AL3 announces $1.1M sale to US Navy supplier - US traction growing

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 6,777,530 AL3 shares at the time of publishing this article. The Company has been engaged by AL3 to share our commentary on the progress of our Investment in AL3 over time.

AML3D (ASX:AL3) has just announced a new $1.1M sale of its ARCEMY 3D printing system to a parts manufacturer supporting the US Navy.

AND the contract includes an initial year of servicing and maintenance contract - valuable annual recurring revenue.

An early, strong start to the new financial year.

Today’s news is a further proof point that AL3 is executing on its strategy of US growth, adding recurring revenue and selling entire 3D printing systems (as opposed to just bespoke 3D printed parts).

And hopefully AL3 can keep up this momentum.

We announced AL3, as our newest Investment last week.

AL3 is a technology company that specialises in robotic, automated 3D printing of metal parts that are built on site and on demand.

What got us most interested in AL3 was its change in sales strategy towards:

- Switch focus to the giant US market

- Adding a recurring revenue component to the 3D printing system sales

- Sell entire 3D printing systems, instead of AL3 just custom printing parts for customers

Our view was that the move away from selling only 3D printed parts to also selling entire 3D printing systems could mean bigger contracts from customers with deeper pockets...

And today, AL3 announced a $1.1M deal to back up the strategy change.

The contract was obtained through the BlueForge Alliance, which was created to promote technology adoption and acceleration in the US Defence sector.

BlueForge making the purchase order is a strong indicator that the US Navy wants to fast track adoption of 3D printing technologies like AL3’s.

The deal sees AL3 convert its lease agreement with US Navy component supplier Laser Welding Solutions (LWS) into an outright sale + a one-year service and maintenance contract.

So AL3 gets a lump sum payment for selling the ARCEMY system and then gets the recurring revenues from the servicing/maintenance contract...

And there is potential for AL3 to do it again with the same customer...

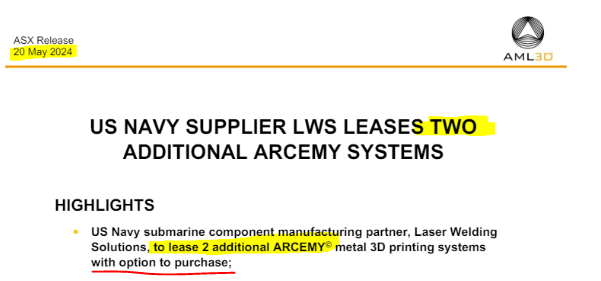

AL3 recently leased two additional ARCEMY systems to LWS - which was announced back in May of this year, both leases also include an “option to purchase”:

(Source)

If LWS are happy to purchase one outright, then we think there is a good chance LWS could do the same with the two additional units.

Those two leased ARCEMY systems should arrive in Texas, USA, in the next few weeks for handover to LWS.

The ARCEMY system is AL3’s metal 3D printing technology which can manufacture complex industrial parts for the defence, oil & gas and aerospace industries.

It's 3D printing but with different metals, steel or alloys based on a user's needs on-site and on-demand...

Here is what an ARCEMY system looks like:

And here is the system in action:

How this announcement impacts our AL3 Investment Memo:

We think today’s deal is important news for the company for three key reasons:

1. High $ value relative to full year revenues

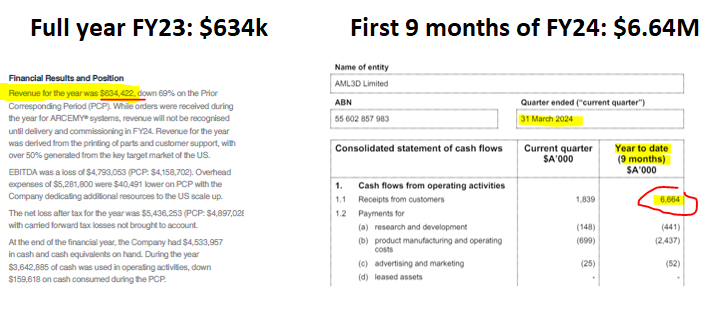

The $1.1M deal equates to a big percentage AL3’s revenues for FY24 (at around $6.6M according to AL3’s FY24 Q3 report)

AL3 had $634K in revenues for FY23 and ~$6.64M in cash receipts for the first 9 months of FY24.

The $1.1M deal is material relative to both of those numbers.

(we will find out what the FY24 full-year revenue number is in the next few weeks when AL3 releases its FY24 Q4 quarterly report)

So it’s a good early start so far to the revenue objectives we want to see AL3 deliver in FY25.

2. Large upfront capital commitment from inside the US Defence industry

The US Defence sector is usually a hard market to crack when it comes to large upfront capital sales.

We see the $1.1M sale + service/maintenance deal as a validation that the industry sees value in AL3’s technology offering.

It also validates the AL3 strategy of selling into a larger subsector of the defence industry.

3. Outright purchase + service/maintenance revenues attached to the deal

The two-pronged sale adds recurring revenues to AL3’s business and is a validation of the company’s capital equipment + add-ons sales strategy.

(Source)

Today’s deal directly relates to three of the eight key reasons why we Invested in AL3 in the first place:

New sales strategy already driving revenue growth

AL3 has moved from a “sell the 3D printed parts” to a “sell the 3D printing system” strategy. This new strategy means bigger contracts for AL3 and gives customers what they want because the parts are made closer to where they are needed.

Source: AL3 Investment Memo 27 June 2024

AL3 would previously have sold custom 3D printed parts to a customer like LWS which would be done at a far lower contact size than today’s deal.

The new sales strategy means AL3 is able to sign deals that are as big as ~$1.1M.

We also note that the system the company sold today (The 2600 Edition ARCEMY® system) is AL3’s smallest industrial scale metal 3D printing system.

So future sales of bigger systems could mean deal sizes even bigger than the $1.1M announced today.

“Sell the 3D printing system” strategy opens up yearly recurring revenue

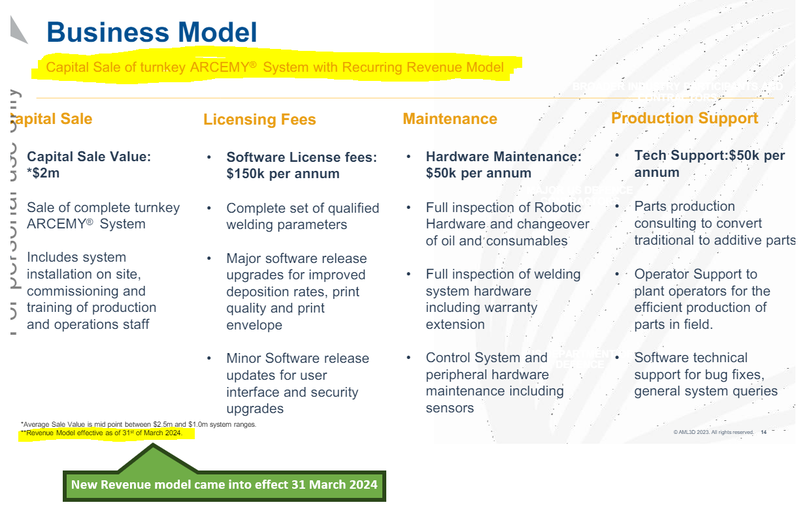

For new orders of the ARCEMY system, AL3 will now build in ARCEMY services to include software and services fees on a recurring revenue basis. This includes software licensing fees, hardware maintenance, and tech support. This is an untapped stream of revenue for AL3 and a potential source of upside for the company as the company grows.

Source: AL3 Investment Memo 27 June 2024

Up until March 2024, the company’s business model didn't have a recurring revenue component.

Today’s deal includes a one year service + maintenance contract which is the first set of recurring revenues the company will be receiving under its new sales strategy.

Recurring annual revenue is highly valuable for a technology company - essentially with every sale made, there will be an upfront AND a yearly cost associated.

As the recurring revenue sales grow, it creates a steady income stream that helps offset opex costs of the business - tech companies with a large recurring revenue component will get valued higher than companies that rely solely on “moving units” alone.

We are hoping to see AL3 grow its recurring revenues over the coming years, especially in this first 12 months to prove it can be done.

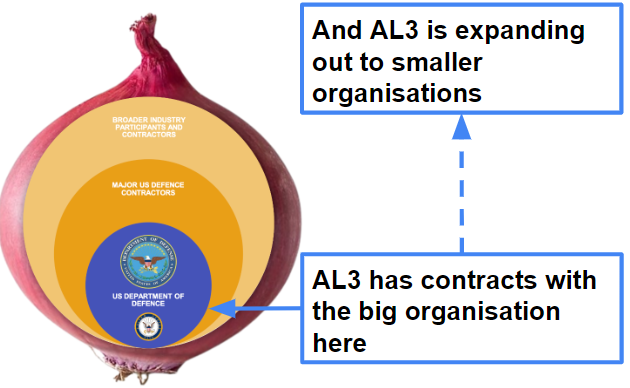

US Navy to help to push AL3 to its parts suppliers

The early signs are there. We want to see AL3 expand into smaller US Navy parts suppliers who are following the US Navy’s lead. In September 2023, a Navy parts supplier called Laser Welding Solutions leased the ARCEMY product from AL3 - we hope the first of many contracts for AL3 from this type of smaller organisation.

Source: AL3 Investment Memo 27 June 2024

Today’s deal was a direct sale to US Navy parts supplier LWS who had previously been operating AL3’s ARCEMY system under a lease agreement.

We think the deal today embeds AL3’s ARCEMY system into one part of the US Defence supply chain AND we hope it opens the door to sales to other organisations like LWS.

Below is a full list of the eight key reasons why we Invested in AL3, which can be found in our AL3 Investment memo that are using to track AL3’s progress:

8 Key reasons why we Invested in AL3:

- 3D printing product at the forefront of manufacturing innovation - AL3 sells large scale modular 3D printing systems to industrial manufacturers. Its product, ARCEMY, provides a better solution to manufacturing parts for complex industrial machinery.

- Blue-chip client base including US Department of Defence - AL3 has a range of high-profile customers including the US Navy, US Department of Defence, Austal (the Australian military shipbuilder) as well as oil & gas giants Chevron and Exxon. These customers provide validation for AL3’s product in future sales as well as a network of potential smaller suppliers for AL3 to target.

- Tiny EV for AL3 with proven tech with sales - At 7.3c AL3 has a market cap of ~$22M, with ~$8M in the bank has an Enterprise Value of ~$14M. AL3 is already at ~A$6.6M in revenue for the first 9 months of FY24. AL3 has invested over ~$30M building out its tech.

- New sales strategy already driving revenue growth - AL3 has moved from a “sell the 3D printed parts” to a “sell the 3D printing system” strategy. This new strategy means bigger contracts for AL3 and gives customers what they want because the parts are made closer to where they are needed.

- “Sell the 3D printing system” strategy opens up yearly recurring revenue - For new orders of the ARCEMY system, AL3 will now build in ARCEMY services to include software and services fees on a recurring revenue basis. This includes software licensing fees, hardware maintenance, and tech support. This is an untapped stream of revenue for AL3 and a potential source of upside for the company as the company grows.

- Strong US focus as AM Forward Program rolls out - In 2023 AL3 commenced its US focused strategy. The US spends more on its defence than the next 9 countries combined and as such is easily the most lucrative defence market jurisdiction to operate in. In 2022, the US has also launched the AM Forward Program to support 3D Printing across the industrial manufacturing sector. We think that the US is the right place for AL3 to grow its business.

- US distribution partner Philips has proven its ability to sell AL3’s product - AL3 has a value added reseller agreement with ~$35BN capped Philips Corporation. Philips’ sales team has already helped AL3 make two US sales, including an ARCEMY sale to the US Navy Centre of Excellence which we see as the first signs that Philips is an engaged partner and we expect their sales team to help drive the marketing of AL3’s products.

- US Navy to help to push AL3 to its parts suppliers - the early signs are there. We want to see AL3 expand into smaller US Navy parts suppliers who are following the US Navy’s lead. In September 2023, a Navy parts supplier called Laser Welding Solutions leased the ARCEMY product from AL3 - we hope the first of many contracts for AL3 from this type of smaller organisation.

Check out our deep dive into AL3 from last week here:

(Source)

We are long term Investors in AL3 and plan to hold a material position for the next 3-5 years (and beyond).

We are hoping, based on all of the reasons that we outlined above, that AL3 will be able progress its plan to grow sales in the large US market and achieve our Big Bet for the company which is as follows:

Our AL3 ‘Big Bet’:

“AL3 re-rates to a $500M market cap on achieving significant sales growth across an expanding range of industries and jurisdictions”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our AL3 Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

How today’s news impacts our Investment Memo objectives for AL3:

Objective #1: Hit $12M in revenue

According to the March quarterly AL3 will hit ~$7M revenue for FY24. We think that if they can back that up with beating $12M revenue in FY25 it would be a huge result.

Source: AL3 Investment Memo 27 June 2024

Two days into FY25 and we already have a $1.1M contract delivered - a good start towards the $12M FY25 revenue goal we want to see from AL3.

We note that contracts converting to booked revenue don’t appear to occur in a predictable timeframe. For example, a lot of the revenue from contracts signed in FY22 slid into FY23.

But this contract has been signed very early in FY25 so we expect it to directly contribute the full $1.1M into the FY25 revenue numbers.

Objective #2: More sales of ARCEMY

We want to see AL3 sign more large contracts via sales of their ARCEMY system (3D printing system).

AL3 already has good traction with the US Navy via the US Department of Defence and we also want to see an expansion in jurisdictions and industries.

It also has a value added reseller agreement with ~$35BN capped Philips Corporation which has a large reach in the US

Milestones

🔄 total 8x new ARCEMY contracts (✅🔲🔲🔲🔲🔲🔲🔲)

🔲New ~$1M contract (New customer in US defense industry)

🔲New ~$1M contract (Aerospace)

🔲 New ~$1M contract (O & G)

🔲 New ~$1M contract (New customer in non-US jurisdiction)

Source: AL3 Investment Memo 27 June 2024

Given this is a new ARCEMY sale to LWS we are going to give it 1 out the 8 sales we want to see AL3 deliver in FY25.

Given LWS were already a customer renting the ARCHEMY system, we aren't going to tick off “new $1M plus contract (New Customer in the US defence industry) - we still want to see AL3 expand to totally new customers that are

Objective #3: Prove recurring revenue from ARCEMY Services Deals

AL3 has built a recurring revenue component into its business model.

For each client that purchases the ARCEMY facility, AL3 has built in ongoing fees for providing ongoing support which includes software license fees of $150K a year, hardware maintenance fees of $50k a year, and tech support of $50k a year.

Milestones

🔄Add new recurring revenue of $500K

🔲Add new recurring revenue of $1M

🔲Stretch target: Add new recurring revenue of $1.5M

Source: AL3 Investment Memo 27 June 2024

The wording in the announcement is a bit ambiguous on whether the software and services component is actually yearly and recurring, but for now we are going to assume it is given the new business model of selling recurring revenue is already in place at AL3, especially given the companies language in the announcement implying that it's the first year of a yearly recurring contract.

We are going to put a tentative “in progress” marker against our objective for AL3 to initially hit $500k in recurring revenue until we find out more.

To see all the other objectives we want to see AL3 achieve check out our AL3 Investment Memo here.

What are the risks?

Every investment carries risk. An investment in AL3 is no different.

In the short term, the key risks we are conscious of for AL3 are “Sales risk” and “Market Risk.”

As AL3’s share price increases, the expectations for future sales/growth increase. If AL3 fails to deliver more sales and its financial performance suffers, the market may start to price in lower growth potential for the future and re-rate AL3’s share price lower.

At the same time, if market sentiment were to turn negative, investors might sell down earlier stage companies like AL3 in favour of more mature, already profitable companies.

AL3 is dependent on investors' willingness to back loss-making high growth businesses as they work toward profitability.

We mention several other risks as part of our AL3 Investment Memo, including:

- Partner risk

- Funding and dilution risk

- Technology and Intellectual Property risk

- Key personnel risk

- Accreditation risk

To see our key risks expanded check out our AL3 Investment Memo.

Our AL3 Investment Memo:

In our AL3 Investment Memo, you can find the following:

- What does AL3 do?

- The macro theme for AL3

- Our AL3 Big Bet

- What we want to see AL3 achieve

- Why we are Invested in AL3

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.