Developing High Grade Uranium in Utah

Overview: GTI Resources Ltd ("GTI", "the Company") is an Australian minerals exploration company focused on uranium and vanadium. The Company’s flagship assets are located in the prolific Henry Mountains region in Utah, the USA with an initial focus on the Jeffrey Project. The Henry Mountains region contains high-grade uranium & vanadium deposits having produced 17.5 Mt of ore averaging 2,400ppm U3O8 and 1.25% V2O5 (92 mlbs U3O8 and 482 mlbs V2O5) dating back from the early 1900s. GTI acquired the projects in 2019 and is currently preparing for its maiden drill program, after sampling established its potential high-grade nature. GTI also owns the Niagara gold project, located in WA, which comprises a granted exploration licence and four prospecting licence applications.

Catalysts: Having recently completed downhole logging of 26 historical drill holes, GTI is now preparing for its maiden drilling program at the past-producing Jeffrey Project in Utah. Located in close proximity to the only fully licenced and operational uranium mill in the US – the White Mesa Mill operated by Energy Fuels Inc (TSE: EFR) – the project has potential to deliver uranium ore to fill existing mill processing capacity. In addition, further sampling and mapping work has been conducted at the nearby highly prospective Rats Nest Project which has also produced uranium and vanadium ore in the past. Upcoming drilling activity scheduled for July offers a potentially high impact value driver. Also, we expect the recently announced support from the US government for domestic uranium producers, and uranium market developments, to drive interest in the Company.

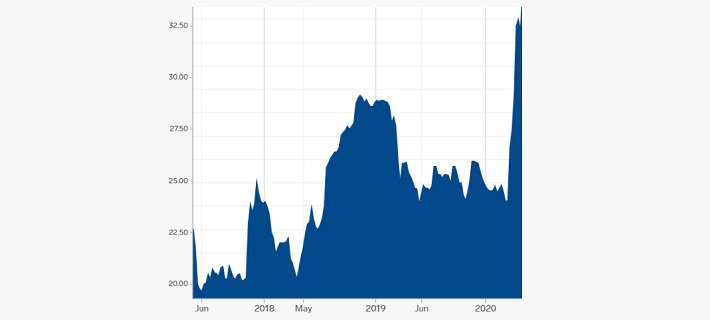

Hurdles: Uranium spot prices have increased by over 30% year-to-date, but the uranium market is subject to significant price volatility and there is no guarantee that the recent recovery will deliver a long-term sustainable price environment. The Company is well funded to progress to the next stage of drilling, it remains reliant on external capital to advance project development. Exploration is relatively inexpensive in this region, nevertheless, considerable further capital and technical investigations are required to establish the feasibility and long-term economic merit of additional mining development in the Henry Mountains.

Investment View: GTI offers speculative exposure to a recovery in uranium markets through a portfolio of exploration assets in the prolific Henry Mountains region. We are attracted to the magnitude of the Company’s assets and proximity to existing infrastructure, particularly the White Mesa Uranium Mill which is the only conventional mill operating in the US. As the initial phase of exploration sampling yielded highly encouraging results, we believe the Company is well-positioned to leverage its assets to capitalise on opportunities as it advances the project. While volatility in uranium prices and funding beyond the current programs are principal risks, the Company’s project represents a strategic exploration asset in a government-backed sector. Amid a limited universe of investible securities on the ASX and with uranium spot prices trading near four-year highs, we initiate coverage.

COMPANY OVERVIEW

GTI Resources is engaged in the exploration and evaluation of mineral and energy resources and is principally focused on the development of the Henry mountains Project in Utah, USA.ASSET OVERVIEW – HENRY MOUNTAINS

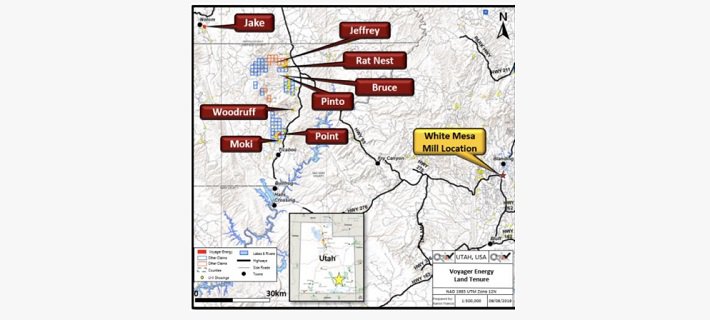

The Henry Mountains project is situated in the Henry Mountains mining district of southeastern, Utah, USA, and consists of eight strategically located projects. GTI has acquired the uranium and vanadium properties through the acquisition of Voyager Energy Pty Ltd (Voyager) in 2019 following a fully underwritten placement and non-renounceable rights entitlement offer that raised ~$2 million.

The properties cover ~1,500 hectares of the Henry Mountains region, within Garfield and Wayne Counties near Hanksville, Utah. The adjacent mining region has historically produced in excess of 17.5 Mt of ore averaging 2,400 ppm (92 mlbs U3O8) and 12,500 pp, V2O5 (482 mlbs V2O5). This region is historically highly prolific and has, in the past, provided the most important uranium resources in the USA. It forms part of the prolific Colorado Plateau uranium province.

The Company’s assets are located in close proximity to the only fully licenced and operational uranium mill in the US – the White Mesa Mill operated by Energy Fuels Inc (TSE: EFR). The mill is currently operating well below capacity and has historically accepted milling agreements and purchase agreements from neighbouring mines. While no arrangements are currently in place between GTI and Energy Fuels, there is a potential in the future for a low-cost opportunity to utilise existing infrastructure and fill existing mill processing capacity.

During the first quarter of 2020 GTI received assays from previously conducted sampling programs with high-grade assay results of 1.39% U3O8 and 2.46% V2O5 and 0.12% U3O8 and 3.89% V2O5, which was followed by a spring exploration program in early May to further establish the high-grade nature of the project. The uranium testing was completed on 7 May 2020 with results expected within 14 days.

The initial focus for exploration in the Henry Mountains is the past-producing Jeffrey Project, where GTI has identified drill targets selected for its initial drilling program to be undertaken in early July.

In addition, the Company is conducting sampling and mapping work in nearby prospective areas including the highly prospective nearby Rats Nest Project which contains historical production workings.

ASSET OVERVIEW – NIAGARA

The Niagara project is located ~6km southwest of Kookynie, in the central goldfields of WA. The project comprises one granted exploration licence, E40/342, and four prospecting licences. Access to the project is provided via Goldfields Highway from the town of Menzies and the sealed Kookynie Road which bisects the northern part of exploration licence E40/342 and the southern part of P40/1506. The Company has met its current work obligations on these gold prospective tenements and has shifted its focus to its uranium & vanadium projects in Utah.URANIUM SECTOR

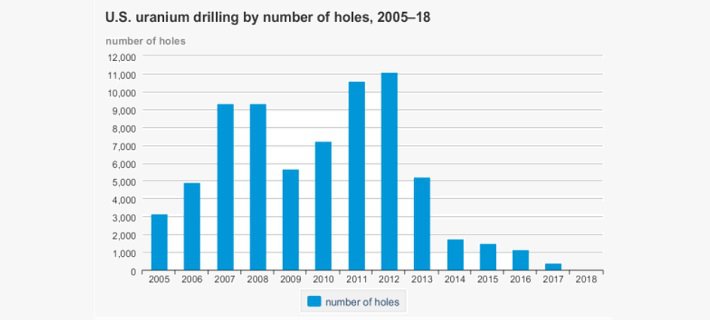

In late April the US Government identified potential national security and geopolitical standing issues and released a report outlining its plan to "revive" uranium mining in the US. The intention of the plan is to develop the nation’s nuclear technology supremacy after concerns it is nuclear technology capabilities lag behind other developed nations.

The FY21 budget proposes a US$1.5BN budget over 10 years to build a US uranium reserve to address sectors most immediately at risk.

In addition, uranium spot prices have increased by over 30% year-to-date, with spot prices hovering at ~US$34/lb, a four-year high. The legislative support together with the recent increase in spot prices could drive significant interest and investments to a sector that was largely neglected in recent years.

OUTLOOK

As GTI currently develops its brownfields past producing projects, there is presently insufficient data to establish the potential economics of a new mining campaign. However, the initial phase of exploration sampling yielded highly encouraging results and we believe the Company is well-positioned to leverage its assets and capitalise on opportunities in a sector that may witness increased interest.

Whilst GTI has sufficient funding to complete upcoming drilling, we note that a future resource delineation drilling program is beyond the scope of GTI’s current capital budget, and hence will require additional funding.

GTI is at a highly speculative stage of its company trajectory and considerable further capital and technical investigations are required to establish the feasibility and long-term economic merit. However, upcoming drilling activity offers a potentially high impact value driver for a company with an attractive asset portfolio in a strategically sound location.

THE BULLS SAY

- The Henry Mountains project is situated in a mining region that has historically produced in excess of 17.5 Mt of ore and in close proximity to the only fully licenced and operational uranium mill in the US – the White Mesa Mill operated by Energy Fuels Inc (TSE: EFR)

- Advanced through previously conducted sampling programs which have delivered high-grade assay results and the recently completed downhole uranium testing program was designed to further validate the data

- The maiden drilling campaign is scheduled for July 2020 and could be a major value driver

- The US government recently committed a US$1.5bn budget over 10 years to support domestic uranium producers

- Subsequent funding rounds for GTI’s exploration projects may be executed at higher valuations, in particular, if uranium spot prices resume recovering

THE BEARS SAY

- The uranium market is subject to significant price volatility and there is no guarantee that the recent price recovery will continue

- Whilst the Company is well funded to progress to the next stage of drilling, it remains reliant on external capital to advance project development

- Considerable further capital and technical investigations are required to establish the feasibility and long-term economic merit of additional mining development in the Henry Mountains.

- GTI is at a highly speculative stage of its company trajectory

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.