Aldoro acquiring advanced exploration projects in Youanmi gold mining district

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Aldoro Resources (ASX:ARN) opened up 75% at 24.5 cents this morning after emerging from a trading halt and announcing the acquisition of advanced exploration projects including the Penny South Gold Project in the Youanmi Gold Mining District.

Aldoro has entered into a binding option agreement to acquire 100% of Altilium Metals Limited.

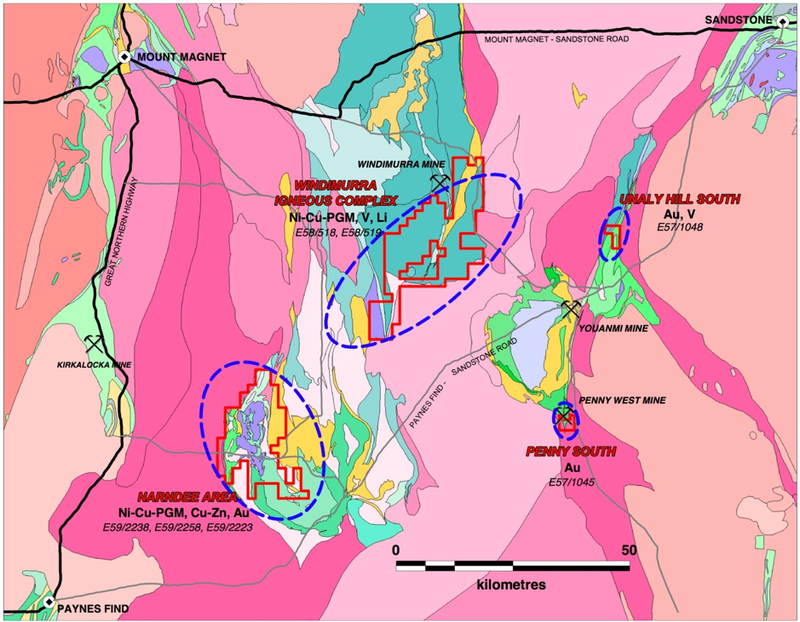

With the acquisition of Altilium, Aldoro will acquire Altilium’s five Exploration Licences and two Exploration Licence Applications in the Murchison Region of Western Australia.

The tenements contain a number of advanced exploration projects around the Younami Gold Mining District and the Windimurra-Narndee Igneous Complex. The projects are principally focused on gold, nickel and copper mineralisation.

The tenements form four main project areas, covering a total of 756km2:

- Penny South Gold Project – contiguous with the Penny West Gold Project owned by Spectrum Metals (ASX:SPX), with over 2.5km strike of Penny West shear

- Narndee Project Area – consisting of the Narndee Igneous Complex (Ni-CuPGM), and Kiabye Greenstone Belt (Au)

- Unaly Hill South (Au) – at the convergence of the major Youanmi and Yuinmery regional shears

- Windimurra Igneous Complex (Ni-Cu-PGM, Li) – recently identified lithium bearing pegmatites

Penny South Gold Project

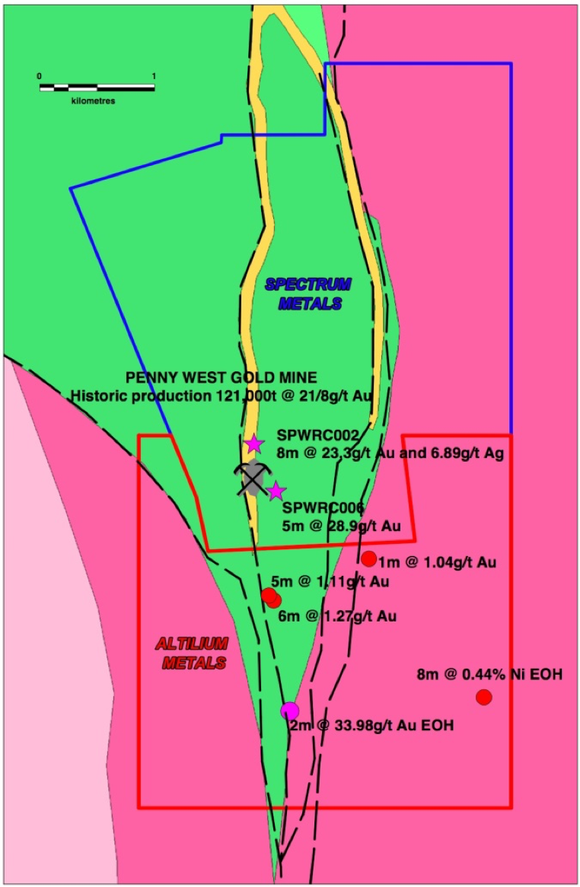

The Penny South Gold Project lies directly to the south of the Penny West Gold Project owned by Spectrum Metals (ASX:SPX) and contains over 2.5km strike extension of the Penny West Shear, that hosts the historic high-grade Penny West Gold Mine.

Spectrum Metals’ share price has gained ~1,500% over the past year as it progresses exploration. It has reported outstanding recent exploration success at Penny North and at the southern end of the Penny West pit within deeper drill holes beneath cover.

Here is the Penny West Area including Altilium’s Penny South Project:

Historic drilling within tenement E57/1045 at Penny South has encountered various significantly anomalous intersections of gold mineralisation including 2m at 33.98g/t Au, 6m at 1.27g/t Au and 5m at 1.11g/t Au.

Like the Penny West area, tenement E57/1045 contains limited outcrop and is overlain by 1m to 30m of sand and sedimentary cover. The average depth of historic drilling within the Penny South Gold Project is less than 40m down hole.

Aldoro intends to utilise a similar exploration strategy to Spectrum to test surface anomalies at depth.

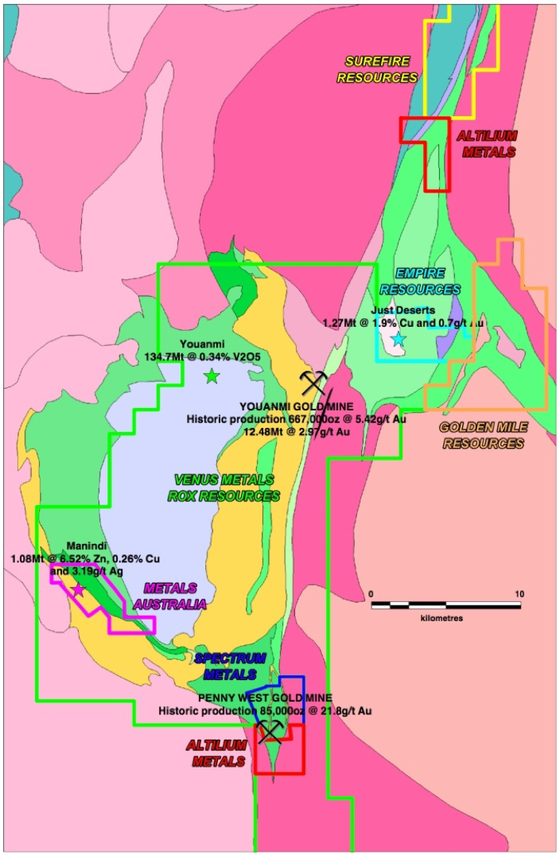

Here is a view of the wider Youanmi Gold Mining District:

Narndee Project Area

The Narndee Project Area is formed of 2 exploration projects (differentiated by different styles of geology) surrounding the Narndee Igneous Complex – the Narndee Igneous Complex (Ni-Cu-PGM) and the Kiabye Greenstone Belt (Au).

Narndee Igneous Complex (Ni-Cu-PGM)

The Narndee Igneous Complex is a large layered mafic-ultramafic complex covering approximately 700km2. Historic exploration has generally focused on PGM mineralisation using a Bushveld model, whilst historic drill results have found good indications of Ni-Cu sulphide mineralisation.

Maximus Resources (ASX:MXR) flew an airborne EM survey over the complex in 2008, identifying multiple EM targets, but only conducted limited follow up work. Aldoro intends to build on this wealth of historical information, including multiple geophysical datasets, and is excited by the nickel potential of the project.

Kiabye Greenstone Belt (Au)

The Kiabye Greenstone Belt wraps around the western side of the Narndee Complex, predominantly formed of Norie Group amphibolite-metabasalt and Yaloginda metasedimentary units, with a sheared contact against the surrounding Tuckanarra Suite granite.

The greenstone belt extends for over 30km of strike and is historically underexplored due to thin 1m to 5m cover. Anomalous indications of gold have been identified along the length of the belt in historic work.

Unaly Hill South

Tenement E57/1048 lies at the southern end of the Atley Complex, located between the Youanmi and Sandstone Gold Mining Districts and contiguous with Surefire Resources (ASX:SRN) Unaly Hill Vanadium Project.

Whilst the tenement contains a significant vanadium titanomagnetite exploration target it is also considered prospective for gold mineralisation with the intersection of two major regional shears – the northern extension of the Youanmi Shear and its intersection with the Yuinmery Shear, also known to host gold mineralisation.

Windimurra Igneous Complex

Tenement applications E58/518 and E58/519 cover approximately 420km2 of the Windimurra Igneous Complex.

Recent field work and geological mapping interpretation by Altilium has identified over 20 pegmatites at the edge of the Windimurra Complex, that are considered prospective for lithium mineralisation.

Acquisition terms

The key terms of the acquisition are as follows:

- Aldoro will pay a $50,000 option fee to secure the exclusive option to acquire 100% of the issued share capital of Altilium.

- If the Option is exercised, at completion Aldoro will issue Altilium shareholders a total of 10,800,000 fully paid ordinary shares to acquire all outstanding shares in Altilium Metals Limited at a deemed price of $0.15 per share.

- Caedmon Marriott and Rhod Grivas to join the board of Aldoro at completion of the acquisition.

- Aldoro will assume a maximum of up to $250,000 of liabilities and debts held by Altilium, consisting of $100,000 payment to the original vendors of the Narndee and Windimurra Projects, and up to $150,000 of outstanding creditors.

- Issue of 1,200,000 facilitator shares to Xcel Capital Pty Ltd.

Commenting on the acquisition Aldoro’s Chairman Jeremy King said: “We are extremely pleased to reach agreement for the acquisition of Altilium Metals. The addition of their exciting exploration assets, including the Penny South Gold Project, greatly enhances Aldoro’s existing portfolio and builds on our long-term strategy of creating a significant Western Australian exploration and development company.”

Share Placement

Aldoro has finalised binding terms for a share placement to raise capital for exploration activities and working capital.

The company will issue 4,333,333 shares at $0.15 per share to raise $650,000 (before costs) which represents a premium of 12.8% to the 20-day VWAP.

The raising was very well supported by the Altilium vendors in addition to the Aldoro directors who have subscribed for $90,000 of the placement (subject to shareholder approval).

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.