Dart hits bullseye at Buckland Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

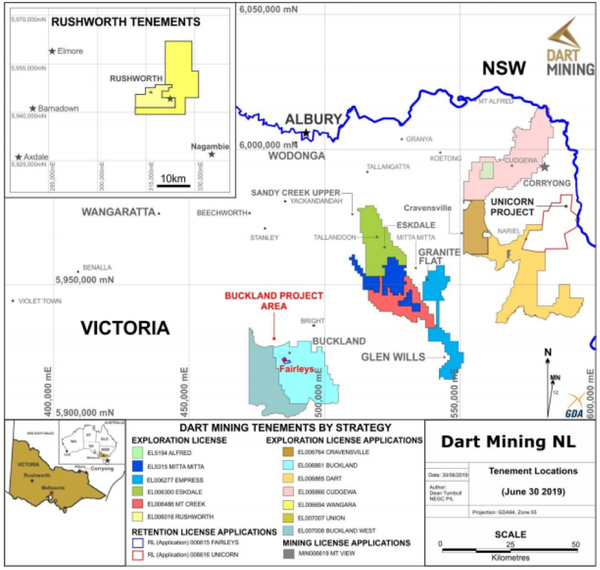

Dart Mining (ASX:DTM) has built a strategic gold footprint in the central and north-east region of Victoria where historical surface mining and alluvial gold indicates the existence of potentially significant gold endowment.

While the company’s background has spanned base and precious metals, including battery metals such as lithium, Dart has narrowed its focus on the gold sector, confident it can establish a mining operation in and around where more than 100,000 ounces of alluvial gold has been sourced since the 1800s.

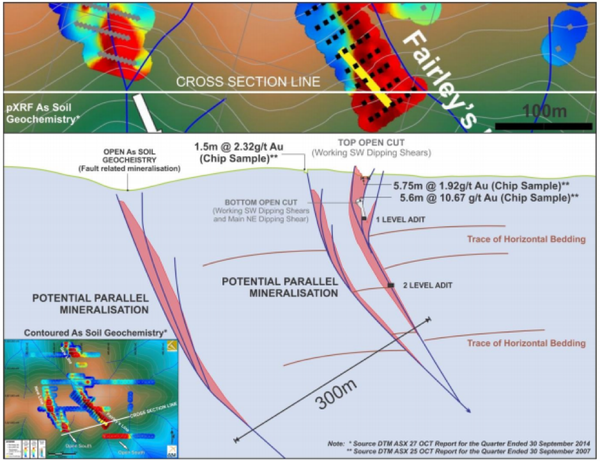

Geological mapping and geochemical soil sampling in recent months indicate the gold-mineralised Fairleys Shear Zone at Dart Mining’s wholly owned Buckland Project in north-east Victoria extends for more than 8.5 kilometres.

Two previous drill holes at the Fairley’s Prospect indicate that the Fairley Shear Zone contains gold mineralisation over extensional widths including 21 metres at 1.4 g/t gold and 40 metres at 0.8 g/t gold.

Also, grab samples of high-grade gold up to 60 g/t have been recorded and logged.

Similar characteristics to Fosterville

There is evidence to suggest that management’s strategy is sound given the success of the Fosterville Mine operated by Kirkland Lake.

This is located in an area which was also renowned for near surface high grade mineralisation, but Kirkland is mining the main orebody.

Today, Fosterville is a high-grade, low cost underground gold mine, 20 kilometres from the city of Bendigo, the centre of a prolific gold mining region.

Exploration in recent years at Fosterville resulted in a new Mineral Reserve and Mineral Resource Estimate, more than doubling underground reserves to 1.03 million ounces and increasing the average underground reserve grade estimate by 83% to 17.9 g/t gold.

Kirkland’s shares have increased from less than $30.00 towards the end of 2018 to a recent high of $75.21.

Nearby explorers such as Catalyst Metals (ASX:CYL) and Navarre Minerals (ASX:NML) have come under the microscope because of Kirkland’s success, but the significant gains in their share prices can also be attributed to the identification of high grade gold in 2019.

With Dart Mining having also had exploration success at its Buckland Project situated south of Bright in north-east Victoria it could come into favour.

In keeping with the Kirkland deposit, Dart believes that exploration in the vicinity of where the alluvial gold was uncovered in such prolific quantities could result in the discovery of a host orebody.

The recent discovery of regionally extensive mineralised shears indicates the 750 square kilometre Buckland Project has high potential for discovery of a large-scale gold mineralisation system.

Management believes that it is likely the bedrock source of the considerable alluvial gold produced historically from the Buckland River, and on this note Dart Mining’s managing director, James Chirnside said, “Dart Mining has made a substantial exploration breakthrough at our Buckland Project where we have now proven the existence of regionally extensive mineralised fault structures that have excellent potential to host a large-scale gold deposit.

‘’We see some similarities between our mineralised structures and the Fosterville Fault that is associated with the fabulous Fosterville Gold Deposit of Kirkland Lake Gold Ltd near Bendigo.

‘’Naturally, therefore, we now consider the Buckland Project to be our highest priority gold project and we are anxious to progress exploration rapidly.”

Looking more specifically at the area Dart is focusing on, the Buckland River historically produced considerable alluvial gold, but previous explorers and prospectors with limited exploration technology failed to find a substantial bedrock source for the alluvial gold.

The Fairleys Shear Zone cuts across the catchment of the Buckland River and Dart Mining considers it has now discovered the elusive bedrock source.

Biomodal system similar to Fosterville deposit

Dart Mining has postulated a mineralisation model for the Buckland Project derived from the regional geological setting and the results of its exploration at the Fairleys Prospect.

This model suggests shear zones with extensive disseminated sulphide development, as well as smaller low sulphide high-grade quartz reefs.

The model anticipates major shear zones, such as the Fairleys Shear Zone, will possibly consist of multiple stacked parallel shears most of which will display arsenic anomalism.

While the smaller, low-sulphide, high grade quartz reefs are not Dart Mining’s prime exploration target, their association with disseminated sulphide-associated gold mineralisation within shears provides evidence of what is termed a bimodal gold system.

The importance of the bimodal nature of the system relates to the analogy to the Fosterville gold deposit in Central Victoria where gold mineralisation is associated with the Fosterville Fault, a regional fault traced for over nine kilometres.

Dart Mining’s current exploration approach is to complete soil geochemical coverage over the catchment of the Buckland River to delineate regional arsenic anomalies that are probable indicators of gold-arsenic mineralised shears.

Dart’s soil sampling which will assist in testing the potential for large-scale gold mineralised systems associated with regionally extensive shear zones is the first modern regional evaluation of the gold field for a new mineralisation style.

Consequently, the company is one of those stocks which will need to be followed closely, as one batch of high-grade exploration results could trigger a significant share price increase.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.