NTI Completes Two Year Milestone for Phase I/II trial for Autism

Today, our biotech Investment Neurotech International (ASX: NTI) announced that patients in its Phase I/II trial for Autism Spectrum Disorder (ASD) had completed a milestone 2 years on the treatment, with no serious adverse events recorded between 90 days and the 2 year milestone.

This is significant as there are very few treatment options available for ASD - which we think could change if NTI is able to commercialise its treatment for ASD.

Our previous coverage of NTI’s ASD trials has focussed on the potential benefits that could accrue to Australia’s NDIS if it were to make use of NTI’s treatment:

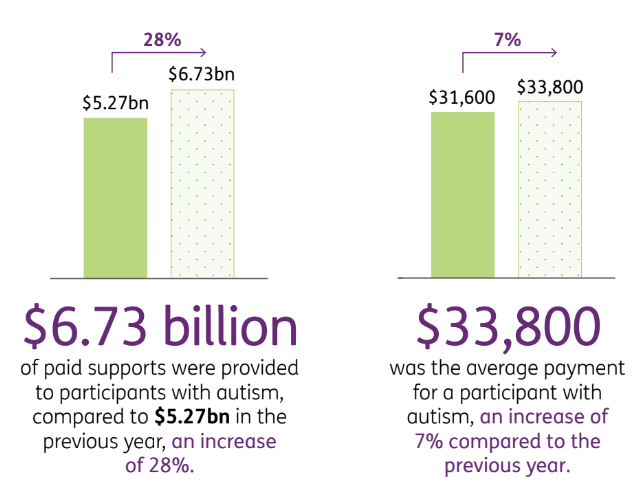

Autism costs now make up $6.7BN per year of the NDIS budget:

(Source)

The NDIS provides an average annual payment of $33,800 per patient to NDIS participants with autism.

This $33,800 per year is to cover ongoing support services such as speech pathologists, psychologists, neurologists, occupational therapists and carers.

If NTI’s treatment could reduce the overall cost burden of NDIS autism payments by reducing the spend on support services - this could have a major net economic effect.

Not to mention significant benefits for carers, and of course, patients themselves.

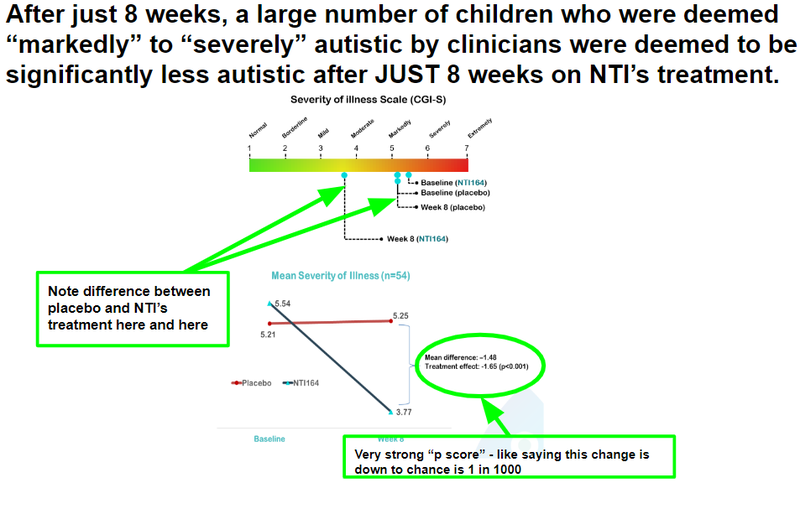

NTI has now conducted two trials on its treatment for ASD, a Phase I/II (the subject of this announcement) and a larger cohort Phase II/III trial which produced the following data:

(Source)

We covered the results of the ASD trial and NTI’s Rett Syndrome trial (which is tough to ignore as well) in the following note:

NTI’s two clinical trial results are in - Treatment success for BOTH Autism AND for Rett Syndrome

Despite these positive results, frustratingly for us as NTI Investors, the NTI share price sits at 6.1 cents after the company closed an “open and shut” $10M cap raise at 10c in April.

We participated in the recent $10M capital raise at 10c on the back of the clinical trial data for BOTH Rett Syndrome and Autism Spectrum Disorder (ASD).

(We were scaled back as well)

NTI previously rose ~300% between June 2023, and February 2024 to 12c in the lead up to its two clinical trial results.

We’re of the belief that NTI has done everything right to this point - delivered clinical trial success across not one trial but multiple trials.

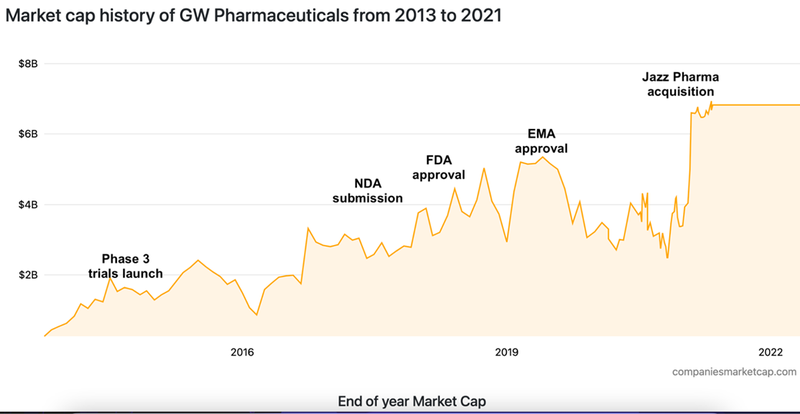

We note that for cannabinoid based therapies (like NTI’s), success is rare but extremely powerful.

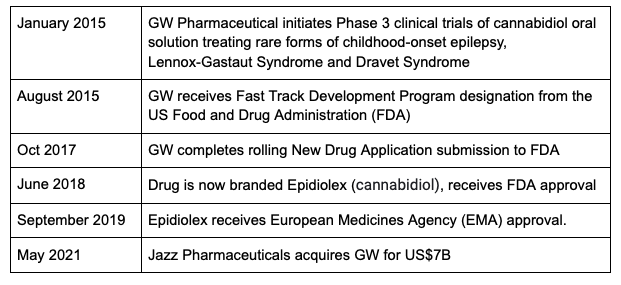

For instance, Jazz Pharmaceuticals completed the acquisition of GW Pharmaceuticals for US$7.2BN for its epilepsy medication Epidiolex in 2021:

Note that it still took over three years from Phase 3 trials in 2015 before Epidiolex received FDA approval - in that time, GW’s market valuation grew from ~US$1.3BN to US$2.9BN, before Jazz Pharmaceuticals acquired the company for US$7.2BN in 2021.

We’re patient here - and we’re hoping NTI can follow a similar trajectory.

What’s next for NTI?

There’s plenty to come for the rest of the year:

Meeting outcome - TGA Regulatory Advice

Metabologenomic data from Phase I/II PANDAS/PANS Clinical Trial

Orphan Drug Designation Europe - Rett Syndrome

Orphan Drug Designation Europe - PANDAS/PANS

Orphan Drug Designation USA - Rett Syndrome

Orphan Drug Designation USA - PANDAS/PANS

Completion of Patient Recruitment Phase I/II Cerebral Palsy

Commence Phase I/II Cerebral Palsy Trial

FDA IND/EMA toxicology

Presentation of Phase I/II Rett Syndrome data at international Rett Syndrome conference

For a full description of these upcoming NTI milestones read our latest NTI note:

NTI’s Phase I/II Rett Syndrome clinical trial results improve upon $2.4BN capped Neuren’s results…