Could EEG be Sitting on 2 Billion Barrels of Oil Equivalent?

Published 25-AUG-2016 10:01 A.M.

|

9 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Empire Energy Group (ASX:EEG) has beefed up the economic value of its reserves and tipped its prospective resources in the NT beyond the 2 billion barrel of oil equivalent mark on a P50 basis.

It’s a positive step forward for this junior oiler with big ambitions in the Northern Territory and a steady patch in the US, particularly after it was all set to execute a big-name farm-out, until a sad twist of fate meant that the deal fell through.

That twist was the death of ex-Chesapeake Energy powerbroker Aubrey McClendon, known as the Steve Jobs of shale, who had instigated a farm-out with the company after calling the region one of the most prolific hydrocarbon-producers for the next 50-100 years...

Following his death, McClendon’s estate subsequently rolled back his assets and pulled investments.

This meant the farm-out agreement was put in limbo, but it had nothing to do with the quality of EEG’s assets.

This has meant that EEG has had to go back to square one to find a cashed-up farm-out partner – which could be beneficial for investors who could get in on the ground floor of a potential company-changing farm-out deal...again!

In the preparation of that ill-fated farm-out, EEG did all the work necessary to potentially turn it into a nine-figure project.

And while EEG has been hard at work in the NT, it is worth remembering, that they also have assets in the US where the company is a proven, profit making oil and gas producer.

Given the current climate of slowly rising oil prices and companies hunting for distressed assets in US, EEG may actually move down the mergers and acquisitions (M&A) path.

And in order to prepare for this, the company will shortly be conducting a share placement to raise $5 million to provide liquidity to potentially acquire assets in a weak onshore USA M&A market.

It’s the right time to be acquiring onshore assets in the USA, and EEG don’t want to be missing out.

This additional cash will also enhance the balance sheet and provide adequate working capital.

However it should be noted that the proposed equity raising will incur significant dilution to existing shareholders. It is always a good idea to seek advice from a professional financial advisor before choosing to make an investment in speculative oil stocks.

If you wanted to go in deep on the EEG story, we’d suggest checking out our initial coverage: Why did the Steve Jobs of Shale Choose to Partner with this ASX Stock?

In this article we’ll go into the work which has EEG has done since we first featured them in July, with a particular focus on how it has increased the economic value of its reserves.

Re-introducing:

Northern Exposure

While it has steady production coming from the US , we’re mainly going to focus on EEG’s Northern Territory play in this article because it may offer the biggest piece of blue sky for the company.

The latest from the NT is that a review of the Talwallah Group source rock at its McArthur Basin play effectively boosted EEG’s P50 prospective reserves beyond the 2 billion barrels of oil equivalent mark.

Now, before we go too far, it should be noted that a lot of EEG’s forward planning on this project is dependent on the upcoming Northern Territory election on Saturday August 27 th .

If the NT Labor Party is elected, it may undertake a review of, or introduce a fracking moratorium, which would pose issues in the exploration and development of the project.

Until there is more certainty regarding politics in the NT, EEG’s proposed 2016 seismic and drilling program has been deferred.

What EEG has been up to

EEG has been working away in the Northern Territory for some time on a project right next door to acreage Audrey McClendon described as containing “the best shale well I have ever seen”.

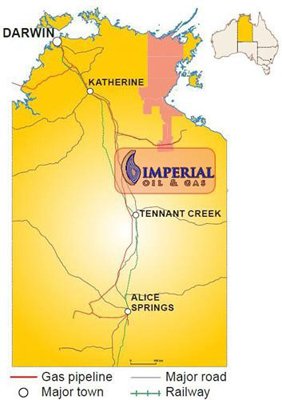

The shaded area above represents EEG’s project (Imperial is the subsidiary), and is about 15 million acres. For reference, that’s roughly the size of Norway.

Underlying this extensive landholding is some of the most prospective shale in Australia. That’s because the shales are part of a depositional basin – where the shales were originally formed.

In oil and gas terms, that’s a pretty sweet spot to be in.

Literally.

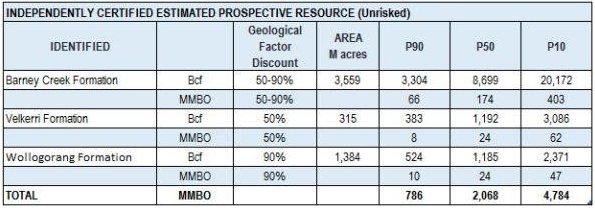

There are three main formations in play here – being the Barney Creek , Velkerri and the Wollogorang .

These shales are starting (on the early technical work at least) to bear similarities to both the Utica and Marcellus shale – two of the more successful plays from the US scene.

There are other shales at various depths, including Lawn Hill, the Riversleigh, McDermott and Kyalla – but the primary target here is the Barney Creek with the Velkerri and Woologorang coming in behind.

A recent study found that the Talwallah group of shale (comprising mainly the Woologorang and McDermott) had the potential for oil and gas generation.

The studies included analysis of core samples taken during previous mineral drilling – with total organic carbon measurements on the cores ranged up to 7%.

Organic content at this range is usually a good sign – remember, all oil is organic. A helpful hint next time you’re chowing down at the local vegan/paleo hotspot...

Work done by EEG to date has allowed it to confirm that the Wollogorang alone could add up to 24 million barrels to potential targets.

EEG has elected to discount the potential area by 90% given the number of unknowns with the formation – but has come up with a figure of 240MMboe on a P50 basis.

By the by, a ‘prospective resource’ refers to an estimated quantity of petroleum which may potentially be recovered by the application of a future petroleum project – with P50 a halfway bet.

EEG said work programs were being planned to firm up the potential of the new formations, but the initial work was enough to push it above the 2Bbbl mark on a P50 basis.

If you want to get even more bullish about it, the P10 was 4.7 billion barrels.

Updated resource table

Note that the above figures are given in barrels of oil equivalent, meaning that not all of it is oil, a lot of it is gas.

EEG has estimated in the past that it could have as much as 12 trillion cubic feet of gas equivalent on its plate.

Now, this is an unrisked prospective number, and it doesn’t necessarily mean EEG will be able to produce oil or gas from the NT, there are a range of factors that go into getting an oil and gas project of the ground, some of which is out of the company’s control. So apply caution to any investment decision.

That in itself would make a nice LNG project (or two), and with the prospect of new gas pipelines connecting to the east coast gas market – EEG is sitting in the right place at potentially the right time.

Having over 2Bboe though and what that means is worth some consideration...

What’s EEG worth?

So this company, capped at under $6 million now has a prospective resource in the Northern Territory of more than 2 billion barrels of oil equivalent.

Just think about that.

The numbers demonstrate the potential value here.

In fact, EEG only recently updated the economic value of its 1P, 2P, and 3P reserves.

A quick note here – there’s a difference between reserves and prospective resources .

In a nutshell, prospective resources are ‘undiscovered accumulations’, while 1P reserves are proven to be there, 2P reserves are probably there, and 3P reserves are possibly there.

That’s why you’ll get big numbers for prospective reserves but then have that come right down for regular reserves.

As part of an ongoing debt facility process, EEG recently calculated the PV10 of its reserves.

PV10 is the current value of approximated oil and gas revenues in the future, minus anticipated expenses, discounted using a yearly discount rate of 10%.

Since December last year, the value of its 1P reserves has gone up 65% to $47 million, its 2P PV10 went up by 59% to $71 million and its 3P PV10 jumped 77% to $83 million.

Remember, this is a company with stable income from its US projects helping to offset the large cost of developing projects in the NT.

So, how did it come to have such a large resource right under the nose of ASX investors – and why hasn’t the market responded to the opportunity to date?

The McClendon factor

It’s not often you get an opportunity to get in on the ground floor twice, but it’s starting to look like EEG could offer that opportunity up.

Sharp-eyed readers may have noticed that we mentioned Aubrey McClendon earlier on in this piece, and there’s a good reason for that.

That’s because the so-called ‘Steve Jobs of Shale’, a man who had a huge hand in the US shale gale through his involvement with Chesapeake Energy, liked the cut of EEG’s jib.

In fact, despite the difficulty in developing in the Northern Territory he placed four bets in the region.

One of them was with EEG.

McClendon and his private company agreed to a definitive farm-out agreement with EEG, to the tune of $US75 million ($A98.7 million) with an additional $100 million on the slate for stage two development.

Obviously this more than experienced shale man knew EEG was onto something here – but unfortunately he passed away earlier this year.

His estate has subsequently rolled back his assets and pulled investments – but it had nothing to do with the quality of assets.

It does mean that EEG is back at square one trying to find a cashed-up investor, but it also means punters can get in before a company-changing farm-out deal...again!

The technical work has been validated and EEG knows exactly how much its NT project is worth and it can point to the judgement of the late Aubrey McClendon to validate it.

At the same time, the results on the upcoming NT state election may also have an influence on the attractiveness of this project to would be suitors. This is a political risk for this stock, and investors should do their own research before making an investment, and seek advice from a professional financial advisor.

The work has by and large been done to snare a farm-out – EEG just needs to do it again.

It’s done it once...

The Final Word

It’s not often that you get a take-two in life.

The passing of McClendon could have seen EEG in dire straits, but the rocks remain the same.

While the winds of fate and misfortune swirl on the surface the rocks only change over millennia.

The rocks remain just as prospective today as they were 2 years ago, 20 years ago, 200 years ago, and 2000 years ago.

They’ll probably remain just as prospective for a while too...

Now EEG has a second chance to snare a company-making farm-out deal, and that generally involves making the project look as good as possible. All the while EEG is generating cash from its US operations.

Depending on the way the upcoming election goes in the NT, that is likely to mean plenty of drilling, plenty of resources updates, and plenty of data to whet the appetites of brokers.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.