EV1 Firms up first offtake deal, sets sights on European downstream manufacturing

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and Associated Entities, own 3,125,000 EV1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our Investment in EV1 over time.

Today our Wise Owl 2021 Pick of the Year, Evolution Energy Minerals (ASX:EV1) , took a step towards securing an offtake agreement AND downstream value-add partnership to produce high value graphite products.

Graphite is a critical material in the production of EV batteries and a range of other modern products.

EV1 announced it has signed a Memorandum of Understanding with a downstream graphite product specialist — a prelude to a ‘binding offtake agreement’ that’s expected to be finalised in the coming weeks , of which key terms are already agreed.

EV1’s MoU is with a global leader in the manufacture of expandable graphite and associated high-value graphite products - Yichang Xincheng Graphite Co Ltd (YXGC).

The MoU covers two key parts for EV1:

- Key terms for a binding offtake agreement:

- YXGS to buy 30,000 tonnes of EV1’s planned coarse flake graphite production over 3 years.

- This represents 56% of EV1’s planned graphite production and over 70% of concentrate revenue for the first three years.

- Intention to form a joint venture on a downstream manufacturing facility in Europe:

- Both parties will explore the feasibility, construction and operation of this facility

- EV1’s graphite to be used, and YXGC’s technology.

- Production of expandable graphite, graphite foil, and other high-value graphite products.

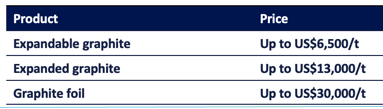

EV1 reported the current pricing of various value added graphite products:

While we don't yet know key terms of the JV or the prices EV1 will receive (so we won’t do a rough "potential revenue" calc right now), today’s MoU is a nice start towards commercial deals and the downstream value add that we were hoping to see EV1 deliver.

It provides EV1 with the platform to start planning its project development strategy and gives the company optionality to produce higher valued products, in combination with selling its graphite as a raw material.

We think that the future for exploration companies — with well defined deposits — is to establish well defined downstream strategies. The market seems to agree with this, valuing companies with downstream operations significantly higher than those simply focused on mining.

ASX listed graphite explorers Magnis Energy Technologies for example has a $435M market cap and EcoGraf has a market cap of $221M, mostly because of the advanced downstream strategies.

With today’s news EV1 has taken the first step towards showing the market where it will build out its downstream strategy and what it hopes to focus on going forward.

Graphite is a key component in lithium ion batteries making up ~50% of the raw materials in every lithium ion battery (and over 95% of every battery anode), making it a critical battery material.

But it's also got a myriad of uses beyond just EVs, with graphite foil used in mobile phones, tablets and TV screens, and even in the production of green hydrogen.

But not all graphite is created equally: different flake sizes determine different use cases AND different prices.

EV1 is a sustainable, ESG focused, development ready, graphite project in Tanzania.

The company expects ~56% of its production to be coarse flake graphite (comprising +100 mesh through to +32 mesh) — a key reason we made EV1 our 2021 Pick of the Year.

This flake size makes EV1’s project well suited to the pursuit of downstream value add opportunities like the ones outlined in the MoU today.

With today’s announcement, EV1 has again shown how it stands to benefit from the optionality its resource gives, with the MoU partner interested in both the raw material via an offtake agreement and the added downstream collaboration being proposed.

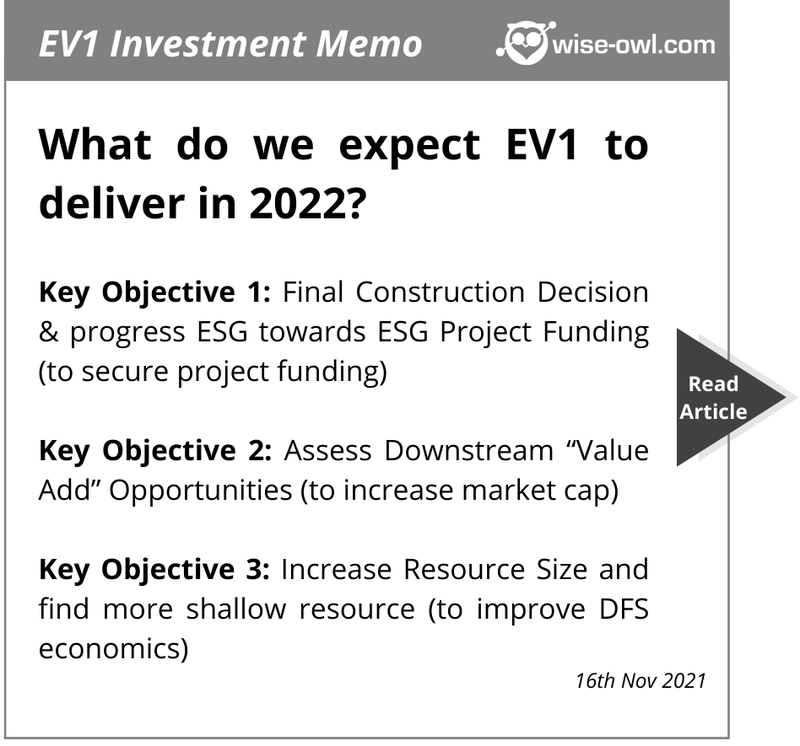

We Invested in the EV1 IPO last year and below is a list of all of the key objectives we want to see EV1 achieve in 2022 as per our 2022 Investment Memo.

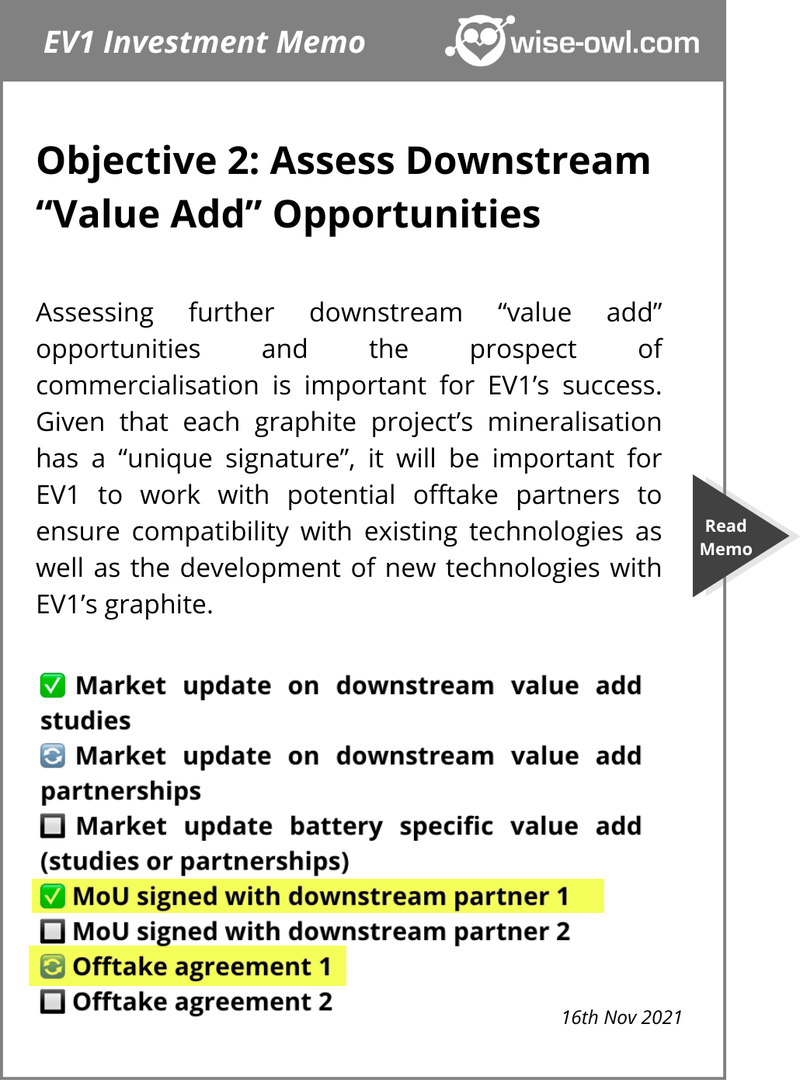

"Key Objective #2" was the assessment of downstream value add opportunities and a potential offtake agreement.

We now have the first MoU signed that we hope will lead to a binding offtake agreement, which is now being negotiated.

We have updated the progress status of the milestones accordingly:

Who is the MoU partner and what will the MoU focus on?

Yichang Xincheng Graphite Co Ltd (YXGC) is a global leader in the manufacture of graphite products, supplying to customers in Europe, North America and Asia for over 20 years.

YXGC focuses mostly on using coarse flake graphite (comprising +100 mesh through to +32 mesh) to produce graphite products like expandable graphite, fire retardant materials, foils, sheets, gaskets and tape.

Under the agreement, it would use EV1’s coarse flake graphite to produce a range of high value graphite products.

Although it is yet to be determined what type of downstream products the joint venture will target, EV1 anticipates the following:

- Expandable graphite – Typically sold directly to Western fire retardant customers (up to US$6,500/t)

- Expanded graphite – Typically sold to battery manufacturers as a conductivity enhancement on the cathode side of the battery (up to US$13,000/t);

- Graphite foil:

- Typically sold to electronic device producers for use as a heat sink (up to US$30,000/t)

- Typically sold to hydrogen battery manufacturers for use in the bipolar plates housing the cathode and anode in hydrogen batteries.

These products, with prices as high as US$30,000/tonne, all sell for well in excess of the raw graphite that EV1 would otherwise be selling.

Consider that the highest quality graphite in EV1’s 2020 DFS was priced at just ~US$3,000/tonne, to return a project value (NPV) of US$323M.

Yet the DFS does not include any of the added value of having a downstream focus and the associated higher pricing that EV1 could sell its product into.

However, we don't yet know how EV1 and YXGC would split revenue on their valued added products.

Moving up the value chain and establishing a downstream manufacturing facility could mean that EV1 can extract more of the value out of its graphite. Instead of simply getting paid to produce the raw material the company will capture some of the margins further down the value chain.

We suspect this will make the overall economic case to develop the project stronger, and expect that this would start to be reflected in the company’s share price.

EV1’s current market cap is $83.3M — that’s less than one-fifth of the project NPV figure in the 2020 DFS which, remember, was calculated using raw graphite pricing rather than value-add product.

More on the MoU

First, the MoU covers a potential offtake agreement that is now being negotiated.

After doing product qualification work since 2015, EV1 MoU partner, YXGC, has now confirmed that EV1’s coarse flake graphite would be suitable for the types of products it produces.

This coarse flake graphite (comprising +100 mesh through to +32 mesh) makes up ~56% of the expected production from EV1’s project.

The MoU is the first step toward signing a binding offtake agreement which EV1 expects in the coming weeks.

The MoU includes the following three key terms:

- An initial period of three years from first delivery. In our opinion, this is standard for offtake agreements on projects that are pre-development, so is a positive.

- A commitment from YXGC to purchase a fixed quantity of graphite over the term of the agreement (up to 30,000t pa (~56% of production) over the first 3 years) . For a potential first offtake, signing up ~56% of the first 3 years production would be a really good result, EV1 is likely to see more interest for its product so we expect the terms to be favourable.

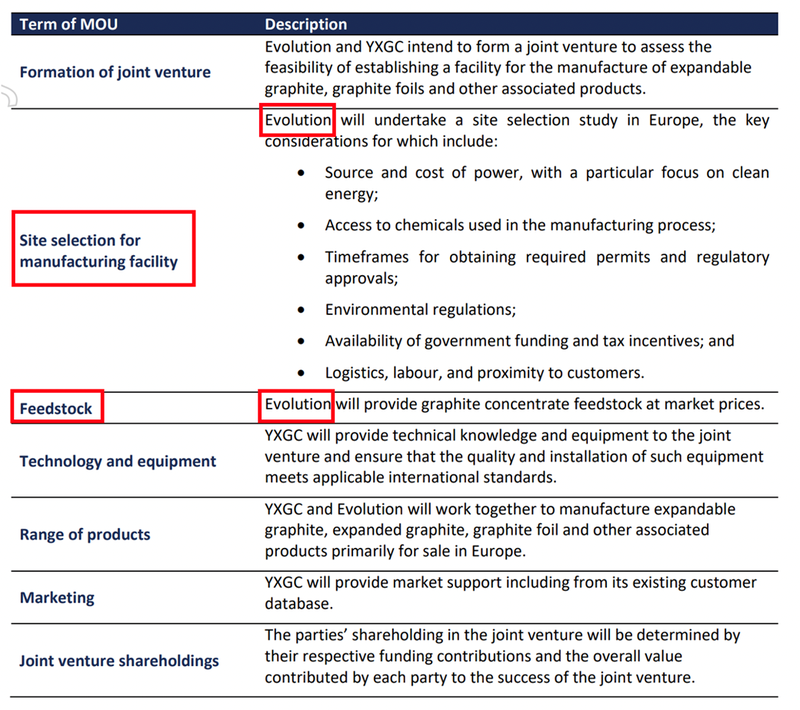

Second is the collaboration on a downstream manufacturing strategy.

The MoU would initially operate as a toll treatment agreement whereby EV1 provides the raw graphite and YXGC uses it to produce high value graphite products ready to be onsold.

That means EV1 can benefit from YXGC’s manufacturing IP without having to actually make any capital investment.

These types of agreements are common for miners, whereby the miner takes on the mining risk and the toll-treatment party takes on the downstream risk and they share in the high value add sales at the end of the production process.

The second part of the MoU will be based on assessing the feasibility of building a dedicated downstream manufacturing facility in Europe.

We have previously had success Investing in ESG conscious battery metals targeting the European EV market - so we are pleased with this development.

EV1 will handle the site selection and feedstock (graphite supply), and YXGC will take care of the technology, equipment, marketing and sales portion of operating the facility.

This part of the MoU is still very conceptual in nature but shows EV1 is thinking about and starting to move the business towards really establishing a clear and rational downstream business plan.

Peer comparisons of graphite players with downstream strategies

With the MoU signed today, we got a first glimpse at what EV1’s downstream strategy may look like.

The key takeaway for us was that a European manufacturing facility was being considered as a base for its downstream operations, a clear recognition from EV1 that proximity to end users will be very important.

The second is that EV1 recognises the importance of a downstream presence.

Our view is that mining companies need to start moving downstream and produce higher value-add products to capture more of the value in their raw materials.

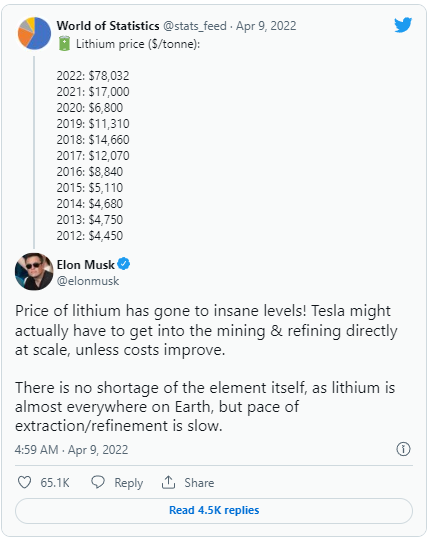

These synergies were seen in recent commentary from Elon Musk who said he is considering acquiring lithium mines under the Tesla banner - a move from downstream back into mining.

And it’s not just us (and Elon) that recognises this.

The market already places a premium on the market caps of the companies that have a clearly defined downstream strategy in place.

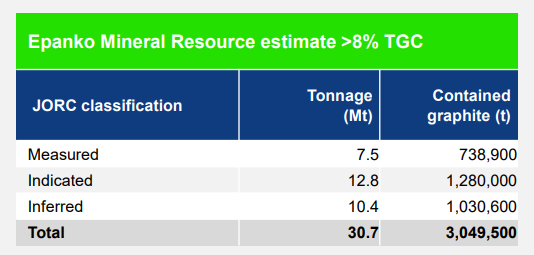

For example, ASX listed EcoGraf whose Tanzanian graphite project has a 30.7mt graphite resource.

The market values EcoGraf at a ~$221M market cap as opposed to EV1’s $83.3M market cap, despite EV1 having a higher grade resource made up of higher quality mesh sizes (which attract premium pricing).

The difference in valuations is mostly due to EcoGraf’s downstream business being far more advanced.

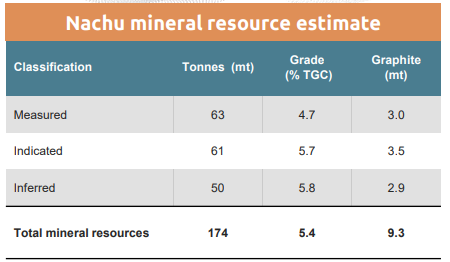

Another comparison to EV1 is ASX-listed Magnis Energy Technologies which has a 174mt graphite resource also in Tanzania.

Magnis’ resource is put together using a much lower cut off grade of ~5.4% — almost half of the 9.9% cut off grade that EV1 uses, explaining the large difference in tonnage.

This effectively means EV1’s resource is much higher grade and likely to produce graphite that is of higher value.

Magnis trades with a market cap of $435M, compared to EV1’s $83.3M.

We think that the difference in market caps is unlikely a result of the resource, but is to do with Magnis being far more advanced with respect to its downstream business.

Clearly, the markets seem to place a higher valuation on companies that have well defined downstream strategies.

With today’s MoU, EV1 is starting to show the market what its strategy will look like going forward.

We think that as the MoUs are converted into binding agreements and the downstream business plan starts to further develop, the market will eventually re-rate EV1. This will include an assumed valuation for all of these downstream capabilities, along with the inherent value of its high grade graphite project.

With a market cap of only $48M, EV1 has plenty of room to move given where its peers are trading.

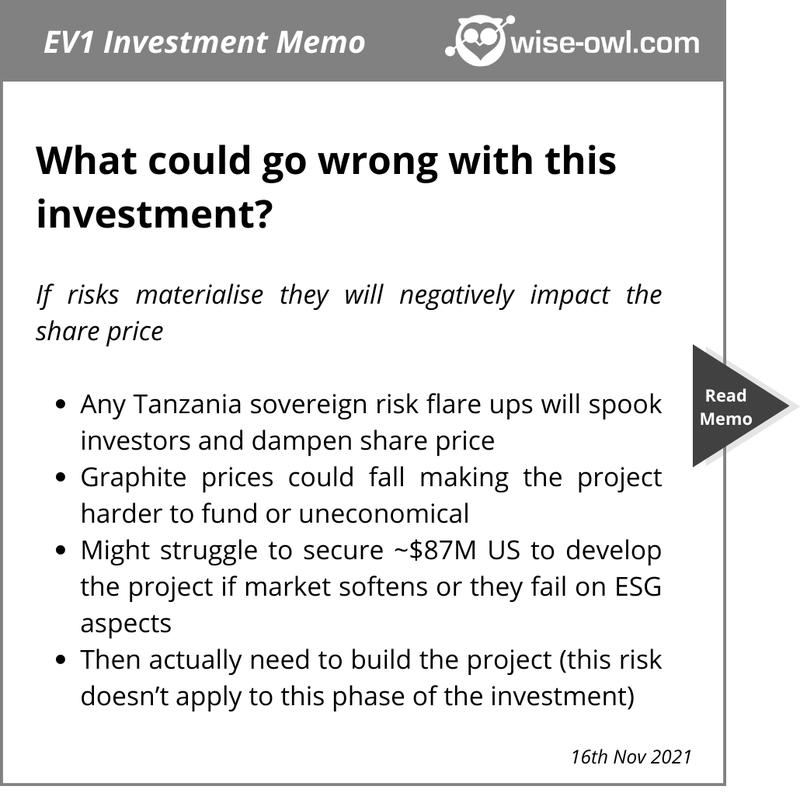

What can go wrong?

Today’s announcement marks EV1’s first step towards establishing a downstream value add business and gives us a first look at the demand for its product with the MOU agreed for a potential offtake agreement.

As EV1 gets closer to making a final investment decision on its graphite project we think its important to always keep in mind the potential risks to our Investment thesis.

Below is a screenshot from our 2022 EV1 Investment Memo detailing the risks we think are most important.

Our 2022 EV1 Investment Memo

Below is our 2022 Investment Memo for EV1 where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to track the progress of our portfolio companies using our Investment Memo as a benchmark, throughout 2022.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022

- Why we continue to hold EV1

- What the key risks to our investment thesis are

- Our investment plan

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and Associated Entities, own 3,125,000 EV1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our Investment in EV1 over time.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.