Is this ASX Oil Explorer the Next Sleeper in the Energy Sector? Imminent Drilling Could Provide the Answer

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There isn’t a one size fits all strategy for finding pockets of value, and it can pay to sift through stocks that may have been missed.

That’s true even for sectors that have already run too hard and would usually be disregarded, as any downside in the sector can have a significant impact on company share prices.

The most likely place to find cheaply priced, yet quality companies is among small and microcap stocks.

The S&P/ASX 200 Energy Index (XEJ) is home to Australia’s big oil and gas producers including Woodside Petroleum (ASX:WPL), Santos (ASX:STO) and Oil Search (ASX:OSH) which have a combined market capitalisation of more than $60 billion and today’s featured company is looking to join them.

This company has been recognised as the ‘next big thing’ in the oil industry, after it led the way in gaining a position in one of the world’s most sought-after offshore oil reservoirs.

It is now set to begin drilling its flagship well, although this is by no means the only highly prospective project the company has, so investors should watch this space with interest.

The reservoir is located offshore Namibia, (an emerging African Nation that investors should take into consideration when determining their investment focus as there are still risks involved) which hosts a number of favourable ingredients for deep-water exploration.

Namibia has seen several oil giants, clamour for deep-water territory, this is also due to the country having a good fiscal and regulatory regime, traps capable of hosting giant-scale oil resources, and the potential for high quality, high flow rate reservoirs.

And within that context, the ASX oil & gas junior we are bringing you today Is about to drill a globally recognised stand out well, of which it holds a 20% interest and doesn’t have to pay for.

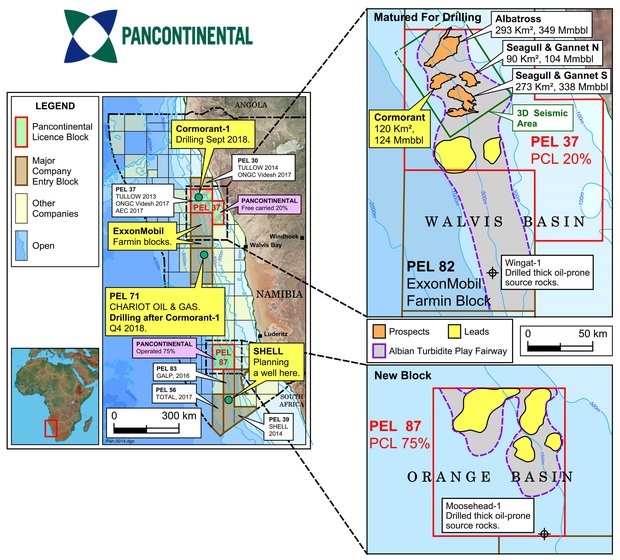

The well, located in the Walvis Basin offshore northern Namibia covers 17,295 km2 (4.2 million acres) in water depths extending from <300m to 1,800m – which we will look at in greater depth shortly.

More details will certainly emerge shortly, with the spudding of the well scheduled for next month. That’s important to keep in mind as the greatest value adding moments for oil and gas exploration companies come via the drill bit – the discovery of large volumes of oil or gas with clear commercial potential.

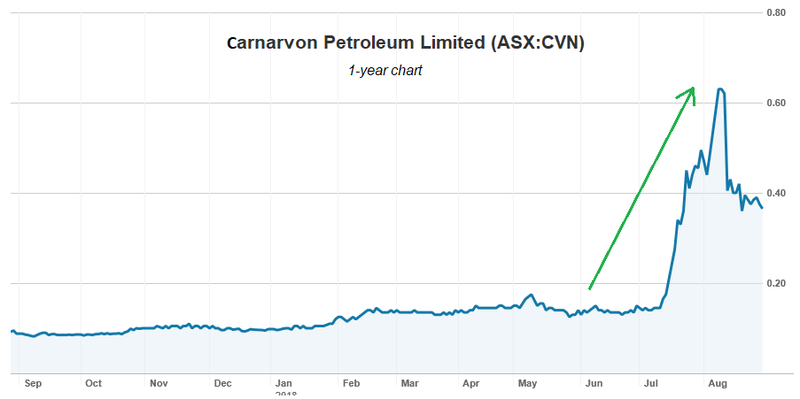

This was certainly the case for Carnavon Petroleum (ASX:CVN). CVN’s market cap reached one-quarter of a billion dollars in July off of its interest in the Dorado oil discovery and continued north to reach a peak ~$800 million.

It should be noted that this is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

In fact, the very oil well that this company is about to drill was earmarked by leading global energy research and consultancy group, Wood Mackenzie, as ‘one of the most watched offshore wells anywhere in the world this year (2018)’.

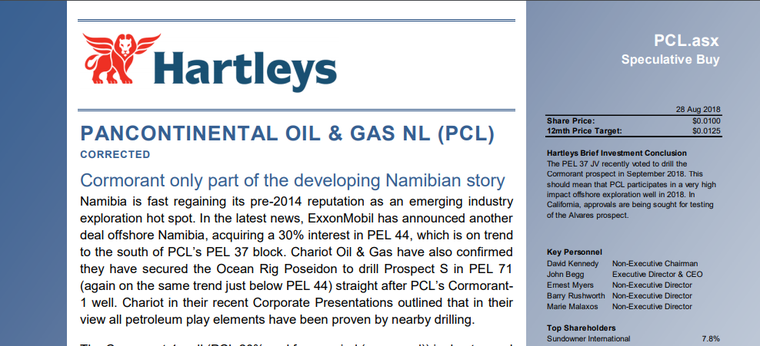

Adding to positive sentiments from Wood Mackenzie, Hartley’s energy analyst, Aiden Bradley provided the following perspective on the company’s well,

“We rate the well among the most prospective (if not the most prospective) for 2018 (relative to market capitalisation) in any portfolio across the whole ASX Junior Oil & Gas sector.

“We continue to view its Namibian exposure as worth more than the group’s total market capitalisation by itself.”

Introducing ASX oil & gas junior,

Pancontinental Oil and Gas (ASX:PCL) is operating in the well-regarded offshore oil and gas province in Namibia.

Such is PCL’s experience in identifying highly prospective regions and gaining a first mover advantage that it was awarded the block in 2011, which is now about to be drilled as block PEL 37.

PCL expands its Namibian exposure

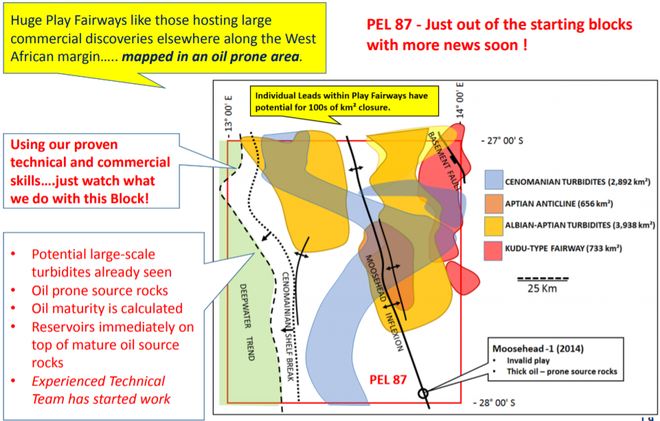

In December 2017, Pancontinental signed a Petroleum Agreement with the Ministry of Mines and Energy of Namibia and Namibian partners for PEL 87 offshore Namibia.

Pancontinental is the project operator, with a 75% interest. PEL 87 is circa 11,000 square kilometres in an area on trend where industry giants Shell, GALP (Portugal) and Total (in 2017) have acquired interests.

PCL has been quick to make some early assessments, having already mapped a number of leads with very large oil volume potential.

PEL 87 has an initial period of four years, and an innovative exploration program is planned.

Commenting on the upcoming drilling of Cormorant-1, CEO John Begg confirmed the company was on track for a September spud and added, “We are obviously keen for the well to commence as the first test of the giant scale oil potential within the block.

“No doubt ExxonMobil, who recently farmed into the immediately adjacent acreage, will be watching closely for the outcome.”

Begg esrlier said, “Undoubtedly, the greatest value adding moments for oil and gas exploration companies come via the drill bit — the discovery of large volumes of oil or gas with clear commercial potential.”

On this note he cited the recent success of Carnarvon Petroleum (ASX:CVN), which stepping back to August 2017 would have been considered as an oil junior.

At that stage, Carnarvon had a market capitalisation of $75 million (not too far north of PCL’s current market capitalisation of $53 million).

However, the drilling of one of CVN's wells, Dorado-1, sent the company’s shares into orbit, hitting a high of 70 cents, a near ten-fold increase compared with the levels it traded at 12 months earlier.

Just a 20% stake in Dorado-1 resulted in Carnarvon’s market capitalisation increasing to around $800 million.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Will Cormorant-1 be a company changer?

While trying to predict the outcome of the first well at PEL 37 is crystal ball gazing, suffice to say that all of the data gathered to date, along with an assessment of the group’s broader strategy is highly encouraging.

Numerous prospects have been mapped, any one of which could be game changing.

Cormorant is one of four large prospects mapped in a cluster on 3D seismic, all within the company’s block PEL 37 and with collective potential for 915 million barrels of recoverable oil.

PCL will benefit from having Tullow Oil as project operator, as it is one of the most successful oil explorers in Africa.

Importantly, PCL is not financially exposed to the drilling costs of the well as per the previously negotiated farm-out agreement with Tullow.

In addition, Pancontinental will receive a cash payment of US$5.5 million (A$7 million) from Africa Energy Corp. which is the second instalment of its investment into PCL’s subsidiary and the PEL 37 project.

Arguably though, one of the most confidence inspiring factors surrounding PCL’s operations in the deep waters off Namibia is the presence of the ‘who’s who’ of the oil industry in neighbouring blocks.

Look at the big names PCL is rubbing shoulders with...

PEL 87 provides further potential upside

PEL 87 exploration adds to PCL’s activities in PEL 37, as the age and type of the Cormorant traps are similar.

The acquisition of this block elevated PCL's areas of interest to 28,000 square kilometres.

As with PEL 37, modern drilling in 2012 and 2014 respectively has proven thick oil prone and mature source rocks extending into the block.

Pancontinental’s mapping in PEL 87 is already showing multiple leads each covering hundreds of square kilometres in area with huge volumetric potential for oil.

Similar to PEL 37, being the early mover, Pancontinental expects to attract strong partners into PEL 87 as its mapping and documentation of the scale of the oil potential advances.

Near-term prominent news includes the documentation of the size of the recoverable oil resource potential for the mapped leads.

Walyering could be the sleeper

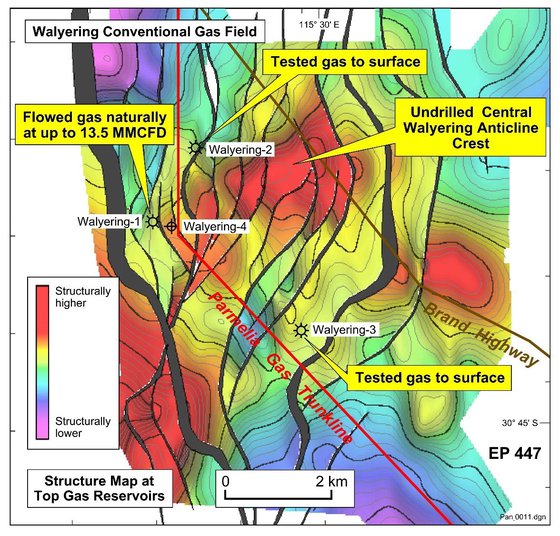

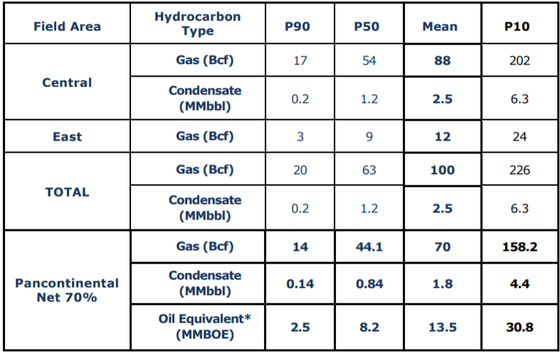

Pancontinental is earning a 70% operated interest in the Walyering project, a 120 square kilometre block in the Perth Basin.

The original 1970s discovery well flowed gas naturally from conventional sandstone reservoirs of Jurassic age, however early drilling was poorly positioned on either flank of the structure.

The results of recent 2D seismic remapping were tied to well control on the structure and as such the company’s exploration team believes that most of the structure remains untapped by earlier drilling.

A 3D seismic survey is planned for later this year which will provide better definition of the mapping at the gas reservoir levels.

The seismic will be funded by PCL and is expected to cost less than $2 million.

During the June quarter, the company released an independent resource estimate which gives weight to the appraisal program designed for the project.

Cautionary Statement

The estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

Well qualified management team

Under the stewardship of then CEO and Director, Barry Rushworth, PCL raised substantial funds with a view to developing the project.

In his current role as Non-Executive Director, PCL continues to benefit from Rushworth’s extensive experience as a geologist with an uncanny knack of pouncing on great prospects ahead of the big players.

Over the last 15 years, Rushworth has been responsible for identifying, negotiating and acquiring international new venture opportunities in Malta, Kenya and Morocco, as well as Namibia.

Rushworth’s proven track record of working closely with international government bodies and attracting blue chip joint venture partners to PCL’s projects can’t be understated, as it is this sort of experience that smaller players in the sector sometimes miss.

PCL has bolstered its management team with the appointment of John Begg as CEO, an ideal fit for a company that sees itself on the brink of moving from exploration to development and production.

Begg is an industry-leading geoscientist who has lived and worked with consistently high business impact in Australia, developing Southeast Asian countries, the UK, Middle East and the USA.

Having been instrumental in the discovery and development of commercial oil and gas fields on three continents, he is ideally qualified for the likes of Pancontinental as it strives towards commercialising what many analysts believe could yield a major discovery in one of the world’s most underexplored yet highly prospective regions.

Consequently, PCL offers investors a globally recognised highly prospective area of exploration and a management team that has a history of delivering success with the drill bit, as well as at the development and production end of its operations.

Keep in mind that it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Energy Index in full flight

As you can see in the chart below, the S&P/ASX 200 Energy Index (XEJ) is in full flight (yellow line).

The most recent rally is evident on the right-hand side of the graph with the index gaining more than 85% between January 2016 and its recent high of 12,450 points. Yet it pays to reflect on the index momentum in the eight years between 2000 and 2008 —prior to the global financial crisis that sent markets into freefall.

Note the resilience of the sector with a solid performance leading up to 2002 followed by a five-fold increase as it surpassed 20,000 points in mid-2008.

This is a sector that can run hard for long periods of time as there are multiple economic drivers due to the broad-based applications of oil and gas across all sectors from non-discretionary residential use to high-volume commercial areas such as aviation and defence.

Consequently, don’t be surprised if there is substantially more upside in the oil price in the coming years.

It is also worth noting that the share prices of companies in the sector tend to react in a less volatile manner than is indicated by the oil price (dark line), arguably because of the sector’s reputation for demonstrating long-term resilience.

With this backdrop it makes sense to target companies that may have been overlooked in the race for the big players ... such as PCL.

What are the analysts saying?

As indicated earlier, Hartleys is bullish on PCL’s prospects, with a ‘speculative buy’ recommendation on the stock.

The most recent report from the broker says, “We set out near term (pre-result) target price at 1.25c per share (up from 0.7c per share based on recent CVN performance as a benchmark) therefore at current levels rate PCL a Speculative Buy.”

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

Similarly, a recent note by one of Australia’s most experienced energy analysts, Peter Strachan included upbeat commentary on the company with a risked value for PCL of 1.2 cents per share and a value for success of 5.1 cents per share, with the latter representing a 400% uplift to its current share price.

However, this was based largely on drilling the Cormorant prospect, and Strachan sees considerably more upside from potential success with PEL 87.

Noting that PCL has a 75% stake in PEL 87, he said that it was in a strong position to attract funding for further 3D seismic acquisition and drilling.

Strachan went on to say, “While a structure with an aerial extent of 600 square kilometres could host a resource of over 1 billion barrels of oil, StockAnalysis assumes a target of 300 mmbbls in PEL 87.

“If the company can retain a 23% interest for drilling, such a target could offer a risked value of circa 0.5 cents per share and a value on success of over 12 cents per share to Pancontinental.”

Consequently, even if the company were to farm out a substantial portion of the project in order to gain funding for exploration there could be value in the order of 12 times the company’s current share price.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.