EV1’s Graphite Meets Purity Standards - Good for Batteries and Nuclear Energy

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and Associated Entities, own 3,125,000 EV1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our Investment in EV1 over time.

Battery grade graphite that is ALSO suitable for use in the nuclear industry?

That’s two of the use cases where we think the highest margin will be for our 2021 Wise-Owl Pick of the Year, Evolution Energy Minerals (ASX:EV1) , and that’s the topic of today’s note.

Yesterday, we got our first proper taste of what EV1’s downstream strategy will look like, with the purity numbers to boot.

The results from some impurity analysis works detailed EV1’s graphite as having:

- Molybdenum concentrations <0.5 parts per million - Almost two times below the threshold for graphite used in premium performance batteries. This type of low molybdenum purified graphite currently sells for between US$8,000-$18,000 per tonne.

- Boron concentrations <2 parts per million - Below the threshold for impurities for graphite that can be used in the nuclear industry. EV1’s graphite returned boron concentrations of ~0.77 ppm which is a positive sign that EV1’s graphite may be able to produce qualified purified graphite which sells for approximately US$30,000 per tonne into the nuclear industry.

For some context, the majority of flake graphite in the market has molybdenum concentrations ranging between 20-200 ppm, finding sources with molybdenum concentration <15ppm is a structural issue in the battery materials industry.

At <0.5ppm molybdenum, EV1’s graphite is two orders of magnitude smaller in concentration than the lower threshold required for application in advanced battery materials.

As for the boron concentrations, typically graphite that is deemed suitable to produce high value added graphite (qualified graphite which sells for up to US$30,000/t) needs to have boron concentrations of <2 ppm.

EV1’s graphite returned boron concentrations of ~0.77ppm are almost half that of the threshold.

This means that pending further testwork - EV1 is currently on track to sell to BOTH the battery industry AND the nuclear industry.

The impurity analysis is the first stage of testing EV1’s graphite fines product to see if it is suitable for these type high value add graphite products.

In yesterday’s announcement EV1 also confirmed that battery anode testwork was ongoing with further results expected in the coming weeks.

The next stage will assess the purification, milling and shaping processes to determine whether EV1’s graphite can achieve the required rates for its product to be suitable for high value add products.

This bid to capture high-margin markets is all part of EV1’s downstream strategy, and we think it promises to add significant value to EV1’s Tanzanian graphite project.

EV1 currently has a market cap of $60M, and our view is that this "value-adding" could produce a sustained re-rate that puts its market cap in the ballpark of some of its larger graphite peers.

We’re talking about companies like Magnis Energy Technologies (market cap $304M), Black Rock Mining (market cap $~156M) and Ecograf (market cap $137M).

There’s more to this than meets the eye though.

There are currently 55 nuclear reactors under construction around the world, around 100 nuclear reactors on order or planned, and over 300 more proposed.

Whether it's China, who has 20 reactors under construction (and more coming), or Europe which is on the cusp of classifying nuclear as a green energy technology, we think nuclear has a big part to play in the global energy mix now and into the future.

And one particular type of nuclear reactor that is in development may require 60,000 tonnes of purified graphite per annum - more on that later in this note.

Best of all, EV1 has contracted with a US based technology partner to do this using thermal purification technology.

This strips out the nasty chemicals usually needed to purify graphite, making it more amenable to the strict ESG standards that potential finance partners and end product users would expect.

The upshot: this is cutting edge graphite technology applied to EV1’s premium graphite product that could simultaneously unlock margin and ESG finance via sustainable practices.

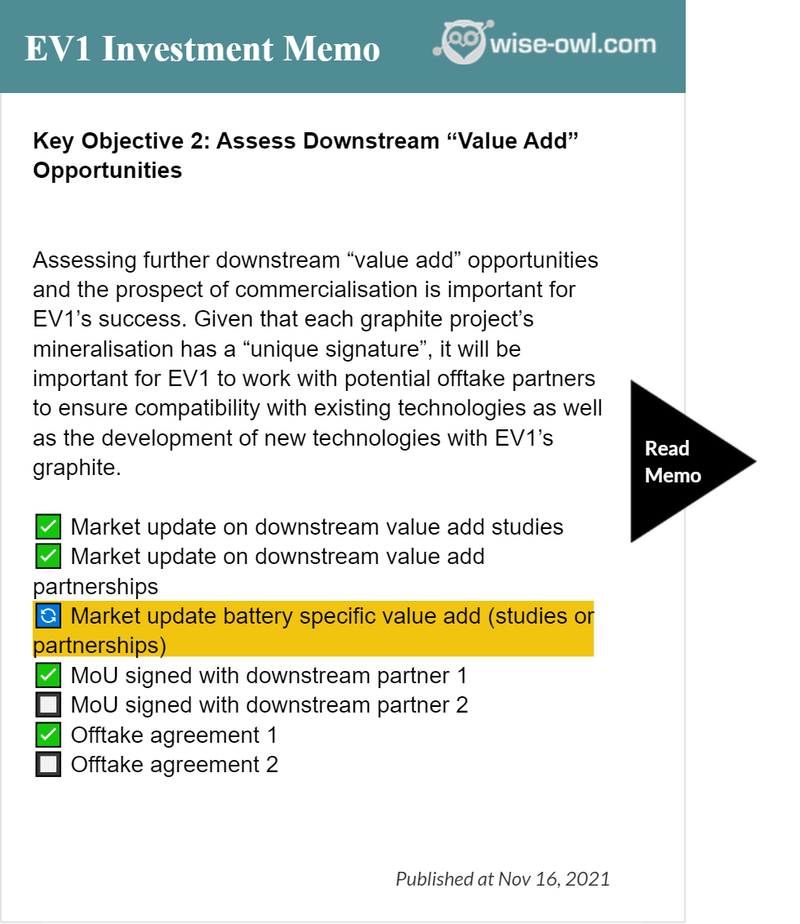

We’re very pleased with EV1’s latest announcement as it means the company is making good progress against our #2 Objective from our EV1 Investment Memo:

That highlighted section is what EV1 made progress on today - and we think there could be more to come as EV1 pushes ahead with its commercial verification program.

To date, EV1 has rapidly been ticking off milestones, accomplishing everything it said it would in its IPO prospectus and putting in place the necessary pieces to move its graphite project towards a final investment decision.

Here’s more on EV1’s latest announcement.

EV1’s battery grade graphite, what about nuclear?

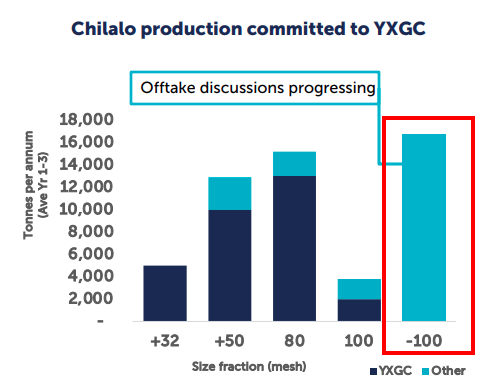

EV1 already has 64% of the first three years of production locked away via a binding offtake with Chinese graphite giant YXGC.

The latest EV1 announcement is concerned with the remaining 36% of production - the graphite fines product.

Fines are initially lower value, but can be enhanced with processing techniques to produce battery grade anode material and other high value add graphite products - the high margin products that can fetch up to US$30,000 per tonne.

EV1 has signalled its intent to use an environmentally friendly thermal purification process for the fines portion of its production.

In order for these fines to be suitable for battery usage (ie. battery grade), the graphite needs to be 1) purified to at least 99.95% C (Carbon) AND 2) contain very few impurities.

Yesterday’s announcement relates to the second part of these requirements - the levels of impurities.

Testwork via an unnamed US technology partner confirmed that EV1’s Tanzanian graphite has extremely low levels of naturally occurring Molybdenum and Boron, namely:

- Molybdenum concentrations <0.5 parts per million - almost 2x below impurity thresholds.

- Boron concentrations <2 ppm Boron - less than half the impurity threshold.

The presence of these two impurities are what could prevent use in batteries or the nuclear industry.

The initial results from this commercial verification program has assessed EV1’s graphite as having the required low levels of impurity that may mean its product is suitable for advanced battery applications and use in the Nuclear industry.

The low levels of molybdenum impurities in EV1’s graphite could see EV1 produce purified graphite - the market price is anywhere between US$8,000-$18,000 per tonne for battery material.

The low levels of boron impurities in EV1’s graphite could see EV1 produce qualified purified graphite where prices can trade as high as US$30,000 per tonne for nuclear uses .

We note that Pebble Bed Modular Reactors - a type of small modular reactor - may require

approximately 60,000 tonnes of purified graphite per annum as each of these reactors requires 300 tonnes of graphite initially and 60-100 tonnes per year to operate.

The US Department of Energy is currently putting money behind the development of these types of reactors that use graphite rather than water to cool the reactor.

Also, as a result of the rapid transition to electric vehicles, we expect the prices that EV1 will fetch for its battery anode material to be towards the upper bounds of that $8000-18,000 per tonne figure.

And if demand from the nuclear industry picks up as the energy source becomes more popular, that US$30,000 per tonne figure will push higher.

What’s next for EV1’s downstream testwork? 🔄

The next stage in the downstream testwork that EV1 is doing with its US technology partner is to assess "the purification, milling and shaping and electrochemical properties of the fines product."

Basically, figuring out exactly how to turn the fines product into a finished product, and how it would perform in a battery.

So there’s more newsflow on the horizon. EV1 says the results will come out in the next few weeks.

We think proving out the quality of its graphite product will enhance EV1’s ability to seal an offtake agreement for the fines portion of its production.

What else are we watching out for with EV1? (Lots)

Offtake agreement for fine flake graphite 🔄

A corporate presentation in early May revealed that EV1 was still in discussions with other interested parties with respect to offtake agreements on the fine flake graphite production.

After the latest EV1 announcement, we suspect that it won’t have any issues getting an offtake agreement over the line on this front.

This portion of its resource represents ~36% of EV1’s life of mine production with the coarse flake higher value graphite already under an offtake agreement with YXGC.

The image below helps visualise what is currently under offtake agreements and what isn’t.

Framework agreement with the Tanzanian Government 🔄

EV1 is currently in discussions with the Tanzanian government over a "framework agreement". Once signed, this will provide fiscal and regulatory certainty to EV1 and to potential financiers.

Other ASX listed companies like Strandline Resources, OreCorp, and Black Rock Mining have already managed to sign these agreements and we have seen BHP and Barrick spend $50M and $60M respectively on projects in Tanzania.

As these agreements provide regulatory certainty around projects, the market reacts positively to this type of news.

For example, Strandline, which signed the agreement on 14 December 2021, saw its share price go from ~25c before the agreement to briefly touch all time highs at 51.5c, after which it completed a $50M capital raise.

This is fully understandable as a lot of institutional capital would rather wait for the company to have regulatory rules in place before investing.

Once EV1 gets a framework agreement signed with the Tanzanian government, the company will then become an attractive opportunity for a whole heap of new investors which we hope will mean an increase in the company’s share price.

Updated Definitive Feasibility Study (DFS) + final investment decision (FID) 🔄

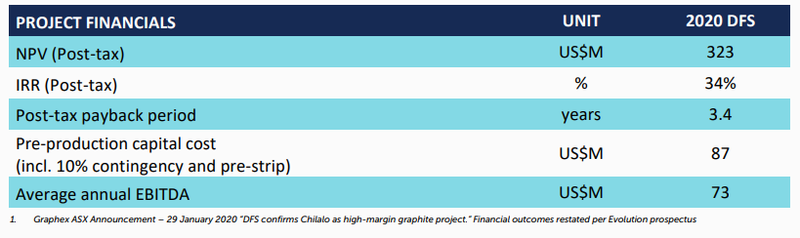

EV1’s 2020 DFS shows an NPV of US$323M with a 3.4 year post tax payback period based on total capital expenditures of ~US$87M to get the mine into development.

Even if yesterday's fines testwork doesn't make it into the DFS upgrade, we still think that it will improve the project economics if EV1 can secure a better offtake price for its last 36% of graphite production.

Every bit counts as EV1 approaches a final investment decision.

Underpinning this is Front End Engineering (FEED) work that a recently appointed contractor will be doing will be incorporated into an updated DFS later this year.

With the recent inflation news, capital costs of building the mine are likely to be higher now versus when the DFS was done (2020). So we suspect the CAPEX figure will be higher when the updated DFS is released.

The importance of getting this work done is more about being able to secure financing partners who will want to see updated estimates for capital costs and would be less likely to finance a project based on 2020 estimates.

To counter the increases in upfront capital costs, we hope EV1’s upcoming drilling can bring more "near surface" graphite resources into the current mine plan, potentially lowering the costs of mining the ore and bringing overall operating costs down.

We think this should improve the overall NPV figure, or at the very least, negate the drag any uplift in CAPEX will have.

We covered the upcoming drilling program in a previous note which can be read here: Never miss a chance to improve DFS economics with near surface exploration .

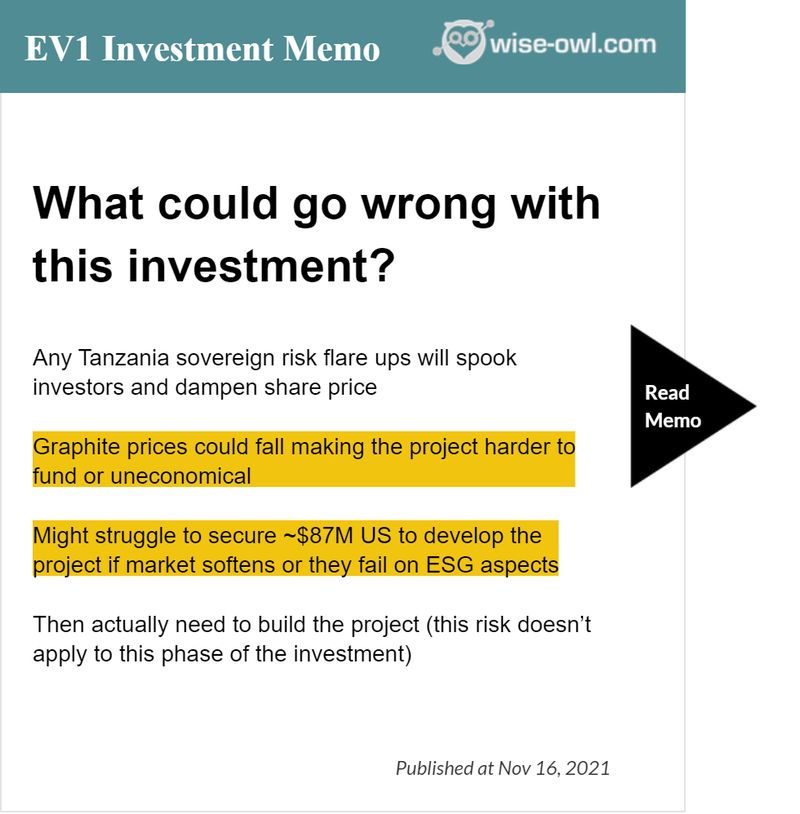

What are the risks?

We highlighted the following risks in our EV1 Investment Memo and we want to focus on two in particular today:

The market conditions have certainly softened over the last six months with tax loss selling, higher rates and inflation all playing a part. The good news we think is that the market seems to have firmed up a bit of late. This could mean that EV1 goes into a final investment decision with a stronger hand.

Aiding their cause should be a healthier graphite price - particularly in light of recent testwork and the quality of EV1’s product.

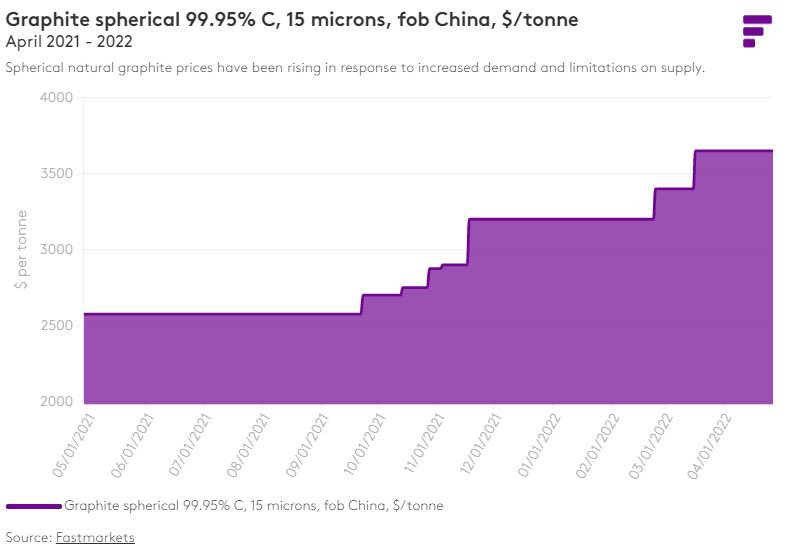

While graphite prices are opaque because of the range of different types of product and levels of quality, by this measure, graphite prices looks to be moving higher:

While prices could change as new supply comes online, we think the strong pricing should flow through to the attractiveness of EV1 as an investment over time as demand continues to ramp up.

Our 2022 EV1 Investment Memo

Below is our 2022 Investment Memo for EV1 where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022

- Why do we continue to hold EV1

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.