LYN's drilling starting in one week

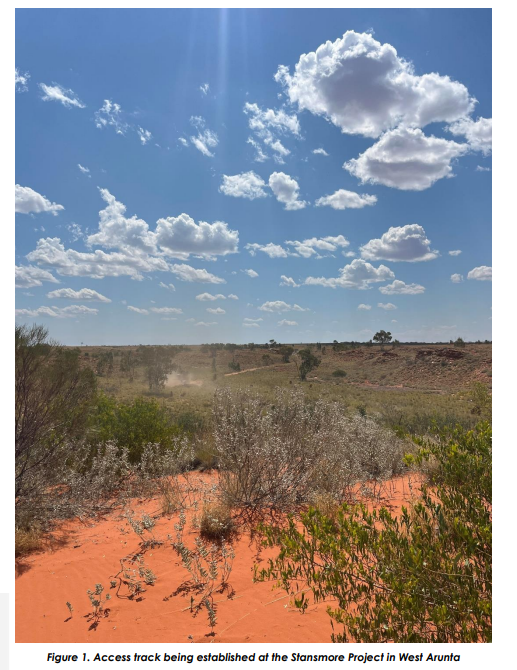

Lycaon Resources (ASX: LYN) is now a week away from drilling its niobium project in the West Arunta, WA.

LYN kicked off earthworks for its drill program this morning and confirmed that drilling was “planned to commence in a week”.

That means we get to see LYN take a shot at a discovery on its ground very soon.

With the upcoming drill program, LYN will be looking to replicate the success of the company that put the West Arunta on the map for other explorers - WA1 Resources.

WA1 Resources made a giant niobium/rare earths discovery back in October 2023 and went from a share price of ~13c to $23.20 in less than two years, a ~17,700% gain.

At its peak, WA1 Resources market cap was over $1BN.

WA1 is the benchmark for what success would look like for LYN.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Regional ASX peers all rallied into drilling... LYN’s turn over the coming weeks?

Now that LYN is roughly a week from drilling its project, we expect to see market interest in the company increase.

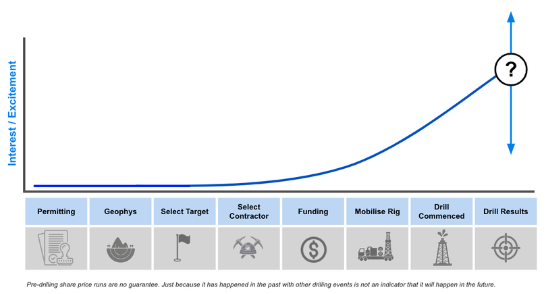

Its something we see in the small end of the market when companies approach major drill programs:

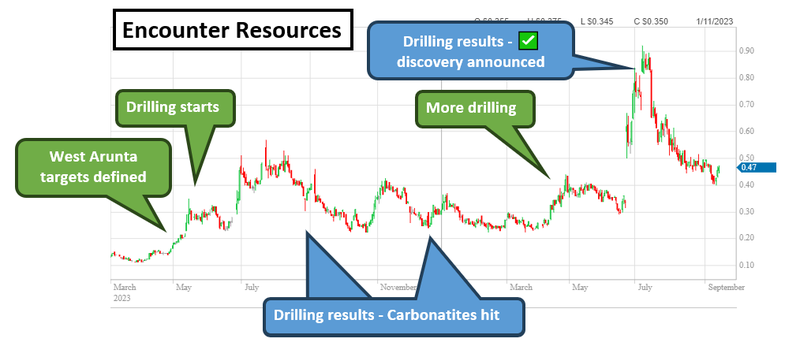

It's also something we have seen happen to other explorers with projects in the West Arunta:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Some of those stocks rallied hard and their share prices managed to protect the share price gains.

Others didn't fare as well and have come back to their pre-drill share price.

Ultimately, it is the drill results and the general market interest in the underlying commodity that determines where a share price settles after a company drills.

What’s next for LYN?

Objective #2: Drilling at its niobium & rare earths project in WA.

We want to see LYN get on the ground and drill its project in the West Arunta region.

Milestones

🔄 Commence drilling

🔲 Assay results

Source: “What do we expect LYN to deliver” Section - LYN Investment Memo 30 Nov 2022.