Cracker-jack British Bulldog AIMs for Oil Windfall

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

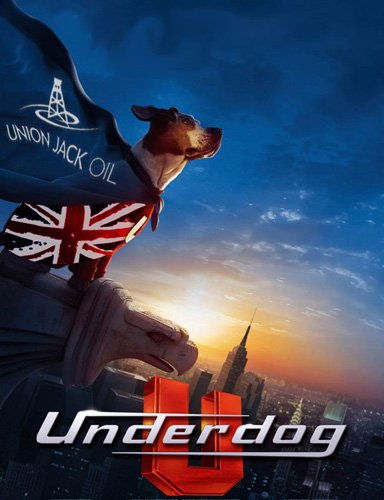

This AIM listed oil opportunity could see investors board the Britannia onshore oil market, a small but hot market niche that’s now offering what could be seen as a ‘politically-motivated’ investment opportunity, and what we think house some handsome risk-reward ratios.

Moving into the Britannia oil breach is a resolute early-stage oiler, that’s getting set to bring a key oil asset into production within months...

...and use its growing momentum to move into other strong oil assets within the UK.

With levels of political hullaballoo in the UK and Europe reaching record highs, this company’s business strategy is aiming to seize hydrocarbon-bearing territory in the East Midlands and Weald Basin and deliver a resounding strike on the Brent oil market in the dawn of night.

Something that looks a bit like this:

Much like the brave hearts fighting for UK interests in Parliament and in Brussels, there happens to be a commercial bulldog scrapping to secure a firm stake in the energy landscape of the UK.

This plucky oiler has given us cause to sit up and take notice here at The Next Oil Rush , packing some rather alluring features which we will go through in detail in this article.

Before we go too far, we should point out that this is an early stage exploration play and a speculative investment, so exercise caution if considering this stock for your portfolio and seek professional financial advice before choosing to make an investment.

Already in production — this underdog is due to see one of its key wells go into full production within the next 3 months.

If all goes to plan, this British underdog will not only secure an initial £1 million in annual revenue...

...but it will also help to improve the UK’s domestic oil production rate.

Furthermore, this AIM listed stock is set to embark on a fully funded drilling and testing programme on its exploration assets over the coming months.

This could be a very intriguing market position that has all sorts of commercially alluring political entanglements. Namely, if the UK political brains-trust pushes through with disentangling the UK from Europe...

...positioning yourself as a highly efficient and productive oil company operating exclusively onshore UK could in hindsight prove to be a masterstroke strategic manoeuvre that Captain Mannering could only dream of.

The overarching plan is to use the proceeds from its upcoming well, to springboard into developing its growing list of potentially productive assets in nearby areas in onshore UK — a bit of an empire-building mission Brits have always been famous for.

One other neat bonus for this British bulldog, is that it is using fully conventional, no-frills, drilling techniques without too much kerfuffle or expense.

Well calculated risks can carry ample rewards for those brave enough to put their money where their mouth is – although of course success is no guarantee in oil investing.

The British Government took a risk by having an EU referendum, looking for political capital as a reward. The British people took a risk by voting ‘Brexit’, in search of sovereignty and the warm-and-fuzzy feeling of giving the Establishment a kicking.

So just as with politics, so too in small-cap oil companies.

This company has taken a risk of buying into 11% of an oil well that’s about to go into full-scale production, and the reward is an initial £1 million in cash flow for this micro capped stock.

Letting the leash off:

Small-cap oil companies must take calculated risks in order to reap significant rewards which means plenty of diligence and a master-plan are required.

All seasoned oil investors realise that a delicate mix of risk and reward is part and parcel of any potential oil opportunity on the London Stock Exchange — risks must be weighed carefully while potential rewards must have realistic expectations.

With that in mind, AIM quoted Union Jack Oil (AIM: UJO) has earmarked a commercial manoeuvre to be executed with military precision in the coming months.

UJO is on course to secure a steady and growing oil flow rate as part of a JV partnership.

Let’s take a closer look at this Brit’s commercial arsenal, to see if it has a chance of hauling in some commercial spoils

The first thing that struck us when doing our due diligence on UJO is the location of its assets. UJO is conducting oil production and exploration all from conventional onshore UK assets.

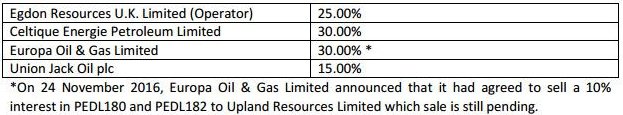

Here they all are mapped out for our readers:

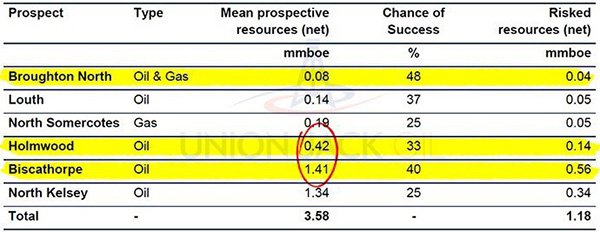

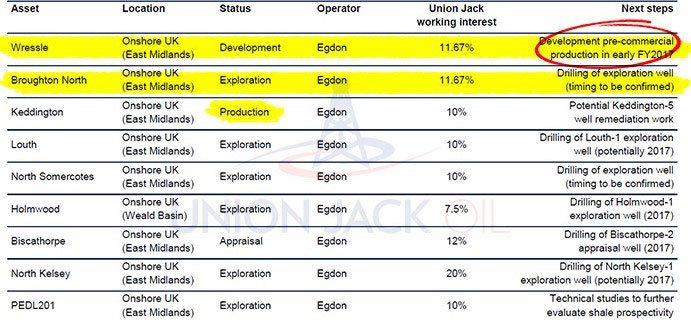

As you can see, UJO has 7 distinct projects in total spread across two regions of the UK.

One is already in production (Keddington) and one is expected to come online within the next 3 months (Wressle).

Further out, UJO plans to maximise its returns for shareholders by drilling and hopefully developing its most highly oil-bearing prospects first and foremost — Biscathorpe, Holmwood and Broughton North.

‘Wrestling’ for oil revenues

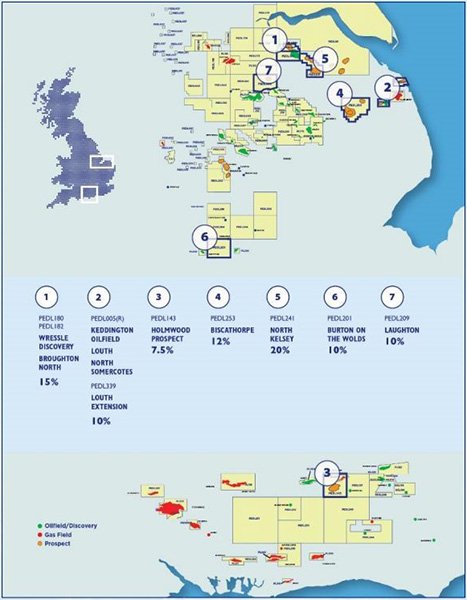

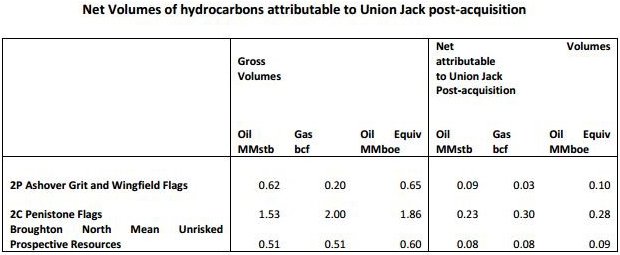

Just last month, UJO topped up its 8% stake in Wressle to 11.67% in exchange for £600,000.

The acquisition was funded via a capital raising which leaves UJO with over £2 million in cash and fully-funded to drill Biscathorpe, Holmwood and Broughton North.

The combination of near term production and follow-on exploration opportunities could mean UJO will set off on a gradual path of expansion once its first Wressle mission is accomplished.

UJO has confirmed 2P reserves for the Ashover Grit and Wingfield Flags horizons within Wressle, in addition to contingent resources in the Penistone Flags zone and prospective resources for Broughton North.

In tandem with its JV partner, UJO is now waiting for planning permission approvals from local authorities, expected to be received in the near future. The granting of production approvals will be a significant price catalyst in its own right given this is the last permitting stage before the taps are cracked open.

Here is some latest reconnaissance footage:

UJO and its partners plan to develop its slice of the East Midlands oil province and prove up a cluster-style project that is incrementally growing on the back of its own oil sales revenues.

Port of call for this black-gold sea-farer is close to the “Gatwick gusher”

After Wressle, UJO has Broughton North waiting in the wings to be drilled given its close proximity to Wressle.

There is also Holmwood and Biscathorpe — two relatively low-risk prospects which are on track for drilling as soon as reasonably possible in 2017.

Significant developments at these two prospects could quickly be accompanied by North Kelsey and Louth , depending on UJO’s ability to find partners. Considering the perked-up activity in oil exploration, especially in the UK, we think future updates on Holmwood and Biscathorpe could have significant revaluation potential.

Keep in mind though that any re-rate is speculative at this stage, so investors should do their own research and take all public information into account – not just what you read in this article – before making an investment decision.

One of the most important facts for investors is that UJO is fully funded to participate in the first wells at Holmwood and Biscathorpe, which together account for more than 50% of net prospective resources across UJO’s portfolio in the UK.

Here it is tabled and summarised:

The Telegraph ran a story on UJO and the UK’s onshore oil industry earlier this year, and hailed UJO’s Holmwood stake near the Gatwick gusher:

The Holmwood oil licence area is 7.5 miles west of Horse Hill within the Weald Basin, which oil explorer UK Oil & Gas (UKOG) claims could hold 9.2 billion barrels of oil. Another junior in the area, Europa, estimates Holmwood to contain around 5.6 million barrels with a geological chance of success estimated at 33%.

For oilers in Saudi Arabia or Texas, these may not be stellar numbers. But when considering that all of UJO’s production is from onshore UK — as part of a broader mission-plan which requires initial small-scale production to get revenues flowing — UJO’s small portfolio is very straightforward and geologically simple to accomplish.

You can read about what happened to UKOG’s valuation when it announced its expectations-beating flow-rate test results:

UJO’s mission plan is now set, and we think there is a good chance of UJO striking a hit on its targets, and therefore helping to raise its meagre £6 million market cap.

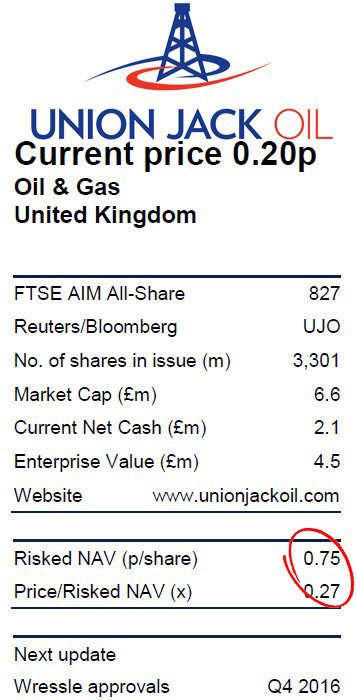

Let’s take a look at what the analysts think UJO is capable of advancing to:

According to consensus forecasts UJO’s risked NAV is £0.75 per share — a 275% premium to today’s market price.

However please note that analyst price targets are based on a number of assumptions that may not eventuate – so don’t invest solely on price targets alone.

Financial metrics

One of the first things we like to do when evaluating a potential stock, is to wade into the financial metrics to see how our stock idea could deliver on its hype. In other words, have a look for any factors that could convince us to move from pencilling in a stock, to penning a share purchase.

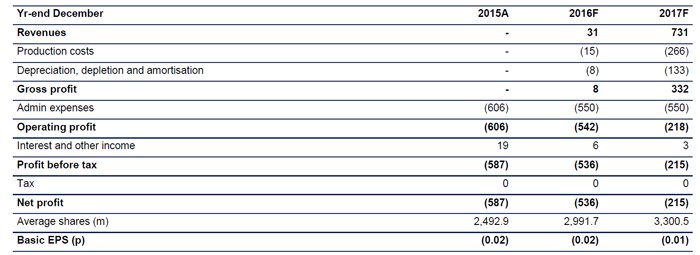

If we look at UJO’s estimated production rate, production cost and take into account its joint-venture commitments, UJO is projected to achieve revenues of around £700,000 per year just from the proceeds received from Wressle and Keddington.

Wressle is expected to produce around 500 barrels gross per day at an estimated cost of approximately $20 per barrel.

If we assume Brent crude prices will remain close their long-term average of around $55 per barrel, UJO is participating in an oil exploration project that will produce around 180,000 barrels per year gross, and generating around $10 million per year.

UJO’s 11% stake in Wressle means it can realistically expect to generate somewhere around £700,000 in initial revenue, and around £330,000 in profit for year-end 2017.

Union Jack Profit & Loss (£’000):

In UJO’s case, the prevailing price of Brent crude oil is helping to make UK oil production more economically viable by the day. The weakness of the British pound is another helpful factor for UJO because it makes its oil sales relatively cheaper and reduces the UK’s import requirement.

If we look at the broader oil market, there is some cheer from the fact that Brent crude prices are trading at their highest levels in over a year, and seem to be consolidating after several years of declines.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The macroeconomic picture is firming in UJO’s favour as a weaker pound, industrial resurgence in Asia and broad improvements in economic data are further underscored by the most recent factor to affect UK-based companies: Brexit.

Brexit has cast serious doubts relating to the UK’s long-term energy security and raised the possibility of the UK having to source more of its energy from home.

That’s music to the ears of many Brexit campaigners, and so too for UJO as a company.

This is the current state of affairs when it comes to working out a hasty EU exit and triggering the highly vaunted Article 50:

It’s a long and winding road, and there’s a long goodbye at the end.

This political background provides UJO with the perfect opportunity to establish a firm foothold in the UK’s domestic energy market, and thereby lead by example in demonstrating why British companies needn’t baulk at European separation, but could instead monetise the living daylights out of it.

Here’s a summary of UJO’s current status in terms of getting its prospects to production stage:

Union Jack Asset Summary Table:

Unconventional potential, with a conventional twist

One kicker card up this oiler’s sleeve is a conventional one for any company searching for rapid market traction: unconventional oil exploration.

UJO has an option to pursue its PEDL201 prospect in the East Midlands, and targeting plumper flow rates compared to its conventional portfolio. Analysts see a further 30% premium applicable to UJO should it successfully proceed with PEDL201.

The good news is that UK government officials have been amenable to approving fracking ( demonstrated by recent approvals for Cuadrilla ), and continue to support it.

What better way to set sail away from Europe than with your very own Brent?

Earlier this year on June 23 rd 2016, the British people unexpectedly voted for the UK to leave the EU.

The ramifications have been many, and yet the answers to how a Brexit will actually proceed have been few. The UK’s energy security is a topic that has hardly been mentioned amongst all the Marmite scare stories .

Amidst this political squabble with potentially huge economic consequences is an oil junior with existing onshore production and the starting gun loaded on its next oil prospect — Wressle in the East Midlands.

Having carefully timed its asset acquisitions, and exploration schedule, UJO is now on a launch pad to raising its lowly £6 million market cap and will hopefully see a re-rating of its 0.20p share price much like other local oil companies such as UKOG have managed to do in recent months.

However, as with all tiny oil companies, a successful investment is no guarantee. Those considering this stock should seek financial advice before making an investment.

When all things are considered, we are asking ourselves only one question here at The Next Oil Rush: Was there ever a better time to buy British, than this?

It’s not the size of the dog in the fight, it’s the size of the fight in the dog...

...and this Underdog is going places.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.