Full Steam Ahead - MNB to assemble fertiliser plant

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,645,000 MNB shares and 1,562,500 options at the time of publishing this article. The Company has been engaged by MNB to share our commentary on the progress of our Investment in MNB over time.

Very few small cap resource companies ever actually build a revenue generating mine.

But it looks like this one will.

Dozens of shipping containers are en route to the Port of Cabinda in Angola heading for Minbos Resources’ (ASX:MNB) phosphate fertiliser project.

The containers are packed with the final components and equipment for MNB’s phosphate (fertiliser) plant.

From the port, the containers will be trucked 16km to the plant site for final assembly.

These are the last of the parts that will be assembled into a 187,5000 tonne p.a phosphate plant, ahead of first production that’s on track for the second half of 2023.

Ultimately, MNB wants to expand to two plants, supporting a 20 year project life that will deliver project gross revenues of over US$1.4BN.

As for the source of the phosphate that will be processed at MNB’s fertiliser plant — the Cácata phosphate deposit, which is located some 36km down the road from the plant — MNB has confirmed that initial construction activities remain on target and within budget.

All this means our 2022 Wise-Owl Pick of the Year should make the leap from a developer to a revenue generating producer by the second half of 2023.

Out of all the small cap resource Investments we have made since 2019, MNB is now leading the race to deliver us the first constructed mine, processing plant, and revenue from production.

Manufacture of the plant was completed in the USA by global engineering and equipment manufacturer, FEECO, before being loaded onto the ship at the Port of Houston ahead of shipment to Angola.

Here’s the plant’s dryer being loaded onto the ship:

This final shipment of the fertiliser plant’s components follows the first of this consignment that landed in Angola at the end of December.

Seven 40-foot containers arrived in the Port of Cabinda, Angola, last month containing conveyor belts, twin screens and vehicles.

The latest shipment comprises:

- Twenty-one 40-foot and two 20-foot containers containing the crusher, bin activators, crossbelt magnets, polishing screens, dust collectors, screw conveyors and conveyor belts and nine breakbulk pieces from the Port of Houston.

- A further five 40-foot and one 20-foot containers, including a truck unloader, have left the Port of Hong Kong.

It's basically one giant Lego set that the MNB team on the ground in Angola will put together to build this phosphate processing plant:

Here are some of the plant components arriving in Angola:

While awaiting the shipment, MNB is getting its house in order, preparing to ramp up engineering, procurement and construction management activities once the ships dock.

With initial construction activities at MNB’s phosphate mine also on track to feed the fertiliser plant, the path to first production in the second half of 2023 is well advanced.

Here you can see the Cabinda Phosphate Project (Subantando Phosphate Fertilizer Plant), Cacata Phosphate Mine, and Cabina Port - all a short truck drive from each other along a main road.

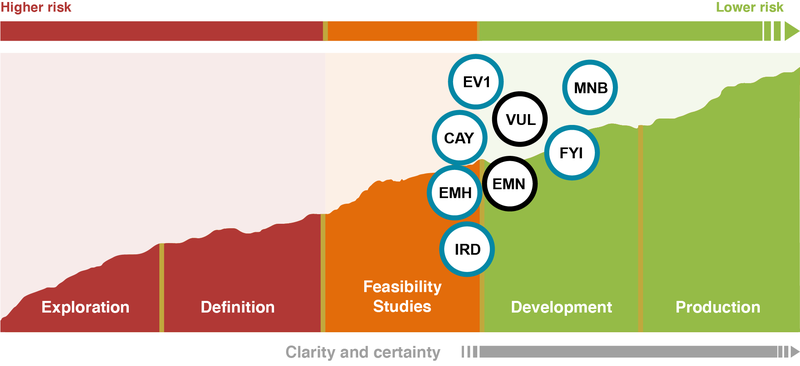

We think 2023 will be the year for companies with projects that are ‘shovel ready’ - meaning resource definition and economic studies are complete and they are ready to start building a mine... if they can get financing.

In early to middle stages of a commodities supercycle, commodity prices are high and the market needs mines built ASAP, so we think significant amounts of capital will start finding its way to later stage projects.

We think that security of supply issues coupled with decades of underinvestment will create a sense of urgency from both the investment community and governments leading to a wave of capital flowing into projects that are closest to being put into production.

We have also seen large global funds pull money out of big US tech companies during the tech crash of 2022 - these funds will be looking for a new sector to achieve the internal rates of return on their capital they previously enjoyed in big tech.

Financing the building of mines during a commodity cycle can deliver those returns.

Below shows the companies in our portfolio that have projects that are at the feasibility/development stage (as of January 2023) and looking for financing to build their project:

For more on our view on advanced stage resource projects in 2023, click here.

Government green lights MNB construction

Today’s news follows an announcement last week that MNB had executed a private investment contract with the Angolan government.

The contract is the final step required by foreign entities wishing to invest in Angola.

For MNB, it was the final approval hurdle ahead of plant construction and first production - providing certainty on the tax environment on importing plant components and other capital expenditure in the country.

Along with giving MNB the green light to invest in the country, the contract also provided for some quite attractive tax concessions and incentives.

You can read more on that contract in our last note, “MNB Seals Key Deal with Angolan Government - Fiscal Regime Now Clear”.

This is far from the only support that MNB has received from the Angolan government.

Another tie in with the Angolan government is MNB’s involvement in the Angola Fertilizer and Farm Productivity Program (AFFPP), a partnership between the government of Angola, the International Fertilizer Development Center (IFDC) and MNB.

The program is designed to double the yields of the ‘Grow to Eat’ market in Angola, comprising 3 million smallholders on 5 million hectares, through the use of fertiliser and education.

The AFFPP is targeting the supply of 30,000-120,000tpa of MNB’s phosphate fertiliser to Angola’s ‘Grow to Eat’ Market in the first full year, which MNB expects will reach up to 250,000 tpa by year 10.

This support for MNB shouldn’t come as a surprise given that the government has been vocal about the programmes it is implementing to promote economic growth aiming to make Angola more sustainable in food.

Angola is a potential agricultural powerhouse and its government is eager to support foreign investment, particularly those benefiting the country’s underdeveloped but high potential agricultural sector.

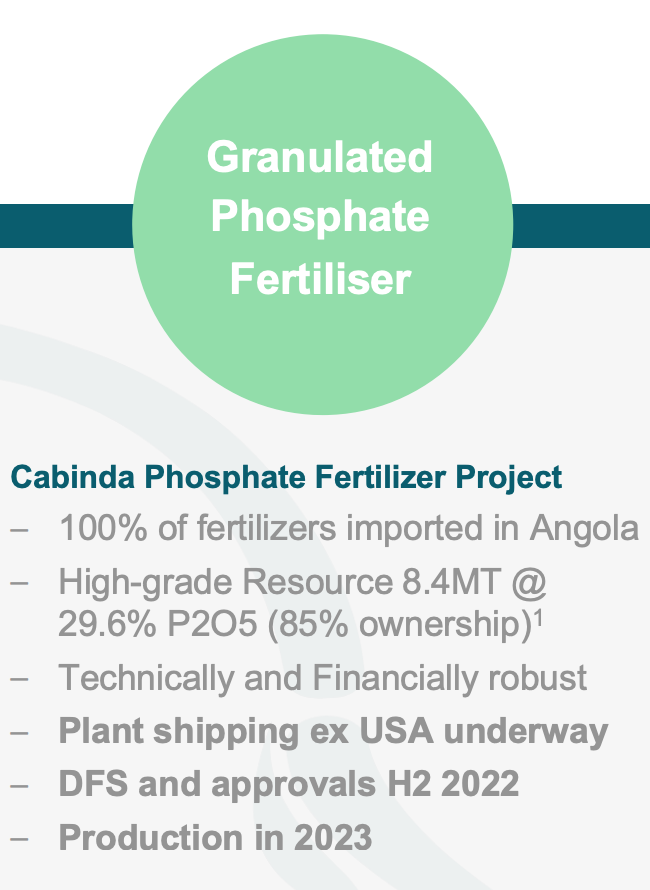

It’s clear why this is important to the government, when we consider that 100% of all fertiliser currently used in Angola is imported to the country.

And of that fertiliser used, it is applied at a rate much lower per hectare, than in other agricultural regions of the world.

This is true for Africa as a whole — presenting a huge potential market for MNB outside of just Angola.

African farmers’ fertiliser use averages just 20 kilograms per hectare — a fraction of that used globally. To maximise yields per acre, it is estimated that African farmers would need to increase their fertiliser application by around tenfold.

MNB is positioning itself as one of the very few local fertiliser product producers in the region, making it well placed to assist farmers locally within Angola and throughout Africa.

This includes the market for its near-term production of phosphate fertiliser, as well any future green ammonia production from its earlier stage green hydrogen/ammonia plant.

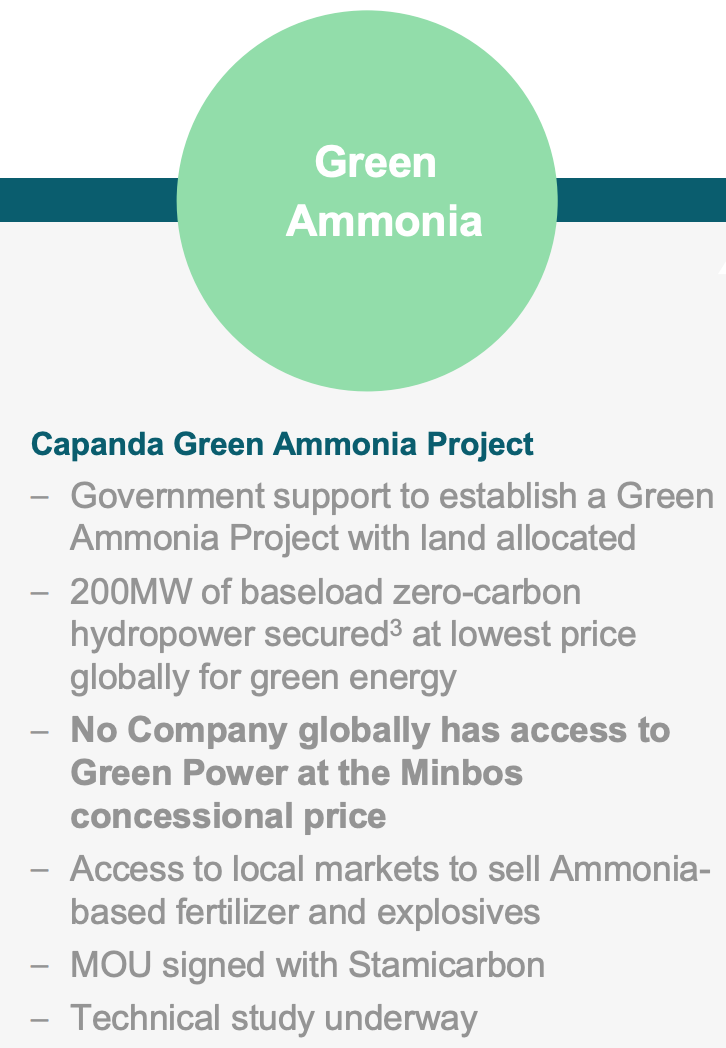

The government has also been supportive of the company’s planned green ammonia project.

Like phosphate, ammonia is an important base material for fertilisers. Ammonia is a compound of nitrogen and hydrogen that is used to make nitrogen fertiliser, whereas phosphate rock is mined to get required phosphorus for phosphorus fertiliser.

MNB last year signed a MOU with Angola’s National Electricity Transmission Network (RNT-EP) outlining the framework and conditions for the supply of 100%-renewable and installed hydroelectric power for MNB’s green ammonia project, including generous access to some of the cheapest electricity in the world.

It was this news that prompted our decision to name MNB as our Wise-Owl Pick of the Year for 2022 - read more on that here.

Looking beyond the fertiliser-related opportunities for MNB, another avenue of potential revenues is the growing market for lithium iron phosphate batteries (LFP or lithium ferro-phosphate batteries).

LFP batteries are projected to carve out a growing amount of the global market share over coming years. Already, in China LFP batteries command 44% of the EV market, while nearly half of all newly made Teslas had phosphate in their batteries.

One of MNB’s significant shareholders is a syndicate of investors that includes an entity controlled by the chairman of Shanghai Putailai New Energy Technology — the world’s largest battery anode producer.

The syndicate invested $15M in MNB during a Placement in July last year, during which the syndicate and MNB signed a “Strategic Cooperation Agreement” to develop a battery materials and large scale green ammonia project.

With MNB now closing in on first phosphate production, it brings us closer to our Big Bet for the company...

Our ‘Big Bet’

“MNB delivers a 10x return by building a profitable phosphate project AND progressing its green ammonia project to construction phase.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our MNB Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress MNB has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following MNB “Progress Tracker".

See our MNB Progress Tracker here:

MNB’s Definitive Feasibility Study (DFS), published in October, showed that spending a further $48.5M could deliver a phosphate mine with a Net Present Value of between ~$200M and ~$400M - depending on the phosphate price.

However, we note that the DFS was prepared during the second half of last year when the world encountered ultra high rates of inflation.

Also, since the DFS was completed, updates from MNB on its progress towards first production suggest that CAPEX may come in lower than anticipated.

This included selection of the fertiliser plant site, now in Subantando — close to both the port at Cabinda and the phosphate mine at Cácata.

The is a different site to what was used in the DFS estimates, and provides for “significant OPEX and production advantages”.

Further, successful field trials testing MNB’s phosphate rock product on crops provided important validation that the fertiliser is fit for purpose for the local agricultural market, including over much of the area of interest of the AFFPP.

This contributes to the overall economic case for the project. The results also confirmed the simplicity of the production flowsheet required to create the phosphate product. MNB this more simplified flowsheet to deliver “significant CAPEX savings”.

What’s next for MNB?

First production from phosphate fertiliser project 🔄

Armed with a robust DFS, and with the final pieces of the plant enroute to Angola, we look ahead to first production at MNB’s phosphate project later this year.

The project is leveraged to fertiliser prices, so the forecast high fertiliser prices and supportive supply-demand dynamics will work to benefit the project.

Offtake agreements and MOUs 🔄

Ahead of initial production we want to see offtake agreements and MOUs signed.

A great result would be having an offtake agreement signed/underwritten by the Angolan government. The project is considered of “National Importance to Angola”, so we think this is a possibility.

Project financing secured 🔄

At the time of the DFS, back in October, the remaining cost to complete the phosphate fertiliser project was US$48.5M, with MNB requiring further funding of US$40M.

The company had already secured the option to access $25M, when it signed a non-binding term sheet for a $25M debt facility alongside its placement last July.

However, we want to see more clarity around how the full project build will be financed. That said, we recognise that MNB has said that it expects CAPEX to be lower than what it anticipated in the DFS.

This is one factor that we believe has been weighing on the company’s share price in recent months. Hopefully, once the market gets a better idea of how the full build will be financed, we will see a re-rate higher in the share price.

Technical study for green hydrogen/ammonia project 🔄

As for MNB’s green hydrogen/ammonia project, a technical study is now underway which will provide more clarity on the opportunity. The study will include preliminary plant designs, CAPEX numbers, OPEX numbers including the required hydroelectricity assumptions.

We are optimistic about the study’s finding, helped by the fact that the company signed an MOU with Angola’s National Electricity Transmission Network in December for hydroelectric power supply.

Ultimately, MNB will use the technical study as the basis for a scoping study that will lay out the financial metrics for its project.

Work on the scoping study is expected to commence as soon as the technical study is completed.

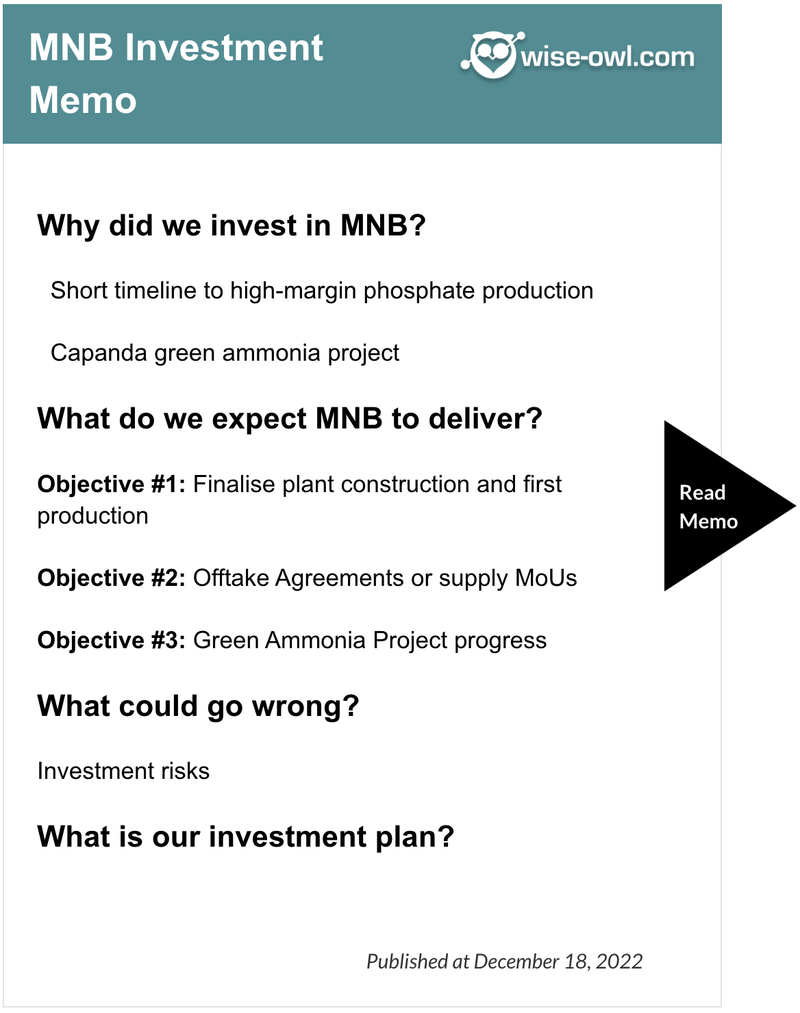

Our MNB Investment Memo

We recently published a revised Investment Memo for MNB that provides an overview of why we Invested, what we want to see the company achieve over the coming 12 months, the risks involved, and our Investment plan going forward.

To see our full Investment Memo click here OR on the image below:

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.