for each of the memo items including our take on the Investment Thesis, Macro Themes, Objectives and Risks, click here for GGE memo retro.

As for our new 2023 Investment Memo we have set the following key objectives we want to see the company achieve:

In our NEW GGE Investment Memo you will find the following:

- Key objectives we want to see GGE achieve

- Why we are Invested in GGE

- What the key risks to our Investment thesis are

- Our Investment plan

CLICK HERE TO SEE OUR NEW 2022 GGE INVESTMENT MEMO

What’s next for GGE?

Drilling of Jesse #2 well 🔄

This is the next big catalyst we are watching out for.

GGE expects the Jesse #2 well to be spudded late in December/early Q1-2023 which means we don't need to wait very long for GGE to start drilling.

Permitting for a third helium well 🔄

GGE also confirmed in its most recent announcement that permitting was underway for a third well in early 2023.

In a previous GGE note, we covered the potential exploration upside at GGE’s project.

Here are the two key takeaways from that note:

- GGE has identified three NEW potential drill locations in addition to the Jesse Prospect

- GGE has identified four mature step out drilling locations at the Jesse Prospect

See our deep dive on those prospects in a previous note here: GGE Hits Gas Column. Flow Rate and Helium Concentration to be Tested Next.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.