ARN Leveraged to a Nickel Discovery - Strategic Investor Secured

Aldoro Resources Ltd (ASX:ARN) is in the process of de-risking its maiden nickel-PGE drilling event in WA.

ARN has 100% of the Nardee Nickel PGE Project in WA.

The Nardee Complex is the largest layered mafic-ultramafic complex in Australia, and in the Top 10 globally with respect to size.

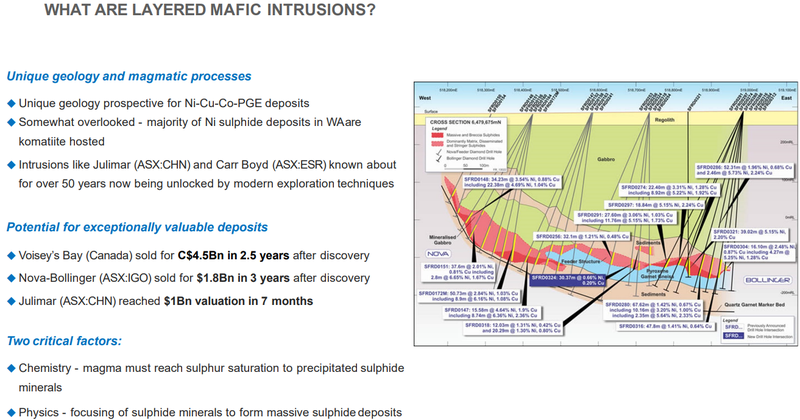

Mafic-ultramafic complexes have unique geology and are the right places to find large nickel-PGE deposits.

ARN has a “whole of play” position, covering 306km2.

ARN is currently capped at $16M, with $4.2M in the bank - translating to an Enterprise Value of $11.8M.

The company has a tight share register and we think the stock is attractively priced right now, following a recent strategic funding injection of $2M from internationally renowned geologist Dr Min Lu Fu and his associates. Upon completion of the $2M placement, Dr Fu will become one of ARN’s largest shareholders.

Whilst it is early days in ARN’s exploration journey, we like the current valuation as an entry point.

We anticipate sustained share price growth in ARN in the lead up to good news and drilling in the coming months.

ARN is currently building its drill targets, and is aiming for maiden drilling this quarter.

This article will explain why we have made an investment.

Whilst we reiterate that it’s early days for ARN, long term investors are ultimately in this stock to hit a Chalice Mines style play opening discovery - this is the blue sky upside in ARN.

Chalice Mines discovered the world class Julimar PGE-Ni-Cu-Co-Au discovery in WA in 2020. This was Australia’s first major palladium discovery and opened up an entirely new minerals province.

On the back of this discovery, Chalice went from 20c to $5.31 - that’s over 25 x return. It is now capped at $1.8BN...

Chalice points the way in terms of what a successful discovery can do to a stock.

It’s the potential to make a large nickel discovery that attracted internationally renowned geologist Dr Minlu Fu to make a strategic investment in ARN.

Dr Fu has been heavily involved in a number of nickel, copper and gold discoveries, and has an enviable track record.

We have first hand experience with how Dr Fu can deliver returns for shareholders.

We have followed the work of Dr Fu at Los Cerros via our later stage fund nextinvestors.com.

Dr Fu also made a strategic investment in Los Cerros in April 2020 when the stock was trading at 3.8c.

With the help of Dr Fu and his specialist geophysics team that conducted IP surveys over drill targets, Los Cerros has gone up as high as 500%, and has consolidated to now be up 320%.

ARN is just scratching the surface right now, and is valued accordingly at ~ $16M market cap. This means there is plenty of leverage to upside.

Dr Minlu Fu - the immediate catalyst

Renowned geologist Dr Minlu Fu has joined ARN as technical advisor for the Narndee Nickel-PGE Project.

Dr Fu has been heavily involved in a number of Nickel, Copper and Gold discoveries and has an envious ASX track record given his successful technical involvement in the significant discoveries made by Los Ceros (ASX: LCL) and Tietto Minerals (ASX: TIE).

Tietto is capped at $147M and Dr Fu has a 9.9% interest.

Dr Fu also has significant maiden exploration success which includes the West Musgrave nickel deposit (Western Australia), the Tampakan copper gold deposit (Philippines), and the Ernest Henry copper-gold deposit (Queensland). Notably, Ernest Henry is one of Australia’s largest, long-life, low-cost copper-gold projects.

Under the agreement, Ausino and Dr Minlu Fu will provide equipment and services to ARN in relation to the Narndee Nickel-PGE project.

Dr Fu and associates have committed to invest $2 million into Aldoro at $0.20 per share, which will give ARN cash reserves to ~$4.2 million. Once the placement is complete, Dr Fu will join the Pioneer Development Fund Limited and the Narndee Nickel-PGE project vendors as Aldoro’s largest shareholders.

Dr Fu’s cornerstone investment is a significant show of faith in ARN’s Narndee Nickel-PGE Projects and the company’s methodical de-risking efforts prior to drilling.

Now that Dr Fu is a top holder of ARN, we are hoping he can deliver similar style value for ARN over the coming months.

Several more catalysts on the horizon

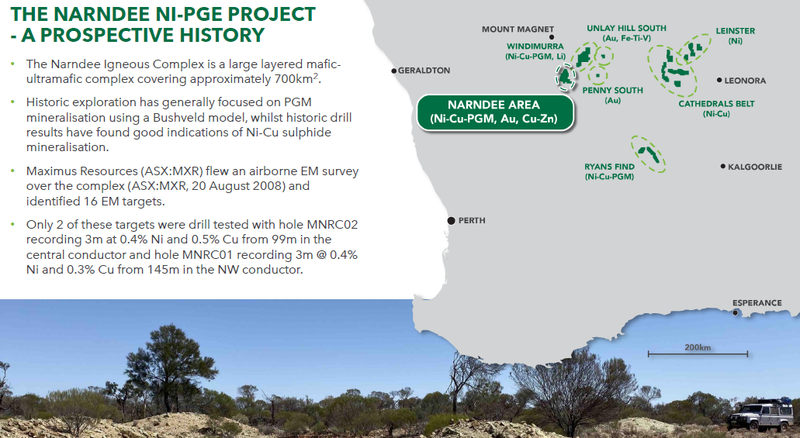

ARN’s 100% owned Narndee Ni-PGE Project in the Murchison Region is 400 kilometres north-north-east of Perth, and the combined Narndee-Windimurra Complex is the largest layered mafic-ultramafic complex in Australia.

Essentially, what this means is that the mineralisation is consistent with a specific type of nickel-copper resource that can also include platinum group elements (PGE).

This has led to multi-billion dollar outcomes for successful explorers.

- Voisey’s Bay sold for C$4.5BN just two and a half years after it made its discovery.

- Nova Bollinger sold for A$1.8BN, three years after its major discovery

- Chalice’s Julimar discovery saw it reach A$1BN valuation in just seven months.

The Narndee Igneous Complex is a world-class jurisdiction, where ARN holds four exploration licences totalling approximately 500 square kilometres.

A major upcoming catalyst will be ARN’s drilling program in April / May.

We have taken a position now as we have seen a host of WA nickel explorers run up in the lead up to drilling.

The timeline of events laid out by ARN, would suggest plenty of news flow to come from ARN as it draws closer to its drilling event.

In fact, ARN is going beyond the traditional approach of “EM & Drill, Hope & Pray” to ensure every possible de-risking technique is applied to assist in delivering commercial success at Narndee.

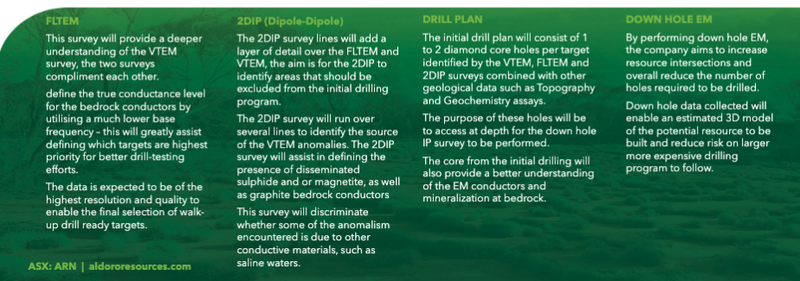

ARN has already released its High Power Fixed Loop Ground EM (FLTEM) results, putting it on track to meet its planned drilling timelines and giving itself every chance to succeed in upcoming drilling.

Much of this success will be down to the modern exploration methods it is using to gather unique and comprehensive data from one of the few known large areas of this type of mineralisation in Australia.

In fact, ARN is well positioned to conduct an extensive exploration campaign with sufficient funding to progress the project through to 3D modelling and commencement of the drilling program.

The company will methodically de-risk the Narndee target prior to drilling, with the majority of these de-risking activities scheduled to be completed shortly.

FLTEM has already been completed and we will look at that in a moment.

Its 2 Dip survey will be the next lot of news to hit the market.

The start of Q2 21 will involve a review of the multiple geological and geophysical layers to identify high priority drilling targets.

At this time the company will assess further surveys to further de-risk prior to drilling.

Here is how it is all unfolding:

As stated, this is one of the most comprehensive de-risking strategies ever undertaken, so ARN will be well prepared when it starts spinning the drillbit in April/May, followed by a more extensive drill programme in June.

Potential for exploration success grows stronger

The potential for exploration success has been strengthened by results released recently from the aforementioned FLTEM survey which remains ongoing.

So far, the survey has delivered promising early stage information in terms of the identification of potential targets at the Narndee Project.

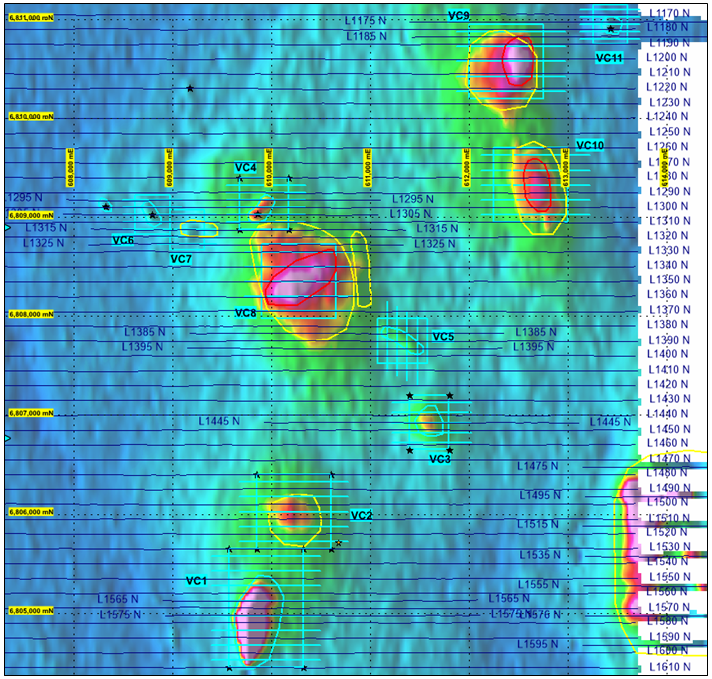

Final data and imagery processing by ARN’s geophysical consultants late last year identified seven clear, discreet bedrock conductors and 9 broader, deeper anomalies.

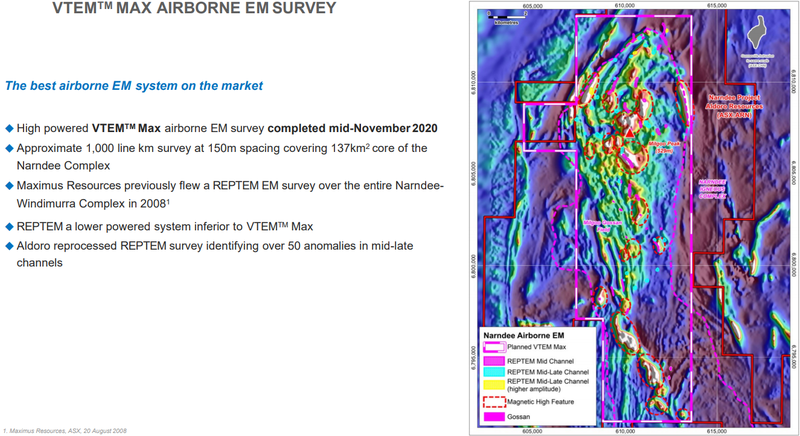

The following diagram shows the relative locations of the 11 FLTEM blocks that will be surveyed, shown with their associated VTEM anomalism.

The first 4 EM targets (VC2, VC3, VC5) were surveyed.

Target VC5 has delivered a formation that points to a possible anomalous system with a confirmed bedrock conductor.

This has warranted further investigation.

Target VC3 demonstrated moderate conductance that will update the source, depth, geometry, and conductance levels.

ARN believes there is value in conducting a planned 2DIP survey to gain a better appreciation of this target.

The 2DIP survey is next on ARN’s agenda.

Is the Narndee Project a company maker?

ARN has stated that historic exploration demonstrates a working sulphide mineral system.

The problem in the past was the use of traditional methods of exploration.

ARN is using modern thinking and exploration techniques and are hoping that these techniques will provide it with the best possible chance to deliver company-making results.

Here’s a look at the history of the project:

To move things forward, ARN is using a high-powered VTEMTM Max survey to focus on magmatic nickel-copper sulphides and attempt to locate possible constrained magma feeder conduits or chonoliths.

This is complicated geology, however all you really need to know is that what ARN is looking for is the type of layered mafic-ultramafic geology akin to recent nickel sulphide discoveries, such as Chalice’s Julimar discovery, as well as other globally significant deposits such as Nova-Bollinger.

It is too early to suggest that Narndee might be the next Julimar, however initial signs suggest the geology is right.

Further technique to create greater confidence

Aldoro will mesh information from its traditional electromagnetic surveying technologies, with more precise data using 2DIP induced polarisation.

This will assist in differentiating targets that possess the genuine features that are characteristic of Julimar type mineralisation, while dispensing with what could be called false positives where anomalism is due to other conductive materials such as saline waters.

This process will be undertaken in the next four weeks, paving the way for the highly anticipated drilling campaign.

The precise method of these techniques pave the way for possible exploration success.

During the June quarter, ARN expects to be reviewing multiple geological and geophysical layers to identify high priority drilling targets, and will assess additional surveys to further de-risk prior to drilling.

The initial drill plant will consist of one or two diamond core holes per target as the company aims to access areas at depth for the downhole IP survey.

The core from the initial drilling will also provide a better understanding of the electromagnetic conductors and mineralisation at bedrock.

By performing downhole electromagnetic, ARN aims to increase resource intersections and from a broader perspective, reduce the number of holes required to be drilled.

Downhole data collected will enable an estimated 3D model of the potential resource to be built, reducing risks associated with follow-up larger and more expensive drilling programs.

Good time to be in nickel

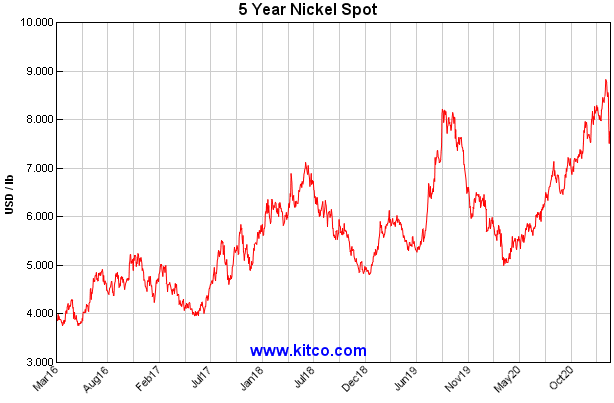

Global nickel demand is expected to grow exponentially over the next 10 to 20 years and Australia’s brownfield and greenfield projects are likely to be viewed as one of the key sources of supply.

There are already early signs that nickel as a commodity is being stockpiled, which is driving up prices.

In the last 12 months, the nickel price has surged from approximately US$5.00 per pound to hit a recent high of US$8.83 per pound, a level it hadn’t traded at since 2014.

While it has fallen back a little bit, it is still trading at a premium of 50% to where it was in March 2020.

Aldoro is leveraged to the best performing base metals in nickel and copper, with both of these expected to see an acceleration in demand as the electric vehicle industry shifts up a gear.

Notably, the world’s largest nickel producer, Tsingshan Holding Group Co. is planning to supply carmakers with cheap, clean metal and intends to supply the EV sector by getting enough nickel to meet demand and ensuring it’s delivered in a climate-friendly way.

“You have, essentially, a market that will grow exponentially in size, but you don’t want to inhibit growth by running short of feed,” said Michael Widmer, head of metals research at Bank of America Merrill Lynch. “What we’re seeing in nickel is Tsingshan trying to resolve those issues.”

Meanwhile, Elon Musk sees nickel as a primary factor in Tesla scaling up battery-cell production.

Just last year he promised a “giant contract” for miners to encourage production.

New sources of supply will be critical to meet the demands of the robust EV industry.

If ARN can fast track its activities, it may well be one of those future suppliers.

There are several reasons to like ARN:

- Tightly held share register, now including Dr Fu

- Global nickel demand is expected to grow exponentially over the next 10 to 20 years and is expected to rise by 2.6 million tonnes in 2040

- Australia’s greenfield and brownfield projects to play a significant role in future demand, according to a Roskill report

- Australia will contribute to more than 25 percent of new mined supply by 2030

- ARN is in a Tier 1 jurisdiction, covering 306km2

Our Investment Strategy for ARN

At Catalyst Hunter we seek to invest in early stage companies with near term price catalysts.

This type of investing is speculative with high risk / high reward outcomes. Only invest what you can afford to lose.

We have made our initial investment in ARN and are holding in the expectation of share price appreciation as the company de-risks its project in the lead up to its key price catalyst - drilling.

We expect ARN to deliver the following key milestones over the next 3 to 6 months and the share price to appreciate as the market speculates on a drilling outcome:

- Key Team additions (✅ Dr Fu announced this week)

- Permits and Land rights ( ✅ all land rights and permits secured)

- Geological surveys and prep work

- Key Risk Point: Technical surveys do not return high potential drilling targets

- Drill targets identified

- Drill rig secured

- Key Catalyst: Drilling begins

In the lead up to drilling we expect the share price to increase and will aim to take back our initial investment in the lead up to drilling.

We plan to retain a significant position into the drilling results which are hopefully positive.

At that point, we will assess our investment strategy based on drilling results.

Once again - it’s early days for ARN and the market is valuing it accordingly, but the blue sky upside is clear.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.