Ambitious ASX Copper Play Heating Up in Chile

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Today’s $19 million-capped junior has its hands on one of the largest copper developments currently on the ASX.

It has just consolidated several Chilean copper mines into what it has dubbed the El Fuego high-grade copper project — and is taking these and adding them to its existing large-scale bulk tonnage ‘Productora’ copper development.

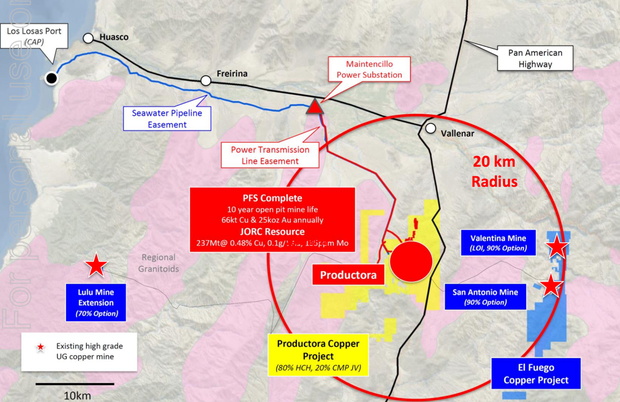

The new additions are all mines within 20-30 kilometres of the site, and are secured via four-year Options with only minimal payments due for the initial few years. The company’s ambitious intention is to define as many Resources as possible and build El Fuego and Productora into a coastal copper super-hub that can tap into the infrastructure-rich Vallenar coastal region of central Chile.

It plans to compile an enviable inventory of high grade ore sources that it can truck to Productora, process and ships from existing nearby port, and thereby achieves an overall higher grade, higher volume copper project — at low-end costs.

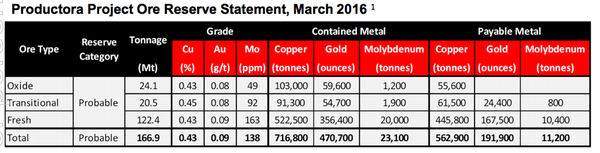

Its existing Productora asset currently has a mine life of 10 years and expected average annual EBITDA of US$185 million over that mine life, at US$3.00/ pound copper price.

The aim is to unlock the exponentially greater value of the separate mines and projects by grouping them together and maximising on their close proximity. This would transform the company’s established Productora mine, offering a higher grade sweetener to future big copper production.

Importantly for this small cap, copper is widely predicted to undergo a supply deficit, with production predicted to tighten in the next 12-24 months.

All commodity plays are tied closely to the market price. Given the current size of the ore reserve at Productora, even a modest spike in the copper price could mean a huge difference as far as this company’s market capitalisation and share price is concerned.

With a PFS already been done, the company also has a 20% JV partner (Chilean major CMP) supporting the project. Given it’s now aiming at significantly increasing the head grade of its copper output, the impact of a price change on the company’s bottom line could be even more significant.

In the last decade we’ve seen relatively few large copper discoveries (compared to the 18 years prior) which is part of the reason the market is now facing a tight supply environment ahead.

It’s good timing for today’s company which is looking to test the bullish copper market of the last 12-18 months, and see if it can maximise on the coming supply deficit.

Keep in mind, the money required to bring a big copper mine (+200ktpa producer) to market is considerable; we are talking in the vicinity of $3-3.5 billion, and a lot of years to get it off the ground (or rather, in the ground). This means that companies have a high capital barrier to overcome, so a company like today’s which is already several years into the process holds a distinct advantage.

It’s time to get in on this story before the market wakes up to it first — introducing:

It’s not a bad time to be a copper junior on the ASX with a large copper Resource already in the bag, and potential off-takers eager to see new high-grade copper projects come on-line...

In fact, some commentators are predicting a supply crunch even sooner than initially expected:

Just this month it was revealed that production at Grasberg in Indonesia (the world’s second largest copper producer) will fall by more than half in 2019 as the mine’s pits transition to underground operations, cutting some 300,000 metric tons of supply:

On that note, let’s delve into what Hot Chili Limited (ASX:HCH) has been up to.

In June, it raised $4 million to bolster its current efforts in Chile and commenced a 5000m drilling program across two of its three recently secured high-grade copper mines — San Antonio and Valentina.

The company has secured option deals to earn controlling interest in three mines — San Antonio, Valentina, Lulu — to form the combined El Fuego copper project, which will add to the production of HCH’s long-standing Productora asset:

HCH has already completed a PFS for Productora establishing a 10 year mine life, 66kt copper and 25koz gold production annually over first eight years, and an overall Resource of 1.5Mt copper & 1Moz gold.

Below is the current ore reserve for Productora:

What’s been made crystal clear in the last 6 months+ is that HCH is in an exciting new phase of growth. Its expanding its coastal copper portfolio and going in search of yet more high-grade opportunities in the El Fuego project area.

El Fuego’s first recruit: San Antonio, the jewel in the crown

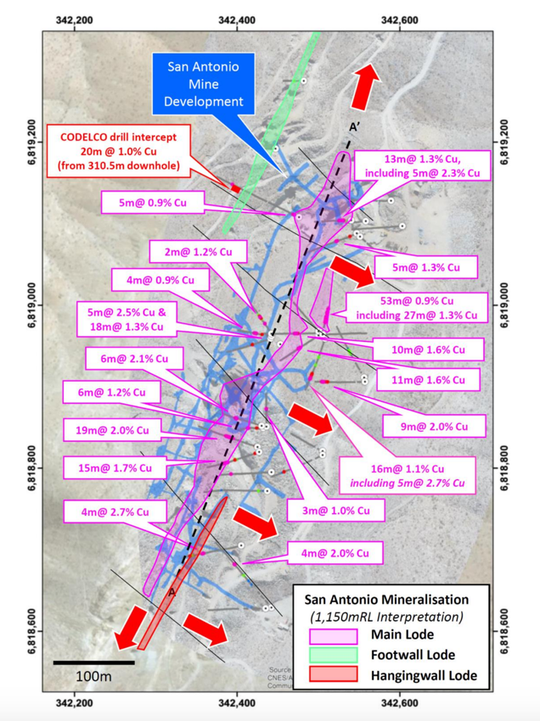

The San Antonio mine is looking likely to become the jewel in the crown of the company’s new El Fuego project.

San Antonio has already produced approximately two million tons grading 2% copper and 0.3g/t gold and 17g/t silver, from shallow depths, since 1964.

So HCH knew they were onto a good thing here, but the game-changing assays that have come through only this week would no doubt have left the team feeling even more confident of its potential.

Here are the strongest of the results from this week:

- 9m grading 2.0% copper from 132m down-hole depth

- 16m grading 1.1% copper from 93m down-hole (including 5m grading 2.7% copper),

- 6m grading 2.1% copper from 65m down-hole depth

- 19m grading 2.0% copper from 61m down-hole depth (including 11m grading 2.4% copper),

- 15m grading 1.7% copper from 80m down-hole depth,

- 13m grading 1.3% copper from 17m down-hole depth (including 5m grading 2.3% copper),

- 53m grading 0.9% copper from 72m down-hole depth (including 27m grading 1.3% copper),

- 10m grading 1.6% copper from 58m down-hole depth (including 4m grading 2.7% copper),

- 5m grading 2.5% copper from 31m down-hole depth (including 2m grading 4.3% copper),

- 18m grading 1.3% copper from 52m down-hole depth (including 5m grading 2.1% copper), and

- 11m grading 1.6% copper from 83m down-hole depth.

Given the shallow, high-grade nature of mineralisation at San Antonio, the mine looks set to become the key addition to HCH’s copper portfolio — possibly being the X factor giving it an extra edge to bring a large-scale open pit Resource inventory to market...

Below is a graphic showing the location of the latest assay results:

These highly positive results indicate San Antonio’s potential to bring HCH a substantial shallow-dipping, near-surface copper Resource — and one that’s amenable to open pit extraction, at that.

Importantly, drilling has successfully indicated major extensions to San Antonio’s Main Lode, and highlighted the potential for definition of a substantial, shallow, high-grade copper Resource over a strike length of at least 700m.

Most recent drill assays for San Antonio are tabled below:

In addition, detailed mapping and sampling results have confirmed and delineated multiple copper targets south of San Antonio, as well as a potential large-scale mineralised copper zone extending along the eastern flank of the mine.

A major bonus for the company’s newest asset bundle is the potential to find new discoveries outside the known mineralised zones, considering the lack of modern day exploration at these sites.

San Antonio has been privately owned and mined since 1964. HCH got its hands on it in November last year via a JV Option agreement which includes a four year term to earn up to 90% interest.

Importantly for the company at this early stage, its Option agreement requires no payments or commitments in the first three years — with a first payment of US$0.3 million due in 36 months and a second payment of US$6.7 million in 48 months.

The ~2 million tons already produced at San Antonio were mined to a depth of 130 metres over a 400 metre strike. HCH believe there is more potential to be exploited, as outlined in this graphic:

2-4% copper ore grades have been found at shallow depth along the northern extent of the mine, which is one among several indicators that there’s a lot of life left in the San Antonio mine yet.

The company is being assisted by Lease miners, who Hot Chili have left to lease-mine up to 50ktpa during the Option period. The company sees San Antonio as an enviable brownfield high-grade copper opportunity; and with large open pit and underground mining potential, it represents a rare find for a company of HCH’s size.

Of particular interest to shareholders, the higher grade material at San Antonio could well serve to drive down production costs at HCH’s Productora mine, potentially leading to higher margins in a rising copper market.

If a copper price rise is coming, as predicted with the looming supply deficit; a large-scale bulk copper project like Productora begins to look even more attractive.

A look at Lulu

Like San Antonio, HCH’s recently secured Lulu asset — located 30 kilometres directly west of Productora — has been privately held for the last 50 years and has never undergone drilling.

The adjacent underground mine to Lulu was reportedly exploited to a depth of 600m at average sulphide production grades of 6% copper and 3g/t gold over 1.5m to 2m width.

The company’s preliminary sampling efforts at Lulu returned grades up to 2.8% copper and 3.9g/t gold from surface. They also confirmed an outcropping of 800m direct extension to one of the region’s highest grade and most substantial underground mines.

Importantly for the company, Lulu offers a second potentially high-grade satellite ore source within a short trucking distance of the company’s Productora project.

HCH is well positioned to define drill targets from field work already completed at Lulu, which as mentioned has never been subjected to any modern exploration. The surface mapping and sampling done so far has provided the company with further confidence in the Lulu project.

Valentina: El Fuego’s third satellite ore source

HCH’s third recently secured asset to make up the newly consolidated El Fuego project is Valentina. It contains an operating high-grade underground copper mine (shallowly developed) with several significant historical drilling intersections which have not been effectively followed up, including...

- End of hole intercept of 11m grading 2.0% copper (including 7m grading 2.7% copper from 129m down-hole).

- 3m grading 3.4% copper from 27m down-hole.

While very little drilling has been completed at Valentina, HCH has managed to confirm over 700m of mineralised strike length potential from surface mapping and sampling (+1% copper rock chip results). The company has a non-binding Letter of Intent (LOI) for Valentina to earn a 90% interest over a four-year period.

It has big hopes that Valentina can prove itself to be a high-grade copper asset like its star recruit, San Antonio... with the first step being to define a Resource at the mine.

Results from recent drilling by Hot Chili at Valentina are expected soon but the company has confirmed that two of three holes drilled have intersected zones of visible copper mineralisation.

The below map shows Valentina in relation to both the Productora and San Antonio mines:

All steps towards a bigger plan

As we mentioned, HCH has big plans to combine multiple ore sources into the one El Fuego project, and add that to its existing Productora asset, to achieve higher grade and critical mass overall.

While it’s early days in that process, things seem so far, so good.

HCH’s El Fuego Options are for four-year periods, with the intention to earn operating ownership. Given the lack of modern exploration or Resource drilling at the mines, they could each hold excellent unlocked value for this $19 million-capped stock.

What to expect from HCH going forward

The junior has been busy accelerating all exploration efforts across El Fuego — San Antonio, Lulu and Valentina — with plans to release further results in the near-term.

Together with its existing large asset base at Productora, the growing scale and potential grade impact from its El Fuego efforts could present the opportunity for a swift share price uplift for HCH once the market cottons on.

With the Valentina mine, the Lulu copper mine extension, and multiple large copper targets defined along the San Antonio-Valentina corridor (8km long), HCH has a robust pipeline of high-grade copper targets to get stuck into in the coming weeks and months, all the while buoyed by sector sentiment around tightening supply and a potential price rise over the next one to two years or more.

It seems the junior is intent on delivering a continuous stream of positive news flow from all its Chilean copper plays, and has advised shareholders to expect more follow up drilling and results in the near-term.

At the same time, this savvy small cap is keeping one eye on additional acquisitions and nearby opportunities to expand its copper prospects in Chile.

It could be an ideal time to hop on the bandwagon as things start to heat up at Hot Chili.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.