ASX Tech Company: 500 Bucks to $11M Market Cap

Published 12-MAR-2015 00:40 A.M.

|

14 minute read

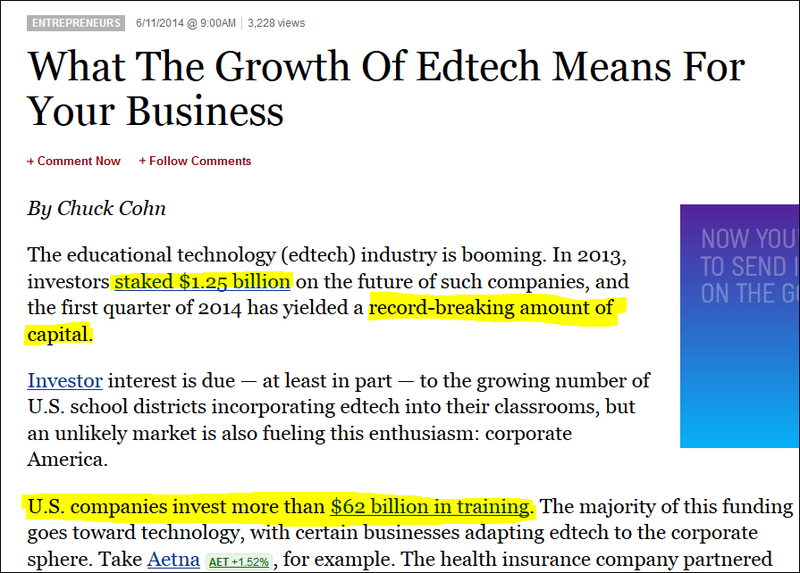

Back in 2012, one hour of video content was uploaded to the video website YouTube every second.

Just a year later, 72 hours of video was uploaded every minute!

With the rapid advances in smart phone technology, almost everyone now has the power in their pockets to produce high quality videos, and broadcast them instantly across the Internet.

In this digital age, video is king – but the challenge is to make it pay...

There are two basic ways to make money from online videos – charge to make them or charge to show them.

And at The Next Tech Stock , we’re just invested in a company that’s doing both right now.

This company is making cash from creating online video reviews and then charging subscription fees to clients to display them on its tech platform – laying the foundations of a full spectrum service that could see it become a one-stop shop for reviews, bookings and payments to the millions of small and medium sized enterprises (SMEs) around the globe.

This company produces and sells promotional videos at a fraction of the normal cost for businesses – normally $399 for a first up video – this is the entry point for an enterprise joining this company’s online ecosystem.

It then uploads the videos to its tech platform, allowing customers hungry for reviews of products, events, restaurants and more, to actually see what they want in living colour – a big edge over a written review.

Following the initial video, the company then charges subscription fees to the merchant for a place on this online eco-system – providing exposure and customer engagement for businesses while giving people access to slick video content that helps them to decide where to spend their cash. A win for everyone.

Customers can then upload their own video reviews to this company’s website, adding to the community conversation and to the value of the service.

From a North Sydney bedroom and a $500 initial investment to an $11M market cap and an ASX listing, here’s The Next Tech Stock’s very latest portfolio addition:

Big Unlimited

ASX : BIG

Big Unlimited (ASX:BIG) is the parent company of Big Review TV .

At The Next Tech Stock , we reckon the best way to describe BIG is that it’s the love child of Instagram and TripAdvisor!

Instagram is a social media network all about photos and videos, while TripAdvisor is famous for its customer-generated reviews of anything and everything – it has over 200 million reviews of more than 3.7 million businesses.

Instagram is now estimated to be valued at $35BN after being bought by Facebook for $1BN back in 2012, while NASDAQ listed TripAdvisor is currently worth $12BN...

All of that value generated largely from online text-based reviews and photos...

BIG combines these elements and animates them – producing videos for its BIG Review TV website that show what a place, event or experience looks and sounds like.

BIG’s About Us page also sums up what the company is all about:

Here’s a review of the MCA (Museum of Contemporary Art) SOCIAL event in Sydney:

That’s a bit more interesting than reading a few lines and looking at some blurry photos!

BIG is tapping into three growing global trends – online video, peer generated content and mobile video creating and sharing apps.

Video is fast becoming the dominant medium on the Internet and video reviews are popular – particularly now that so many people own smart phones that can display crystal clear HD video, and produce their own high quality videos – from anywhere.

Demand for online video is soaring – eight in ten Americans watch videos online, and by creating videos, BIG is meeting that demand head on.

And by providing a platform for peer generated video reviews, it’s harnessing the power of social networks and creating a peer to peer online community – something that businesses want to be a part of to engage with their customers.

It’s all possible because BIG has created a downloadable video app that puts the power to create online video reviews in the hands of consumers. This app allows instant upload to Facebook, Youtube and BIG’s own platform – we think this may be the only video app around that allows this.

Those three trends are rapidly becoming the three pillars this business stands on.

It’s a clever idea catching on with tech-savvy Generation Y – but it’s also one founded on the solid business logic of supply and demand.

5,000 merchants are already in the Big Review TV pipeline:

BIG builds engagement with their merchants and then offer valued added services that ideally get them hooked to the company’s ecosystem.

BIG normally charges an initial fee of $399 to Small to Medium Enterprises (SMEs) to produce a professional quality video that is then uploaded to the BIG Review TV website and promoted through social media channels, advertising and internet searches.

This solves a clear problem for SMEs, who want videos but often can’t afford them – $399 is not a lot for a video that can often cost thousands.

Next, people searching for a restaurant, event, pub, club, whatever can find a video of what they want at BIG Review TV and actually see what it’s like – a powerful service that can influence their buying decision.

A US survey found that up over 90% of people reported being influenced by positive online reviews when making a buying decision.

Next, those customers can whip out their smartphones, download Big Review TV’s app and make their own video review of the place or experience they just discovered through BIG.

This app puts the power to make peer-to-peer online videos into people’s hands. This is BIG’s edge – its users create a community of reviews, opinions and exposure for the companies within the BIG Review TV network and become an active audience, something businesses are prepared to pay for.

For us at The Next Tech Stock , we see the basic investment case for BIG is that it’s a company with a great idea that’s being executed well now, generating cash flow and growing at a clip.

But we also have our eyes on its blue sky potential – for BIG to expand its reach, grow its community, and make videos for bigger companies, whilst incorporating new technologies like payments and bookings, and open up more advertising and promotional strategies.

Before we get into that though, let’s have a quick look at the story behind BIG – it’s a cracker!

500 bucks to $11M market cap – BIG’s meteoric rise to date

BIG is the brainchild of 21-year-old Brandon Evertz from Sydney’s Palm Beach.

Evertz came up with the idea for a video-based review site – now BIG – when he was 18 and did what most teenagers do when they need something – he asked his Dad for a loan.

The elder Evertz duly coughed up $500 and BIG was established.

The concept quickly gathered momentum, with extensive research and investigation made to validate the potential of the ideas ahead of establishing the company.

Business was brisk so the next step had to be an ASX-listing and an IPO – and in 2014 a reverse takeover was enacted with gold explorer Republic Gold .

A capital raise to support BIG’s IPO was launched – Republic had $2M in the cash box and lead broker and underwriter Patersons Securities drummed up another $3M from sophisticated investors.

And on the New Year’s Eve just gone, BIG launched onto the ASX – turning Brandon Evertz’s $500 loan into an $11M market cap listed company, and turning him into the youngest founder of a publicly listed company in Australia, perhaps the world...

It’s an Australian start up success story that’s seen Evertz splashed across newspapers and websites everywhere, including Australia’s business bible – BRW :

At first glance, BIG reads like another one of those blockbuster internet startups, drummed up by kids too young to shave properly who are signing billion dollar deals with Google.

But to us at The Next Tech Stock , a closer look at BIG, past all of the media buzz, shows it’s a solid business with a well thought out product that’s generating cash flow now and has the potential for growth.

It’s supply and demand meets right place, right time...

Record, upload, play – why video is King

BIG’s founder Brandon Evertz told The Daily Telegraph newspaper he was frustrated with text reviews on sites like TripAdvisor which left him in the dark about what the place he wanted to go to actually looked and sounded like.

And he’s not alone in wanting more video content on the internet.

A report says 8 out of every 10 Americans watch online videos and that 1 in 4 upload video content to the web.

Here’s that report, in video form!

As network speeds get faster, smart phones become more powerful and social networks grow bigger the demand for content – particularly video content – just gets greater and greater.

Over 90% of Americans own a smart phone and ownership is rising around the world – over 1 billion devices are in use.

The people using those smart phones want video content – and each and every video is an opportunity to make money – whether from selling advertising space or charging for the production.

That’s why we have added BIG to our portfolio – an internet business with video as its central offering and a business model focussed on monetising it.

This company is tapping into three growing global trends – online video, peer generated content and mobile apps.

Its online platform – BIG Review TV – provides consumers with online videos that help them make buying decisions – a service that businesses are prepared to pay for and that people are demanding to have access to.

And BIG’s downloadable video review app puts the power to create online videos into consumers hands, allowing them to create communities that discuss the products being promoted on BIG’s platform – an active audience most businesses would kill for!

Mobile apps, online video and peer to peer sharing – all of it done by BIG...

High definition for a high margin

Right now on the BIG website – BIG Review TV – there are scores of high quality videos you can scroll through and watch. Here’s a yoga school in rural Victoria:

And a tattoo parlour in Cairns:

BIG offers small to medium enterprises (SMEs) the production of a promotional video at a fraction of the usual cost – and then uses its reviews website BIG REVIEW TV to get it out to the public.

SMEs that have a video produced by BIG can then tap into the growing power of online video, gain more exposure and attract more business. Many SMEs otherwise may not be able to afford a video, so BIG is solving a big marketing problem.

The costs are low – $399 for the first one – and for that the customer gets a professional quality video that explains and reviews their business.

That kind of thing can cost thousands, if not tens of thousands of dollars to make with a production or advertising company – and then more money must be spent to get it seen as an advert or a link on a website.

BIG makes a solid margin on the production of the video and is generating cash flow already.

There’s no limit to the businesses that can call on BIG’s services – cafes, restaurants, clubs, pubs, events, schools, even the hotel Sheraton on the Park in Sydney has one:

Next up in the revenue chain is the subscription deal – putting the finished video on the BIG review website so it can be seen by the public generally costs up to $75 a week depending on the package the customer chooses.

And BIG’s aim is to sign up 1,000 SME merchants every month and keep growing its client list in Australia and then the world.

That’s two initial ways to make money from online video in BIG’s bag – video production and subscription fees. The next step is getting video reviews back in...

Sharing holds the key for BIG’s plans

Facebook – worth over $200BN – famously IPO’d back in 2012 with a share price of $38.

It then tailed off to $18 because the market began to doubt Facebook could make money through its traditional web-page based advertising. But now, Facebook is now listed at twice its IPO price – hovering above the $76 mark!

To do that, Facebook’s CEO Mark Zuckerberg (pictured above) honed a laser-like focus to develop a monetisation strategy based on mobile smart phones.

Facebook now generates two thirds of its profits from mobile advertising, capturing dollars from the billion plus users who access the site through their phone.

So what does this mean for BIG?

Well, the smartphone app for BIG has been downloaded more than 20,000 times since it was launched at the beginning of 2015.

BIG has been built from the ground up as a mobile optimised social media platform.

Unlike Facebook, BIG IPO’d with that strategy firmly in place.

And unlike Facebook, it’s possible to invest in BIG at this early, speculative stage, when the opportunity for growth is biggest...

The first part of BIG’s business strategy is of course to make high quality, low cost videos that show off what a pub, restaurant, hotel, gig or event looks like. That generates a solid revenue base.

All of this paid content is then available free for step two – the mobile app that allows the public to view the videos – and then post their own reviews of the places being promoted.

Say a person clicks on the BIG review of the Radisson Plaza Hotel in Sydney:

That person then stays at the hotel, has a good experience and wants to share it. BIG can help...

The BIG Review TV app, which is available as a free download , works on Apple and Android smart phones and they all have HD cameras and microphones. The Radisson customer can shoot a review, upload it to BIG Review TV and share the experience with everyone else.

As smart phones get more technologically advanced almost by the day, the video production skills of everyone continue to drastically improve...

That’s a win for the corporate client because customer reviews are increasingly important in the online world – remember, up to 90% of customer decisions can be influenced by online reviews.

And it’s a win for BIG because with every customer review that’s posted, its network grows. The more customer reviews it gathers, the more business it will be able to drum up based on the size and activity of its audience.

The user generated reviews allows consumers to engage with businesses and their friends and allows businesses to engage with their customers – all on video, which let’s face it is a lot cooler on a smart phone screen than a slab of writing on a review website!

And as this eco-system develops, BIG can then expand everything its doing and aim for the blue sky in its business model...

BIG’s growth focus for 2015

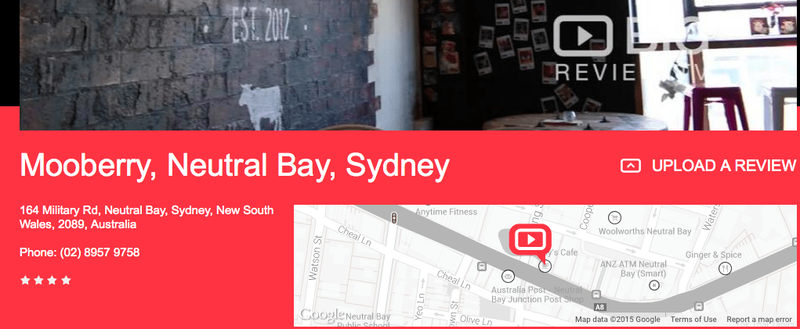

Right now a customer can search for a BIG review of a restaurant for example, and the BIG website will not only provide the review but also a Google map feature that guides them to the site:

But what if BIG was also able to offer a booking service to that customer?

And what if BIG was able to offer a payment gateway?

BIG wants to become a one stop online shop where people can search for what they want, see a review to decide if they like it, then book and pay for the experience – and afterward post a review of how it went.

TripAdvisor does it with text and photos – why can’t BIG do it with video?

Not only would these full spectrum additions provide more revenue streams for BIG, they would also enhance the eco-system of videos and reviews it’s created, getting more people involved and adding to the value for its customers.

And looking even wider, BIG will start going after bigger companies and businesses than the SMEs it’s concentrating on now.

That’s the future for BIG, but at The Next Tech Stock we’re happy to see the team keeping up the work to sign on more video clients and get more and more people reviewing in its community.

And coming up next...

BIG has a busy year ahead – its first as an ASX listed company.

It launched on a solid platform with over 5,000 merchants on board, cash flow from video and subscription sales, and a fair bit of traditional media and social media buzz.

At The Next Tech Stock we’ll be keeping an eye on how BIG goes signing up more clients and expanding its BIG Review TV website – and we’ll be watching the videos!

Then, the challenge for BIG is to keep that momentum going and develop its blue sky features like bookings portals and payments, and landing bigger clients.

BIG has had a great start and we’re looking forward to seeing what BIG thing it does next.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.