$6.6M capped WHK signs US $1.2M PER YEAR contract with “Top 5 Global Social Media Company”

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 8,406,087 WHK shares at the time of publishing this article. The Company has been engaged by WHK to share our commentary on the progress of our Investment in WHK over time.

Our micro cap US cybersecurity Investment, Whitehawk (ASX:WHK) announced a new contract for its services that is valued at US$1.2M per year.

Huge new yearly revenues for WHK that has a current market cap of just ~$6.6M.

The deal is with a “Top 5 Global Social Media Company”.

(WHK can’t reveal the name due to sensitivity around cyber security.)

The first year of this contract alone is ~37% more than WHK’s ENTIRE FY2023 revenue.

This US $1.2M revenue to WHK repeats EVERY YEAR of the contract

The contract is a massive step in rebuilding WHK’s credibility with the market.

If WHK can keep delivering big contracts and building its recurring revenue, we think the beaten down share price could quickly re-rate.

The cybersecurity macro theme continues to be very strong - cyber attacks are constantly in the mainstream news.

Now that WHK has secured a long awaited win with a large contract, the company just needs to deliver a string of back to back contract wins to take advantage of the years of work it has put in.

WHK is still an important part of our Portfolio, we have held a position since the IPO in 2018 and continue holding in the hope that in 2024 WHK can finally deliver what we have always believed it is capable of.

WHK’s share price has suffered due to how long it takes to sign cyber security contracts with major institutions, combined with a rough market over the last 18 months and a convertible loan facility (which we hope it soon gets rid of) that has weighed on the share price during a period of low news flow.

The market looks like it has gotten impatient with how long things were taking and the share price drop reflects that (we have been hanging on and increasing our positio, having seen how beaten down stocks can turn back quickly on positive momentum).

Like we saw with our other tech investment Oneview, we hope that WHK can deliver a quick bounceback after an “extended slow period” with a string of quick, positive news announcements.

Namely conversion of its sales pipeline into deals.

So WHK have a new major contract in the bag now, and we want to see them back it up with more contracts.

Normally a contract with a “Top 5 Global Social Media Company” for a small ASX company would attract more attention than this contract did.

As we’ve noted before, due to the sensitive nature of cybersecurity defences, WHK is unable to reveal the exact identities of all of its customers.

Imagine if a microcap company capped less than $10M came out with an announcement that read - “New large contract with Google”, Meta (Facebook), LinkedIn or you name the tech giant.

The inability to disclose the name of the client often reduces some of the market impact these announcements have.

Because WHK is not allowed to reveal big brand names, the $ values of the WHK contracts need to do the talking to the market, like the US $1.2M per year in WHK’s latest deal.

Especially for yearly recurring revenue.

It’s been a long journey for us as WHK Investors, we first Invested in WHK prior to its IPO and announced it to our Portfolio in May 2019.

We’ve participated in multiple capital raises over this period, and we participated in the most recent rights issue that took place in the middle of 2023.

In July 2023, we wrote about how WHK had grown its sales pipeline to USD$22M - which is quite a significant pipeline for a company that is currently capped at less than A$8M.

And WHK has now landed the first big conversion on this pipeline.

With reported revenues last financial year through to 30 June 2023 of ~US$870K we see last week’s news as a potential step change in the company’s sales activities.

WHK has been engaged with this client, again, a “Top 5 Global Social Media Company”, for 3 years now - which we see as evidence of customer stickiness.

Customers renewing and increasing the size of contracts is an indicator that the technology is working and the customer is happy with it.

Last week’s contract is for a Third-Party Risk Platform under an existing Master Services agreement - we’ve got more on what that means below.

WHK is effectively expanding the scope of its services to this unnamed major company, which is a good sign of growing traction and proven value.

WHK says this service is “AI based [and] automated” - a trend in cybersecurity that we think will only become more prominent.

It also sounds like it will be relatively cheaper and require less people to deliver given the ‘automation’ aspect.

The world of cybersecurity is always going to be somewhat opaque, but we see WHK as potentially solving for major tech companies’ supply chain risk with many third party tech integrated into their platforms.

As long term holders, we want to see more large, sticky customers continue to sign up for WHK’s services resulting in sustained financial performance.

We note that in the last quarter, WHK trimmed its cash outflows to US$53K for the September quarter after reporting an improved US$670K in receipts from customers.

We saw the WHK share price fall from 8c to 2c over the course of the year, likely due market impatience due to new contract delays, general negative market sentiment compounded by the convertible loan facility from Lind.

But we think the previous and appropriate belt tightening at WHK combined with a few big long term contract wins, such as the one announced last week, could help improve WHK’s fortunes.

Today, we are launching a new and updated Investment Memo for WHK that reflects its progress since we Invested, and what we want to see WHK deliver in 2024.

Our WHK Big Bet is as follows...

Our Big Bet for WHK:

“WHK becomes a $500M technology company by securing new contracts and partnerships as legislation and public pressure force governments and companies to invest in cybersecurity”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our WHK Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What is TPRM? And why is WHK’s new AI contract important?

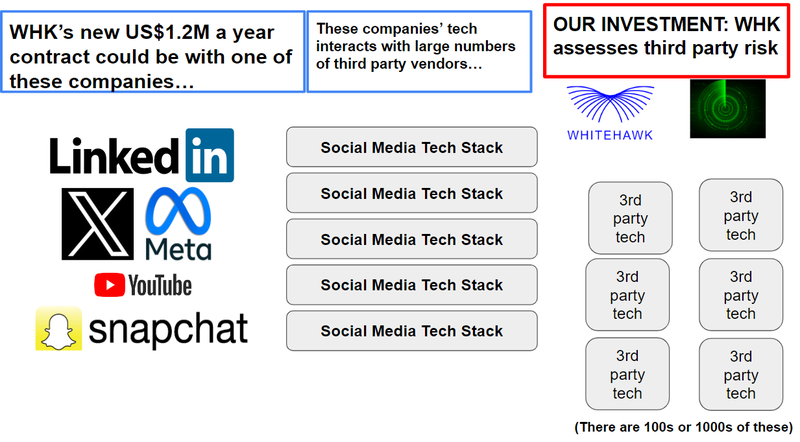

WHK’s latest US$1.2M a year contract is for something called TPRM services.

To our understanding, TPRM is a process of identifying and mitigating risk based on external vendor partnerships.

Part of what WHK is doing for this unnamed Top 5 Social Media Company is providing a TPRM “platform”.

Think of it a bit like a dashboard that provides monitoring and analytics on third parties that interact with a global tech company’s tech stack.

AI helps with the generation of data used by an Application Programming Interface for monitoring these third parties, measuring the level of risk associated with their technology.

An API is a type of software interface that helps computers talk to each other, with large amounts of data.

The daily volume of attacks on APIs has been growing at a rapid clip - with over 100M attacks daily around the world occurring every day (Source).

So given WHK is developing its own API for measuring third party risk - it makes sense why the company can’t talk specifically about who it is working for.

Risk has long been the space that WHK works in for these unnamed large tech companies.

These companies want to know - what could go wrong if we integrate a third party’s tech with our own?

These large tech companies aren’t a single monolith of technology - there are oftentimes hundreds or thousands of third party vendors that they work with whose technology interacts with the tech stacks of these giant companies.

These interaction points can expose companies to cyber risk and new attack vectors - so WHK’s products and services help mitigate this risk by identifying potential problems before they can be exploited.

Here’s an image which we think represents how WHK’s products and services work:

Increasingly, these threats are sophisticated and so WHK is using AI and automation to tailor its products and services to the problems at hand.

Indeed, these attackers may themselves employ AI and automation to achieve their goals.

We’re glad that WHK is moving towards greater use of AI and automation - and we think it is definitely in keeping with current trends in cybersecurity.

Again in terms of deal value - the US$1.2M a year contract is ~37% more than WHK’s entire FY2023 revenue.

So it's a big contract for the company - and more of the same or even better contracts could go a long way towards improving WHK’s fortunes.

As we mentioned in our last note on WHK in July, there is over US$12.5M in potential contracts that could be on the table for WHK’s Cyber Risk Radar product alone.

That’s nearly 4x the total revenue WHK generated in CY2022.

And across all its sales channel partnerships and products - WHK said in the same May presentation that its pipeline is worth USD$22M.

Monday’s contract was the first major conversion since details on that sales pipeline were discussed - and we hope, a sign of much bigger things to come.

It has been a long and slow process - as seen by the WHK share price performance, and we would have liked to see this contract come much earlier than it did.

As we note in our Investment Memo retrospective - WHK relies on larger companies and a delayed merger of two multi-billion dollar companies hurt WHK’s ability to generate sales.

Which in turn hurt WHK’s cash balance, which required a top up via a Lind convertible note earlier this year.

Here’s where that financing facility is at right now...

What’s the status of the Lind convertible note?

Late last year, WHK signed a funding deal with New York based Lind Partners for a total of $3M.

The arrangement saw WHK receive an initial $2M with the option of securing a further $1M.

The Lind funding deal is slightly different to the typical “equity placement” capital raisings we are used to seeing (i.e. placements) - instead the deal saw WHK receive a cash loan upfront from Lind, and then Lind slowly converts the loan into WHK shares over a 12-24 month period.

So far, Lind has converted ~$2.35M of the facility into shares.

We also note (that if both parties agree), a further $1M was available to WHK by Lind.

With the latest conversation going over the initial facility amount of $2.2M, it seems that an extra $1M has been taken up by WHK.

That means that there should be roughly ~$850k left to convert in the short-medium term - assuming the entire $1M is taken up by WHK.

In the short term, we expect the conversions to lead to some selling pressure on the market.

For example, the latest conversion was for $150k at 1.7c per share - below the current share price of 2.1c per share.

What does the funding facility mean for WHK’s share price?

The convertible note financing business model relies on being able to convert and sell the shares of a company on market.

Ultimately this adds some selling pressure on share prices for as long as that facility remains open.

The selling pressure also dampens any momentum the share price is trying to build when a company delivers a good announcement.

It's similar to what happens after a standard capital raise, except it’s more like a series of mini-capital raises over time, rather than the full “cap raise digestion” happening all at once after the cap raise.

This WHK note structure would have worked out a lot better if WHK had delivered a few material contracts shortly after the facility was put in place back in late 2022, but the delays in new contracts have seen conversions done at lower and lower share prices.

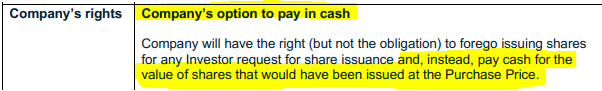

ON a positive note, WHK has the option to repay for the remaining amounts in cash (now that they have signed contract for material new revenues).

IF WHK can deliver material news, a re-rate in its share price to the upside and lock away a capital raise at a higher share price, generate positive cashflows OR get a lump sum upfront payment from a contract, then the company could just pay out the remainder of the Lind deal.

Ultimately, we want to see WHK deliver news and make that happen - which is why we participated in the WHK rights issue mid year.

With a new year just around the corner, we are now launching a new, updated WHK Investment Memo to reflect where we think WHK is right now and where it could go in the future.

In this memo we will cover:

- Why we are Invested in WHK

- Our long term bet - what we think is the upside Investment case for WHK

- The key objectives we want to see WHK achieve over the next 12-18 months

- The key risks to our Investment thesis

- Our Investment Plan

We are also publishing our Investment Memo Retrospective and evaluating WHK’s performance against the objectives we wanted the company to achieve in the 2022/2023 which you can see on our WHK company page under the tab WHK-IM1.

Investment Memo 2: WhiteHawk (ASX:WHK)

Memo Opened: 18 December 2023

Share at Open: 8,406,087

What does WHK do?

WhiteHawk (ASX:WHK) is an ASX-listed, USA based cybersecurity micro cap, providing cyber risk products, services and solutions.

What is the macro theme behind WHK?

Global cybersecurity threats are growing and businesses and governments are ramping up spending on their cybersecurity defences.

Increasingly state sanctioned, or state-tolerated actors are involved in major attacks, meaning cybersecurity has never been more important.

We expect capital to continue to flow towards cybersecurity companies that can seal long term contracts with large companies.

Our Big Bet for WHK:

“WHK becomes a $500M technology company by securing new contracts and partnerships as legislation and public pressure force governments and companies to invest in cybersecurity”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our WHK Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Why do we continue to hold WHK?

Six years to work out the kinks and build a pipeline of sales

We have been Invested in WHK since the company’s IPO in 2018.

In this time WHK has developed its product, reputation and relationships in the market.

Importantly, over this time WHK has developed a pipeline of sales, for contracts that take time to deliver.

WHK has recently said that its sales pipeline is worth US$22M. If WHK can convert roughly a quarter of that pipeline over 2024 we think that would put it on a good footing for sustained financial performance.

Coming off a low base WHK is primed for a re-rate

As of writing this note WHK is capped at just ~$6.6M.

At these levels, we feel that the company is coming off a low base and has a chance to significantly re-rate if it can finally deliver a string of material contracts.

Strong management team

With a deep connection to US government organisations, WHK’s team has a proven ability to sign big contracts with big organisations

Large Contract Sizes

WHK is slow to progress deals, but when they happen they are generally for large $ contracts, with big organisations that are sticky customers.

Cybersecurity continues to be a strong thematic

In the 2024 Australian CEO survey, “Cyber risk” was classified as the number one thing keeping CEOs awake at night.

The rate and frequency of cyber attacks is increasing, and we expect that large organisations will be allocating more resources to cyber protection.

What do we expect the company to deliver?

Objective #1: More Contracts, follow through

WHK management has proven they can sign contracts and partnerships with top tier large organisations, but so far new deals have taken a long time to get signed. We want to see the effort of the last few years in building the pipeline come to fruition, with WHK delivering the following:

- At least one contract worth more than $1.5M annually

- Increase the contract size of an existing contract

- Win a new large organisation contract

Objective #2: First material revenue from channel partnerships

WHK has already signed some interesting partnership deals (Dun & Bradstreet, Amazon Web Services, Sontiq, Peraton) which have great potential. We want to see the first revenue coming in from these partnerships.

Objective #3: Proof of value (POV’s leading to larger multi-year contracts)

WHK is now signing proof of value contracts (smaller contracts which identify product value based on customer use cases) - we want to see WHK successfully convert several POV’s to larger contracts.

Objective #4: Deliver ~US$4M in the 2024 annual report

Objectives 1,2 and 3 will lead to the ultimate goal of growing revenue, for a stronger share price performance we want to see WHK grow its revenue - with US$672K in receipts from customers in the September 2023 quarter and a new US$1.2M a year contract with a US “Top 5 Global Social Media Company”, as a baseline we want see WHK deliver at least ~US$4M in its 2024 report and be operating cashflow positive for at least two quarters.

What could go wrong?

Sales Risk

Deals continue take a long time and investors lose interest, alternatively loss of key contracts

Market Risk

The market could sell off or a bear market could continue for longer than expected taking the WHK share price down with it.

Competition Risk

The cybersecurity industry is a competitive space. Other companies may step in and take key clients.

Funding / Dilution risk

WHK like all small caps is subject to funding and dilution risk.

Capital raises can lead to dilution and may take place at a discount, reducing the value of WHK shares.

Capital may not be available depending on the market, and may need to be secured through a variety of instruments which can undermine the financial and share price performance of the business.

What is our investment plan?

We have been holding WHK for a few years now, increasing our position on multiple occasions since we announced it to our Portfolio in May 2019.

While it has been a disappointing journey over the last two years, we believe WHK can finally turn things around, and deliver a re-rate on one or more large long term contracts and follow through with increased sales from its large pipeline.

Our plan is to increase our position if WHK do another equity capital raise, “averaging down” on our Entry Price, and we will look to top slice if WHK can deliver a re-rate from these lows.

You can find our retro on the 2022/23 WHK Investment Memo on the WHK company page under the tab WHK-IM1.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.