Fantasy sports platform PlayUp to acquire fourth gaming business

Published 15-MAY-2018 15:29 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

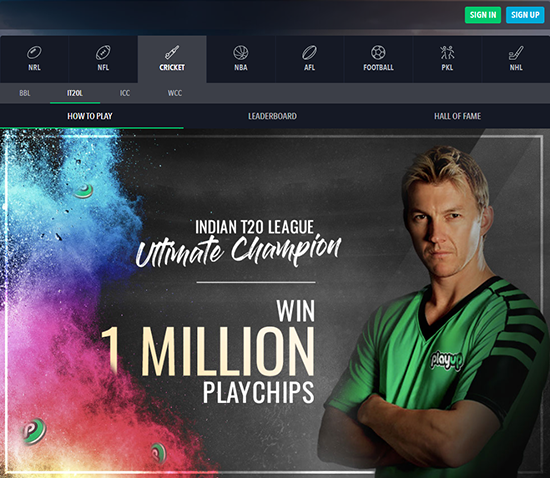

Australian online gaming and DFS firm PlayUp is racking up the acquisitions prior to its dual listing on the NASDAQ and the ASX via a reverse takeover of Mission NewEnergy Limited (ASX:MBT | OTC:MNELF).

The company plans to raise $US40 million ($51.5 million) through the reverse listing on the ASX and deliver “the world’s first fully-integrated, blockchain enabled global fantasy sports, online sports betting & gaming ecosystem”.

Headed by Sydney-based entrepreneur Daniel Simic, PlayUp has already locked in a number of acquisitions as it works towards its goal of becoming one of the largest fantasy sports platform operators.

The company is also represented by sporting legend, Brett Lee, who has a social network of over four million sports fans.

PlayUp, which is understood to have 400,000 registered users, has also revealed that it will enter the cryptocurrency craze, by introducing a new online currency the PlayChip Utility Token as part of its fantasy sports platform.

However, any news is speculative at this stage therefore investors considering this stock for their portfolio, should seek professional financial advice.

PlayUp’s latest acquisition is of online platform, betting.club, which it acquired from community organisations the Mounties Group, Campsie RSL and Club Rivers. The platform lets players rate and share form, share tips and then place the bets and is an opportunity for PlayUp to integrate the PlayChip as a way to wager or collect rewards.

Simic commented on the acquisition saying, “Betting.club has been on our radar for some time as they have built a truly social wagering platform used by a high volume of punters as well as developed an innovative app and online presence.

“We’re committed to enhancing the social and community focus of the platform as well as integrate the PlayChip as an optional wagering payments and rewards offering.”

This acquisition comes after company’s recent acquisition of CrownBet’s DraftStars. While it also has plans to buy Sydney-based ClassicBet, pending approval from the Northern Territory Racing Commission or Harness Racing NSW. These two acquisitions alone are forecast to lift PlayUp’s gross gaming turnover by more than $200 million, according to the company.

PlayUp had a rocky start before it get to where it is today. The original owner of the business, Revo — headed by former NSW premier Nick Greiner, collapsed into liquidation in 2016. A number of high profile investors were involved including Malcolm Turnbull, David Paradice, Allan Myers, as well as Steve Waugh and Adam Gilchrist.

In 2017, Simic and investors resurrected the PlayUp brand and it’s reassuring to know that PlayUp's founders, Luke Bunbury and George Tomeski, who oversaw the business burn through A$100 million of investor funds, are no longer involved in the business in anyway.

Previous management spent far too much money on staff and opening offices around the world and building its own software. By January 2016 its parent company Revo Pty Ltd was in liquidation. Simic noted that he would be spending a lot less money than previous management.

Mission NewEnergy has lodged disclosure documents to the ASX approve the proposed transaction with PlayUp, however it is yet to make an announcement regarding the deal to as it works to determine the whether the company will be suitable for listing.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.