SS1 Submits US$60M Silver Paste Funding Application

Our silver Investment Sun Silver Limited (ASX: SS1) has submitted an application to the U.S. Department of Energy for a USD $60M investment tax credit.

The application is to establish a Silver Paste Production Facility in the USA, aimed at supporting local solar photovoltaic (PV) cell manufacturing.

This initiative not only aligns with the U.S. efforts to reduce dependence on Chinese silver paste but also promotes job creation and economic growth in the renewable energy sector.

Previously, SS1 had appointed law firm Holland & Knight to seek out grant funding from the US Department of Energy (DOE) for the production of solar paste - a crucial component in the manufacture of solar panels. (Read our Quick Take)

So it’s very pleasing to see Holland & Knight moving so quickly on what could be a material contribution to SS1’s operations.

We’re following SS1’s silver paste efforts closely - as we think this value added product will differentiate SS1 in the market and help the company integrate with the US solar manufacturing industry more closely over the long-term.

How does this news impact our SS1 Investment Memo?

In our SS1 Investment Memo we said the following:

The US Solar Industry will need a lot more silver

Silver is a key material used in solar panels. Silver demand from solar energy is forecast to “go exponential”. In the next six years, the US government is aiming for more than 6x current solar capacity. And to satisfy solar energy targets for 2050, the world would need to dig up nearly EVERY single known ounce of silver EVER found in current reserves (98%).

Building a silver paste facility in the US would mean SS1 could play a key role in the US solar panel industry. Silver paste accounts for 23% of the material cost of solar panels, and is crucial for creating electrical contacts essential in converting sunlight into electricity.

US push to “onshore” solar industry away from China

SS1 has a giant supply of silver for solar panels on US soil (Nevada).The US has just applied a 50% tariff to solar cells that are imported from China into the US, up from 25% previously. We expect this to provide additional economic incentives and support to domestic US solar manufacturers while also creating further demand for domestically sourced silver and silver paste both of which SS1 is pursuing production of.

This government incentive reduces reliance from overseas for solar power demand such as China.

US Government to support domestic solar industry and help bring strategic projects online

SS1’s project may be seen as having strategic value to US onshoring of solar panel manufacturing. We think SS1 could benefit from US government tax incentives included in the Inflation Reduction Act, tariffs on Chinese solar panels and potential government grants for strategic projects and manufacturing initiatives.

Political and geopolitical risk

There is always a risk that the US government changes course under a new administration or rolls back policies and incentives designed to support a US domestic solar manufacturing industry. Alternatively, the market may be flooded with cheap solar panels such that these policies and incentives do not have the desired effect, hurting the SS1 share price. Governments and policies change and these changes could impact the future economics of SS1’s project.

This news further proves the US’s commitment to domestic solar manufacturing.

Click here to read our SS1 Investment Memo in full

What’s next for SS1?

Drilling Program

SS1 is currently getting set up for its maiden drill program. The next key piece of news that we want to see is some drill targets to follow.

✅ Permitting for drill programme

✅ Drilling contractor secured

🔄 Finalise drill targets + announce a drilling plan

- ✅ Review historical drill logs and interpret data (

- 🔄 Undertake geophysical surveys

🔲 Drilling commenced

🔲 Drilling results

Resource upgrade/update

Off the back of its drill program we want to see SS1:

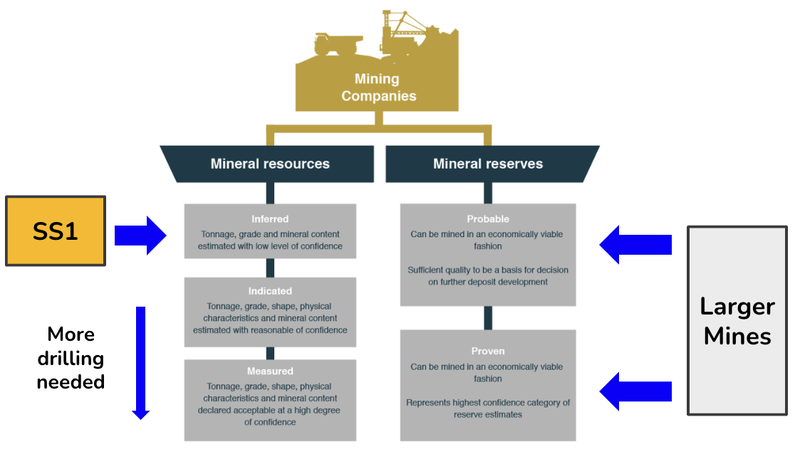

- Upgrade the size of its JORC resource with exploration drilling, AND

- Upgrade its resource classification with infill drilling - SS1’s resource is mostly inferred, we are hoping to see SS1 move some of the resource into the higher confidence indicated category).

🎓 Learn more about JORC resources here: What is a JORC resource? How does a company define a resource?

Read more about SS1 in our latest SS1 note: