FYI receives positive ESG rating from Sustainalytics

Published 16-JUN-2021 09:39 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FYI Resources Ltd (ASX: FYI; OTCQB: FYIRF; FSE: SDL) has received an impressive initial result for its inaugural Environmental, Social and Governance (ESG) rating, rewarding the initiatives management has undertaken in order to develop a strong and professional corporate culture, ideals that are being increasingly recognised across the investment community at retail and institutional levels.

FYI is positioning itself to be a significant producer of 4N and 5N HPA in the rapidly developing high-tech product markets.

HPA is increasingly becoming the primary sought-after input material for certain high-tech products principally for its unique properties, characteristics and chemical elements that address those applications’ high specification requirements such as LED’s and other sapphire glass products.

Environmental, Social, and Corporate Governance (ESG) refer to the three central criteria of the sustainability and societal impact of a company.

Analysis of these criteria is considered to help to better determine the future financial performance and potential investment merit in a company and to promote a sustainable business model while also assisting with the company’s contribution in fundamentally reshaping the global economy with a change to its attitude and mindset via the goal to achieve net zero carbon emissions.

The independent ESG rating service company, Sustainalytics, a Morningstar Inc company, provides a best-in-class analysis and methodology to measure a company’s exposure to industry specific ESG risks and consequently rates how well a company manages those risks.

The ratings are comparable across peers and sub-industries.

ESG recognition comes on the back of MSCI inclusion

It was just last month that FYI’s investment credentials received another lift with the group being added to the MSCI Australia Micro Cap Index which is designed to measure the performance of the microcap segment of companies traded on the ASX.

This was the catalyst for a 10% share price increase with investors realising that inclusion in the MSCI would provide increased exposure to global institutions and investment markets and the potential for liquidity to increase, providing better access to capital sources and the ability to negotiate finance on competitive terms.

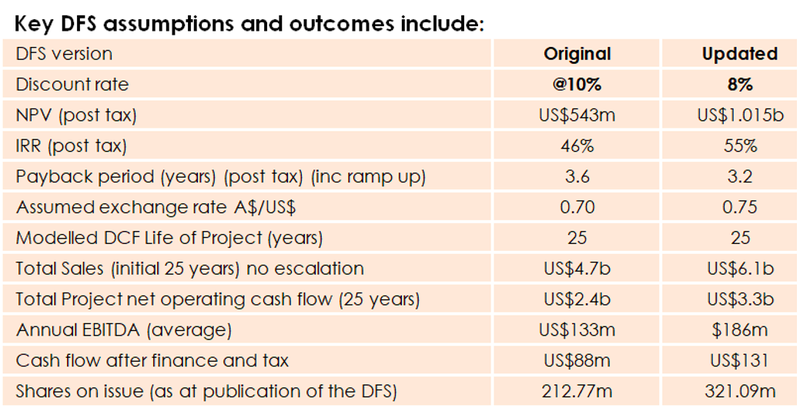

However, even after this rerating, FYI presents as undervalued with its market capitalisation of approximately $200 million failing to capture the compelling metrics of its High Purity Alumina Project.

It is worth noting that FYI’s shares are trading close to their 12 month high, and with the company undertaking inclusive negotiations with Alcoa Australia Ltd regarding a possible High Purity Alumina Project Joint Venture a potential development is looming that would have a decided impact on the company’s share price.

FYI measured against 14,000 global industry participants

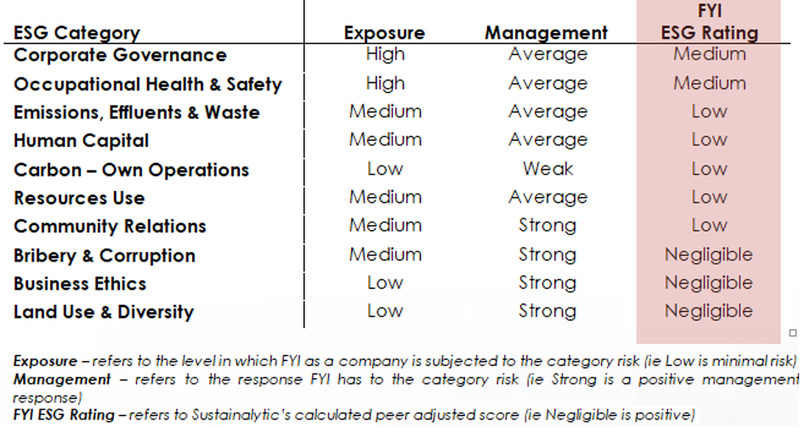

Harking back to the ESG evaluation process, Sustainalytics has calculated FYI’s initial ESG rating measured against their universe of approximately 14,000 global industry participants, including a sub-industry category of 153 direct peer and competitor companies.

FYI will apply both an ESG and economic overlay to the company to ensure long-term sustainable and shareholder value is created via the development of its innovative, high quality, ultra-pure HPA project.

Sustainalytics has calculated FYI’s initial ESG rating based on the group’s stringent evaluation process.

FYI achieved an impressive overall ESG rating of 28.0 (out of 100) and a ranking of 9th out of 153 peers, placing it in the top 6th percentile.

The company was top-ranked in three categories and top 5 ranking in a further five categories.

This ranking equated to an adjusted “Medium” score, and it is important to note that no company in the peer group achieved a “Low” score due to Sustainalytic’s strict analysis methodology.

Reaffirming FYI’s dedicated commitment to ESG principles, managing Director Roland Hill said, “FYI is committed to developing and continuing a strong corporate culture to implement our ESG objectives.

"FYI’s goal is to efficiently manage and grow our business under a defined ESG framework and to progressively improve the company and its ESG standards.

"It is pleasing then, to receive our inaugural ESG rating from a globally respected agency.

"The rating itself is outstanding in the context of our peer group results and provides an excellent platform on which FYI can develop and improve our ESG aspirations.’’

Importantly, the company’s ESG framework not only provides transparency over its own ESG management and activities, it also includes full traceability of the group’s entire integrated supply chain, allowing for confident verification of the quality and ethical origins of its HPA.

The following table underlines FYI’s performance across the various categories.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.