ASX MedTech Transforming the US$50B Women’s Health Market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After search, mobile devices, social media, and transport, where are the world’s tech giants turning to next for multi-billion dollar opportunities?

Healthcare.

Healthcare is increasingly looking like the next industry to be disrupted by the all seeing, all knowing behemoths such as Google, Facebook and Amazon.

The digital healthcare market is predicted to reach US$423 billion by 2024.

The AI healthcare market is set to jump to US$36 billion by 2025.

These markets are being pushed higher by new entrants like Google, which as part of its reorganisation into healthcare, is absorbing DeepMind Health, a part of its London-based AI lab DeepMind.

DeepMind’s Streams app has been developed to help the UK’s National Health Service (NHS) transition into ‘an AI-powered assistant for nurses and doctors’.

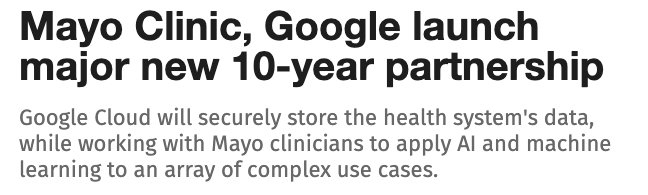

Google is moving quickly in this space. Its recent partnership with the world renowned Mayo Clinic is set to redefine how health care is delivered and accelerate the pace of healthcare innovation through digital technologies.

Google Cloud is to be the cornerstone of the Mayo Clinic’s digital transformation as it attempts to redefine healthcare delivery.

The Mayo Clinic’s deep focus on digital transformation of the healthcare industry has put it in the path of an ASX Med-tech company working in the field of women’s health diagnostics.

The global women’s health diagnostics market is set to hit US$54 billion by 2026.

This market is becoming increasingly important in pre-natal care, which due to the antiquated nature of some of its operations (no real change for almost 60 years), is ripe for disruption.

Today’s company in focus is determined to lead this disruption and has, with the help of a highly experienced team, developed the world’s most advanced prenatal care solution.

The Israel-based company has reinvented the pregnancy experience via the digital transformation of pregnancy care by developing innovative, medically accurate, safe and affordable connected pregnancy monitoring solutions for home use.

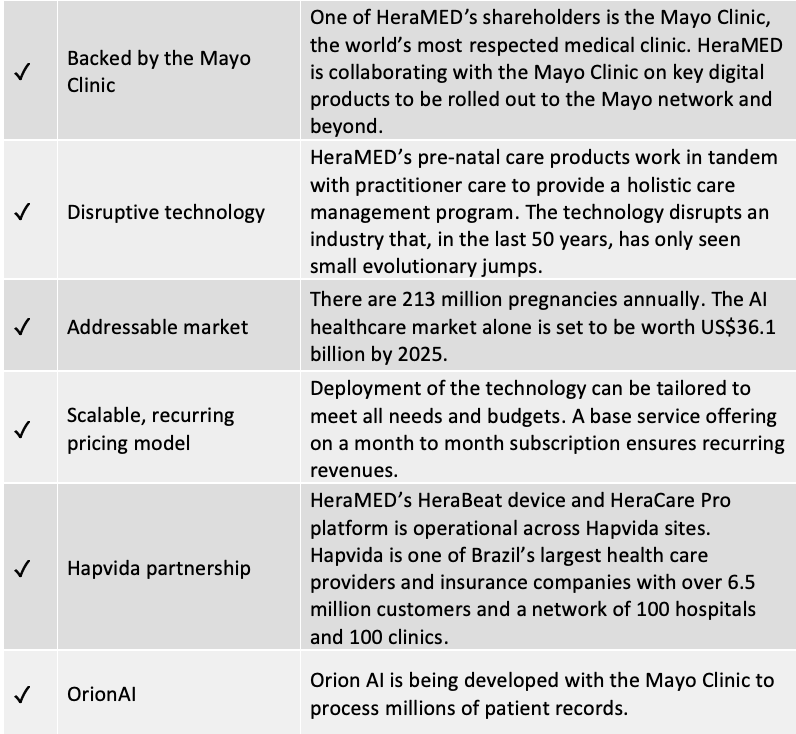

It has effectively been commissioned by the world’s best and largest medical clinic, the non-profit Mayo Clinic, which is also a shareholder, to provide a globally disruptive solution which will replace existing infrastructure that hasn't changed in over 60 years.

The Mayo Clinic boasts $12 billion in annual revenues and 63,000 employees. It operates in five states and cares for more than one million people a year, from all 50 US states and nearly 140 countries.

Its patient care goals are heavily aligned with technological breakthroughs, which makes its relationship with this ASX junior all the more important.

Together, the pair is co-developing a tailored approach to in-home patient monitoring. HeraCARE will be the world’s most advanced digital platform that will optimise pregnancy care though the deployment of AI algorithms, a combination of digital tools and smart connected devices to bring together expecting mothers and healthcare professionals in a way that will optimise pregnancy care.

This ASX junior’s technology and three proprietary products, are in fact being utilised to replace the Mayo Clinic’s existing manual based infrastructure and will be deployed to its 50,000 pregnancies under management annually.

The Mayo Clinic isn’t the only medical facilitator this company is involved with. It also has a very strong relationship with Brazil’s leading healthcare provider, Hapvida.

Hapvida manages approximately 200,000 births per annum and is currently conducting trials with 750 women.

This could lead to significant revenue generation.

Yet, when the “Worlds Number 1” voted hospital, Mayo Clinic, adopts this system, it should be endorsement enough for the rest of the medical world to open their arms to this Australian company’s unique technology.

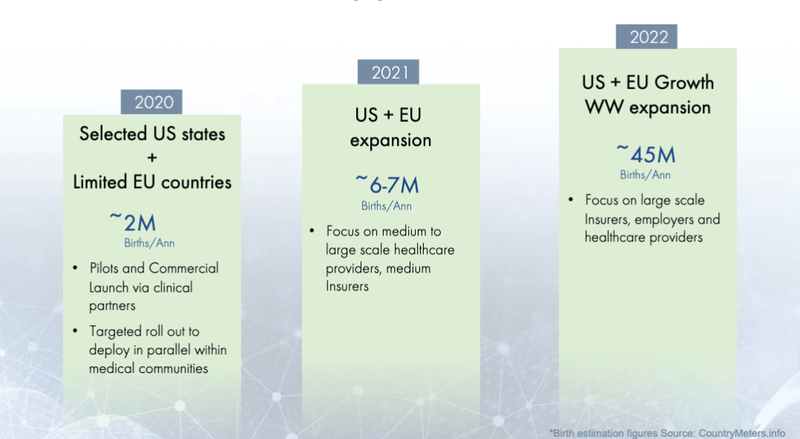

HeraMED has outlined that is has a target market of 2 million pregnancies in 2020, 6 million in 2021 and 45 million in 2022.

There are 213 million pregnancies globally every year. This is a huge addressable market and with the Mayo Clinic (and its vast database) in its corner, and as the company expands its reach into Europe, India, Mexico and beyond, it has plenty of catalysts to come.

It is also, in fact, the only company able to deliver such a solution. By combining three proprietary products with the underpinned research, and protocols developed by the Mayo Clinic into the world's most advanced digital pre natal platform.

There is a lot to like about this company from a medical perspective, and given its current momentum, and near term catalysts it could develop into an astute investment.

Time to introduce...

Market Capitalisation: $12.69M

Share Price: $0.14

Here’s why I like HeraMED...

HeraMed breathes new life into prenatal care

It is often the case that some of the greatest breakthroughs in human life, were born of trying personal experiences. In a very recent development breast cancer survivor Kathy Reid invented smart breast, a prototype smart prosthetic breast that she hopes will improve recovery of other breast cancer survivors.

For the founder of HeraMED (ASX:HMD |WKN: A2PQND), it was the fear of losing a child that spurred him on to create a burgeoning med-tech company that has the potential to positively disrupt the prenatal health industry.

“It was our third pregnancy and my wife was considered to be a low level, high risk pregnancy,” HeraMED CEO David Groberman says.

“We had a lot of concerns and were quite anxious about the status of the pregnancy and the wellbeing of the foetus. However, the only genuine medical solution available to us was to go into the doctor's office or to the hospital to get checked.”

The catalyst came when, one day, Odelia didn’t feel the foetus move.

David and his wife Odelia spent hours in the clinic waiting to be checked, and then after hours of administration and tests a doctor was finally able to give the pair their test results. To their relief – that everything was fine.

However, while peace of mind is paramount when it comes to children and their health, David was surprised that no better monitoring solution existed.

With his business partner Tal Slonim, with whom he had acted in an advisory capacity for the $144 billion capped Medtronics (NYSE:MDT), the $36.2 billion capped Phillips (AMS:PHIA) and the $65.9 billion capped Bayer (ETR:BAYN), he founded HeraMED and in relatively quick time launched HeraBEAT, and a fully integrated smartphone app that monitors foetal heartbeat in the home to medical standards.

HeraBEAT – marching to the BEAT – the first piece to the puzzle

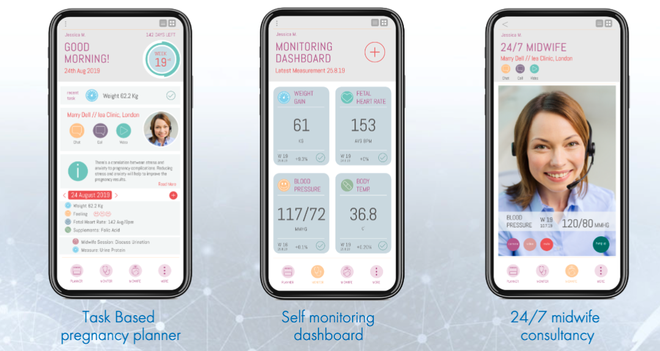

HeraBEAT is a medical grade foetal heart rate monitor, with patent pending technology and a unique user interface.

The device offers several advantages, including a portable Ultrasound Doppler device that makes it reliable, safe to use and proven, whilst amplifying its accuracy and efficiency.

The technology works in the following manner:

Proprietary “Smart Search” technology uses advanced algorithms to accurately locate the foetal heartbeat.

HeraBEAT also enables immediate and user-transparent data sharing with doctors, caregivers and other medical professionals who can analyse the data to produce better care.

The following video illustrates HeraBEAT in action:

“HeraBEAT was designed from scratch to be as reliable and as accurate as Phillips’ or GE's professional monitors,” Groberman says.

“The difference is that these other devices can only be operated by a physician or a midwife in the hospital and costs somewhere between $5000 to $10,000 US dollars.”

Multiple clinical trials conducted by different healthcare professionals and industry leaders across the globe, have proven that HeraBEAT works.

And while it saves time and money and gives patients peace of mind, it was just the first step for HeraMED in creating a holistic prenatal health care solution.

HeraCARE: The world's most advanced digital prenatal care solution – the second piece to the puzzle

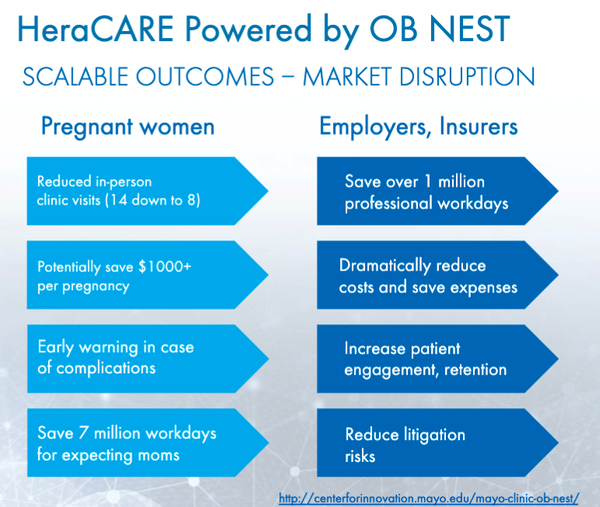

HeraCARE is a cloud-based SaaS pregnancy monitoring platform co-developed with the Mayo Clinic, based on the Mayo Clinic’s successful OB Nest platform.

OB Nest is complementary to HeraCARE in that it is aimed to de-medicalise the experience of pregnancy by providing a supportive and empowering experience that fits within patients' daily lives.

OB Nest is the product of five years of research between 2011 and 2016 and has undergone 14 prenatal care option trials and tests. It has since become the Mayo Clinic standard of care in the prenatal field, reducing the costs of care and improving patient satisfaction.

Study results have concluded that OB Nest reduces doctor visits from 14 to 8 per pregnancy and lowers pregnancy stress.

HeraCARE will be powered by OB Nest and will deliver the following scalable outcomes:

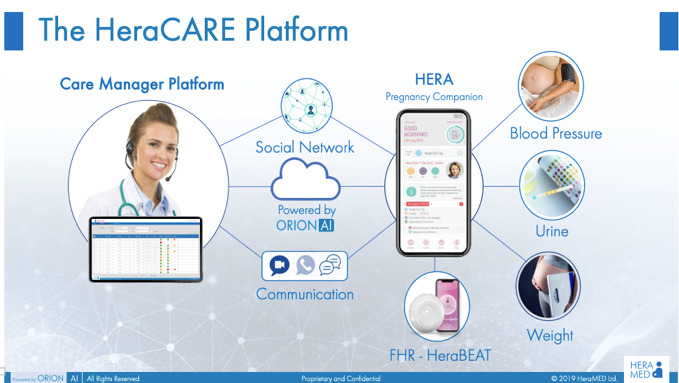

How does HeraCARE work?

HeraCARE is an in-home monitoring platform with which patients can leverage technology and expertise.

Once operational HeraCARE will deploy its AI powered algorithm and combination of a digital platform and smart connected devices to assist expecting mothers as well as healthcare professionals in better managing pregnancy care, with a focus on personalised, continuous and proactive home-oriented solution.

It looks like this:

As you can see in the illustration above, it will monitor everything from blood pressure, to weight and heartbeat. That information can then be provided to a healthcare practitioner.

HeraCARE is effectively an end-to-end medical grade solution with substantial market opportunities:

Pilots are already being conducted by one of Brazil’s largest healthcare providers, Hapvida Saude.

Hapvida has a network of over 100 hospitals and 1,000 clinics across 11 states. It has already integrated HeraCARE Pro into its IT systems, to be used by medical professionals and patients across multiple sites as part of its broader pilot trial, currently taking place on a daily basis.

The scale potential is significant.

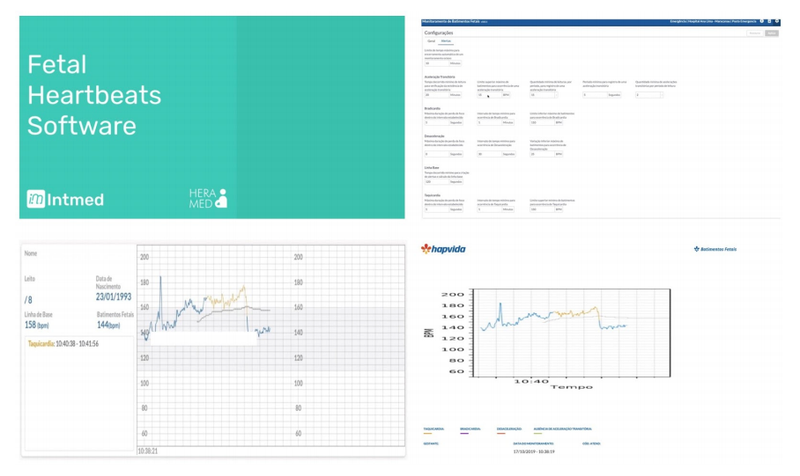

So far, the trial has been highly successful with HeraMED achieving seamless data upload sharing between operational HeraBEAT monitors and the HeraCARE Pro platform from Hapvida.

HeraBEAT monitors with cloud support have been fully deployed into 15 hospitals and clinics across Brazil, with solutions being trialled amongst approximately 750 pregnant women with thousands of data sessions being collated to date.

The expectations are that successful trials will underpin increased uptake across the entire network in due course.

When looking at the addressable market in Brazil alone, the scalability of HeraCARE’s pricing model is impressive.

Keep in mind how affordable this is and how the adoption or uptake of the technology is expected to be widespread.

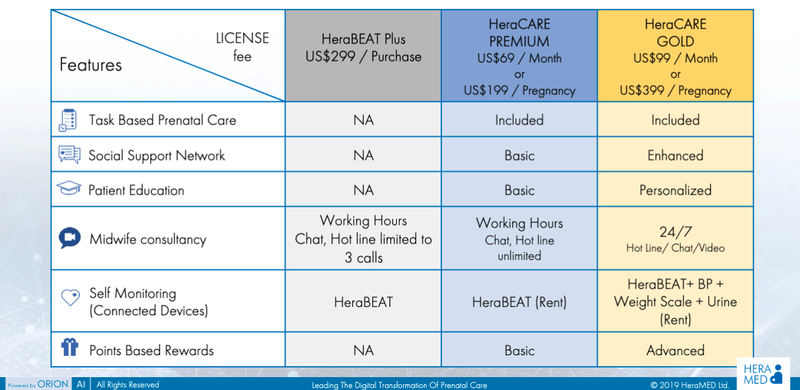

The following table details how HeraMED is set to make money through the uptake of HeraBEAT and HeraCARE:

Let’s reiterate the revenue upside here based on two existing agreements with Mayo and Hapvida.

Hapvida has circa 200,000 pregnancies under management annually.

If you assume the technology was adopted across all pregnancies under management, HeraMED could be bringing in hundreds of millions in revenue from Brazil alone.

That doesn’t include Mayo Clinic patients, or other hospitals around the world that could be compelled to adopt the technology with Hapvida through the Mayo Clinic’s endorsement and adoption.

Scalability will be built through partnerships.

As you can glean from the above table, HeraMED will provide a base service offering to existing clientele on a month-to-month subscription model. This ensures recurring revenue for all parties, based on a revenue sharing co-operation model.

An example of how this revenue sharing model works can be found in its relationship with IntMED.

Further Brazilian scale

HeraMED’s work in Brazil doesn’t end with Hapvida. The company has also signed an agreement with Brazilian technology and software provider IntMED to expedite co-development, geographical adaptation and progress the uptake of HeraCARE.

IntMED is already in partnership with Hapvida, yet could broaden HeraMED’s scope considerably through its relationships with Pague Menos, one of Brazil’s largest pharmacy chains and Unimed, Brazil’s largest healthcare network.

There are 2.9 million births in Brazil each year and IntMED will assist HeraMED to ensure the best possible uptake of the platform in the region.

IntMED will receive one third of revenues received by HeraMED from any prospect introduced by, engaged by or managed by IntMED. Further revenue sharing deals have been agreed, but the key takeaway here is the vast network of providers that HeraMED will have access to via this new relationship.

In bed with Mayo

While Hapvida is of enormous importance, the Mayo partnership shouldn’t be underestimated. It is the partnership that should kick off global interest.

As stated The Mayo Clinic is already working closely with Google and has its sights set firmly on completely disrupting and reinventing the natal and prenatal spaces.

"Data-driven medical innovation is growing exponentially, and our partnership with Google will help us lead the digital transformation in health care," says Gianrico Farrugia, M.D., president and CEO of Mayo Clinic.

"It will empower us to solve some of the most complex medical problems; better anticipate the needs of people we serve; and meet them when, where and how they need us. We will share our knowledge and expertise globally while caring for people locally and always do it with a human touch."

The Clinic recently developed a tele-neonatology program that allows neonatologists to establish a real-time audio/video telemedicine connection with care teams in community hospitals during high-risk, low-frequency neonatal emergencies.

The technology now allows the Mayo Clinic to connect on the first attempt 96% of the time, compared with 73% for the previous telemedicine carts; with enhanced monitoring and support, tele-neonatology availability is now 99%.

The Mayo Clinic’s work with HeraMED is just as important and likely to be just as disruptive.

The Clinic has recognised that prenatal care needs to move forward.

It has recognised that HeraMED has a solution to facilitate the industry’s growth and the companies are determined to work closely together to create an AI and digital solution that lowers the cost of care, whilst delivering a real time prenatal management plan.

The overall market

There is a reason for the growing interest in the prenatal care market.

Let’s first reiterate the numbers:

By 2025, the market potential in women’s health diagnostics, products and services is set to reach US$50 billion. In the US alone, there are 3.95 million births each year at a cost of US$111 billion – the second largest healthcare spend in the country.

Interestingly retail giant Target has for years known how lucrative the antenatal market is. Take for instance the Minneapolis father who received baby clothes mail outs from Target addressed to his teenage daughter. Target knew she was pregnant before the father did, just by measuring her shopping patterns to accurately estimate her due date.

It’s time to take that capability away from Target and put it back in the hands of the people who matter: women, their partners and health care professionals.

Meanwhile the overall worth of the digital healthcare market is predicted to reach US$423 billion by 2024.

It is these numbers that have attracted several listed stocks to the digital healthcare market.

EMvision Medical (ASX:EMV) has seen its share surge as it looks to assist brain diagnostics. The company is developing a portable brain scanner for rapid, point of care, Stroke Diagnosis and Monitoring.

The $46.9 million capped EMV jumped from 0.37 cents to 0.97 cents from September to late October. It has come back slightly now to sit at 0.81 cents.

Interestingly, sitting on the boards of both EMvision and HeraMED is Dr Ron Weinberger.

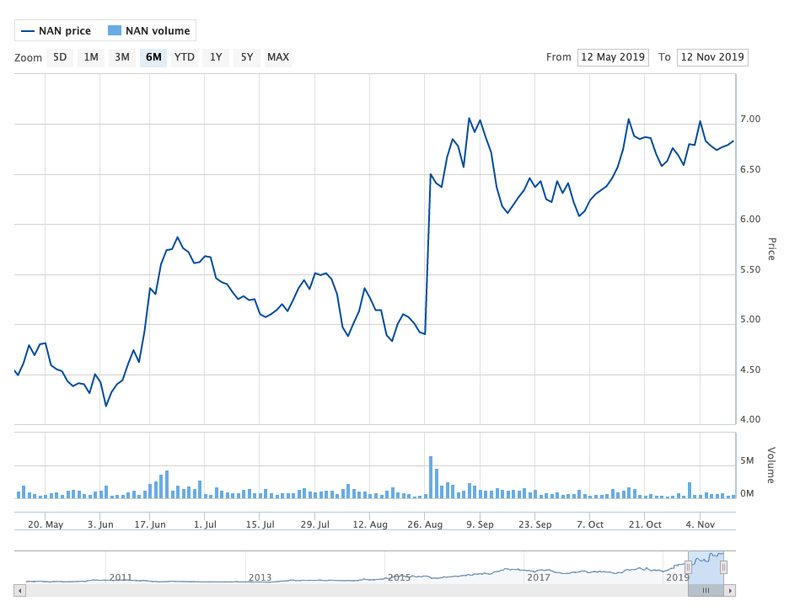

Nanosonics is another that has seen the tide turn for it.

Nanosonics improve the safety of patients, clinics, their staff and the environment by transforming the way infection prevention practices are understood and conducted, and introducing innovative technologies that deliver improved standards of care.

This $2.5 billion capped company has also recently enjoyed a steady share price appreciation:

Dr Ron Weinberger is also a former Executive Director and CEO of Nanosonics...

Will HeraMED be “third time lucky” for Dr Ron Weinberger on the ASX?

The dream team

It is the human resources providing the strategic direction that has led HeraMED down the path of developing new age technologies addressing age-old issues.

Chief executive and co-founder Mr David Groberman has years of experience conducting research and development and engineering for medical technology companies such as Phillips, Bayer, Medtronics, GE, and Siemens.

As mentioned above, non-executive chairman, Ron Weinberger was appointed to the board of Nanosonics in 2008 when the company had a market capitalisation of approximately $50 million.

His strong scientific background and understanding of international markets was instrumental in growing Nanosonics to a $1 billion company by the time he retired in 2016 — just eight years later.

There are plenty of entrepreneurial success stories across the board, with non-executive director Doron Birger’s background as chairman of NASDAQ listed Given Imaging prior to its takeover by Medtronic for US$1 billion.

David Hinton provides extensive experience in both tech and communications with the latter being extremely important for HeraMED given the emphasis on optimising communications between patients and medical staff via remote devices.

Hinton will also be instrumental in providing corporate direction, having been successful in driving ASX listed telco Amcom to a $1.6 billion merger with Vocus Group.

In examining HeraMed’s board of directors, one of the standout common denominators is the level of expertise they have demonstrated in establishing highly valuable relationships with leading industry players, which in many cases provided the platform for success.

Orion AI stars – THE FINAL PIECE OF THE PUZZLE

Artificial intelligence can be used to detect tumours, manage diabetes and heart disease. It is used in hospitals, via Med-tech apps, to connect surgeons with doctors and nurses and to ensure that patient histories are up to date and known to all relevant parties.

AI can help facilitate better patient outcomes, reduce the costs of care and increase staff awareness of potential patient issues.

The AI that HeraMED is using is known as OrionAI and again, it is being developed in conjunction with the Mayo Clinic.

Orion is the result of HeraMED’s research achievements in pregnancy monitoring analysis and has been designed as an alternative to current manual, paper and expert-based analysis.

The company states: “OrionAI is trained to detect precursors that can indicate possible pregnancy complications before these become a problem. In OrionAI, we are integrating massive pregnancy monitoring datasets with Convolutional Neural Nets (CNNs), deep learning algorithms in order to identify both existing as well as new risk factors.

"It empowers physicians, offering them an opportunity to get free from the tedious, scut work, giving them time to apply their knowledge in a more focused, intelligent and efficient way.”

HeraMED is working closely with the Mayo Clinic to collect relevant data.

Groberman says, “One of the biggest problems when it comes to developing algorithms, machine learning algorithms for the health care industry, is you need data. In a lot of cases, that data doesn't exist. You need to collect the data using your own systems and you need thousands of data records in order to really make the outcomes work. Now the biggest value and advantage that we have here, is that there are hundreds of thousands of data records of pregnancy monitoring information in the world.

“We've started with the Mayo Clinic and in the long term we are attempting to own the biggest repository of foetal monitoring information in the world. This will really allow us to fast track the development of the algorithms. It includes the physician and the patient and the result of the pregnancy. So, there's a lot of engineering and sophistication and machine learning work to be conducted, but the data place will be there for us to work on.

“We're now working with additional, potential partners across the world in order to have more and more data integrated into the algorithm.”

What the future holds

The future is looking bright for HeraMED.

It has recently entered into an agreement with a leading wellbeing and electronics distributor in Germany.

Duttenhoffer, a European distributor of wellbeing, electronics and digital imaging products with annual revenues of ~€250 million (A$402.6M), will distribute HeraBEAT in Germany, Austria and Switzerland. The agreement also came with a purchase order worth ~€30,000.

Duttenhofer represents some of the world’s largest brands including Siemens, Braun, Sharp, Zeiss, Sony and Samsung and has strong connections to medical service providers which will allow HeraMED to approach medical institutions and Health Maintenance Organisations (HMOs) in its network.

In further good news, Israel Innovation Authority (IIA) advised HeraMED that it successfully passed the first stage of the approvals process required to receive a grant from the Israel Innovation Authority.

The grant is to be issued as a collaboration between the Israeli government and the Mayo Clinic to promote collaboration between the clinic and Israeli companies.

The company received strong support from the Mayo Clinic during the first phase of the application.

Further funding will become available if HeraCARE trials are successful. Funding will be granted for up to 50% of the project costs for a period of 24 months and be utilised for R&D, production modification, regulatory approvals and establishing beta programs.

It is estimated that a decision around the funding will be made by the end of Q1 2020.

Meanwhile it continues to expand.

The map below highlights how far HeraMED has taken its product so far:

The green dots represent HeraMED’s current distribution footprint, while the blue dots represent near term opportunities.

Notice the blue dot on India.

This is significant as HeraMED recently received its second order for HeraBEAT devices to be used in hospitals and clinics. The purchase order is for US$45,000.

This is HeraMED’s first ever re-order and coincides with a Memorandum of Understanding with Consultus India, the company’s distributor in the region, to support the launch of HeraCARE in India.

There are 28 million pregnancies in India each year. It is just the start of HeraMED’s influence there as it will also look to roll out Orion as well.

The final word

Having the Mayo Clinic collaborate as a full partner in the development and roll out of disruptive medical technology is no small feat. Having it as a shareholder in the company harks to another level entirely.

This is a powerful partnership for HeraMED to have.

Yet, it is not the only one.

HeraMED’s relationship with Hapvida is just as impressive and both collaborations open up vast markets across the US, Brazil and beyond.

There are also further roll outs of its technology currently happening across Europe and India and FDA clearance is targeted by the company for Q4 2019 with the subsequent ability to pursue significant partnerships. The relationship with the Mayo Clinic will be instrumental in building credibility with potential partners.

These should start filtering through in Q1 2020 and beyond.

These are exciting times for this med-tech disruptor and with plenty of catalysts on the horizon, there is plenty of scope for growth for this $12.6 million capped company with grand ambitions.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.