Client Growth Up 20% as VPC Furthers Global Ambitions

Published 06-SEP-2016 10:35 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

2016 has been a transformational chapter in the life of Velpic (ASX:VPC) and its shareholders.

The company is beginning to make a significant dent in the LMS market with its learning management software solutions. Just think about the amount spent on the market and you get a clear indication of just how potent VPC could be.

Here are the numbers: $130BN is spent on training, $107BN is spent on e-learning and $4BN is spent on LMS technologies.

VPC has begun its ascent into this market and is already having a global impact in the Asia Pacific, the UK and the US.

So even though analysts are not expecting the group to transition to profitability until fiscal 2018, management has paved the way for strong revenue growth over the coming 12 months and beyond.

A key driver of this accelerated revenue growth should be the recently announced release of the group’s version 3.1 cloud-based video e-learning platform in conjunction with US-based NASDAQ listed ADP.

Integration with ADP is an integral part of VPC’s international expansion plans.

Integrating with ADP’s global human resources Marketplace is important in that this technology helps employers manage an ecosystem of complementary enterprise applications.

The deal with ADP also stacks up well on the numbers front given that Marketplace allows employers to manage business applications in one simple and secure location, effectively providing VPC with an addressable market of 630,000 customers across more than 100 countries.

Including the UK.

It was only at the start of August that VPC informed the market that it had successfully tendered for the UK government procurement platform G-Cloud.

Crunching the numbers, with VPC approved as a vendor on the UK government procurement platform, G-Cloud gives the company access to over 38,000 public-sector buyers.

It should be noted here that the number of people VPC may attract is indeterminate and as such should not be the only fact to influence your investment decision. For more information about VPC seek professional financial advice.

The significance of having established partnerships and agreements in the large UK and US markets is that, with the release of Velpic 3.1, administrators can immediately commence using the new technology to fast track automated scheduling, consumption and reporting, while professional video content is being created.

These market and technology milestones demonstrate that VPC is willing to put customers first, has its ears to the ground, and is committed to provide the most user-friendly technology to make life easier and more productive for more training managers across all sectors and geographic regions.

Re-connecting with:

Getting to know Velpic

Reflecting on Xero’s evolution as a listed company, investors took a little time to understand the stock after it listed on the ASX in November 2012.

Its shares traded between $5.00 and $10.00 for the first six months, but in the ensuing 12 months increased more than four-fold to hit an all-time high of nearly $43.00. Xero is currently capped at $2.6 BN.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

While not suggesting VPC will have the same meteoric share price rerating, it is one of those stocks that takes a little time to understand and it would appear that once the underlying SaaS technology and its numerous applications in the learning management industry are grasped there could be strong support for the stock.

This article will take you through all the latest at VPC, and its outlook for the coming months.

The Next Tech Stock track record

The Next Tech Stock is always on the look out for early stage ASX listed companies that represent strong potential for growth, such as VPC.

Whilst the sector has been somewhat out of favour recently, two of our tech stocks have been performing exceptionally well, demonstrating that quality companies can garner the interest of the market.

We first wrote about Fast Brick Robotics (ASX: FBR) in this June article , and reminded readers again about the stock in August ...

FBR is up over 180% since our first article:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Meanwhile Megastar Millionaire (ASX:MSM) continues to go from strength to strength. We first wrote about the stock back in January , and reminded readers about the stock in May .

MSM has been up as high as 340% since our first article:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Can VPC follow in the footsteps of other ASX tech success stories?

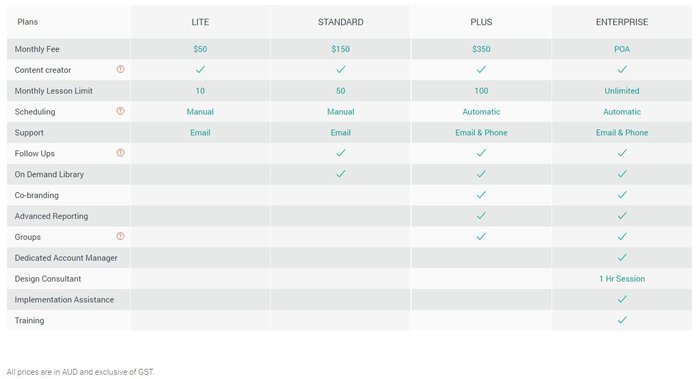

We will have to wait and see. What is clear is that the size of VPC’s end markets cannot be ignored for long. The company has positioned itself well to target the small to medium enterprise market (SME), and the following table demonstrates the potential size of this sector alone.

Of course, VPC is already strongly positioned in terms of servicing top tier companies with its client base including Alcoa, Australia’s largest automotive retailer, AHG (ASX: AHG) and leading engineering and construction groups such as Clough, Monadelphous (ASX: MND) and Laing O’Rourke. VPC also has a presence in the government owned utilities sectors with clients such as WA’s Water Corporation, through its brand technology agency Dash Digital.

Efficient scalability is the key to VPC’s success as it looks to expand its areas of representation, industry exposure and client portfolio off a relatively fixed cost base.

Businesses like VPC that generate strong upfront revenues combined with robust recurring income with nominal ongoing capital expenditure traditionally generate quality margins resulting in earnings increasing exponentially as the top line grows.

However, for investors taking their first look at the business it is important to understand the developments that have occurred to date and in particular gain an appreciation of the progress management has made since the company listed on the ASX – as it could be argued this isn’t reflected in the company’s share price performance over the last 8 months.

The following table provides a pre-and post ASX listing snapshot of VPC through to the important launch of Version 3.0 of its cloud-based video e-learning platform. Importantly, this was achieved three months ahead of schedule, effectively providing the group with the opportunity to accelerate its entry into global markets.

Entry into global markets can now be done with the launch of Velpic 3.1.

Yet how long this takes and at what rate remains to be seen, so invest with caution if considering VPC for your portfolio.

What does Velpic 3.1 bring to the table?

Velpic 3.1 will be welcomed by both large and small businesses, consistent with the group’s strategy of expanding its presence and rolling out new products among established blue-chip clients, while gaining increasing penetration in the small to medium enterprise market.

Switching to its video lessons, VPC will be able to reduce costs, improve learning outcomes and increase productivity by up to 75% compared to traditional training methods and the use of static or text-based training materials.

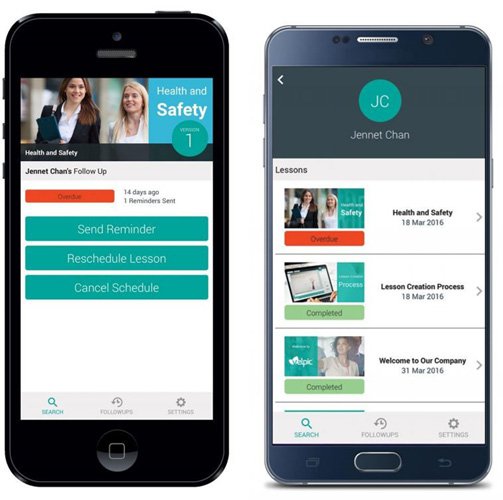

The new product will be technologically rich with native mobile apps for administering and consuming training support, as well as the rapid creation and rollout of timely and frequent micro-learning strategies.

Here’s an idea of how Velpic 3.1 simplifies learning:

Early adopters of VPC’s industry disrupting integrated technology will recognise the profitable long-term value of creating a learning culture.

Enterprises are increasingly taking a proactive approach with a view to increasing productivity, rather than merely meeting their compliance obligations.

Generally, the better and more user-friendly the technology, the quicker management is to accelerate its learning programs, as well as broadening their reach to personnel who may have traditionally not been targeted for training programs.

On this note, VPC’s flexible value for money “per seat” pricing, based on the number of monthly active users, puts its LMS within the budget of organisations of any size, encourages deeper uptake by more users in the same organisation and can be conveniently paid by credit card or added to an ADP invoice.

Importantly though, customers would still be able to use the technology on a pay-per-view pricing arrangement if that was better aligned with their business model.

Conversion of capex to cashflow comes into sync in 2017

When examining VPC’s timeline to profitability it is worth noting that many companies that have listed in the Software as a Service (SaaS) space are looking much further out than 2018 in terms of becoming earnings positive.

Furthermore, it is important to realise that VPC has a clearly defined revenue stream, a strategy that will generate income growth in the near term and a far superior capex to cashflow recognition model than many other players in the SaaS industry that have experienced significant share price re-ratings despite substantial cash burn and no visible inflection point.

With the May launch of Version 3.0 of VPC’s cloud-based video e-learning platform delivered three months ahead of schedule (and 3.1 just launched), much of VPC’s upfront expenditure in terms of systems and intellectual property is now behind the group and the infrastructure is in place to introduce new clients, drive sales, generate revenues and establish recurring income streams.

Expect the deals to keep coming

VPC intends to continue client acquisition for the Velpic platform and rapidly accelerate the company’s overseas expansion.

Over the course of fiscal 2017 there will be an emphasis on the development of additional sales partnerships and digital marketing channels.

An important distribution partnership agreement was secured in June with high-growth business advisory platform provider Panalitix.

This potentially offers a tripling in recurring monthly revenues within a twelve month period.

However, this is speculation on our part and no guarantee to occur. Don’t base your investment on this speculation alone and seek professional financial advice fir further information.

The agreement also provided VPC with access to an immediate 165 new customers and potentially 500 new customers in both Australia and the US.

Employing a multi-tiered sales strategy, VPC is able to generate revenue through direct subscription packages with Panalitix and a reseller revenue sharing agreement.

This type of arrangement is generally suited to the small to medium enterprise market, but more specifically the underlying agreement demonstrates the breadth of value creation that comes with each deal.

These developments are expected to make a strong and positive contribution to revenue and cash flow as growth in customer numbers begins to accelerate with minimal increase in current overheads.

Look for a Rerating

It would appear that there will be significant news flow in the near to medium-term and this is definitely a factor highly regarded by investors looking to spot an emerging company at an early stage.

As a guide to what the analysts are thinking, Luke McNab from Baillieu Holst expects the group to transition to profitability in 2018.

In terms of recommendation, McNab said, “Velpic is a speculative BUY with large potential upside in the medium term”. He has a share price target of 5 cents on the stock, representing upside of circa 150% to the recent low of 2 cents.

While achieving this price target would represent a significant jump, at the same time it should be noted that analyst price targets are no guarantee to eventuate, so don’t invest purely on the strength of an analyst report alone.

VPC is arguably recovering from an oversold base, with strong news flow leading into the end of the fiscal year seemingly overlooked as tax loss selling prevailed.

Now that this has washed through, investors will have an opportunity to focus on what should be a period of extensive and significant news flow, so a substantial rerating wouldn’t surprise.

It is worth noting that the company’s shares traded at 5 cents as recently as April, and the retracement since then hasn’t occurred on the back of unfavourable news, rather it appears that the company has just slipped off the radar.

However, you can’t keep growing business at this pace without being noticed.

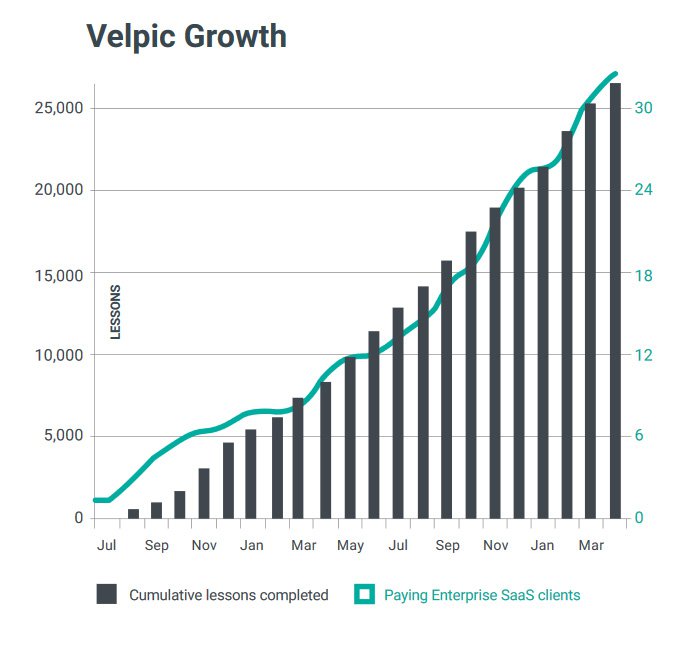

In only eight months, VPC has transformed from a private business with a single enterprise revenue stream based solely in Western Australia, to a public company with the ability to perform on the international stage.

With Velpic 3.1 now launched and deals such as the one VPC has done with ADP, all the world may be just be the stage.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.