African phosphate project set to improve crop yield

Overview: Minbos Resources Limited (ASX:MNB) is an exploration and development company which won an international tender for the Cabinda Phosphate Project in March 2020. Minbos and its in-country partner, Soul Rock Ltda (15% carried interest), won the tender based on producing Enhanced Phosphate Rock as a substitute for fertilisers currently imported by the Angolan Government for distribution to wholesalers and farmers. The company’s vision is to build a nutrient supply and distribution business that stimulates agricultural production and promotes food security in Angola and the broader Middle Africa region. A recent scoping study demonstrated that the Cabinda project has the potential to generate strong cash returns for relatively small capital investment, and management is moving quickly to complete a definitive feasibility study (DFS).

Catalysts: Following the successful scoping study at the Cabinda Project, management completed a capital raising of approximately $2.3 million, attracting new high net worth investors to Minbos’ register. This leaves the group well placed to accelerate its DFS, arguably the most important near to medium-term catalyst. However, in the interim, the group will be releasing information regarding the mining plan, tendering, plant construction, and the conduct of commercial demonstration field trials in Angola. The latter has the potential to provide significant share price momentum, along with the receipt of environmental approvals. In tandem with the DFS, Minbos will be undertaking negotiations for port and land access, as well as energy supply, offtake, and project finance.

Hurdles: Minbos should only be constrained by traditional risks and/or uncertainties that can be associated with most mining projects. Most of the key milestones that we outlined as catalysts still have to be achieved. However, it is worth noting that it is in the best interests of the Angolan government to see the project progress due to the benefits it will have in terms of employment, security of food supply within Angola and the financial investment that it would bring to the country. Project finance and offtake agreements are essential in moving to production, and these sometimes go hand-in-hand given offtake agreements generally provide financial security.

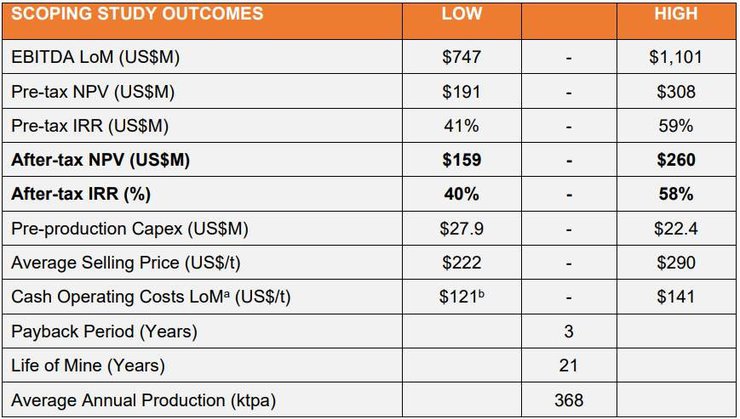

Investment View: One of the most attractive features of the Cabinda Phosphate Project from an investment perspective is the extremely moderate upfront capital investment required to bring it into production. This is of particular significance for a smaller company such as Minbos which has limitations regarding access to capital because of its size. The scoping study points to mid-range pre-production capital expenditure of about $25 million. Cabinda is forecast to generate EBITDA in a range between $747 million and $1.1 billion over a mine life of 21 years. Looking across the broader mining industry there are very few projects that offer such a long mine life with such strong underlying earnings for a nominal investment. Further, this is a high margin project with cash operating costs of around US$130 per tonne offering robust margins for a product that sells at an average price of US$260 per tonne. Cabinda is projected to pay for itself in three years.

ASSET OVERVIEW - Cabinda Phosphate Project

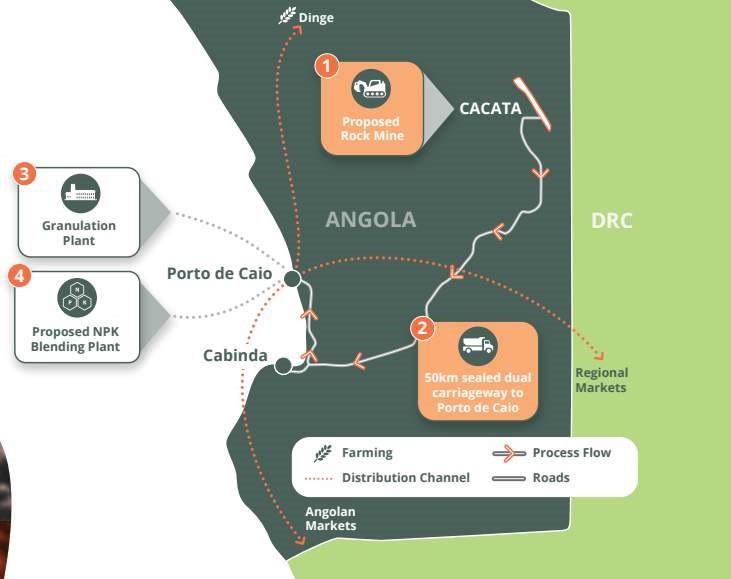

Following its successful tender for the production of Enhanced Phosphate Rock as a substitute for fertilisers currently imported by the Angolan Government, Minbos plans to mine Phosphate Rock from the Cácata Deposit and transport it to Porto de Caio where a granulation plant will be built and operated at the industrial site to produce Enhanced Phosphate Rock (EPR) granules (Phosphate Rock + mono-ammonium phosphate or MAP).

With the DFS still to be completed, the findings of the scoping study which we outlined earlier are the key areas to focus on in terms of appreciating the merits of the project. While we discuss the financial metrics, it is also important to understand the nature of the resource, the strategy behind its production, and the proposed markets that management is planning to target.

The Resource

Results from the Scoping Study demonstrate the Cabinda Phosphate Project to be technically and financially robust. Agronomic trials of the Cabinda Phosphate Rock enhanced by granulation with MAP (monoammonium phosphate) demonstrated agronomic effectiveness for soils, crops, and climates typical in Angolan and Middle Africa. The Mineral Resource for the Cácata Phosphate Rock deposit stands at 27 million tonnes at 17.7% P2O5 including, 15.2 million tonnes at 24.5% P2O5 in Measured and Indicated categories.

The Strategy

MAP makes up approximately half of the operating costs, but it also sets the price for the Enhanced Phosphate Rock, providing a natural hedge against operating costs. Strong supply/demand dynamics underpin the project with potential to sell into other Middle Eastern markets as well as Angola.

Angola has 35 million hectares of arable land with only 8% currently tilled for farming. Currently, 100% of all nitrogen phosphate potassium (NPK) is imported, opening up a vast market for Minbos’ MAP.

There are two important factors to bear in mind regarding the above metrics.

Firstly, cash operating costs include all mining, transport, granulation, shipping, government royalties, site administration and raw material purchase costs.

Further, the low case column on the left contemplates a lower MAP price which decreases revenues, but because MAP comprises approximately 50% of the operating costs it also decreases the operating costs in the low case. The reverse is reflected in the high case – this is what we referred to above when identifying MAP as a natural hedge against operating costs

An open-pit mine production target of 6.5 million tonnes at 30.2% P2O5 has been selected from pit optimisation studies utilising only Measured and Indicated Mineral Resources. The project is forecast to have low capital costs due to the high grade of the mine production target which can be utilised without beneficiation in the granulation plant.

The project is based on an initial nameplate capacity of 150,000 tonnes per annum (tpa) of enhanced Phosphate Rock, but is forecast to commence production at 50,000tpa. The plant is forecast to expand in two stages adding a second and third granulation circuit to reach a nameplate capacity of 450,000 tonnes per annum after eight years.

The Market

In the last 10 years, Angola was importing almost 90% of its food. However, buoyed by strong demand for local products, Angola is currently undergoing an agricultural revolution, with more than US$2 billion of Foreign Direct Investment pouring into farms and farm infrastructure projects.

Agriculture is the main source of income for 90% of the 9.6 million Angolans living in rural areas with 44% of Angola’s 30.8 million population employed in agriculture.

This not only highlights the size of the market Minbos will be selling into but also demonstrates significant incentives for the Angolan government to support such a project.

OTHER ASSETS

While Cabinda is Minbos’ key focus, the group has the Ambato Rare Earth Project in Madagascar as part of its portfolio.

Bastnaesite mineralisation is clearly visible in outcrops at Ambato which is located approximately 200 kilometres to the southwest of Antananarivo, in the Ambatofinandrahana Municipal area of the South-Central Highlands of Madagascar.

Tests conducted on grab samples from the prospect indicate that 90% of the contained rare-earth mineralisation consists of bastnaesite.

OUTLOOK

A key takeaway that jumps off the page when assessing Minbos is the group’s conservative approach in terms of formulating projections.

Of the 6.54 million tonnes (Mt) of plant feed mined, 1.54Mt (24%) is in the high confidence Measured Resource category and 5Mt (76%) is in the Resource category – there is no Inferred material in the optimised pit design.

In the first five years, nearly 640,000 tonnes of plant feed will be mined at 30.2% P2O5, all of which is classified as Indicated.

The production schedule assumes run of mine phosphate rock will be granulated with mono-ammonium phosphate (MAP) at the granulation plant.

The blending ratio of 84% Phosphate Rock to 16% MAP is based independent agronomic and granulation trials carried out by International Fertilizer Development Center (IFDC).

The export price of the MAP in Angola is assumed to be US$478/t (range US$407 – 532/t) based on a ten-year average price and adding US$50 for shipping and wholesale margins.

The anticipated CNF (cost and freight, not including insurance) sale price for Enhanced Phosphate Rock product at the Port of Luanda is US$222-291/t which is scaled to its Relative Agronomic Effect (RAE) with MAP and adjusted downwards relative to the Phosphorous (P) content of MAP.

Management has demonstrated its extremely patient and astute approach in terms of successfully tendering for the project, especially given many smaller companies would have walked away from it when confronted with obstacles over recent years.

For example, in 2018 the Angolan National Directorate of Mineral Resources issued a Notice of Termination for the Cabinda Project, citing as cause, the lack of progress and the licences were forfeited.

Despite not having any ownership interest after the Notice of Termination was received, Minbos continued to push ahead with the Cabinda phosphate agronomic research and development programs, an initiative that played a key role in the company’s successful tender.

Minbos has completed four greenhouse trials with the IFDC with the broad aim of maximising the EPR agronomic potential and ensuring the suitability of the crops for use in Angola and the surrounding Congo Basin.

The graphic above shows an area in Huambo, Angola where field trials are being conducted.

Consequently, this has been a gritty performance by management, and just as its hard work and passion for the Cabinda Project have paid off with the company’s bid being successful, my assessment is that management has the determination and the expertise to bring this project into production.

It is worth bearing in mind that in the last ten years, Minbos invested more the $20 million on phosphate projects in the Congo Basin, developing specific technical knowledge and financial support capable of advancing phosphate projects in the region.

Management knows what it’s like to do business in Angola and the broader African region, and it has the required understanding of resource requirements, technical knowledge, and market awareness to generate strong shareholder returns.

THE BULLS SAY

- This is an ideal project for a smaller company given its moderate development costs and management’s expectation of being able to fund the project through a mix of debt and equity.

- With the project backed by a comprehensive and impressive scoping study, the DFS could be market-moving.

- Holding shares in a mining stock that generates income from food production suggests that the demand side of the equation should remain robust and predictable, particularly given the unmet needs in the region.

- Management has a demonstrated record of working successfully in Angola and other regions of Africa, an important factor is given problems traditionally encountered by less experienced management teams.

THE BEARS SAY

- It can be difficult for smaller companies to gain finance for mining projects in Africa.

- This is an early-stage project and there are always risks in relation to studies and permitting.

- Minbos doesn’t have the benefits of diversification by commodity and/or region.

- Angola and other parts of Africa are viewed as sovereign risk regions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.