EV1 Locks in Binding Terms for Downstream Graphite JV

Disclosure : S3 Consortium Pty Ltd (The Company) and Associated Entities own 3,578,125 EV1 shares at the time of publishing this article. The Company has been engaged by EV1 to share our commentary on the progress of our Investment in EV1 over time.

The 2021 Wise Owl Pick of the Year Evolution Energy Minerals (ASX:EV1) is developing a graphite mine in Tanzania with heavy focus on best in class sustainability and ESG.

Today it announced a binding term sheet with its existing offtake partner YXGC to pursue a downstream processing facility - potentially in Europe or the Middle East.

Establishing "value adding" downstream opportunities has been EV1’s strategy from the beginning, and establishing a manufacturing facility for its graphite will help the company capture greater margins.

Together, current offtake partner YXGC and EV1 will conduct Market Studies and a Scoping Study to assess the prospect of downstream development of EV1’s processing plant.

All of this with a view to a facility that processes 25k tonnes per year of coarse flake concentrate.

EV1’s downstream strategy is important because these high value products can fetch up to US$30,000/tonne - which is many multiples of the graphite prices that are usually quoted.

We also think this will eventually feed through to how potential financiers of EV1’s Tanzanian mine look at the overall value proposition - EV1 is targeting a Final Investment Decision in Q1 2023 as outlined in today’s announcement.

That Final Investment Decision needs to be successful in order to commence mine construction and make EV1s graphite mining project a reality.

Which leads us to what we think the ultimate success case for EV1 is:

Our Big Bet

EV1 will achieve first production of the world’s most sustainably produced graphite by early 2024 (including value adding processing) — coinciding with the onset of a long-term supply shortage in the graphite market.

NOTE: The above is what we think the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done by the company to get to this outcome and obvious risks which need to be considered, some of which we list in our EV1 Investment Memo.

We Invested in the EV1 IPO at 20c at 16 November 2021, and recently Invested again at 32c in the placement in early August.

EV1 is currently trading at 23c after the usual post-placement digestion which looks to be exacerbated by the current market conditions.

Following that placement, EV1 is now capped at about $42M with an estimated ~$18.4M in the bank, and "downstream value add" in progress.

We previously made note of other ASX listed graphite companies that have downstream processing capacity — these are their current market caps:

- Magnis Energy Technologies: ~$363M

- EcoGraf: ~$146M

- Talga Group: ~$431M

- Syrah Resources: ~$1.1BN

It takes a few minutes to scroll the EV1 Progress Tracker to get a quick helicopter summary of its progress, which we find helpful to do before reading each new EV1 announcement.

A quick scan of the Progress Tracker gives context to how the new announcements contribute to our Big Bet and near term Investment Memo objectives for EV1:

What did EV1 announce today?

EV1 announced today that it had secured a binding term sheet to form a downstream JV with its existing Chinese offtake partner YXGC.

YXGC is a giant graphite company, and we expect it to contribute much of the technical know-how around graphite processing. EV1 will contribute market contacts and, of course, the raw product for these high value graphite products.

(For a deep dive on EV1’s downstream work, particularly the prices these products can fetch and EV1’s test work to date - read this article .)

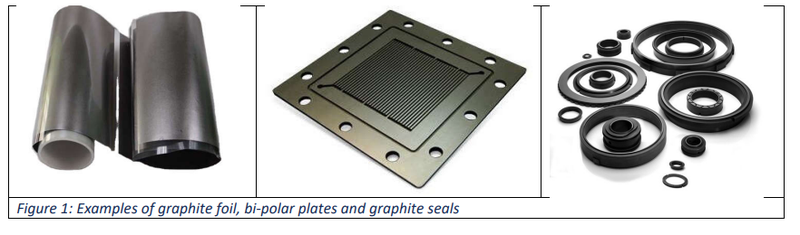

The ownership structure will be 60% EV1 and 40% YXGC and the pair envision a processing facility to process 25,000 tonnes per year of coarse flake concentrate into high-value graphite products including graphite foil, bi-polar plates and seals for electric vehicles.

These are what the products look like:

EV1 had previously signed a binding offtake agreement with YXGC to supply 30,000 tonnes per year of flake graphite concentrate for three years from first production at Chilalo.

We said at the time that EV1 was specifically targeting a downstream facility following that announcement.

Well today, that ambition has firmed up significantly.

Today’s binding term sheet provides for a Market Study, Scoping Study and Definitive Feasibility Study — these will form the backbone of the JVs strategy.

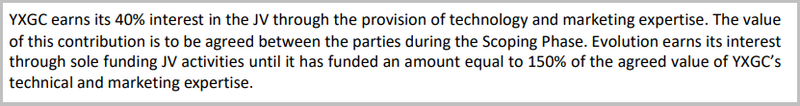

Here is what we see as the key section of the terms released today:

Our bet here is that YXGC is very keen to get this JV off the ground, especially in light of current elevated graphite prices and a looming structural supply-demand imbalance.

Indeed, one Chinese mining managing director recently observed that China is switching from an exporter of graphite to an importer of the EV anode material:

"The historic benefits of using Chinese sourced graphite [are] now being outweighed by issues in supply and price instability, environment, labour force and costs, political factors, seasonal (rains/winter), and quality control (grade mixing). " ( Source )

So we are looking to see what value YXGC ascribes to its technical and marketing expertise down the track.

Importantly, today’s announcement also flagged that EV1 is looking at sites for the downstream facility with a focus on Europe and the Middle East.

While Europe is the natural end point for value added graphite given its rapidly accelerating EV push, the Middle East is an interesting one.

For one, it is much closer to Tanzania — just up the coast of East Africa into the Red Sea.

While that has obvious benefits in terms of logistics, it is also worth noting that many oil-rich Middle Eastern countries are increasingly determined to develop green economies.

Saudi Arabia for example, as part of its Vision 2030 green energy model, is investing heavily in renewable energy and EVs:

Key takeaways:

- Saudi Arabia wants 30% of cars on its capital city’s roads to be electric by the end of this decade

- Aim is to become a key part of the global electric vehicle-value chain

- Upwards of US$18B already allocated for battery metals mining, EV manufacturing and EV chip making

While we are unsure of where EV1’s downstream processing facility will be located, it makes sense for the company to keep its options open.

The Middle East could wind up being a good option.

How does today's announcement relate to our EV1 Memo?

Today’s announcement directly advances Key Objective #2 from our EV1 Investment Memo:

We have also updated our internal "Progress Tracking" document to reflect today's news.

Click here to see our Progress Tracker

Our 2022 EV1 Investment Memo

Below is our 2022 Investment Memo for EV1 where you can find a short, high level summary of our reasons for Investing.

The ultimate purpose of the memo is to track the progress of our Portfolio companies using our Investment Memo as a benchmark throughout 2022.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022

- Why do we continue to hold EV1

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.